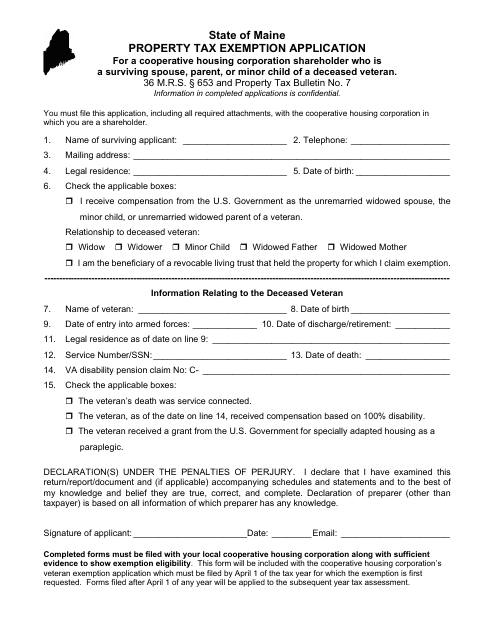

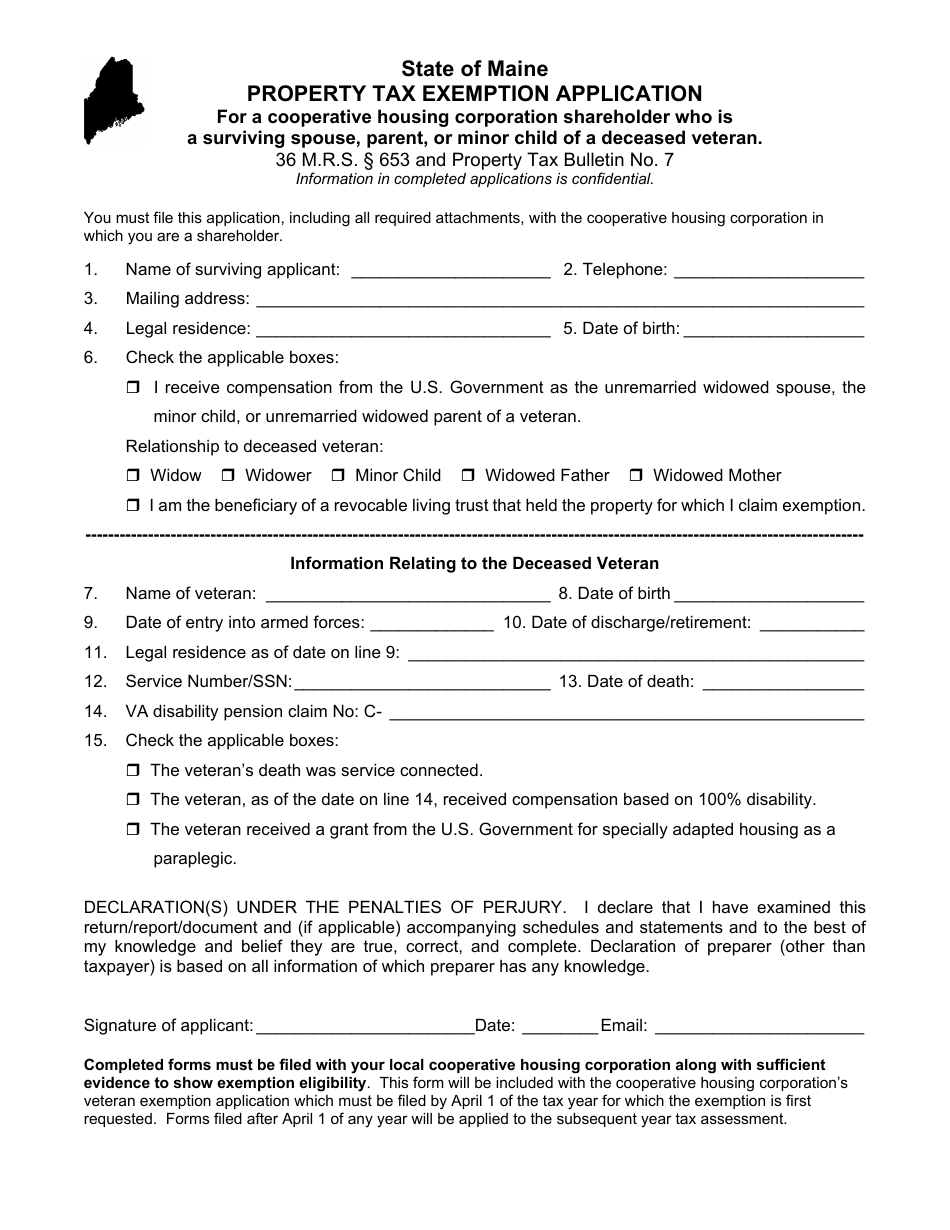

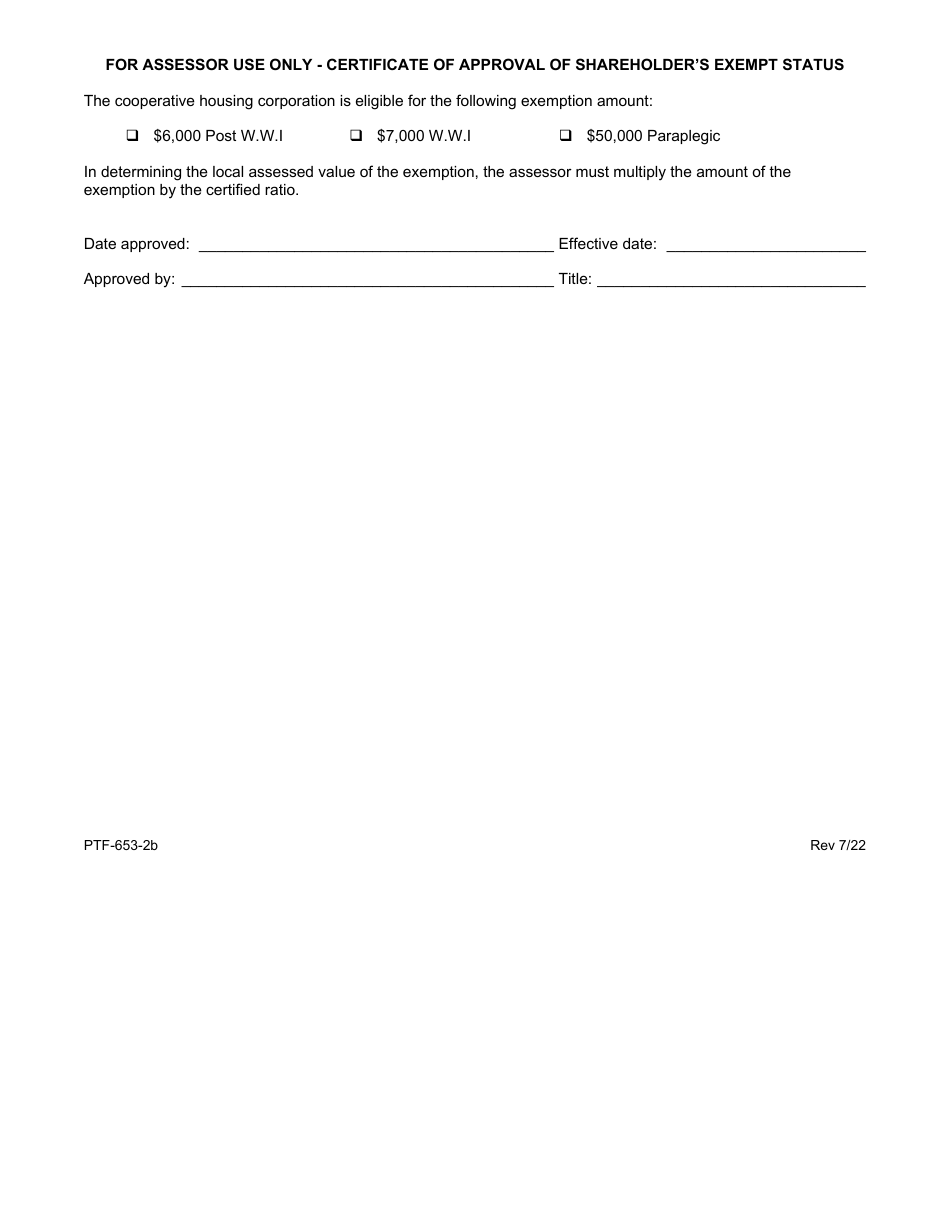

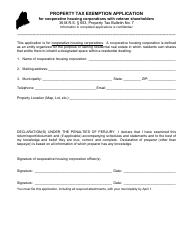

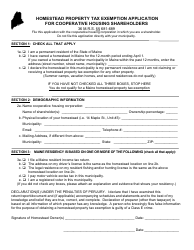

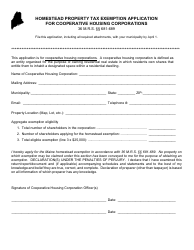

Form PTF-653-2B Property Tax Exemption Application for a Cooperative Housing Corporation Shareholder Who Is a Surviving Spouse, Parent, or Minor Child of a Deceased Veteran - Maine

What Is Form PTF-653-2B?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

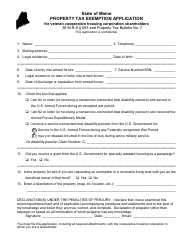

Q: What is Form PTF-653-2B?

A: Form PTF-653-2B is a property tax exemption application for a cooperative housing corporation shareholder who is a surviving spouse, parent, or minor child of a deceased veteran in Maine.

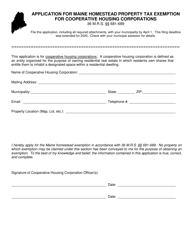

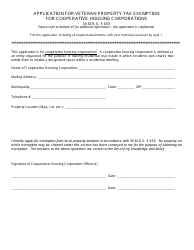

Q: Who can use Form PTF-653-2B?

A: This form is specifically for cooperative housing corporation shareholders who are surviving spouses, parents, or minor children of deceased veterans in Maine.

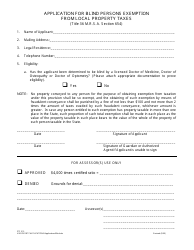

Q: What is the purpose of Form PTF-653-2B?

A: The purpose of this form is to apply for a property tax exemption for qualifying individuals who meet the criteria as outlined in the form.

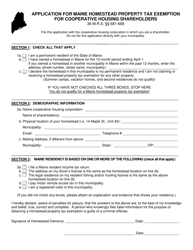

Q: What are the eligibility requirements for using Form PTF-653-2B?

A: To use this form, you must be a cooperative housing corporation shareholder, be a surviving spouse, parent, or minor child of a deceased veteran, and meet other specified criteria mentioned in the form.

Q: Are there any fees associated with filing Form PTF-653-2B?

A: No, there are no filing fees associated with submitting this form.

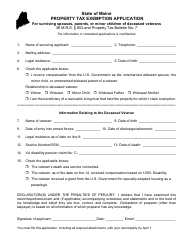

Q: What is the deadline for filing Form PTF-653-2B?

A: The deadline for filing this form may vary. It is advisable to check the form or consult with the Maine Revenue Services for specific deadline information.

Q: What supporting documents are required with Form PTF-653-2B?

A: You may be required to submit additional supporting documents such as proof of qualifying relationship, proof of ownership, and other documentation as specified in the form.

Q: What happens after submitting Form PTF-653-2B?

A: Once you submit the form, it will be reviewed by the Maine Revenue Services. If approved, you will receive the property tax exemption as specified in the form.

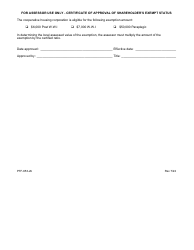

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTF-653-2B by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.