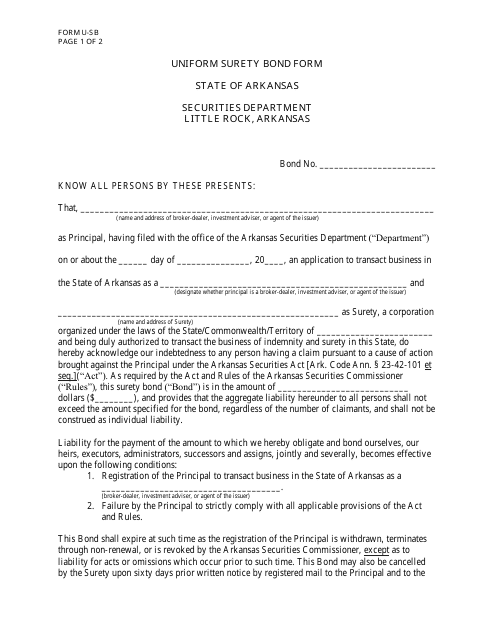

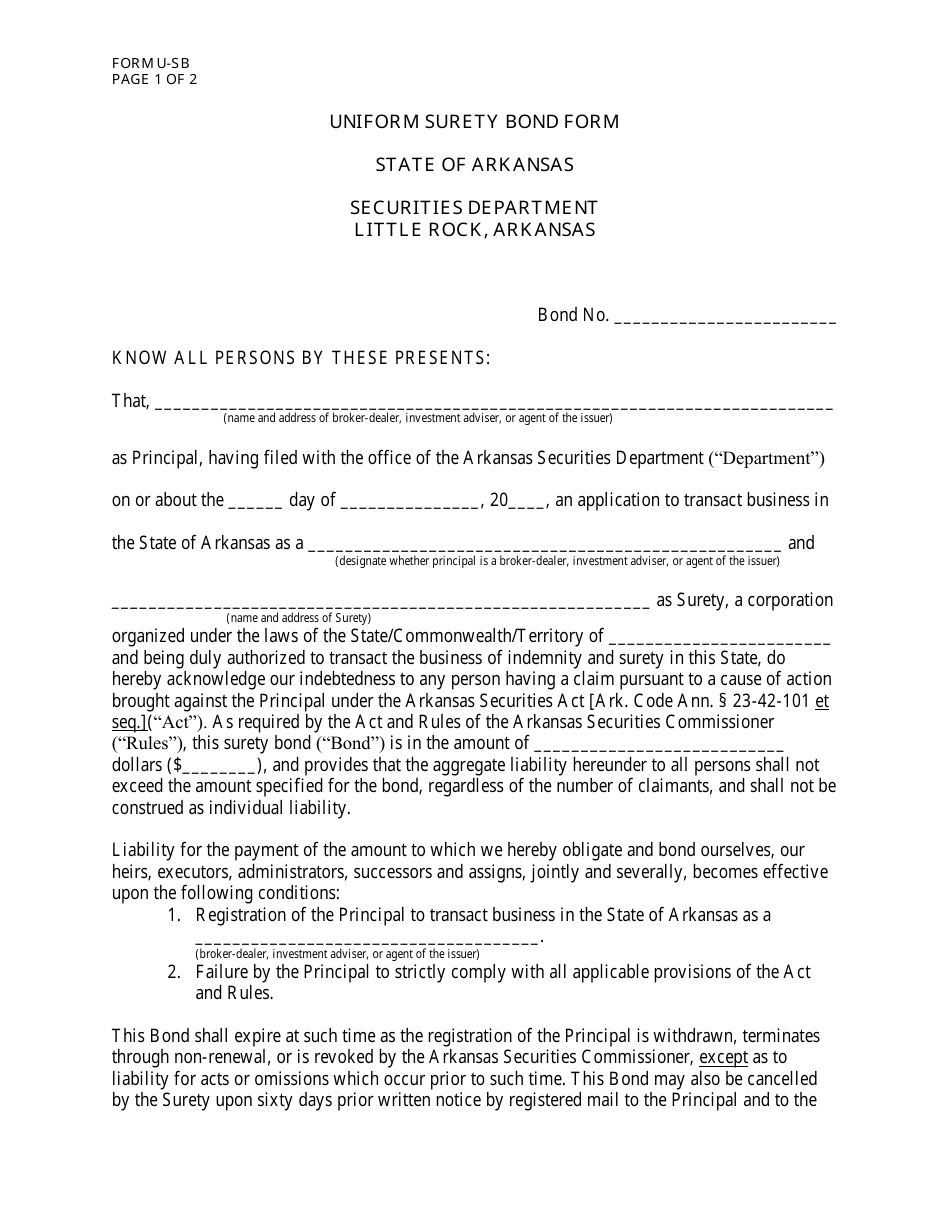

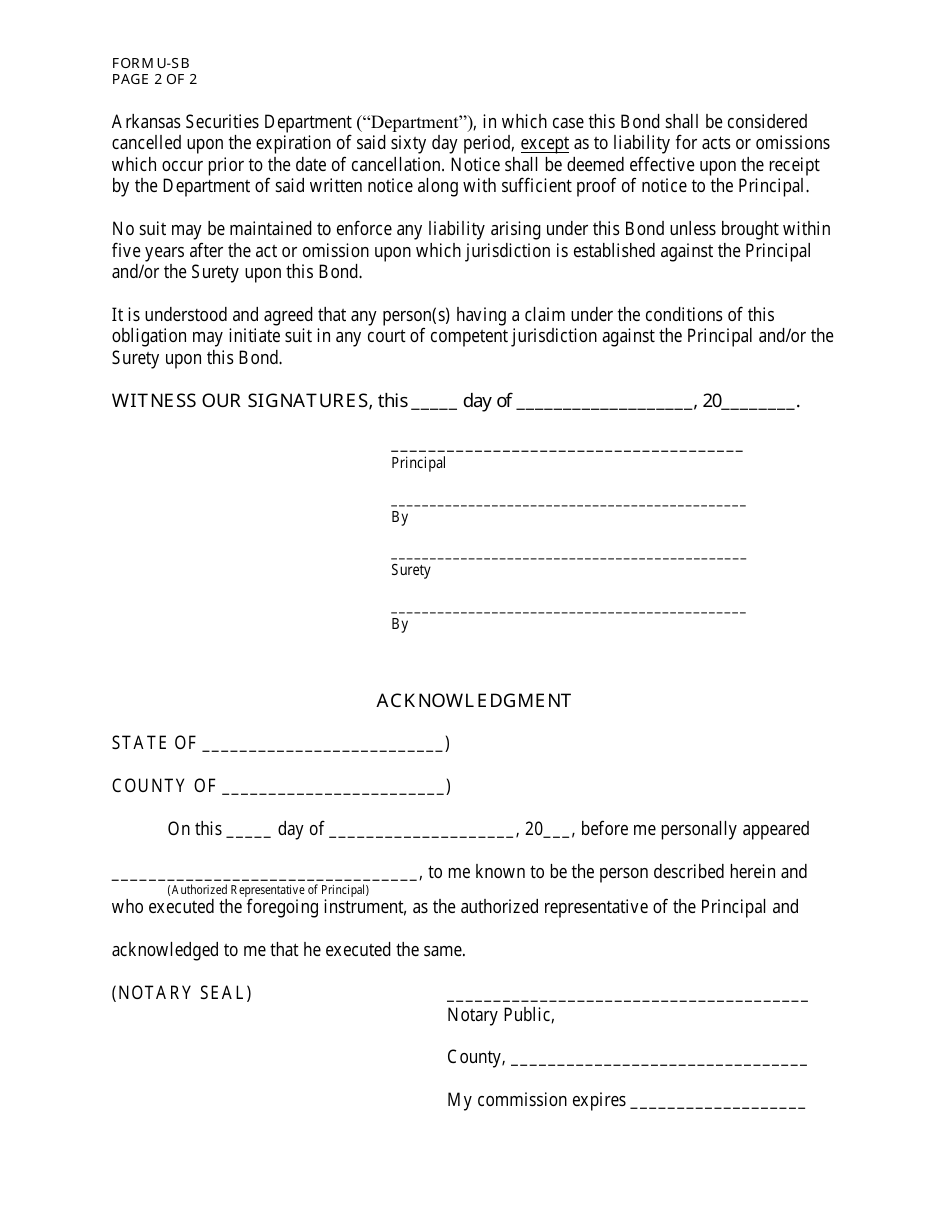

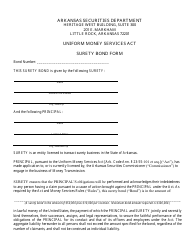

Form U-SB Uniform Surety Bond Form - Arkansas

What Is Form U-SB?

This is a legal form that was released by the Arkansas Securities Department - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

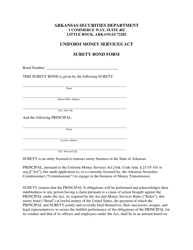

Q: What is U-SB Uniform Surety Bond Form?

A: U-SB Uniform Surety Bond Form is a standard form used in Arkansas for surety bonds.

Q: What is a surety bond?

A: A surety bond is a contractual agreement between three parties: the principal, the obligee, and the surety. It guarantees that the principal will fulfill their obligations to the obligee.

Q: Who is the principal in a surety bond?

A: The principal is the party who is required to obtain the surety bond. They are the one who must fulfill certain obligations.

Q: Who is the obligee in a surety bond?

A: The obligee is the party who is protected by the surety bond. They are the one who will receive compensation if the principal fails to fulfill their obligations.

Q: What is the purpose of a surety bond?

A: The purpose of a surety bond is to provide financial protection to the obligee in case the principal fails to meet their obligations.

Q: What are some common types of surety bonds?

A: Some common types of surety bonds include construction bonds, license and permit bonds, and court bonds.

Q: Is U-SB Uniform Surety Bond Form specific to Arkansas?

A: Yes, U-SB Uniform Surety Bond Form is specific to Arkansas.

Q: Are surety bonds required in Arkansas?

A: Yes, surety bonds are required for certain professions and industries in Arkansas.

Q: How much does a surety bond cost in Arkansas?

A: The cost of a surety bond in Arkansas varies depending on factors such as the bond amount and the applicant's credit history.

Q: How long does it take to get a surety bond in Arkansas?

A: The time it takes to get a surety bond in Arkansas can vary depending on the specific bond and the applicant's qualifications.

Q: What happens if a principal fails to fulfill their obligations under a surety bond?

A: If a principal fails to fulfill their obligations under a surety bond, the obligee may make a claim against the surety bond to seek compensation.

Q: Can I cancel a surety bond in Arkansas?

A: Yes, a surety bond can be canceled in Arkansas. However, the process and any associated fees may vary depending on the specific bond and the surety provider.

Q: Can I renew a surety bond in Arkansas?

A: Yes, a surety bond can be renewed in Arkansas. The renewal process may involve submitting updated information and paying a renewal premium.

Q: What happens if I don't obtain the required surety bond in Arkansas?

A: If you fail to obtain the required surety bond in Arkansas, you may face penalties, fines, or the inability to operate legally in your profession or industry.

Q: Can I get a surety bond with bad credit in Arkansas?

A: It may be more challenging to get a surety bond with bad credit in Arkansas, but it is not impossible. Some surety providers offer options for applicants with lower credit scores.

Form Details:

- The latest edition provided by the Arkansas Securities Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form U-SB by clicking the link below or browse more documents and templates provided by the Arkansas Securities Department.