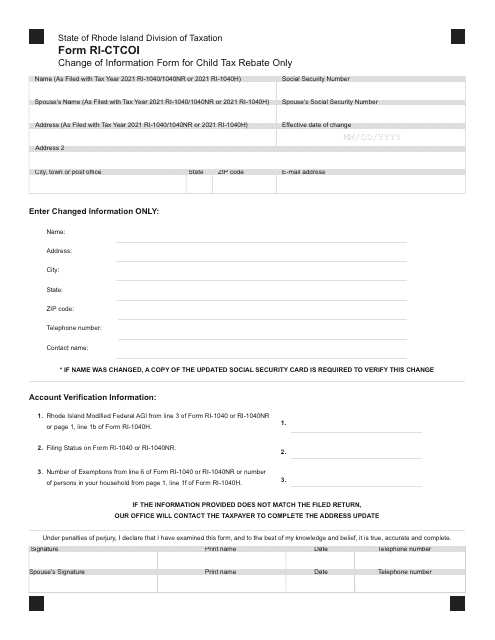

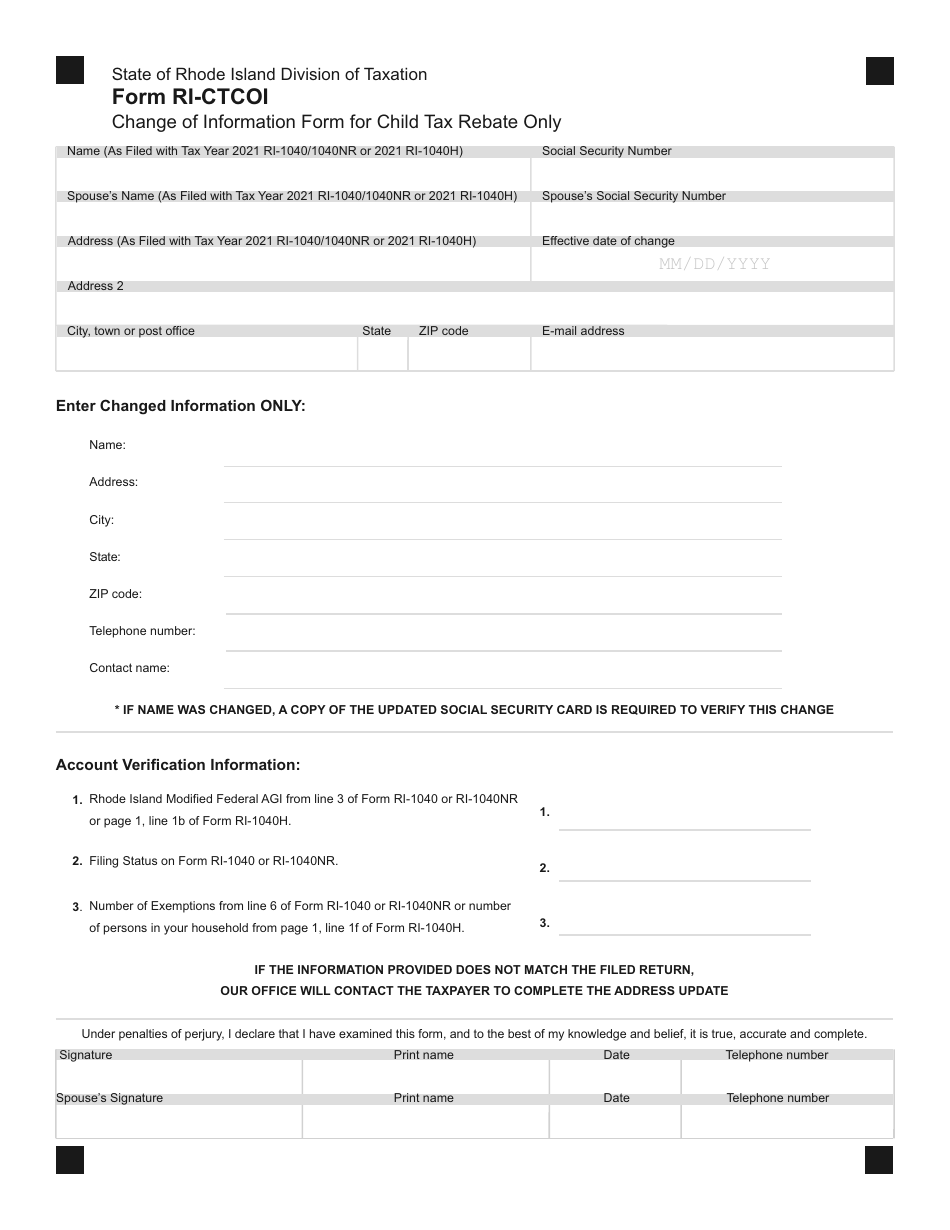

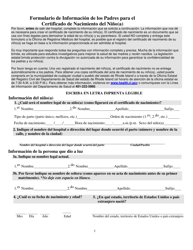

Form RI-CTCOI Change of Information Form for Child Tax Rebate Only - Rhode Island

What Is Form RI-CTCOI?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-CTCOI?

A: Form RI-CTCOI is the Change of Information Form for Child Tax Rebate Only - Rhode Island.

Q: What is the purpose of Form RI-CTCOI?

A: The purpose of Form RI-CTCOI is to update information related to the Child Tax Rebate only in Rhode Island.

Q: Who needs to use Form RI-CTCOI?

A: Anyone who wants to make changes to their information for the Child Tax Rebate in Rhode Island needs to use Form RI-CTCOI.

Q: Is Form RI-CTCOI specific to Rhode Island?

A: Yes, Form RI-CTCOI is specific to Rhode Island and is used only for the Child Tax Rebate in the state.

Q: What type of information can be changed using Form RI-CTCOI?

A: Form RI-CTCOI allows you to change information such as your name, address, social security number, and mailing preferences for the Child Tax Rebate in Rhode Island.

Q: Are there any fees associated with submitting Form RI-CTCOI?

A: No, there are no fees associated with submitting Form RI-CTCOI.

Q: What should I do if I have additional questions about Form RI-CTCOI?

A: If you have additional questions about Form RI-CTCOI, you can contact the Rhode Island Department of Revenue for assistance.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-CTCOI by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.