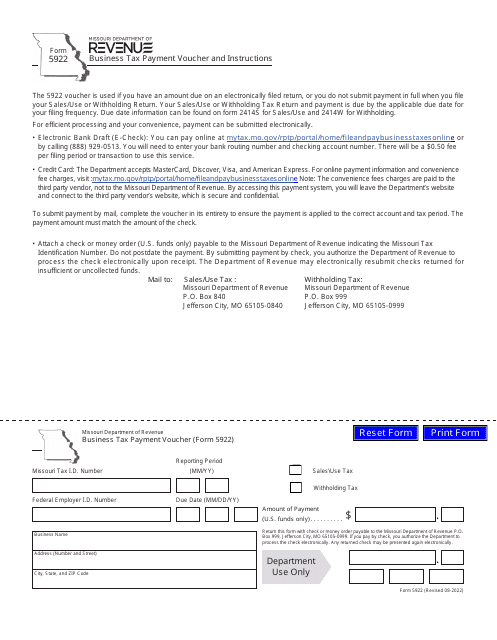

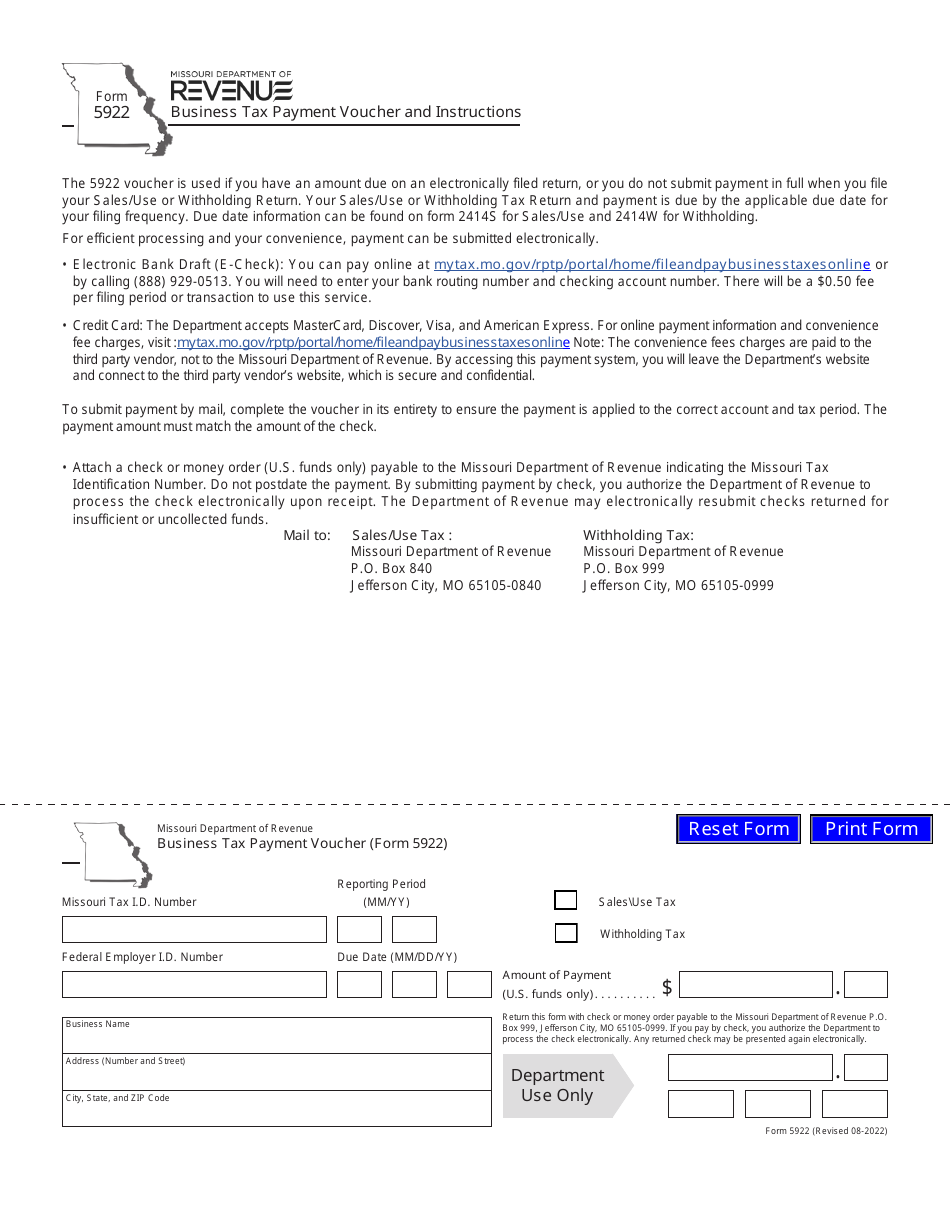

Form 5922 Business Tax Payment Voucher - Missouri

What Is Form 5922?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5922?

A: Form 5922 is a business tax payment voucher used in Missouri.

Q: Who needs to file Form 5922?

A: Businesses in Missouri that need to make tax payments.

Q: What is the purpose of Form 5922?

A: Form 5922 is used to submit payments for various business taxes in Missouri.

Q: What taxes can be paid using Form 5922?

A: Form 5922 can be used to pay taxes such as sales tax, withholding tax, and corporate income tax in Missouri.

Q: Are there any penalties for late or incorrect filing of Form 5922?

A: Yes, there may be penalties for late or incorrect filing of Form 5922. It's important to ensure timely and accurate filing to avoid penalties.

Q: Is Form 5922 specific to businesses in Missouri?

A: Yes, Form 5922 is specific to businesses operating in Missouri and making tax payments in the state.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5922 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.