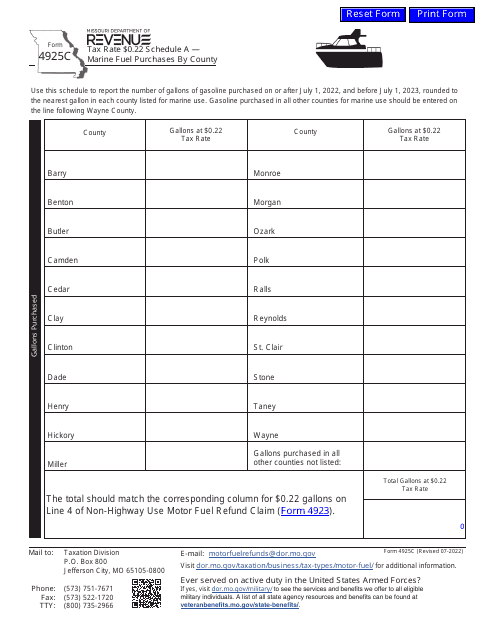

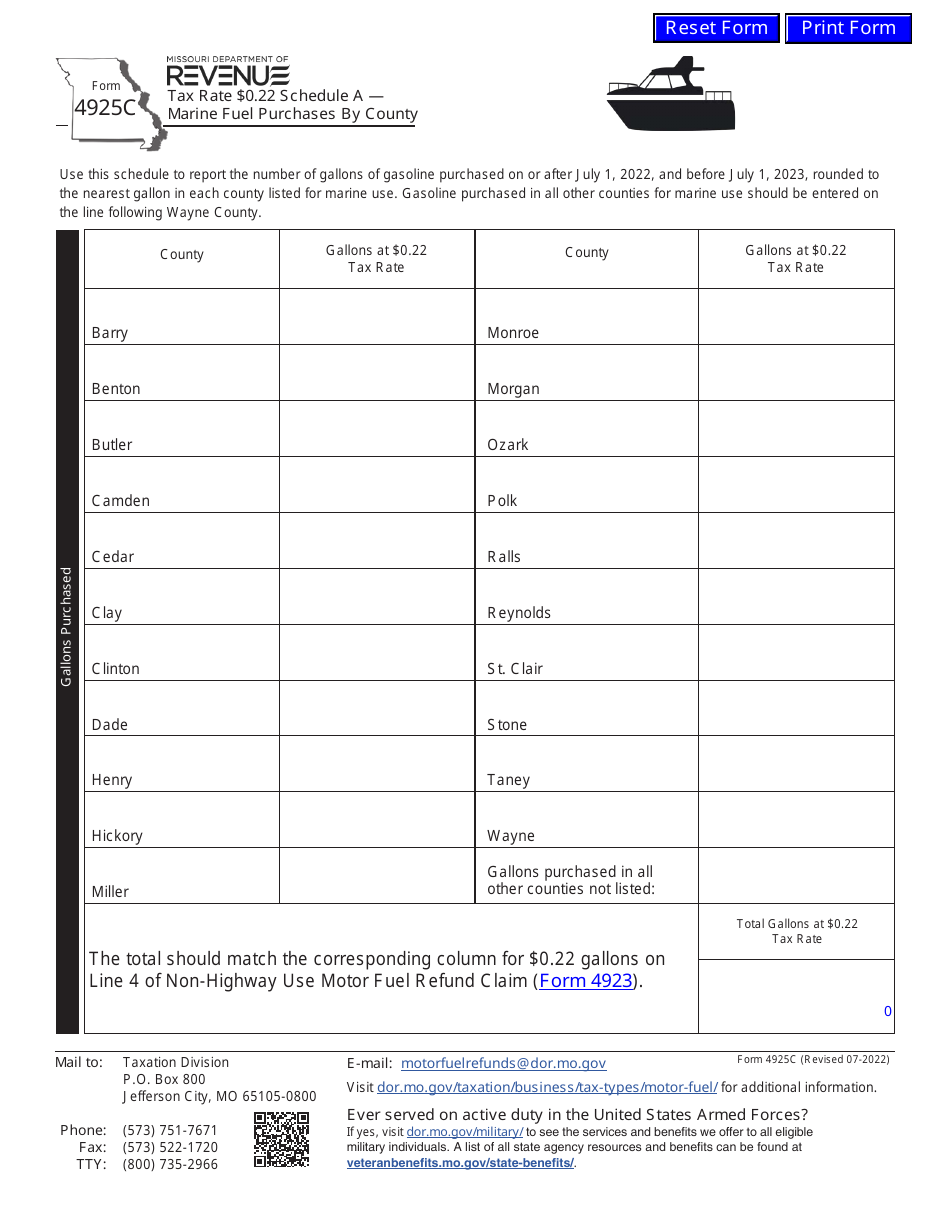

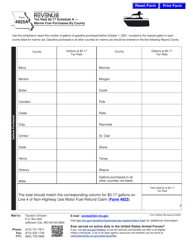

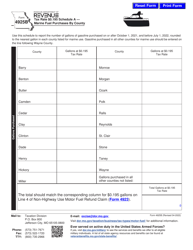

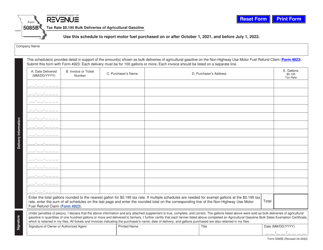

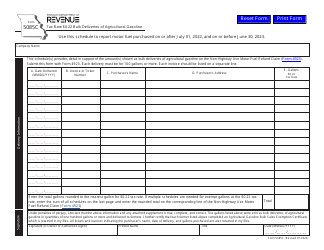

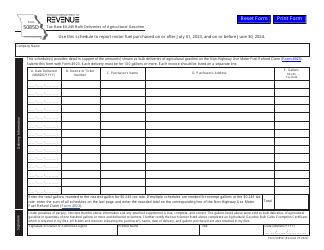

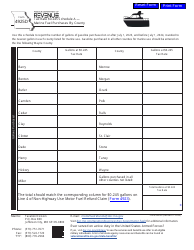

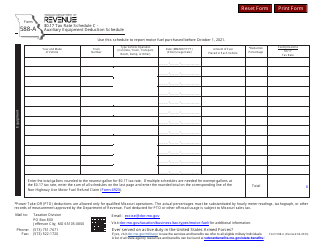

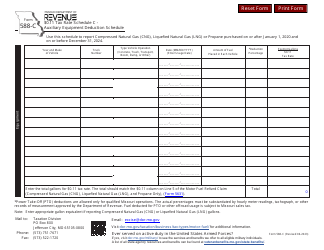

Form 4923C Schedule A Tax Rate $0.22 - Marine Fuel Purchases by County - Missouri

What Is Form 4923C Schedule A?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4923C?

A: Form 4923C is a schedule used for reporting the tax rate on marine fuel purchases.

Q: What is Schedule A on Form 4923C?

A: Schedule A on Form 4923C is used specifically for reporting the tax rate on marine fuel purchases by county.

Q: What is the tax rate on marine fuel purchases?

A: The tax rate on marine fuel purchases is $0.22.

Q: Which state is this tax rate applicable to?

A: This tax rate is applicable to marine fuel purchases in Missouri.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4923C Schedule A by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.