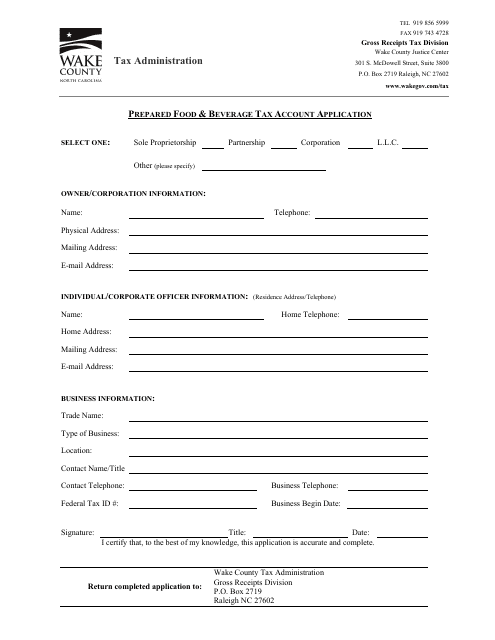

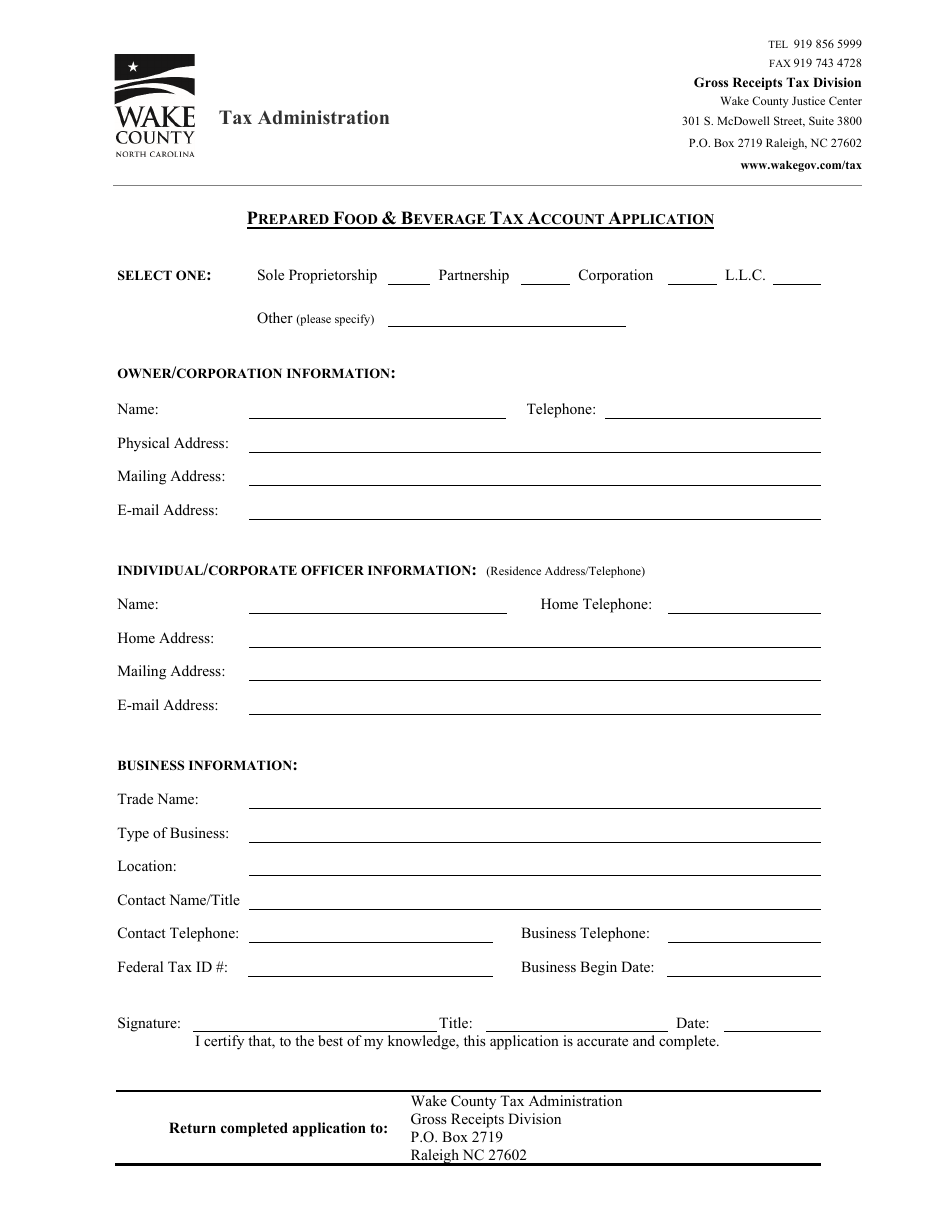

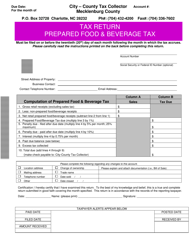

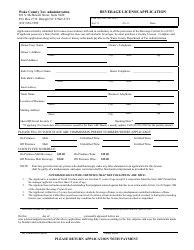

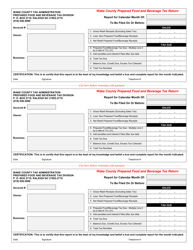

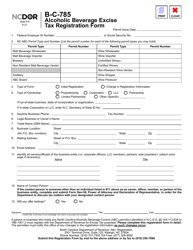

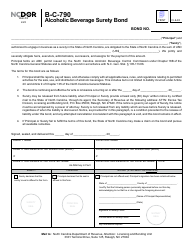

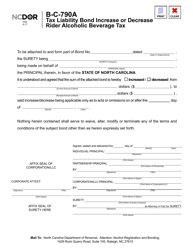

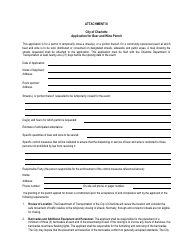

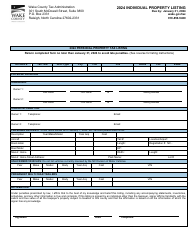

Prepared Food & Beverage Tax Account Application - Wake County, North Carolina

Prepared Food & Beverage Tax Account Application is a legal document that was released by the Department of Tax Administration - Wake County, North Carolina - a government authority operating within North Carolina. The form may be used strictly within Wake County.

FAQ

Q: What is the Prepared Food & Beverage Tax Account Application?

A: The Prepared Food & Beverage Tax Account Application is a form to apply for a tax account related to prepared food and beverages in Wake County, North Carolina.

Q: Who needs to fill out the Prepared Food & Beverage Tax Account Application?

A: Businesses that have prepared food and beverage sales in Wake County, North Carolina need to fill out this application.

Q: What is the purpose of the Prepared Food & Beverage Tax Account?

A: The purpose of the Prepared Food & Beverage Tax Account is to collect taxes on the sales of prepared food and beverages in Wake County, North Carolina.

Q: Are there any fees associated with the Prepared Food & Beverage Tax Account?

A: There may be fees associated with the Prepared Food & Beverage Tax Account. You should refer to the application or contact the relevant authorities for specific fee information.

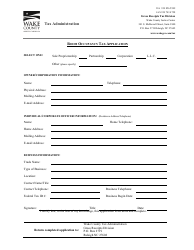

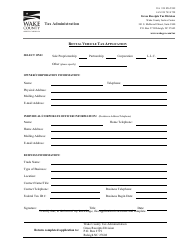

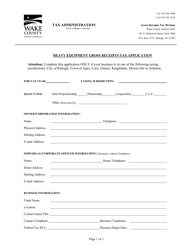

Q: What information do I need to provide on the Prepared Food & Beverage Tax Account Application?

A: You will need to provide information such as your business details, sales information, and other relevant details as required in the application form.

Q: Is the Prepared Food & Beverage Tax Account specific to Wake County, North Carolina?

A: Yes, the Prepared Food & Beverage Tax Account is specific to Wake County, North Carolina. Other counties or states may have their own tax account applications and requirements.

Q: How long does it take to process the Prepared Food & Beverage Tax Account Application?

A: The processing time for the Prepared Food & Beverage Tax Account Application may vary. Contact the relevant authorities for more information on processing times.

Q: What happens after I submit the Prepared Food & Beverage Tax Account Application?

A: After you submit the Prepared Food & Beverage Tax Account Application, it will be reviewed by the relevant authorities. They will inform you of the status of your application and provide further instructions if needed.

Form Details:

- The latest edition currently provided by the Department of Tax Administration - Wake County, North Carolina;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Tax Administration - Wake County, North Carolina.