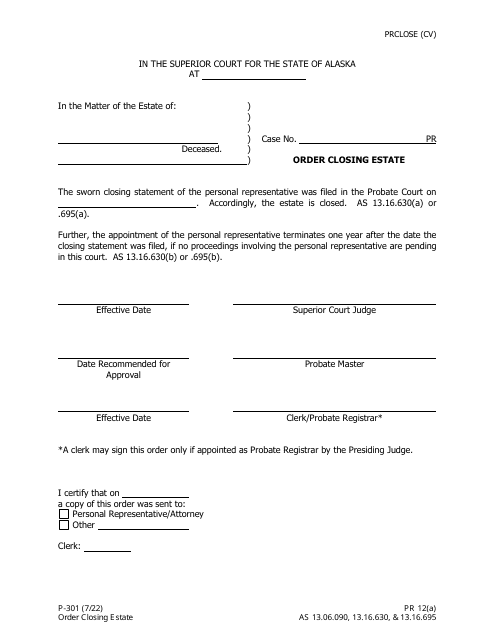

Form P-301 Order Closing Estate - Alaska

What Is Form P-301?

This is a legal form that was released by the Alaska Superior Court - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-301?

A: Form P-301 is a document used in Alaska to close an estate.

Q: When is Form P-301 used?

A: Form P-301 is used when all the requirements for closing an estate in Alaska have been met.

Q: What does Form P-301 do?

A: Form P-301 officially closes the estate and allows for the distribution of assets to beneficiaries.

Q: Who can file Form P-301?

A: Form P-301 can be filed by the personal representative of the estate or their attorney.

Q: Are there any fees associated with filing Form P-301?

A: Yes, there is a filing fee associated with submitting Form P-301.

Q: Do I need to provide any supporting documents with Form P-301?

A: Yes, you will need to provide various supporting documents, such as an inventory of assets and a final accounting of the estate.

Q: What happens after Form P-301 is filed?

A: After Form P-301 is filed, the court will review the documents and issue an order officially closing the estate.

Q: How long does it take for the court to process Form P-301?

A: The processing time can vary, but it typically takes a few weeks to a few months for the court to review and process Form P-301.

Q: Can I appeal the court's decision on Form P-301?

A: Yes, if you disagree with the court's decision, you may have the option to appeal.

Q: What should I do after the estate is closed with Form P-301?

A: After the estate is closed, you can proceed with distributing the assets to the beneficiaries according to the court's order.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Alaska Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-301 by clicking the link below or browse more documents and templates provided by the Alaska Superior Court.