Schedule NC K-1 Owner or Beneficiary's Share of N.c. Additions and Deductions - North Carolina

What Is Schedule NC K-1?

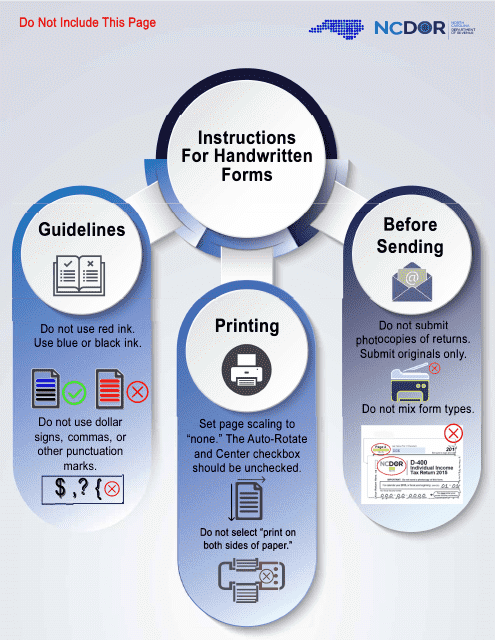

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NC K-1?

A: Schedule NC K-1 is a tax form used in North Carolina to report an owner or beneficiary's share of North Carolina additions and deductions.

Q: Who needs to file Schedule NC K-1?

A: Anyone who is an owner or beneficiary of a North Carolina business entity, such as a partnership or S corporation, needs to file Schedule NC K-1.

Q: What is reported on Schedule NC K-1?

A: Schedule NC K-1 is used to report the owner or beneficiary's share of North Carolina additions and deductions, which can include items such as interest income, rental income, and certain tax credits.

Q: How do I complete Schedule NC K-1?

A: To complete Schedule NC K-1, you will need to refer to the instructions provided by the North Carolina Department of Revenue. The form requires you to provide information about the business entity and the owner or beneficiary's share of additions and deductions.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

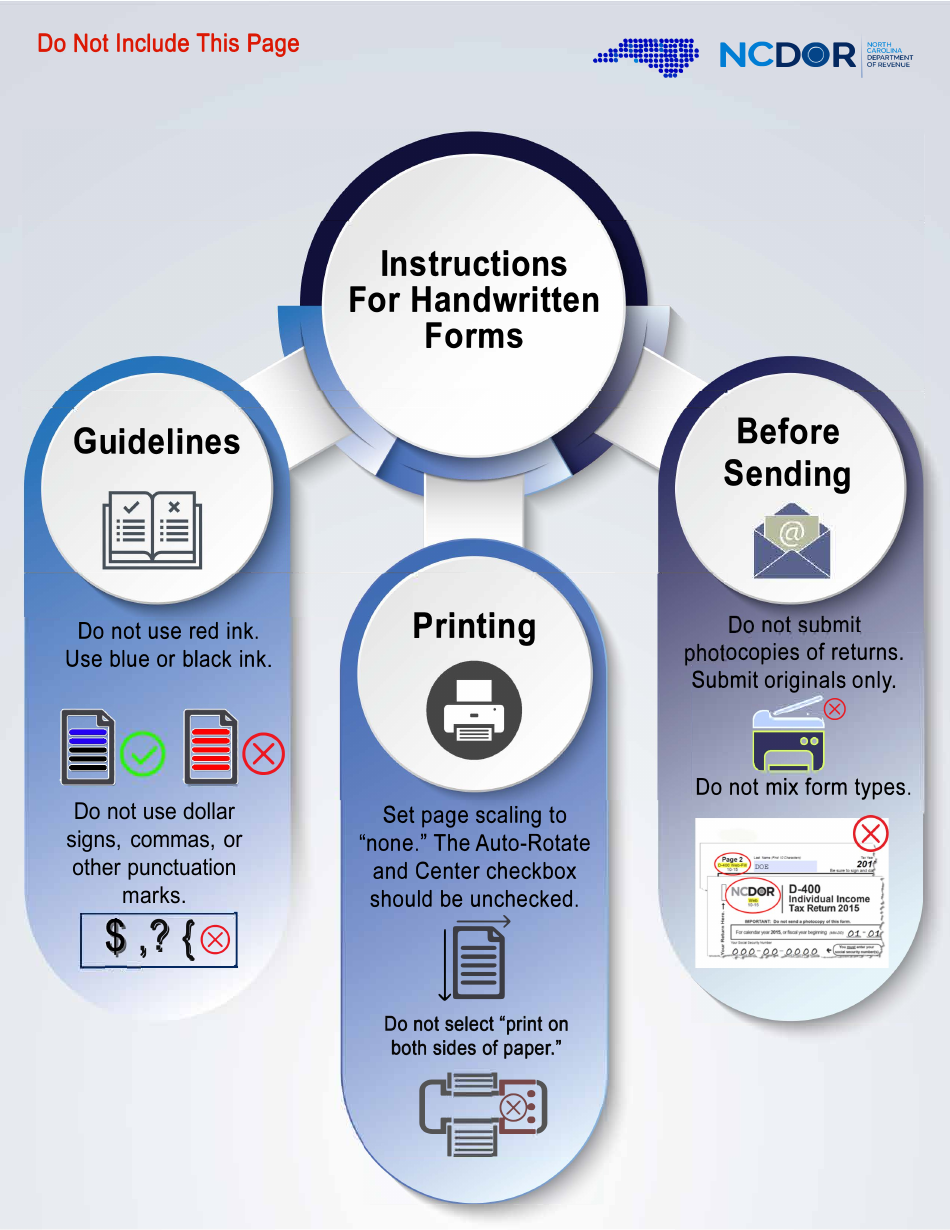

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule NC K-1 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.