This version of the form is not currently in use and is provided for reference only. Download this version of

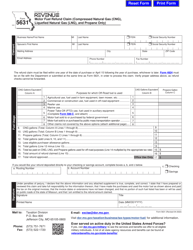

Form 4923

for the current year.

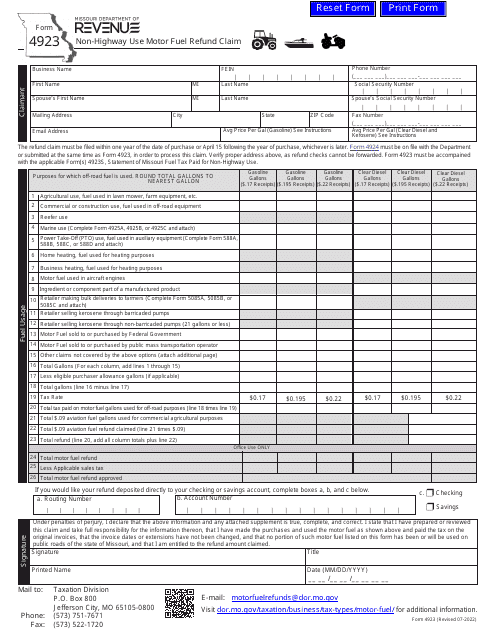

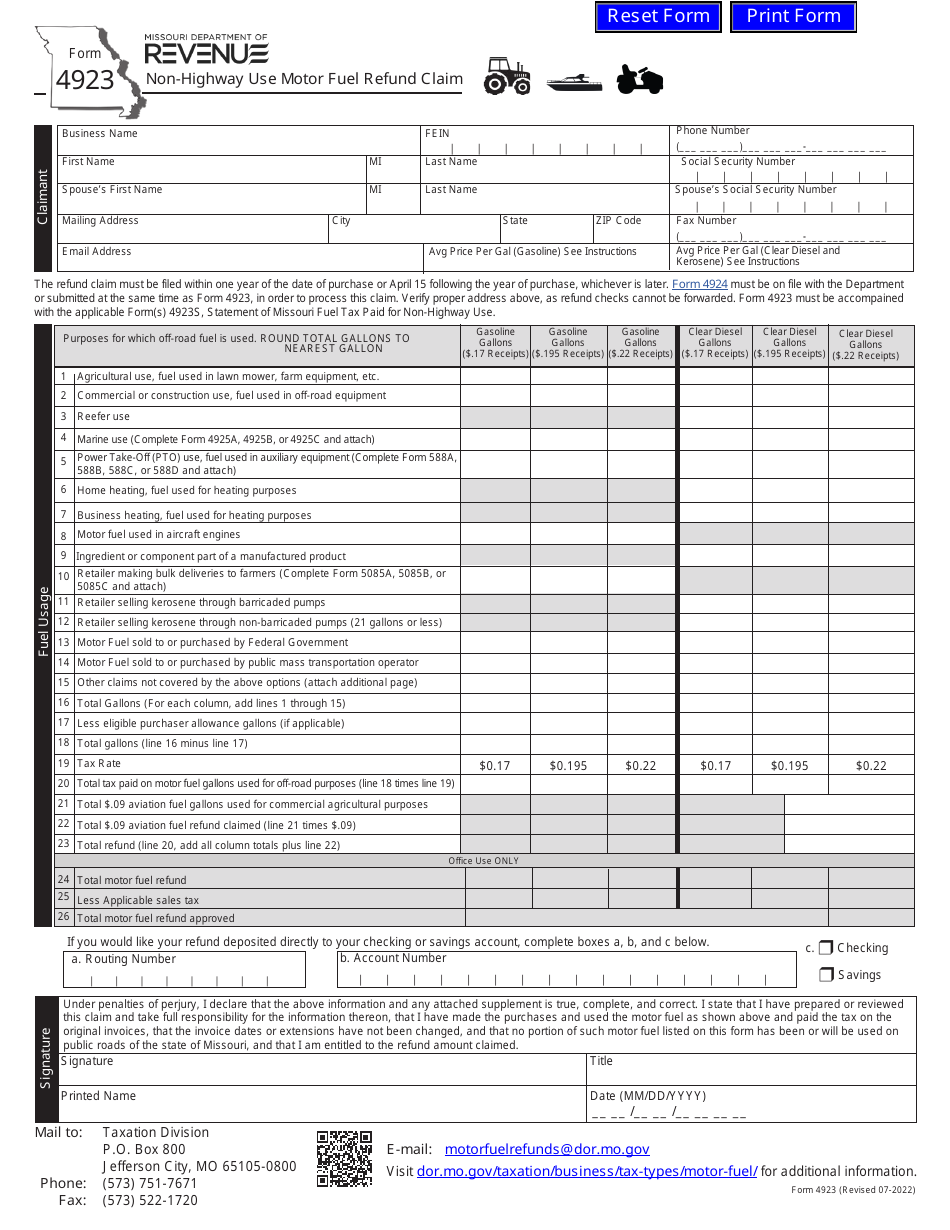

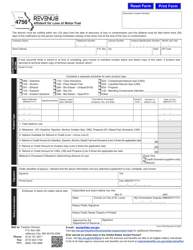

Form 4923 Non-highway Use Motor Fuel Refund Claim - Missouri

What Is Form 4923?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4923?

A: Form 4923 is a Non-highway Use Motor Fuel Refund Claim form used in Missouri.

Q: What is the purpose of Form 4923?

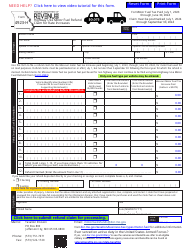

A: The purpose of Form 4923 is to claim a refund for motor fuel used in non-highway vehicles in Missouri.

Q: Who needs to file Form 4923?

A: Anyone who wants to claim a refund for motor fuel used in non-highway vehicles in Missouri needs to file Form 4923.

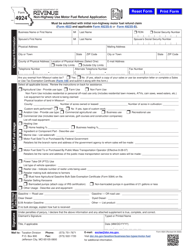

Q: What types of vehicles are considered non-highway vehicles?

A: Non-highway vehicles include off-road vehicles, construction equipment, generators, and other equipment that is not designed for use on public roadways.

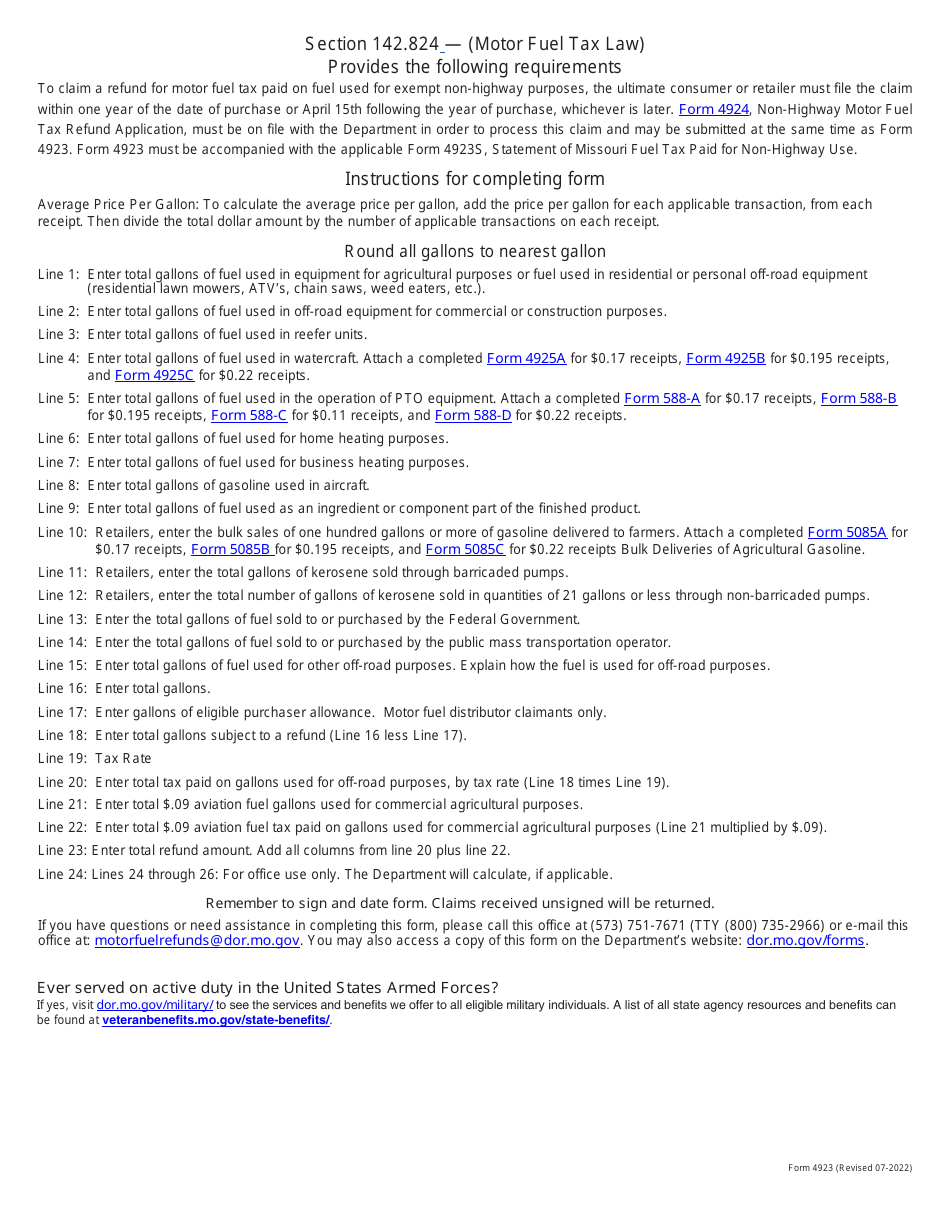

Q: What information is required on Form 4923?

A: Form 4923 requires information such as the name and address of the claimant, the type of non-highway vehicle, the number of gallons of motor fuel used, and proof of purchase.

Q: What is the deadline for filing Form 4923?

A: Form 4923 must be filed within 90 days of the date of purchase of the motor fuel.

Q: How long does it take to process the refund claim?

A: The processing time for a refund claim on Form 4923 can vary. It is advisable to contact the Missouri Department of Revenue for more information on processing times.

Q: Is there a fee to file Form 4923?

A: No, there is no fee to file Form 4923.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4923 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.