This version of the form is not currently in use and is provided for reference only. Download this version of

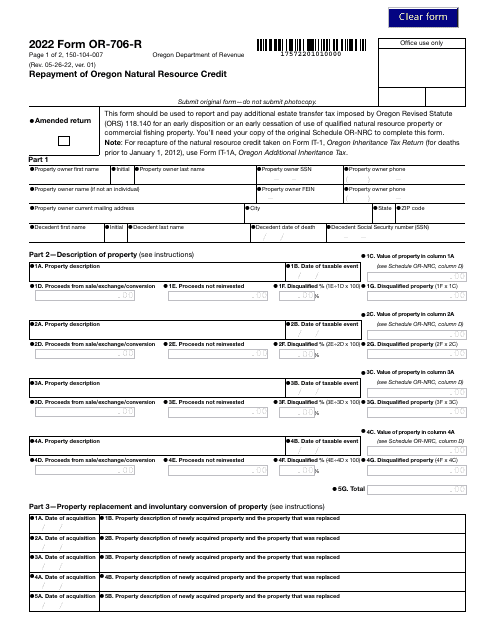

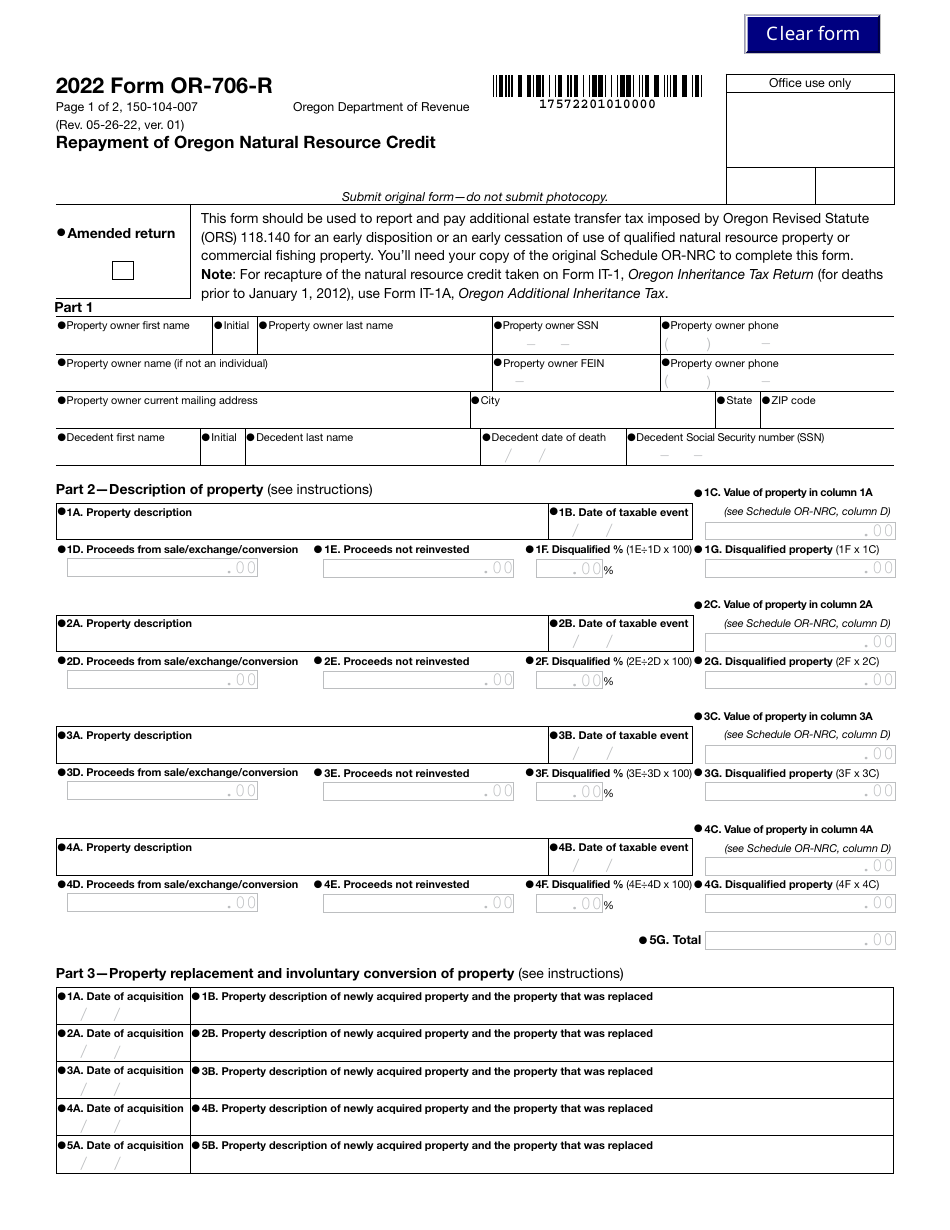

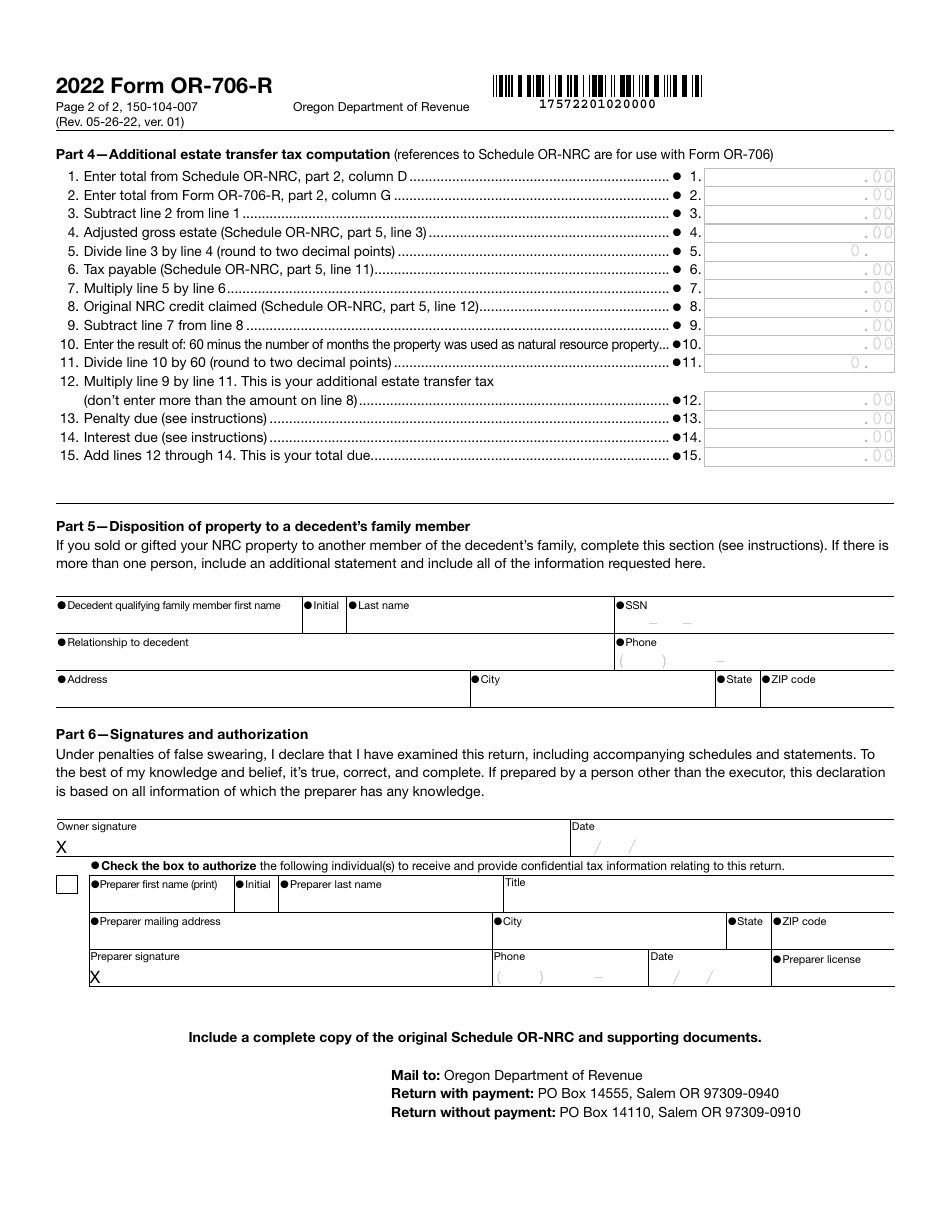

Form OR-706-R (150-104-007)

for the current year.

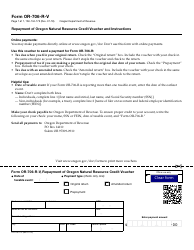

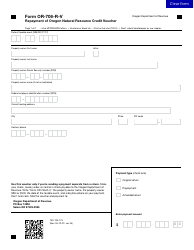

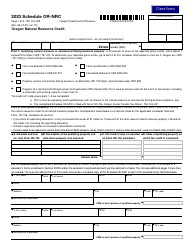

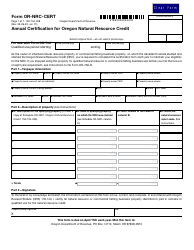

Form OR-706-R (150-104-007) Repayment of Oregon Natural Resource Credit - Oregon

What Is Form OR-706-R (150-104-007)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-706-R?

A: Form OR-706-R is the form used for Repayment of Oregon Natural Resource Credit in Oregon.

Q: What is the purpose of Form OR-706-R?

A: The purpose of Form OR-706-R is to repay the Oregon Natural Resource Credit in Oregon.

Q: Which tax credit does Form OR-706-R apply to?

A: Form OR-706-R applies to the Oregon Natural Resource Credit.

Q: What information do I need to complete Form OR-706-R?

A: To complete Form OR-706-R, you will need information about the natural resource credit you received, as well as your personal and tax identification information.

Form Details:

- Released on May 26, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-706-R (150-104-007) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.