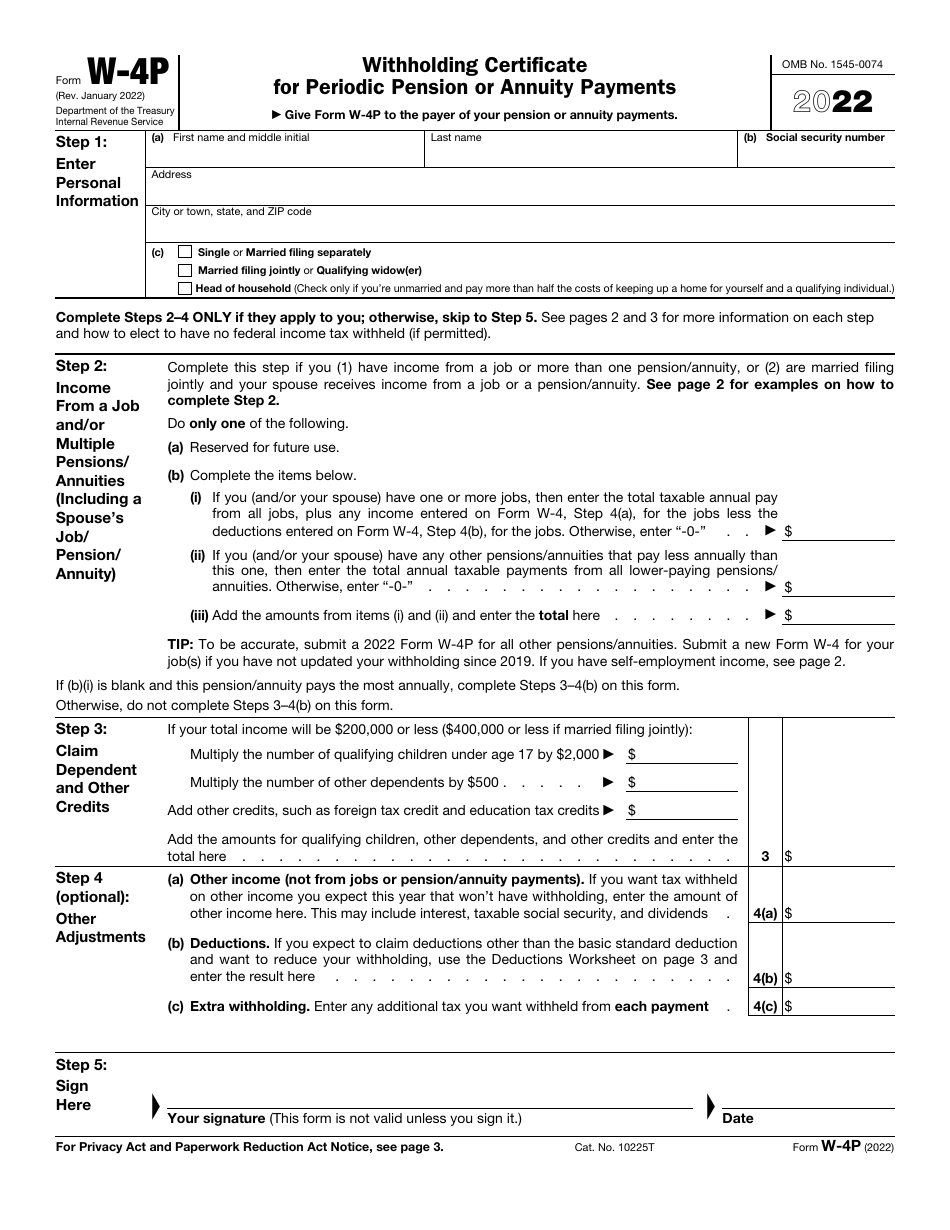

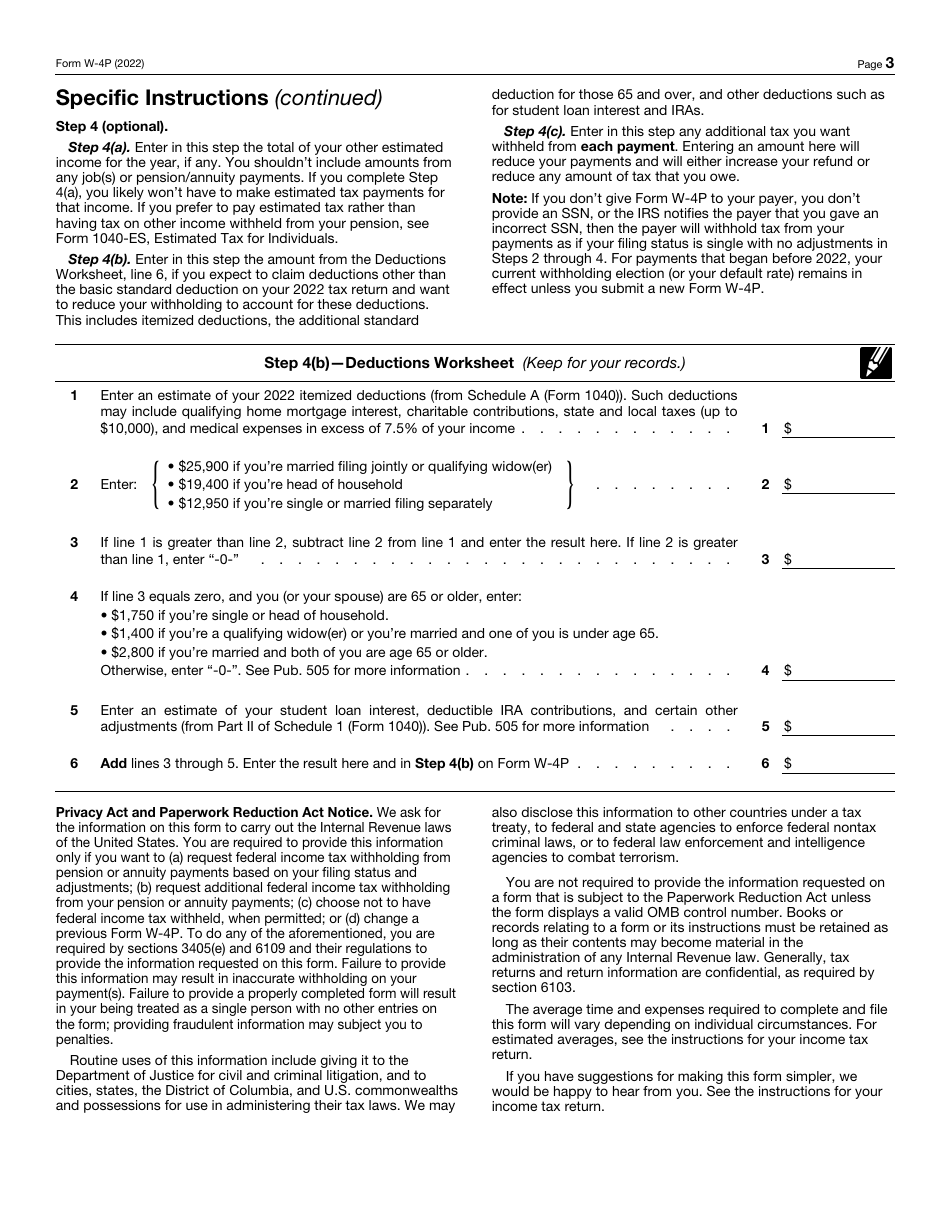

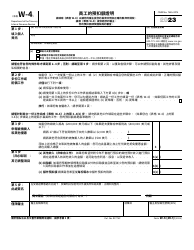

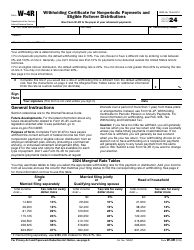

IRS Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments - Florida

What Is IRS Form W-4P?

This is a legal form that was released by the Florida Department of Management Services - Florida Retirement System - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IRS Form W-4P?

A: IRS Form W-4P is a withholding certificate used for periodic pension or annuity payments.

Q: Who needs to use IRS Form W-4P?

A: Anyone receiving periodic pension or annuity payments may need to use IRS Form W-4P.

Q: What is the purpose of IRS Form W-4P?

A: The purpose of IRS Form W-4P is to determine how much federal income tax should be withheld from the periodic pension or annuity payments.

Q: Do I need to fill out IRS Form W-4P every year?

A: You may need to fill out IRS Form W-4P every year if your withholding preferences change or if requested by the payer of your pension or annuity.

Q: Are there any specific instructions for Florida residents regarding IRS Form W-4P?

A: There are no specific instructions for Florida residents regarding IRS Form W-4P. The form is used nationwide.

Q: Is IRS Form W-4P only for Florida residents?

A: No, IRS Form W-4P is used by taxpayers nationwide, not just Florida residents.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Florida Department of Management Services - Florida Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-4P by clicking the link below or browse more documents and templates provided by the Florida Department of Management Services - Florida Retirement System.