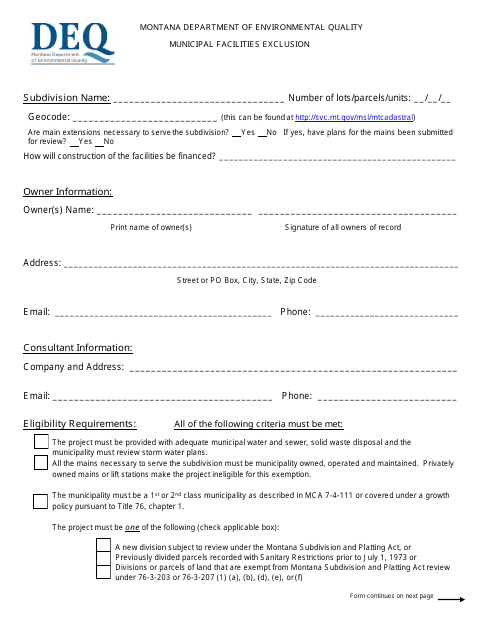

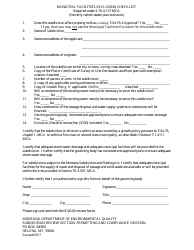

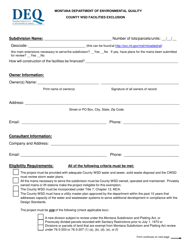

Municipal Facilities Exclusion - Montana

Municipal Facilities Exclusion is a legal document that was released by the Montana Department of Environmental Quality - a government authority operating within Montana.

FAQ

Q: What is the Municipal Facilities Exclusion?

A: The Municipal Facilities Exclusion is a property tax exemption available in Montana.

Q: Who qualifies for the Municipal Facilities Exclusion?

A: Qualifying municipalities in Montana are eligible for the Municipal Facilities Exclusion.

Q: What is the purpose of the Municipal Facilities Exclusion?

A: The purpose of the Municipal Facilities Exclusion is to provide property tax relief for qualifying municipalities.

Q: Which properties are eligible for the Municipal Facilities Exclusion?

A: Properties owned by qualifying municipalities, such as city halls, police stations, and fire stations, may be eligible for the Municipal Facilities Exclusion.

Q: How does the Municipal Facilities Exclusion work?

A: Under the Municipal Facilities Exclusion, eligible properties owned by qualifying municipalities are exempt from property taxes.

Q: Are there any limitations or requirements for the Municipal Facilities Exclusion?

A: Yes, there may be limitations and requirements for the Municipal Facilities Exclusion, such as specific criteria for qualifying municipalities and eligible properties.

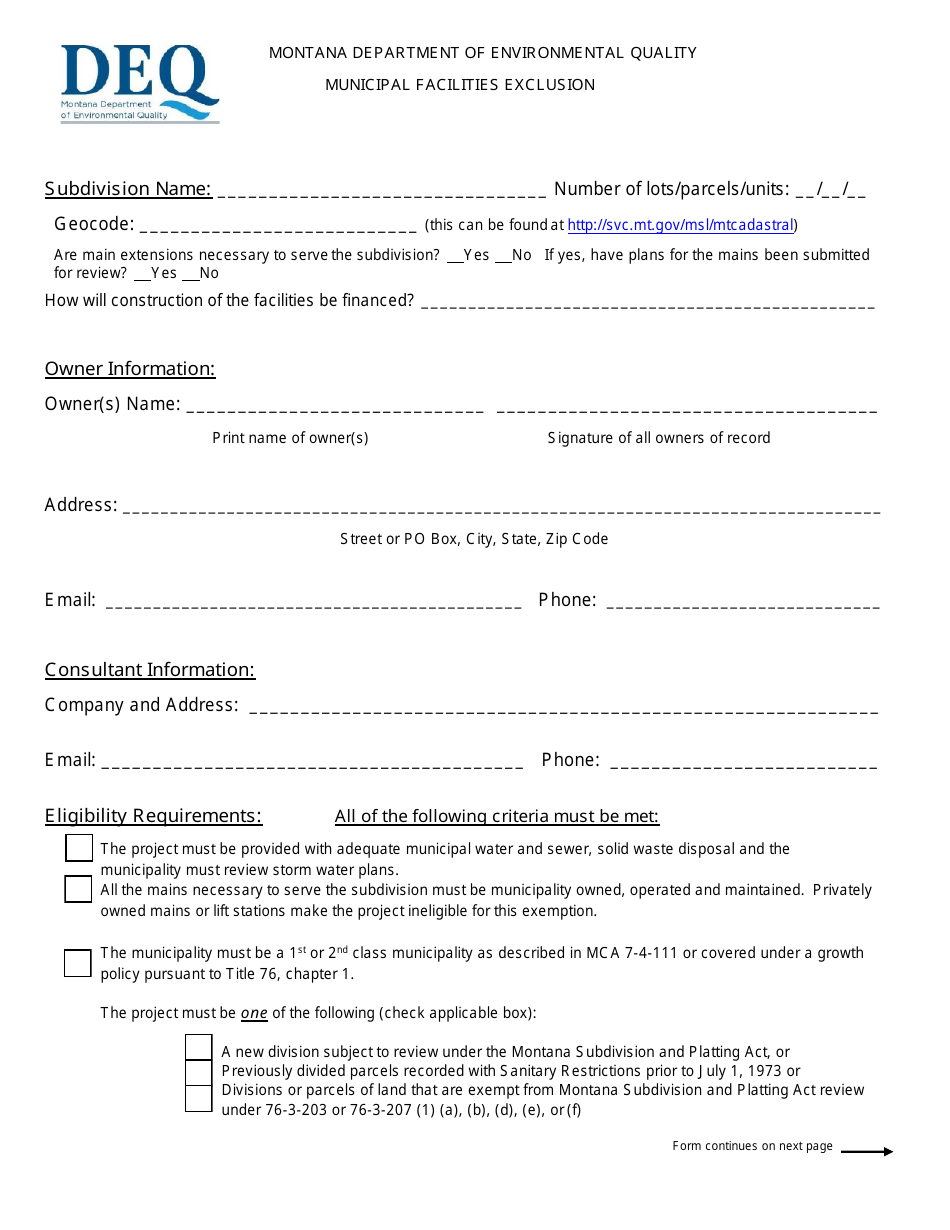

Form Details:

- The latest edition currently provided by the Montana Department of Environmental Quality;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Environmental Quality.