This version of the form is not currently in use and is provided for reference only. Download this version of

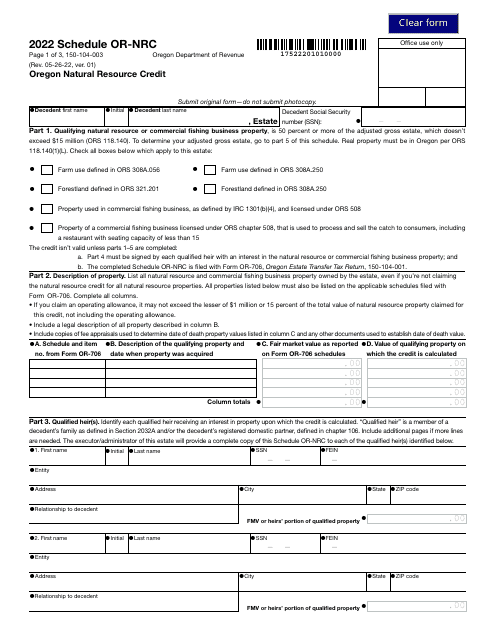

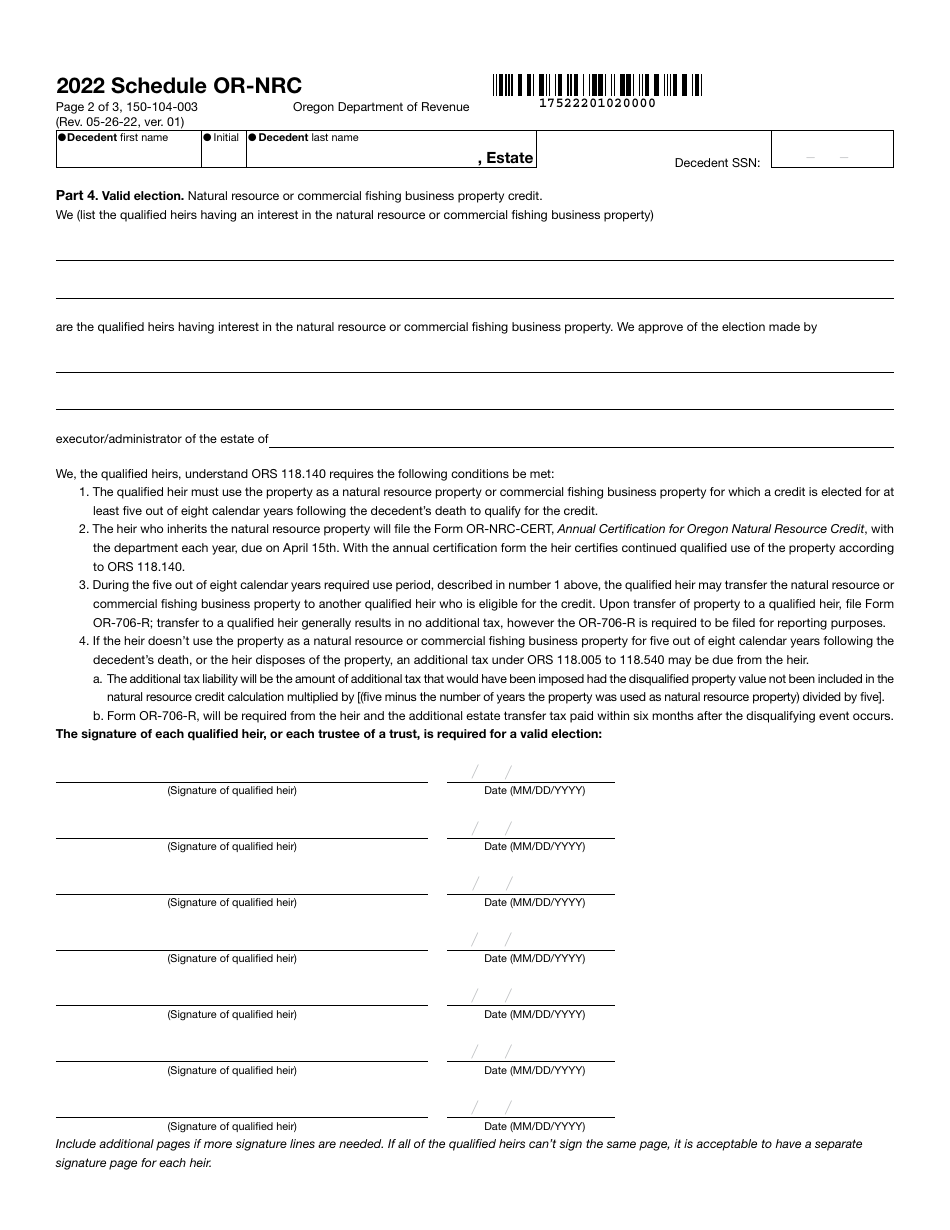

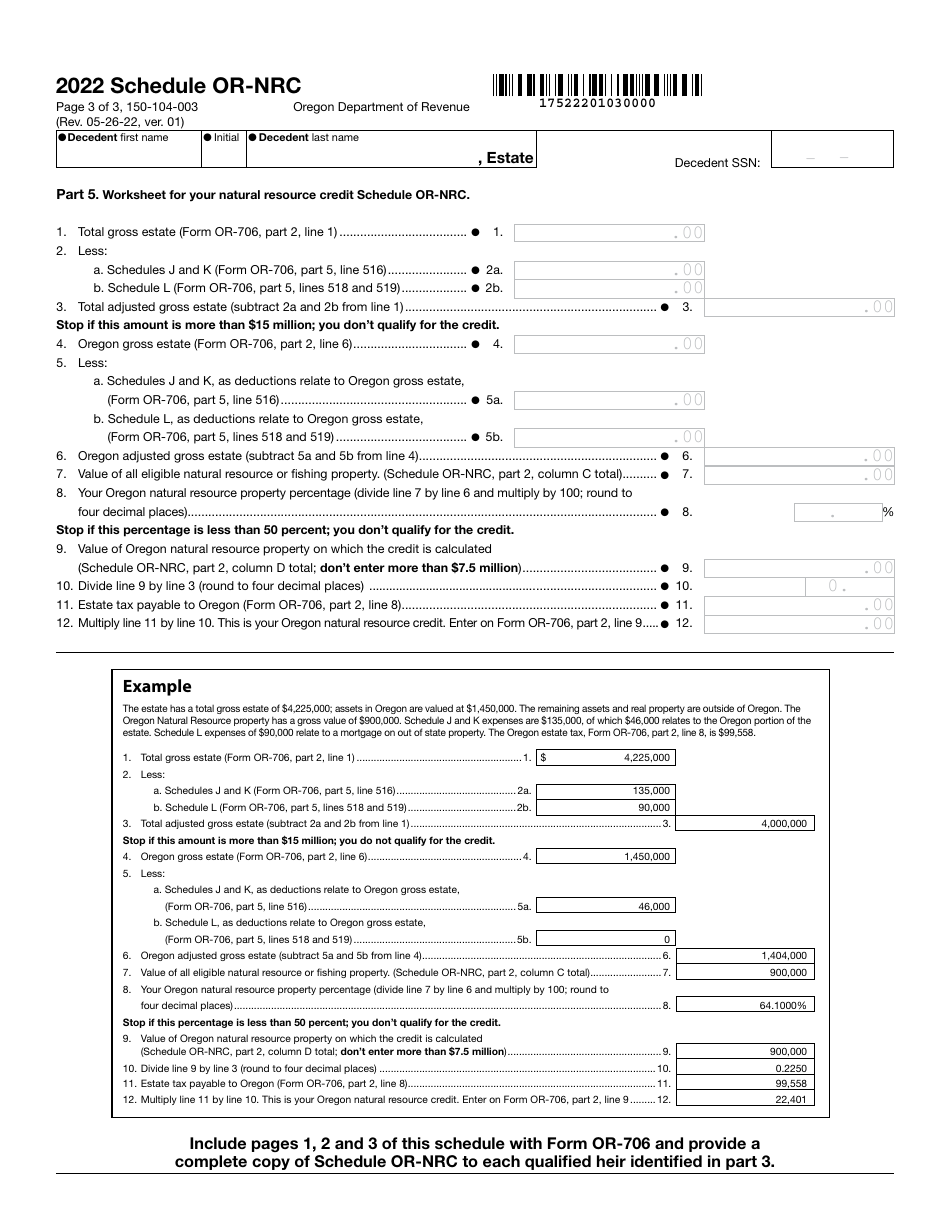

Form 150-104-003 Schedule OR-NRC

for the current year.

Form 150-104-003 Schedule OR-NRC Oregon Natural Resource Credit - Oregon

What Is Form 150-104-003 Schedule OR-NRC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-104-003?

A: Form 150-104-003 is a tax form used for claiming the Oregon Natural Resource Credit in Oregon.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit provided to individuals and businesses who invest in qualified natural resource projects in Oregon.

Q: Who is eligible for the Oregon Natural Resource Credit?

A: Individuals and businesses who invest in qualified natural resource projects in Oregon are eligible for the Oregon Natural Resource Credit.

Q: What can be considered as qualified natural resource projects?

A: Qualified natural resource projects include forest conservation, wetland restoration, habitat enhancement, and watershed restoration projects.

Q: How do I claim the Oregon Natural Resource Credit?

A: To claim the Oregon Natural Resource Credit, you need to complete and file Form 150-104-003 with the Oregon Department of Revenue.

Q: Are there any limitations or restrictions on the Oregon Natural Resource Credit?

A: Yes, there are certain limitations and restrictions on the Oregon Natural Resource Credit. It is recommended to refer to the instructions provided with Form 150-104-003 for detailed information.

Form Details:

- Released on May 26, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-104-003 Schedule OR-NRC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.