This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

Tax Chart - Missouri

Tax Chart is a legal document that was released by the Missouri Department of Revenue - a government authority operating within Missouri.

FAQ

Q: What is the sales tax rate in Missouri?

A: The sales tax rate in Missouri varies by city and county, ranging from 4.225% to 10.975%.

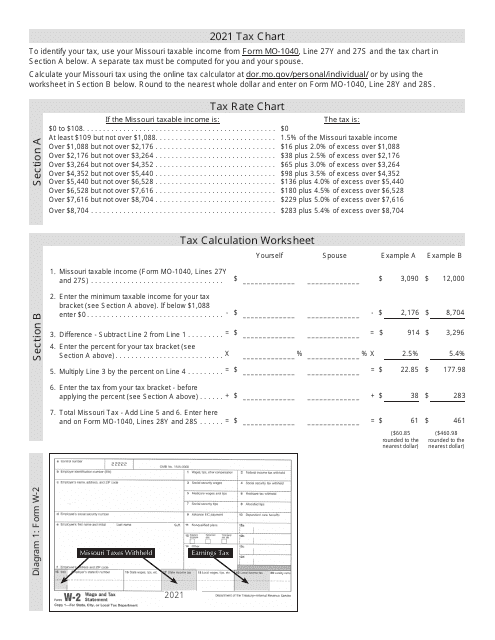

Q: What is the income tax rate in Missouri?

A: Missouri has a progressive income tax system with rates ranging from 1.5% to 5.4%.

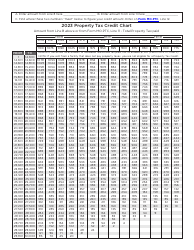

Q: Is there a property tax in Missouri?

A: Yes, there is a property tax in Missouri. The exact rate varies depending on the county and municipality.

Q: Are there any tax exemptions or credits available in Missouri?

A: Yes, Missouri offers various tax exemptions and credits, such as the Homestead Preservation Credit and the Missouri Property Tax Credit.

Q: What is the estate tax rate in Missouri?

A: Missouri does not have an estate tax.

Form Details:

- The latest edition currently provided by the Missouri Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.