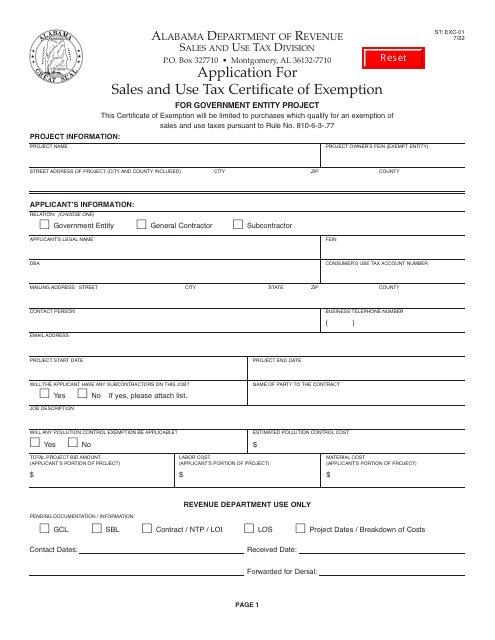

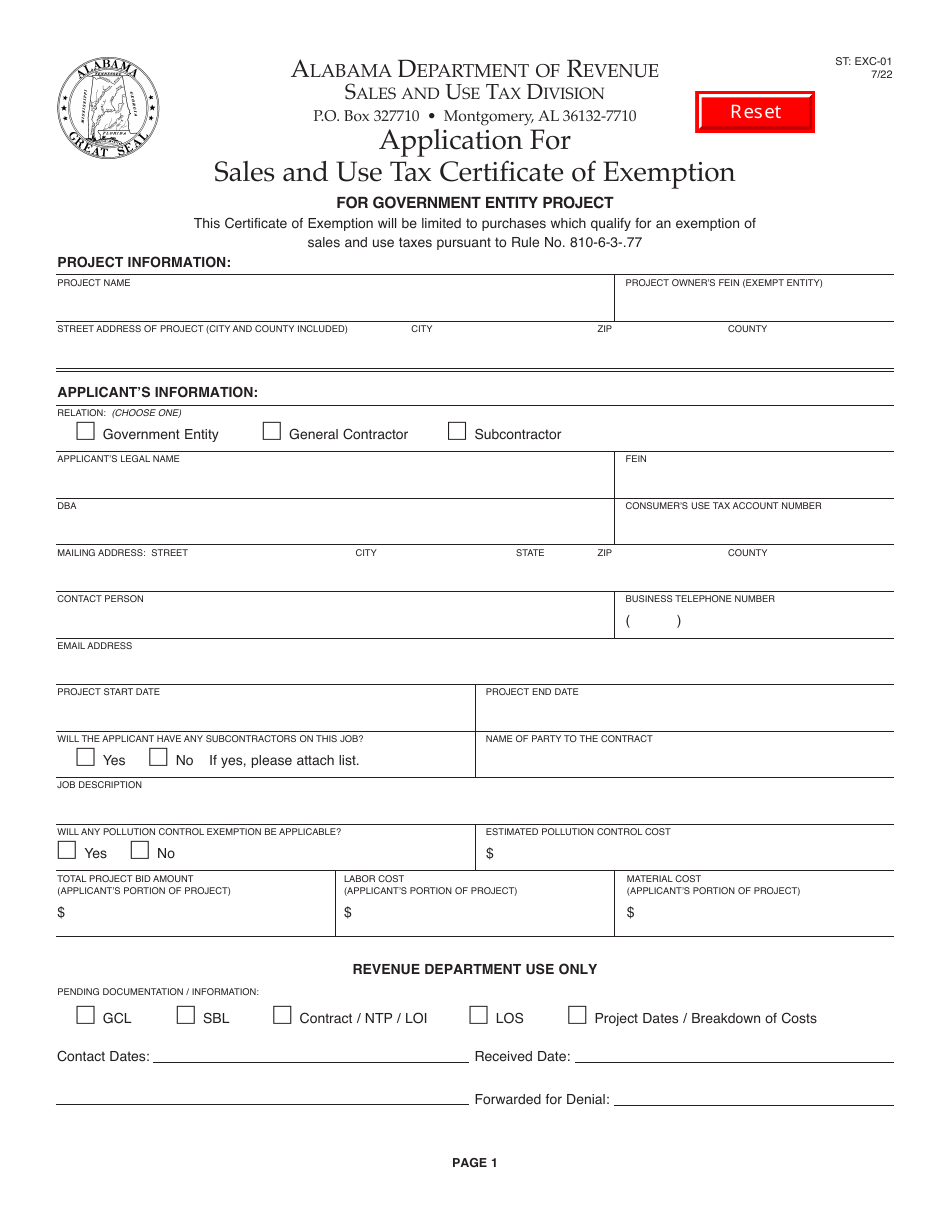

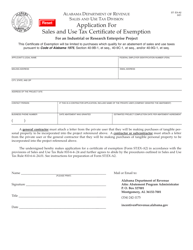

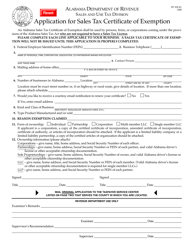

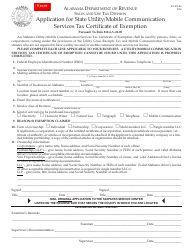

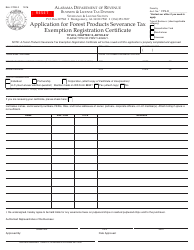

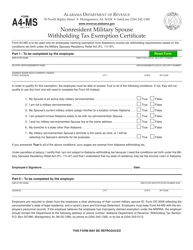

Form ST: EXC-01 Application for Sales and Use Tax Certificate of Exemption - Alabama

What Is Form ST: EXC-01?

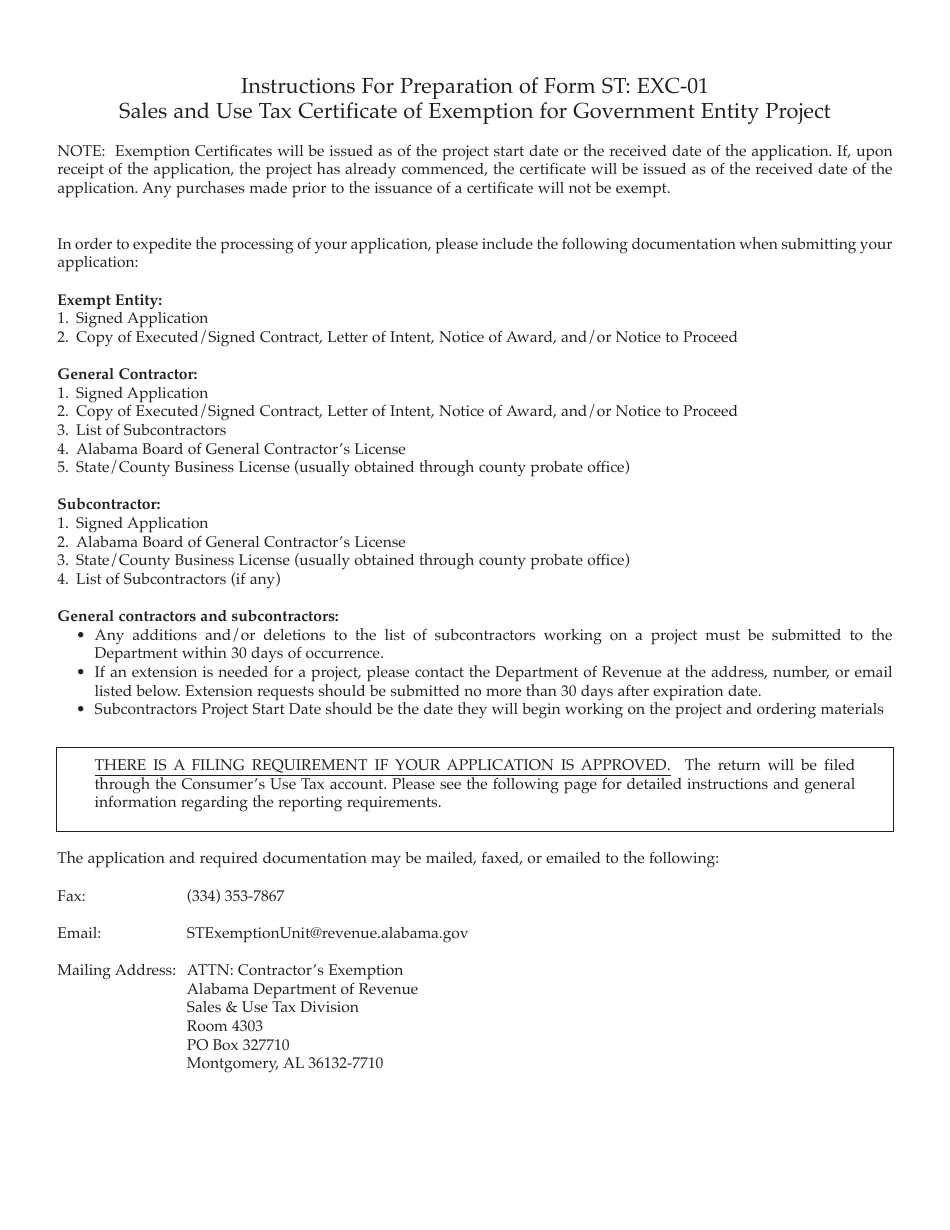

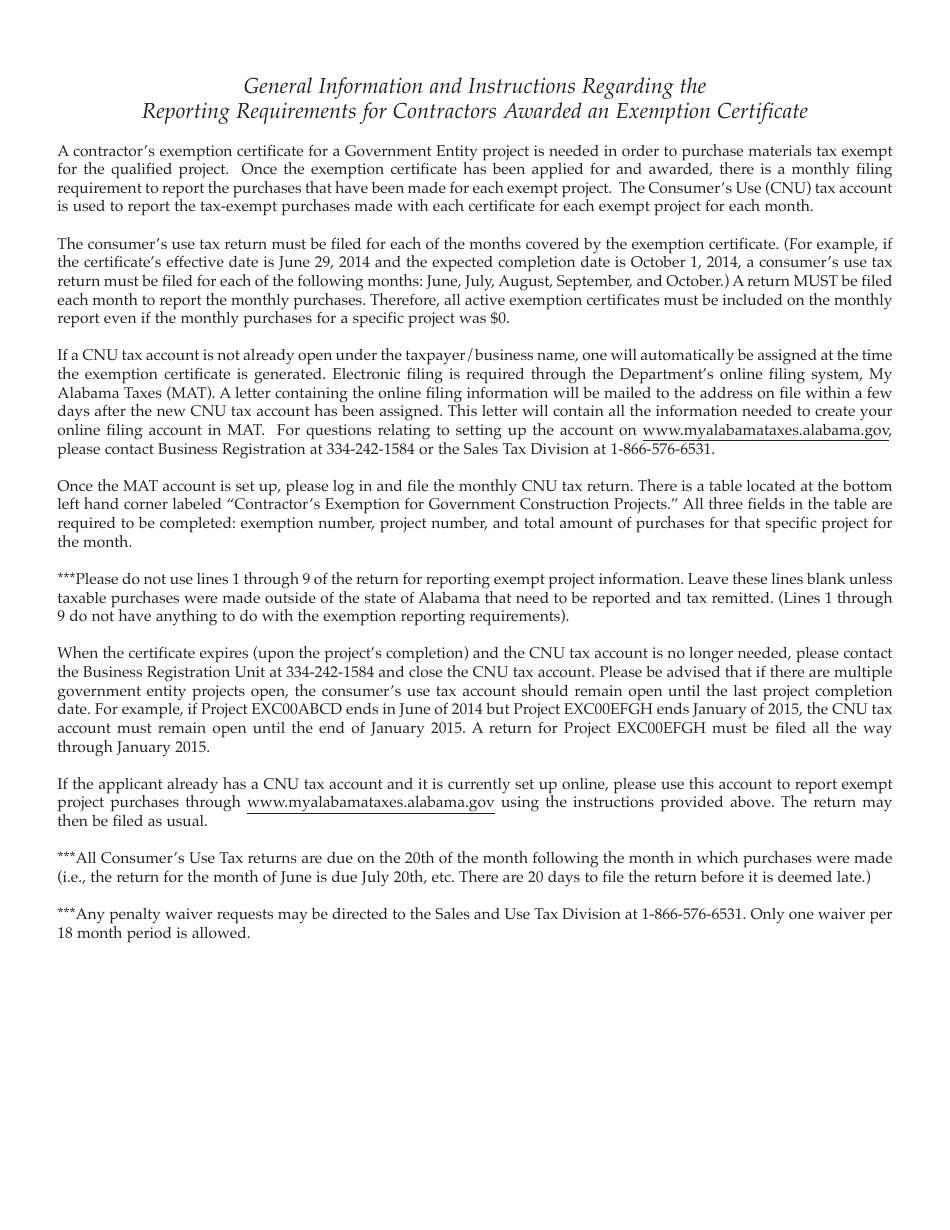

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST: EXC-01?

A: Form ST: EXC-01 is the Application for Sales and Use Tax Certificate of Exemption in Alabama.

Q: What is the purpose of Form ST: EXC-01?

A: Form ST: EXC-01 is used to apply for a sales and use tax certificate of exemption in Alabama.

Q: Who needs to fill out Form ST: EXC-01?

A: Anyone who wants to apply for a sales and use tax certificate of exemption in Alabama needs to fill out Form ST: EXC-01.

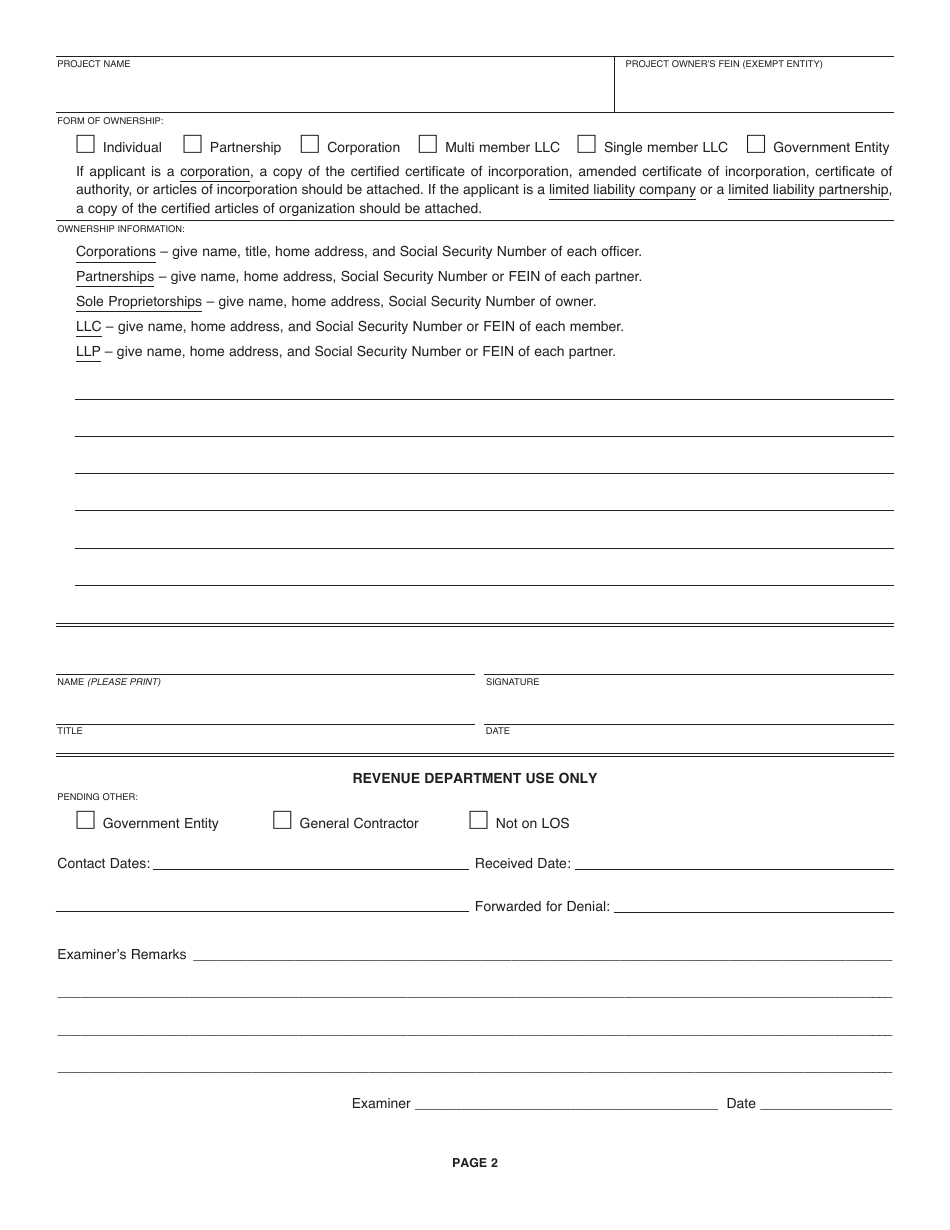

Q: What information is required on Form ST: EXC-01?

A: Form ST: EXC-01 requires information such as the applicant's name and address, the type of exemption being claimed, and supporting documentation.

Q: Is there a fee to submit Form ST: EXC-01?

A: No, there is no fee to submit Form ST: EXC-01.

Q: How long does it take to process Form ST: EXC-01?

A: The processing time for Form ST: EXC-01 can vary, but it is typically processed within a few weeks.

Q: What should I do after submitting Form ST: EXC-01?

A: After submitting Form ST: EXC-01, you should keep a copy for your records and wait for notification from the Alabama Department of Revenue regarding the status of your application.

Q: Can I use Form ST: EXC-01 for multiple exemptions?

A: Yes, Form ST: EXC-01 can be used to apply for multiple sales and use tax exemptions in Alabama.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST: EXC-01 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.