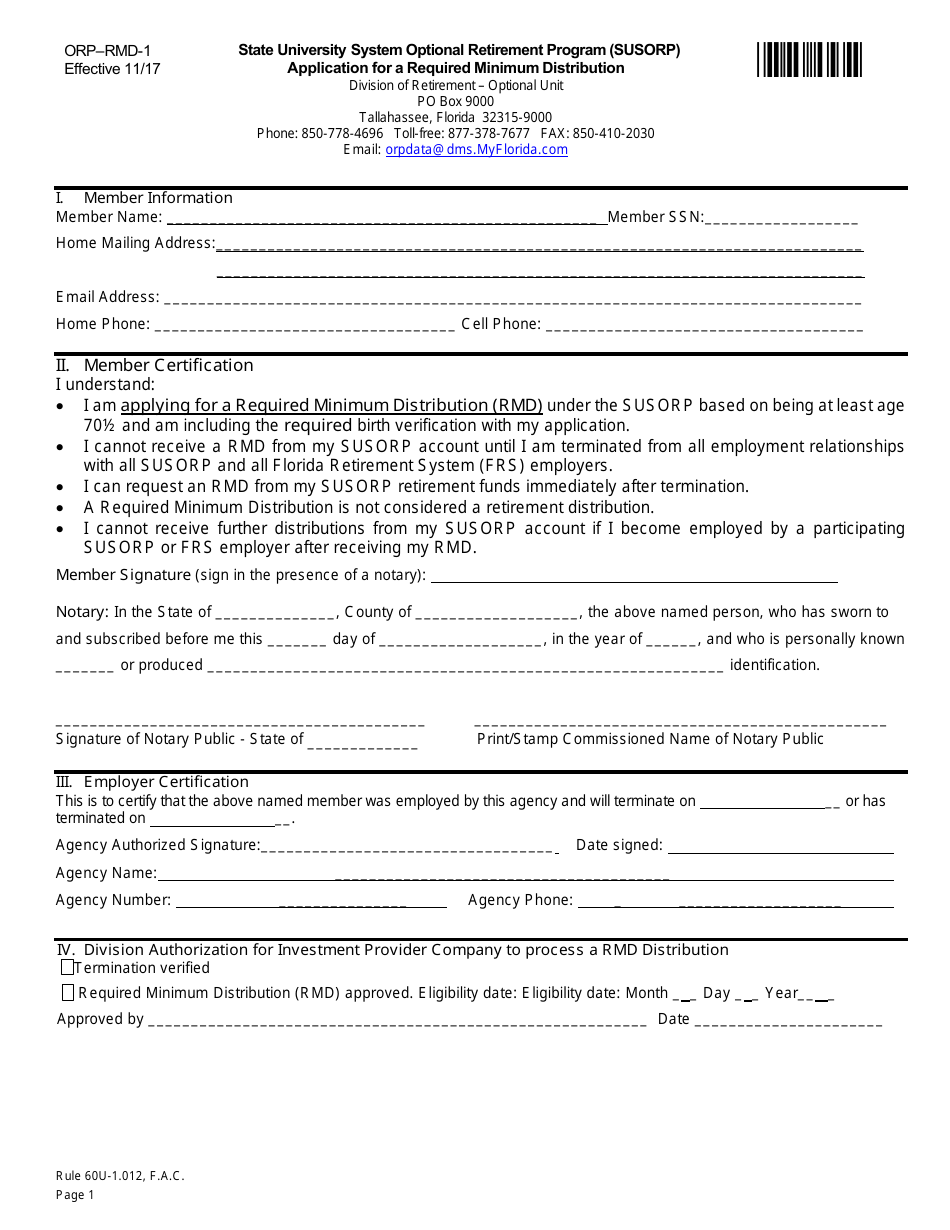

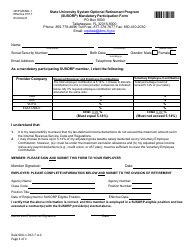

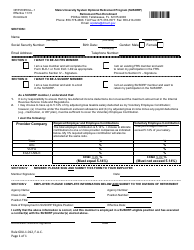

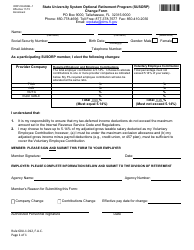

Form ORP-RMD-1 State University System Optional Retirement Program (Susorp) Application for a Required Minimum Distribution - Florida

What Is Form ORP-RMD-1?

This is a legal form that was released by the Florida Department of Management Services - Florida Retirement System - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ORP-RMD-1?

A: Form ORP-RMD-1 is an application for a Required Minimum Distribution in the State University System Optional Retirement Program (Susorp) in Florida.

Q: What is the State University System Optional Retirement Program (Susorp)?

A: Susorp is a retirement program available to employees in the State University System of Florida.

Q: What is a Required Minimum Distribution?

A: A Required Minimum Distribution (RMD) is the minimum amount that must be withdrawn from a retirement account each year once an individual reaches a certain age.

Q: Who is eligible to apply for a Required Minimum Distribution through Susorp?

A: Employees in the State University System of Florida who have reached the age at which RMDs are required to be taken.

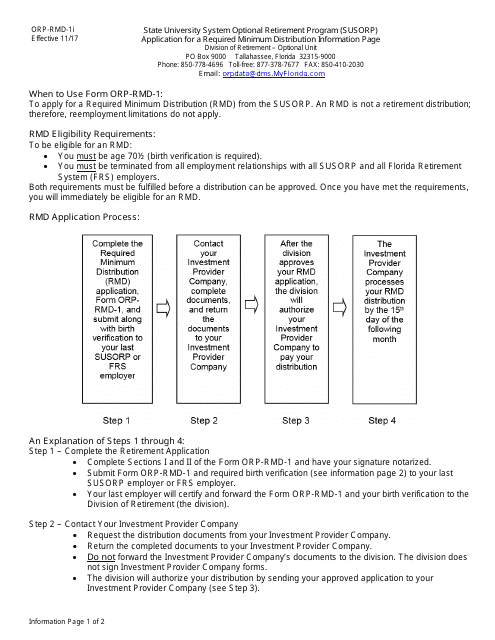

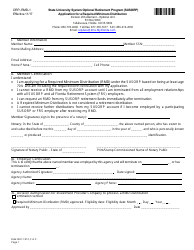

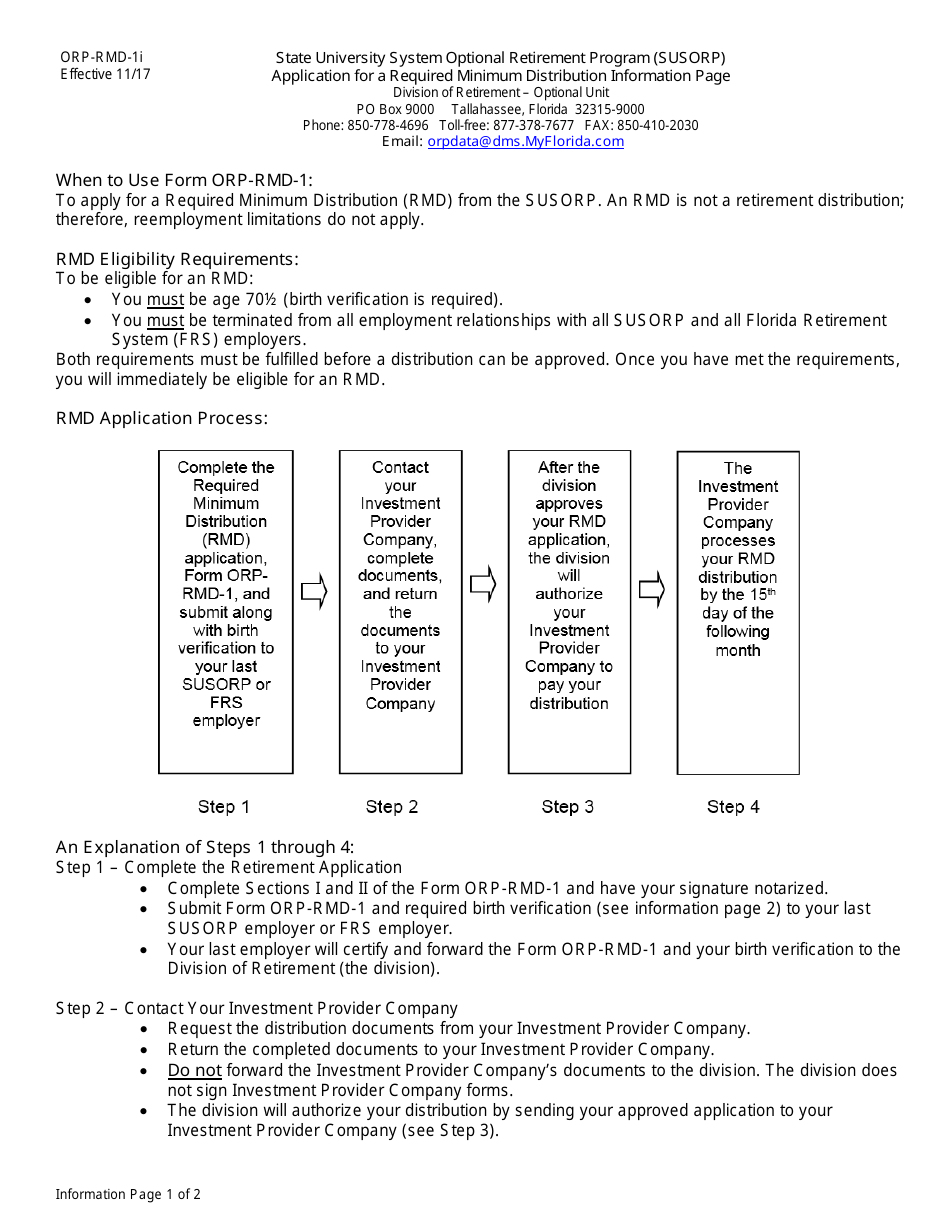

Q: How do I complete the Form ORP-RMD-1?

A: The form requires the employee's personal information, retirement account details, and the requested distribution amount.

Q: Are there any fees associated with taking a Required Minimum Distribution?

A: There may be fees associated with taking a Required Minimum Distribution. It is recommended to consult the retirement plan's terms and conditions or contact a financial advisor for more information.

Q: What happens if I do not take a Required Minimum Distribution?

A: Failure to take a Required Minimum Distribution can result in penalties and additional taxes imposed by the Internal Revenue Service (IRS).

Q: Can I roll over or transfer my Required Minimum Distribution to another retirement account?

A: No, Required Minimum Distributions cannot be rolled over or transferred to another retirement account.

Q: How often do I need to take a Required Minimum Distribution?

A: Required Minimum Distributions must be taken annually, usually by the end of the calendar year.

Q: Can I change the amount of my Required Minimum Distribution each year?

A: Yes, the amount of the Required Minimum Distribution can be adjusted each year based on the individual's account balance and life expectancy.

Q: What tax implications are associated with a Required Minimum Distribution?

A: Required Minimum Distributions are generally subject to income tax. It is recommended to consult with a tax advisor for specific details.

Q: Is the Form ORP-RMD-1 specific to the State University System Optional Retirement Program?

A: Yes, the Form ORP-RMD-1 is specific to the State University System Optional Retirement Program (Susorp) in Florida.

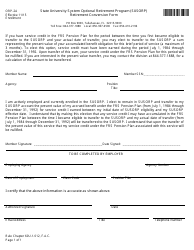

Q: Are there any deadlines for submitting the Form ORP-RMD-1?

A: Deadlines for submitting the Form ORP-RMD-1 may vary. It is recommended to follow the instructions provided on the form or contact the relevant authorities for specific deadlines.

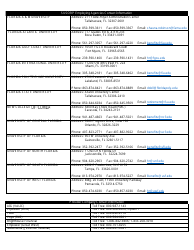

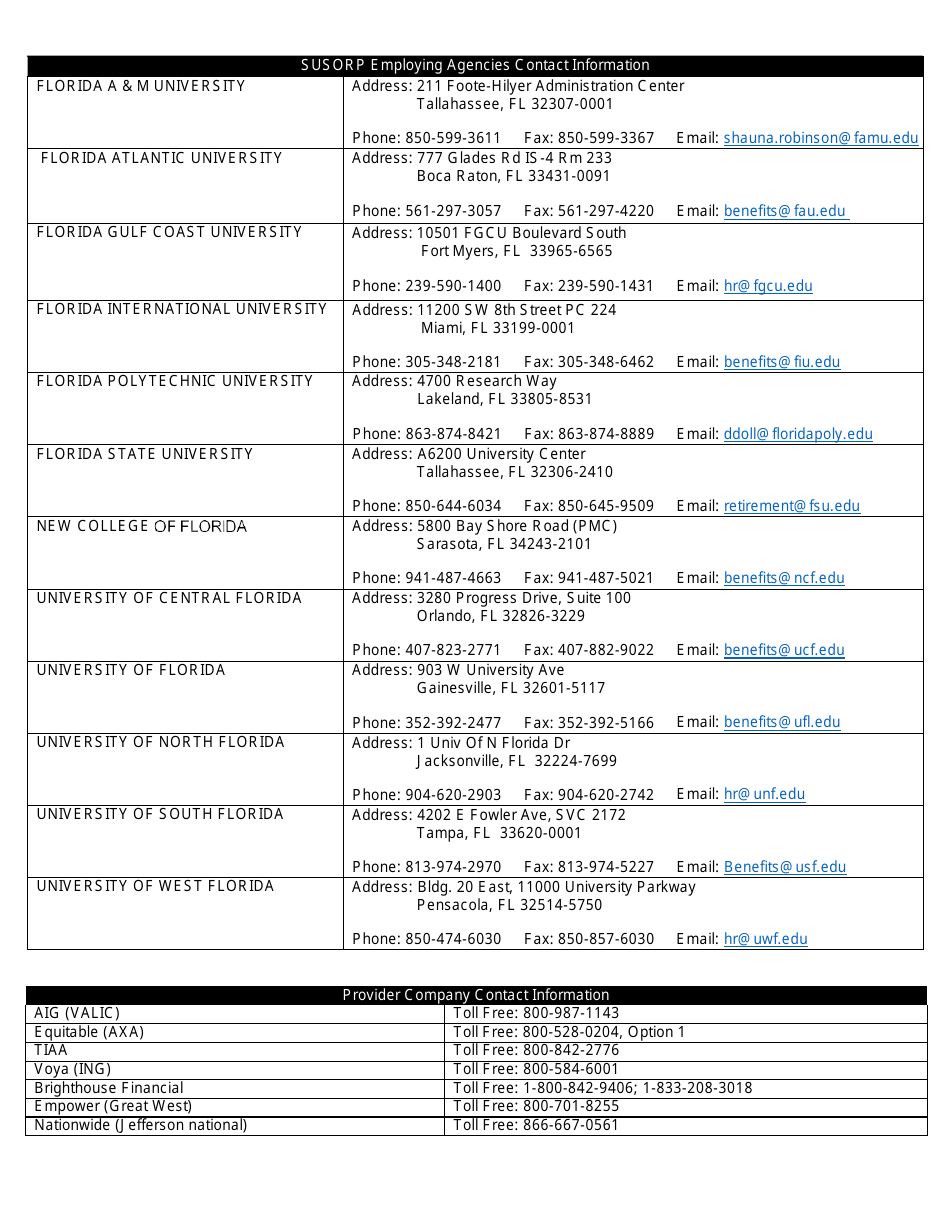

Q: Who should I contact if I have questions about the Form ORP-RMD-1 or the Required Minimum Distribution process?

A: For questions about the Form ORP-RMD-1 or the Required Minimum Distribution process, it is recommended to contact the human resources department of the employee's university or the retirement plan administrator.

Q: Is the Required Minimum Distribution the same for all retirement accounts?

A: No, the Required Minimum Distribution can vary depending on the type of retirement account and the individual's age.

Q: Can I take a Required Minimum Distribution before reaching the age at which they are required?

A: In certain situations, individuals may be eligible to take a Required Minimum Distribution before reaching the age at which they are normally required. It is recommended to consult with a financial advisor or the retirement plan administrator for further information.

Q: Are there any exceptions or special circumstances regarding Required Minimum Distributions?

A: There are certain exceptions and special circumstances that may apply to Required Minimum Distributions. It is recommended to consult with a financial advisor or the retirement plan administrator for specific details.

Q: Can I apply for a Required Minimum Distribution if I am no longer employed with the State University System of Florida?

A: The eligibility to apply for a Required Minimum Distribution may vary depending on the terms and conditions of the retirement program. It is recommended to consult with a financial advisor or the retirement plan administrator for specific eligibility criteria.

Q: Can I choose not to take a Required Minimum Distribution if I don't need the funds?

A: No, individuals who are required to take a Required Minimum Distribution must comply with the distribution requirements set by the Internal Revenue Service (IRS).

Q: What documentation do I need to include with the Form ORP-RMD-1?

A: The specific documentation required may vary. It is recommended to carefully review the instructions provided with the form or contact the relevant authorities for documentation requirements.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Florida Department of Management Services - Florida Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ORP-RMD-1 by clicking the link below or browse more documents and templates provided by the Florida Department of Management Services - Florida Retirement System.