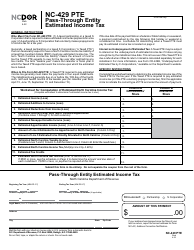

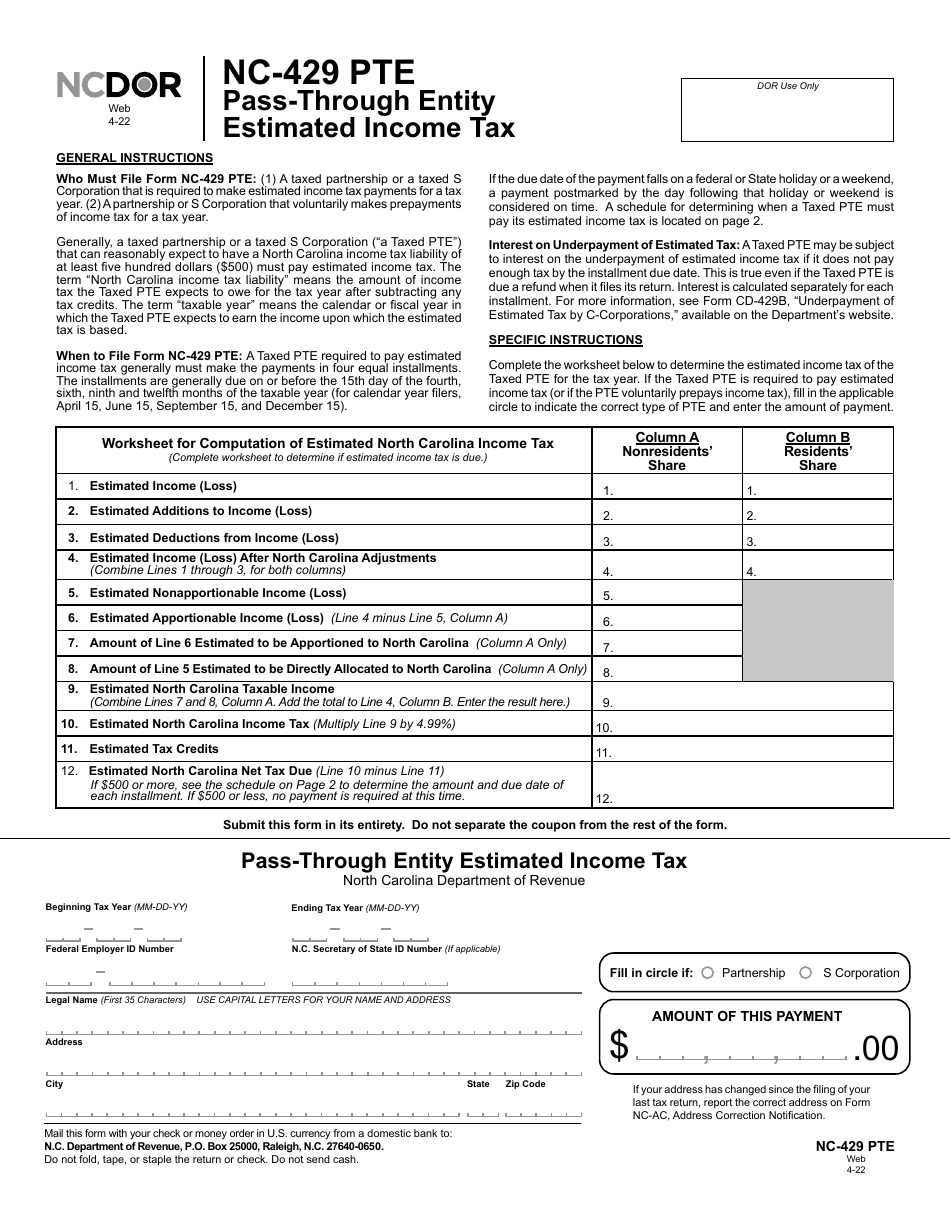

Form NC-429 PTE Pass-Through Entity Estimated Income Tax - North Carolina

What Is Form NC-429 PTE?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-429 PTE?

A: Form NC-429 PTE is the Pass-Through Entity Estimated Income Tax form for North Carolina.

Q: Who needs to file Form NC-429 PTE?

A: Pass-through entities in North Carolina, such as partnerships and S corporations, need to file Form NC-429 PTE.

Q: What is the purpose of Form NC-429 PTE?

A: Form NC-429 PTE is used to estimate and pay income tax for pass-through entities in North Carolina.

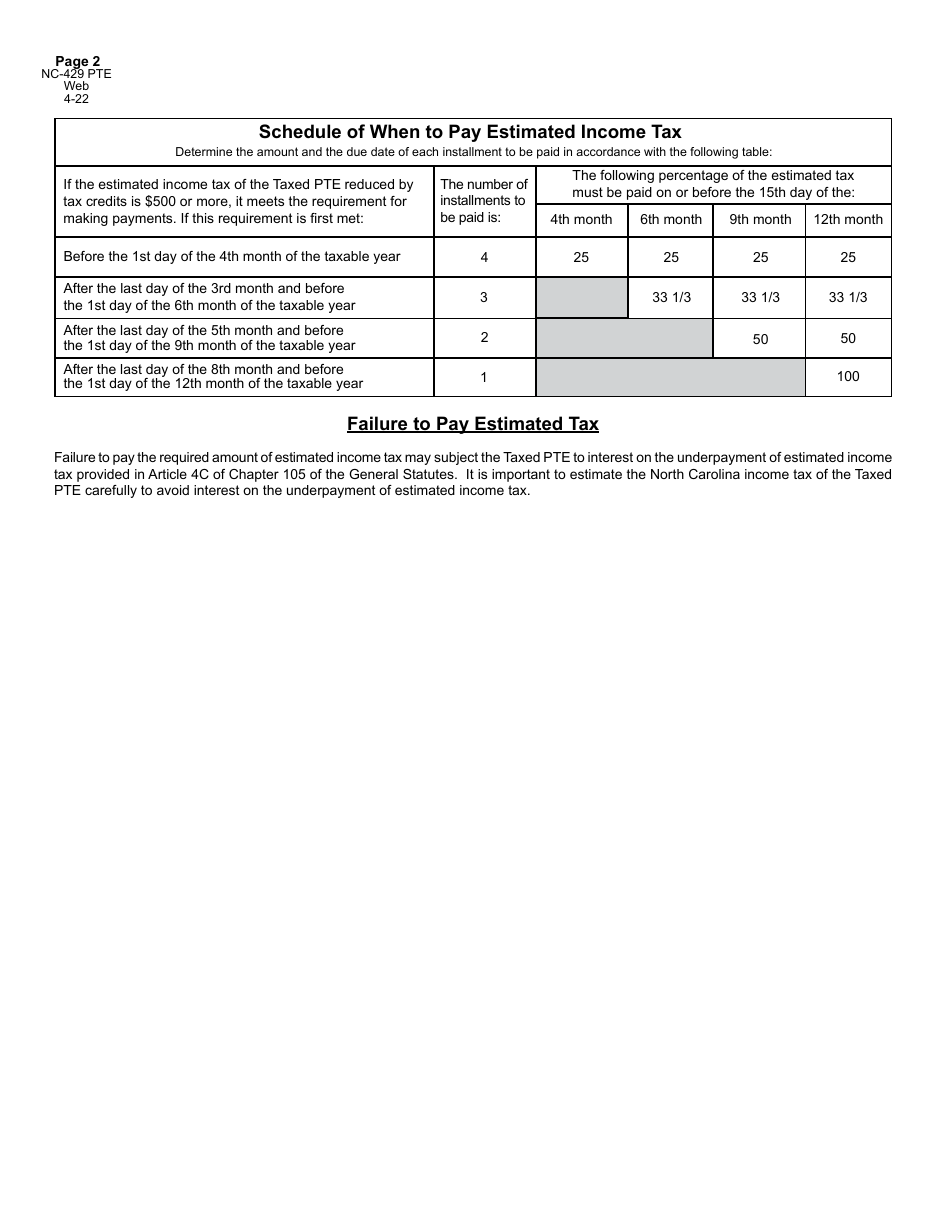

Q: When is Form NC-429 PTE due?

A: Form NC-429 PTE is due on the 15th day of the fourth month following the close of the taxable year.

Q: Is Form NC-429 PTE mandatory?

A: Yes, pass-through entities in North Carolina are required to file Form NC-429 PTE if they have taxable income or income tax due.

Q: Can I file Form NC-429 PTE electronically?

A: Yes, North Carolina allows electronic filing of Form NC-429 PTE.

Q: What information do I need to complete Form NC-429 PTE?

A: You will need information about the pass-through entity's income, deductions, and any estimated tax payments made.

Q: Are there any penalties for not filing Form NC-429 PTE?

A: Yes, failure to file Form NC-429 PTE may result in penalties and interest on the unpaid tax amount.

Q: Can I amend my Form NC-429 PTE?

A: Yes, if you need to make changes or corrections to your originally filed Form NC-429 PTE, you can file an amended form.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the North Carolina Department of Revenue;

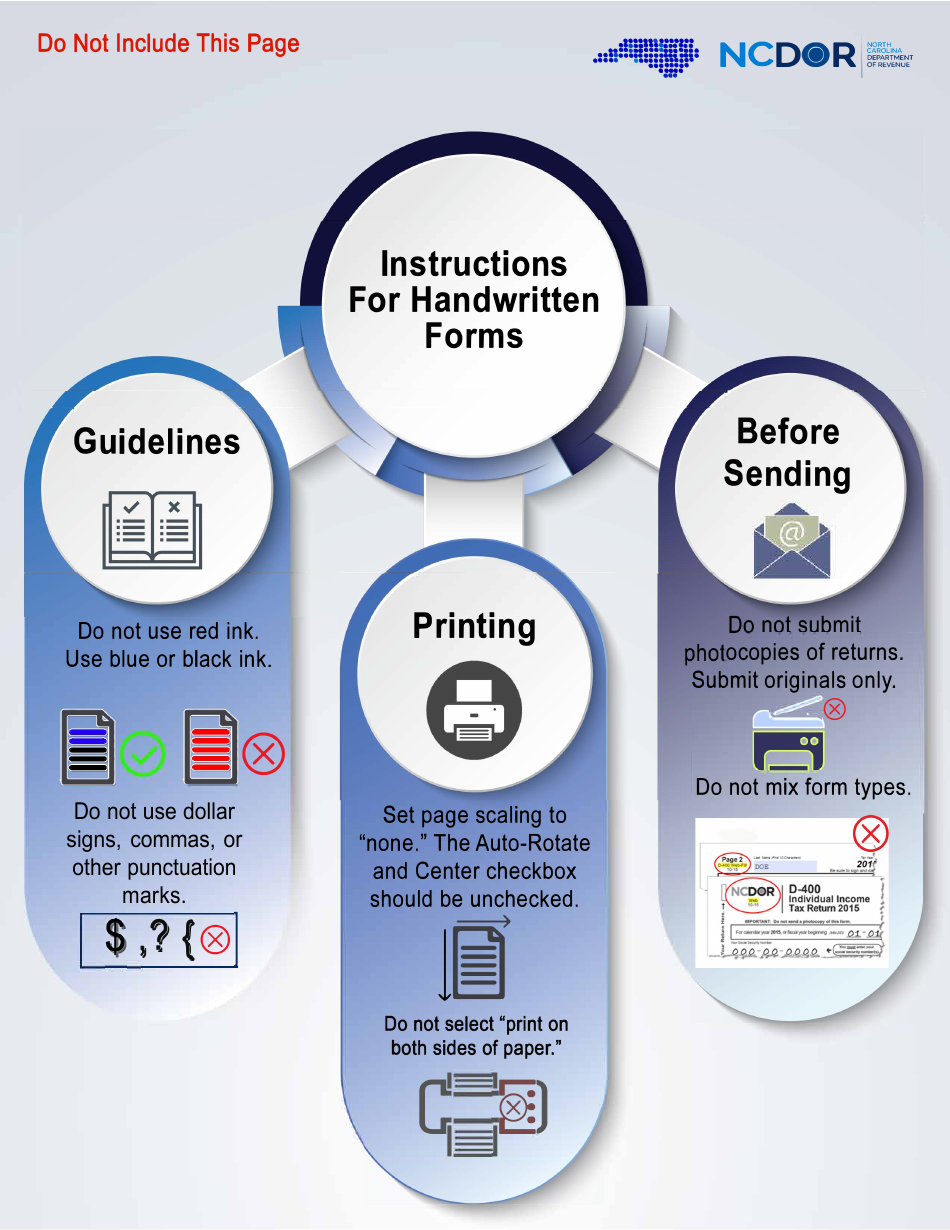

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-429 PTE by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.