This version of the form is not currently in use and is provided for reference only. Download this version of

Form DBPR CPA13

for the current year.

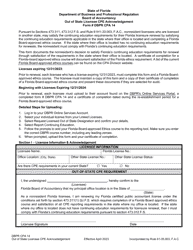

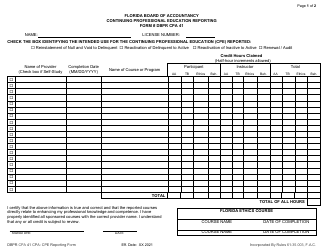

Form DBPR CPA13 Instructor Cpe Credit Reporting Form - Florida

What Is Form DBPR CPA13?

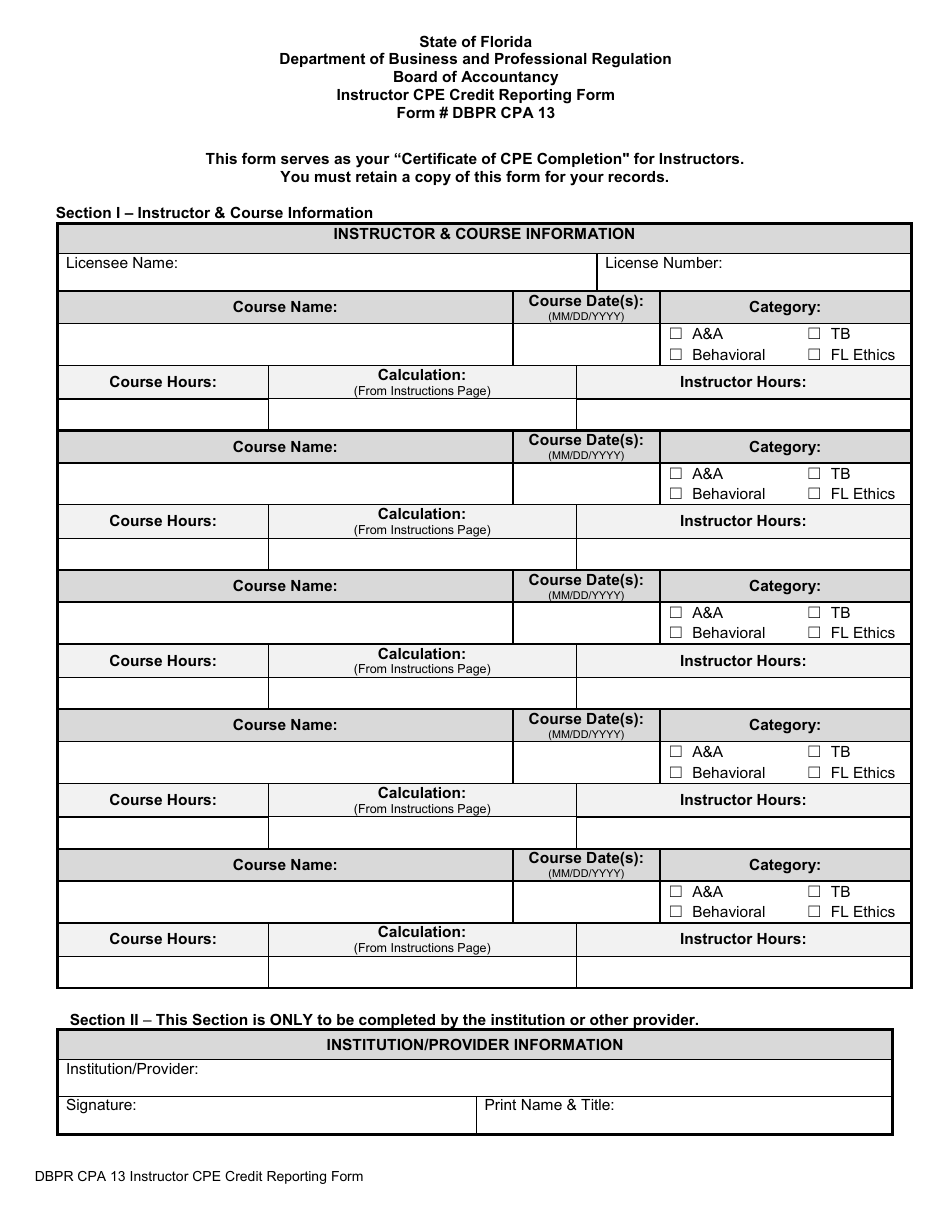

This is a legal form that was released by the Florida Department of Business & Professional Regulation - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

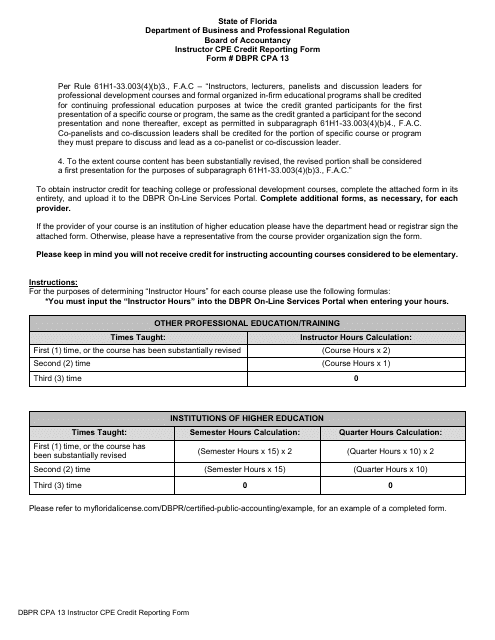

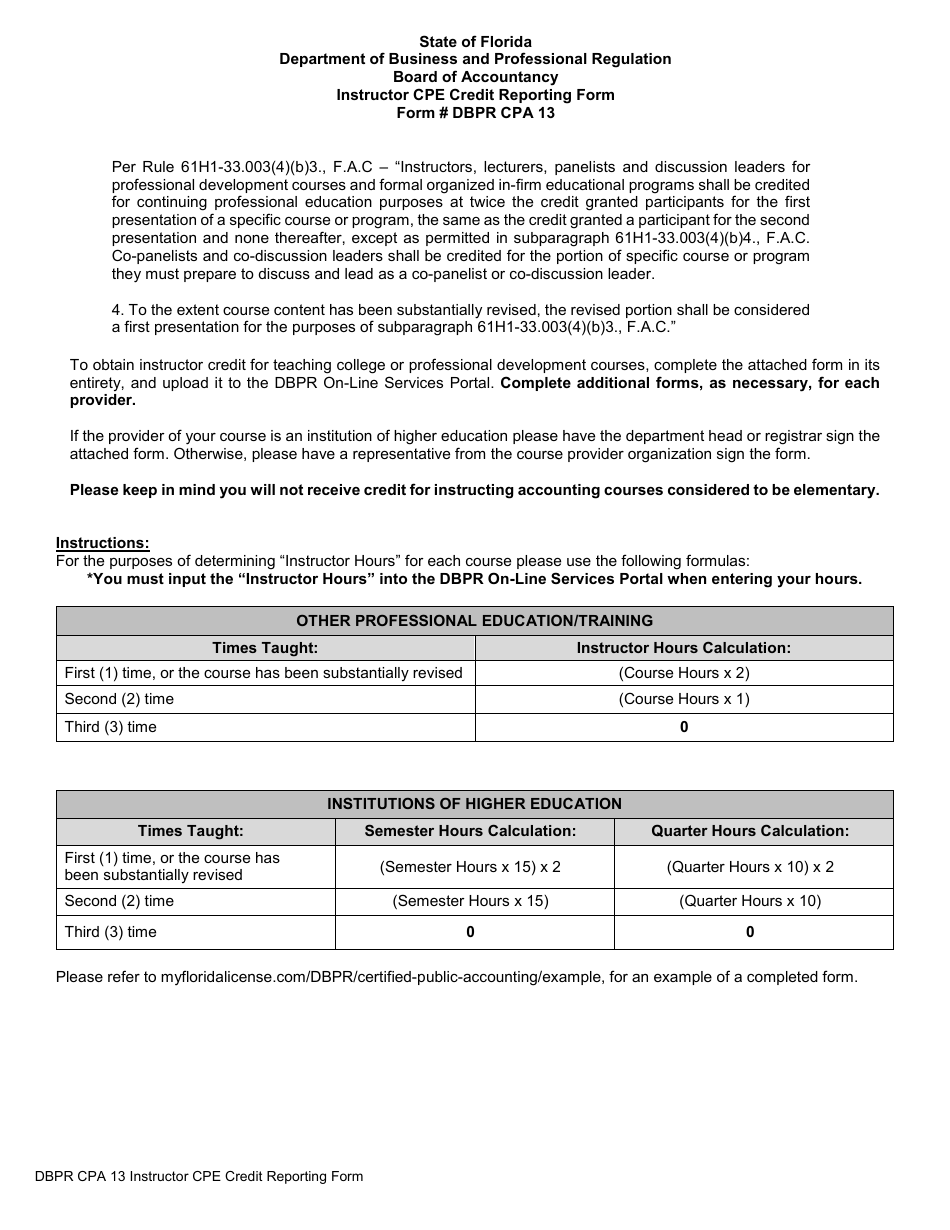

Q: What is the DBPR CPA13 Instructor CPE Credit Reporting Form?

A: The DBPR CPA13 Instructor CPE Credit Reporting Form is a form that instructors use to report their continuing professional education credits in the state of Florida.

Q: Who is required to use the DBPR CPA13 Instructor CPE Credit Reporting Form?

A: Instructors who teach continuing professional education courses in Florida are required to use the DBPR CPA13 Instructor CPE Credit Reporting Form.

Q: What kind of credits can be reported on the DBPR CPA13 Instructor CPE Credit Reporting Form?

A: The DBPR CPA13 Instructor CPE Credit Reporting Form can be used to report credits earned through teaching or instructing continuing professional education courses.

Q: Is the DBPR CPA13 Instructor CPE Credit Reporting Form only for CPAs?

A: No, the DBPR CPA13 Instructor CPE Credit Reporting Form is not only for CPAs. It can be used by instructors of various professional disciplines.

Q: How often do instructors need to report their CPE credits using the DBPR CPA13 Instructor CPE Credit Reporting Form?

A: Instructors need to report their CPE credits using the DBPR CPA13 Instructor CPE Credit Reporting Form within 30 days of completing a course.

Q: What information is required on the DBPR CPA13 Instructor CPE Credit Reporting Form?

A: The DBPR CPA13 Instructor CPE Credit Reporting Form requires instructors to provide their personal information, course information, and the number of CPE credits earned.

Q: Are there any fees associated with submitting the DBPR CPA13 Instructor CPE Credit Reporting Form?

A: No, there are no fees associated with submitting the DBPR CPA13 Instructor CPE Credit Reporting Form.

Q: What happens after instructors submit the DBPR CPA13 Instructor CPE Credit Reporting Form?

A: After instructors submit the DBPR CPA13 Instructor CPE Credit Reporting Form, their credits will be recorded and added to their continuing education record.

Form Details:

- The latest edition provided by the Florida Department of Business & Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DBPR CPA13 by clicking the link below or browse more documents and templates provided by the Florida Department of Business & Professional Regulation.