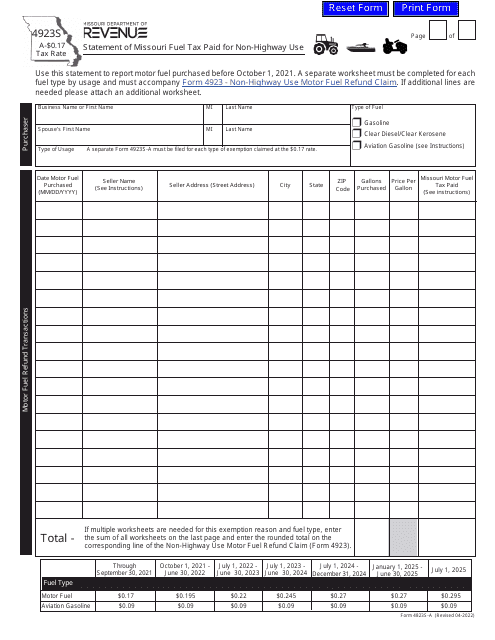

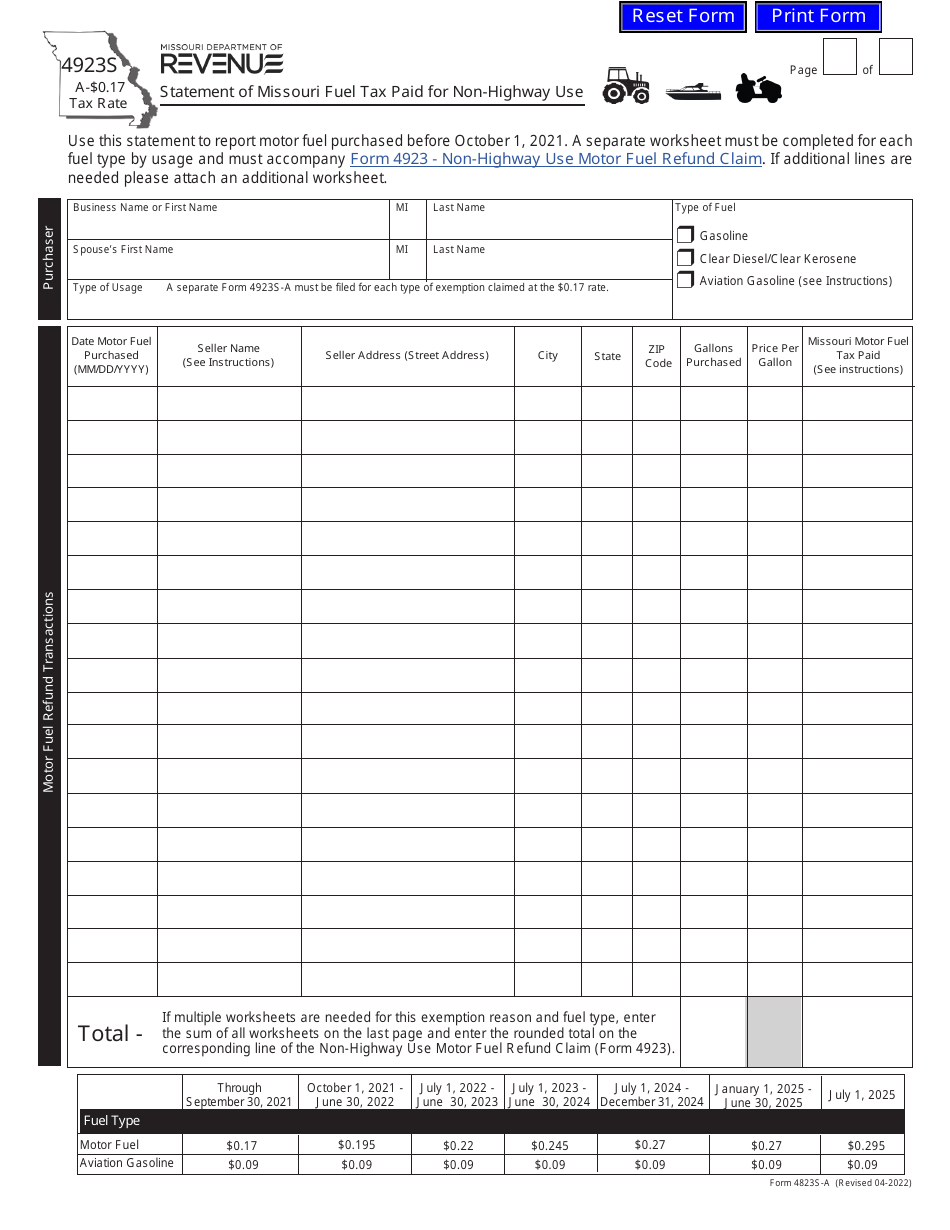

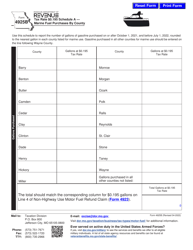

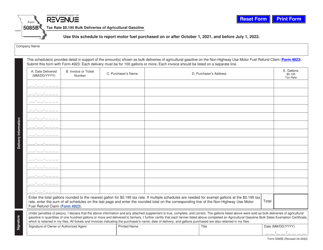

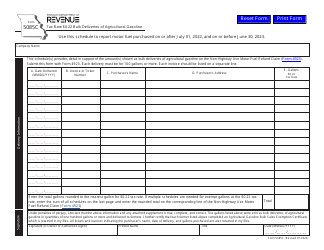

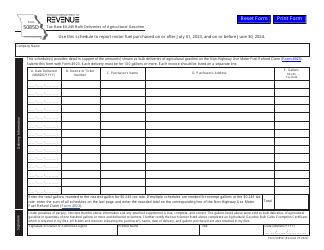

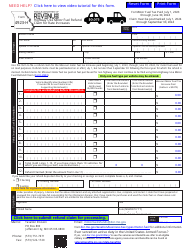

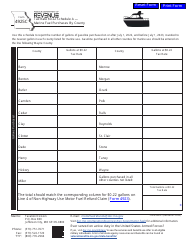

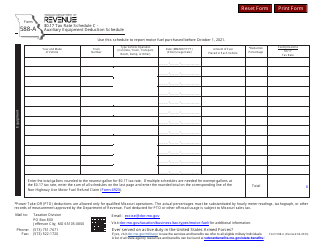

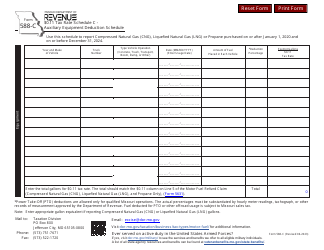

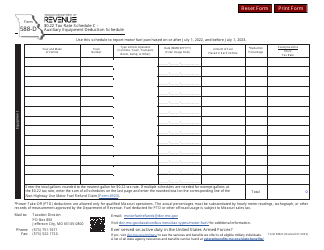

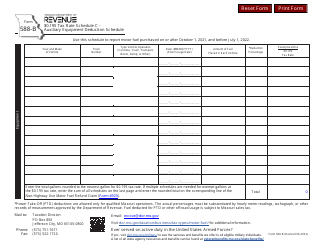

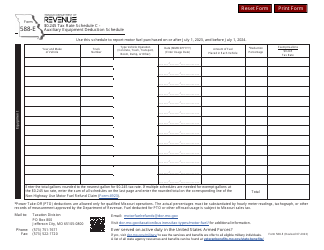

Form 4923S-A $0.17 Tax Rate Statement of Missouri Fuel Tax Paid for Non-highway Use - Missouri

What Is Form 4923S-A?

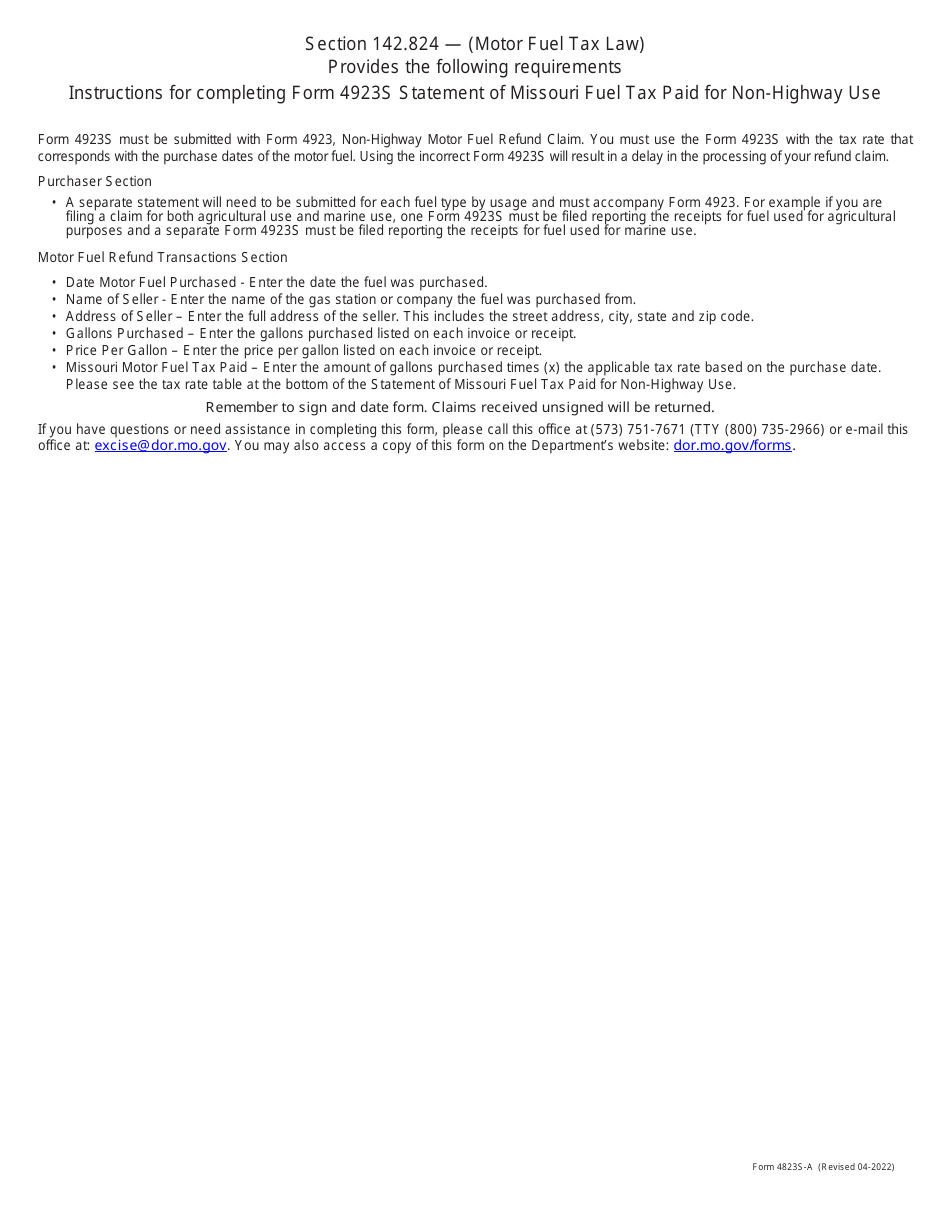

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4923S-A?

A: Form 4923S-A is a Tax Rate Statement of Missouri Fuel Tax Paid for Non-highway Use.

Q: What is the tax rate for Form 4923S-A?

A: The tax rate for Form 4923S-A is $0.17.

Q: What is the purpose of Form 4923S-A?

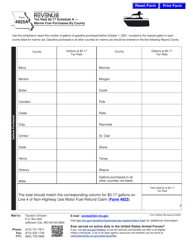

A: The purpose of Form 4923S-A is to report the amount of Missouri fuel tax paid for non-highway use.

Q: Who needs to file Form 4923S-A?

A: Anyone who has paid Missouri fuel tax for non-highway use needs to file Form 4923S-A.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4923S-A by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.