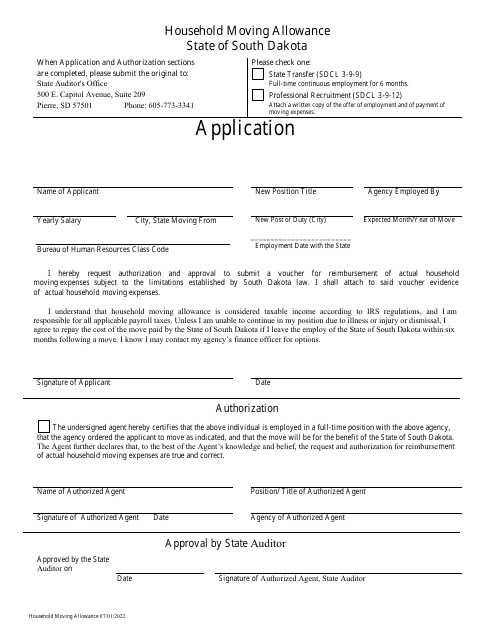

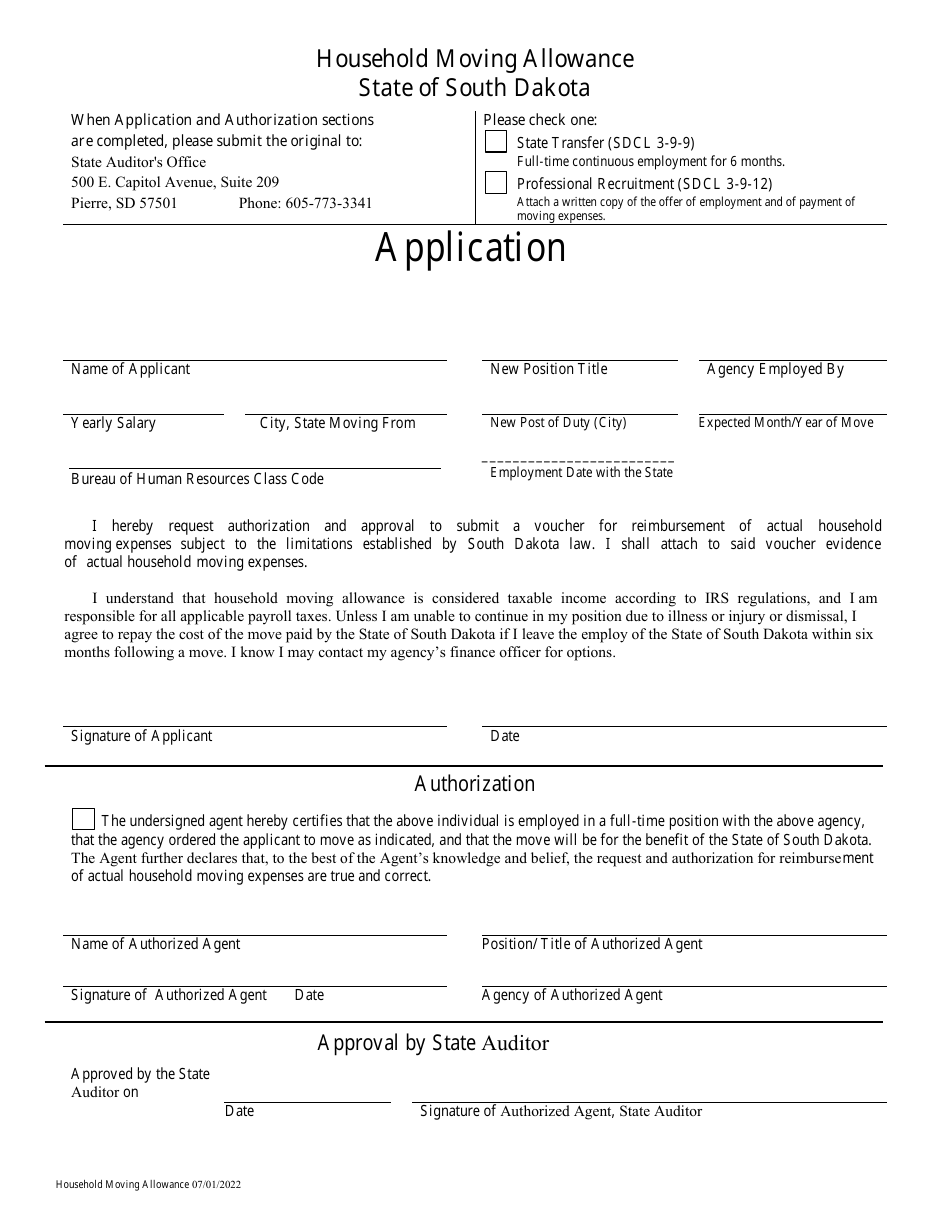

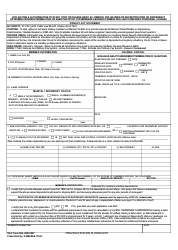

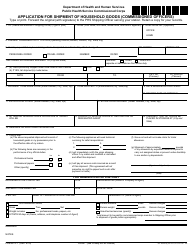

Household Moving Allowance Application - South Dakota

Household Moving Allowance Application is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

Q: What is a household moving allowance?

A: A household moving allowance is a financial benefit provided to employees or individuals to help cover the costs of moving their household belongings from one location to another.

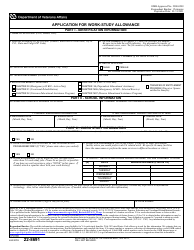

Q: Who is eligible for a household moving allowance?

A: Eligibility for a household moving allowance may vary depending on the specific policies of the employer or organization providing the benefits. Typically, it is offered to employees who are required to relocate for work purposes.

Q: How can I apply for a household moving allowance in South Dakota?

A: To apply for a household moving allowance in South Dakota, you should contact your employer or human resources department for information about the application process. They will guide you through the necessary steps and provide you with the required forms.

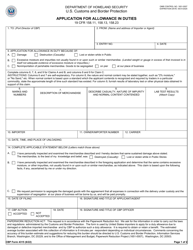

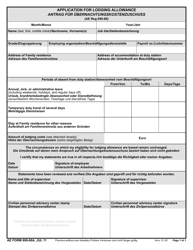

Q: What expenses does a household moving allowance cover?

A: A household moving allowance may cover various expenses related to the relocation, such as packing and transportation of household goods, temporary storage, travel expenses, and other costs incurred during the move. The specific coverage may depend on the employer's policy.

Q: Is a household moving allowance taxable?

A: In general, household moving allowances are taxable income. However, certain expenses related to the move may be deductible on your income tax return. It is recommended to consult a tax professional for guidance on your specific situation.

Q: Are there any limitations on the amount of a household moving allowance?

A: The amount of a household moving allowance can vary depending on the employer's policy and the employee's circumstances. There may be limitations or maximum caps on the reimbursable expenses. It is best to check with your employer for specific details.

Q: How long does it take to receive a household moving allowance?

A: The processing time for a household moving allowance can vary depending on the employer and the complexity of the relocation. It is advisable to submit your application as early as possible to allow sufficient time for processing and reimbursement.

Q: Can I receive a household moving allowance if I am relocating within the same state?

A: The eligibility for a household moving allowance may depend on the specific policies of your employer or organization. Some employers may provide allowances even for intrastate relocations, while others may limit it to inter-state or international moves. It is best to check with your employer for clarification.

Q: What happens if I am not eligible for a household moving allowance?

A: If you are not eligible for a household moving allowance, you may need to bear the costs of relocation yourself. However, you can still explore other options such as negotiating with your employer for assistance or researching potential tax deductions for moving-related expenses.

Q: Can I use a household moving allowance for other purposes?

A: A household moving allowance is typically meant to be used specifically for relocation-related expenses. It is important to use the funds responsibly and in line with the terms and conditions set by your employer or organization.

Form Details:

- Released on July 1, 2022;

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.