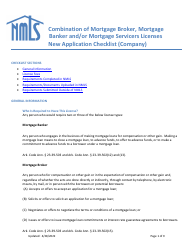

Ar Mortgage Servicer License New Application Checklist (Company) - Arkansas

Ar Mortgage Servicer License New Application Checklist (Company) is a legal document that was released by the Arkansas Securities Department - a government authority operating within Arkansas.

FAQ

Q: What is an AR mortgage servicer license?

A: An AR mortgage servicer license is a license required by the state of Arkansas for companies that want to provide mortgage servicing services.

Q: What is the purpose of the new application checklist for an AR mortgage servicer license?

A: The purpose of the new application checklist is to provide a list of documents and requirements that companies need to fulfill in order to apply for an AR mortgage servicer license.

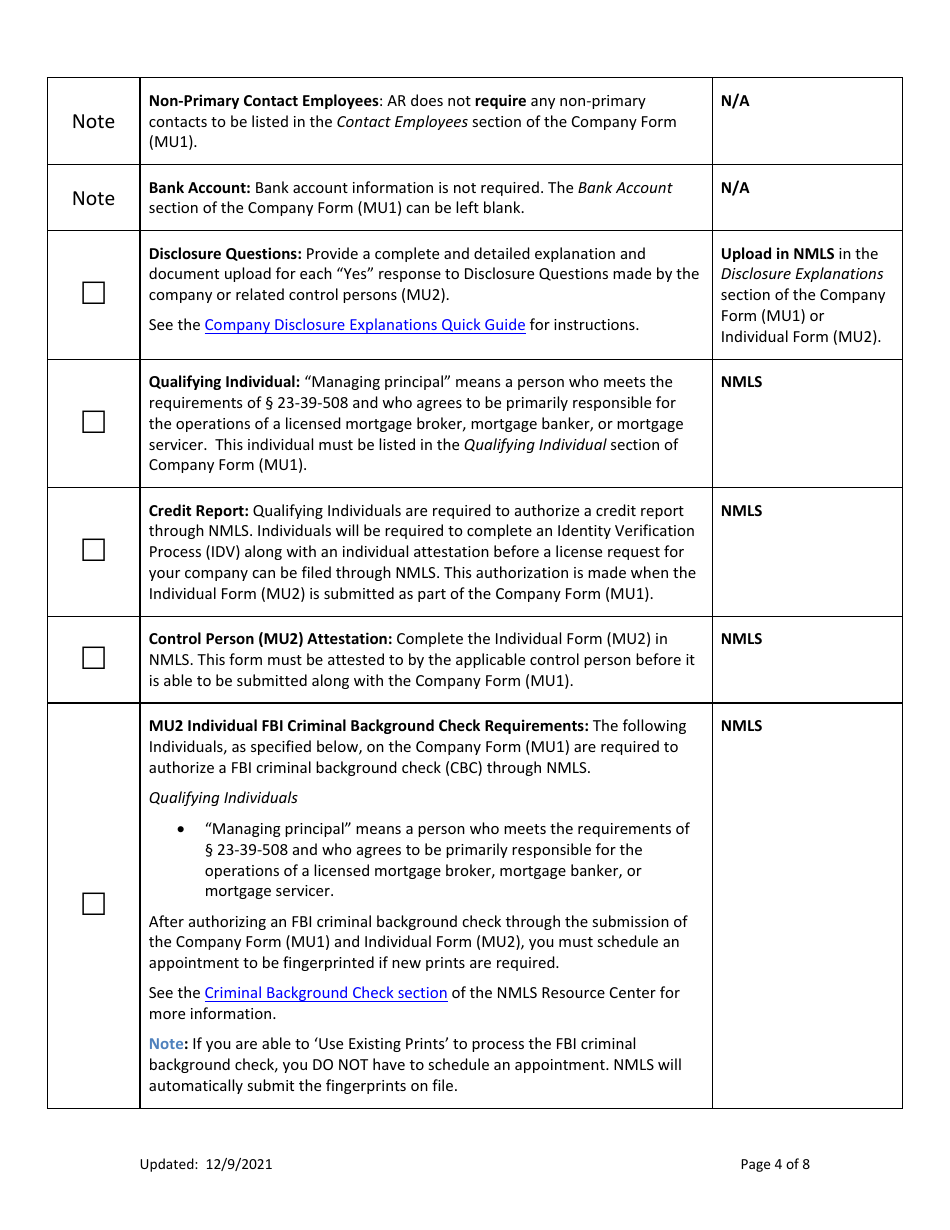

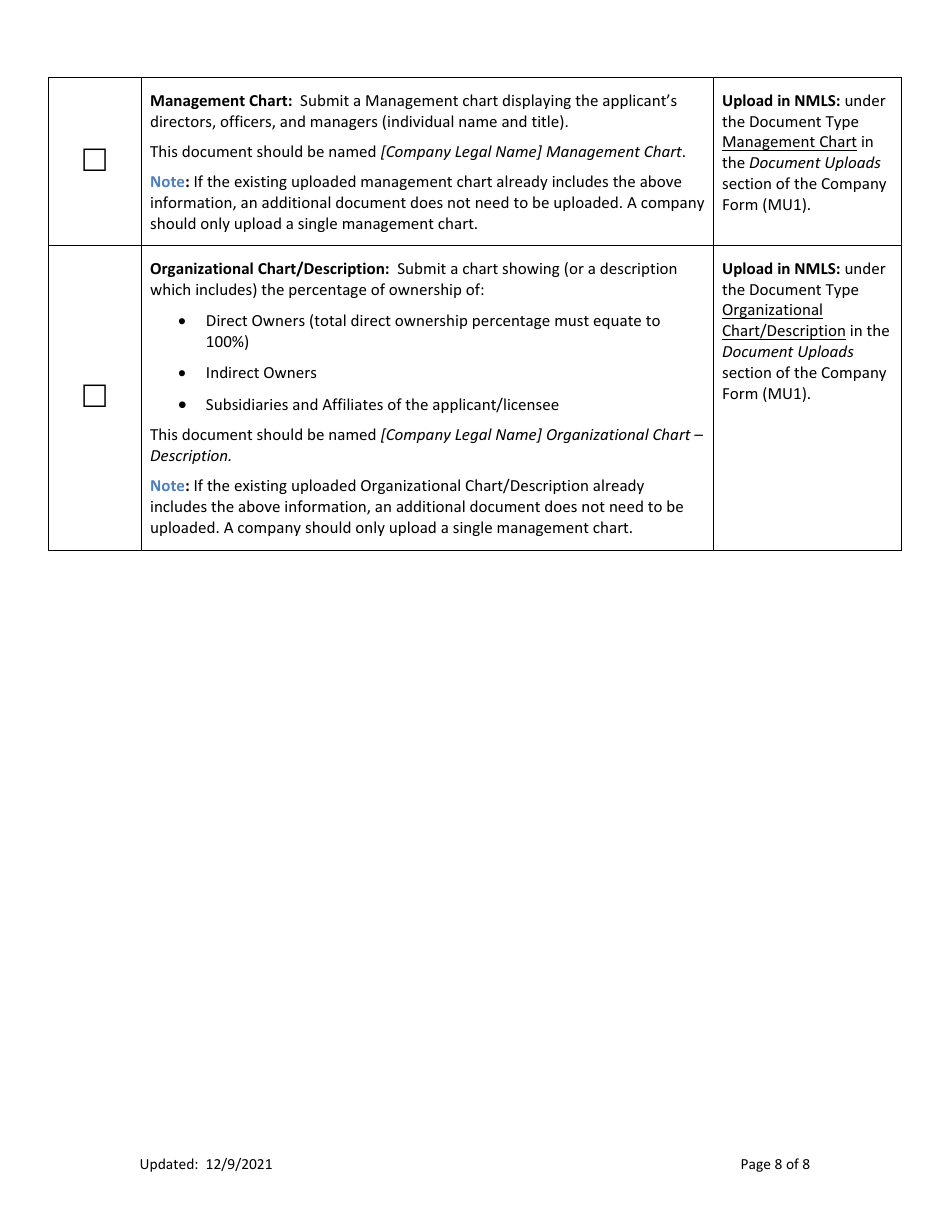

Q: What documents are typically included in the new application checklist for an AR mortgage servicer license?

A: The documents typically included in the new application checklist may include a completed application form, financial statements, surety bond, background check information, and other supporting documents.

Q: Who needs to complete the new application checklist for an AR mortgage servicer license?

A: Companies that are seeking to provide mortgage servicing services in the state of Arkansas need to complete the new application checklist.

Q: Are there any fees associated with the AR mortgage servicer license application?

A: Yes, there are fees associated with the AR mortgage servicer license application. The specific fees may vary and can be found in the application checklist.

Q: How long does it take to process the AR mortgage servicer license application?

A: The processing time for the AR mortgage servicer license application can vary. It is recommended to check with the Arkansas Securities Department for the current processing time.

Q: What are the requirements for obtaining an AR mortgage servicer license?

A: The requirements for obtaining an AR mortgage servicer license may include meeting certain financial stability criteria, submitting a complete application with supporting documents, passing background checks, and fulfilling any other requirements specified by the Arkansas Securities Department.

Q: Can an out-of-state mortgage servicer apply for an AR mortgage servicer license?

A: Yes, an out-of-state mortgage servicer can apply for an AR mortgage servicer license, but they must meet the requirements set by the Arkansas Securities Department.

Q: Is it mandatory to have an AR mortgage servicer license to provide mortgage servicing services in Arkansas?

A: Yes, it is mandatory to have an AR mortgage servicer license to provide mortgage servicing services in Arkansas. Operating without a license is a violation of the state's regulations.

Form Details:

- Released on December 9, 2021;

- The latest edition currently provided by the Arkansas Securities Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Securities Department.