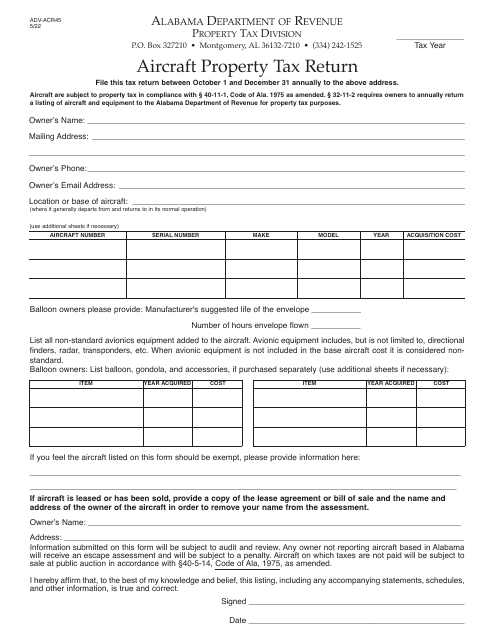

Form ADV-ACR45 Aircraft Property Tax Return - Alabama

What Is Form ADV-ACR45?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADV-ACR45?

A: Form ADV-ACR45 is the Aircraft Property Tax Return for the state of Alabama.

Q: Who needs to file Form ADV-ACR45?

A: Individuals or businesses who own aircraft located in Alabama need to file Form ADV-ACR45.

Q: When is Form ADV-ACR45 due?

A: Form ADV-ACR45 is due on or before October 1st of each year.

Q: What information is needed to complete Form ADV-ACR45?

A: You will need to provide details about the aircraft, such as its make, model, registration number, and value.

Q: Are there any fees associated with filing Form ADV-ACR45?

A: Yes, there is a filing fee of $25 per aircraft.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADV-ACR45 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.