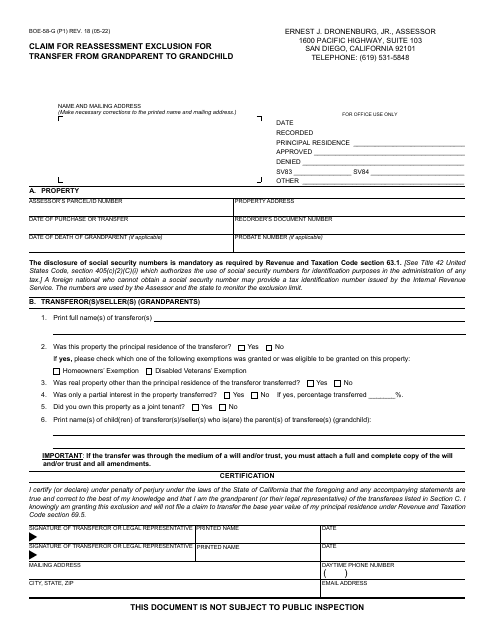

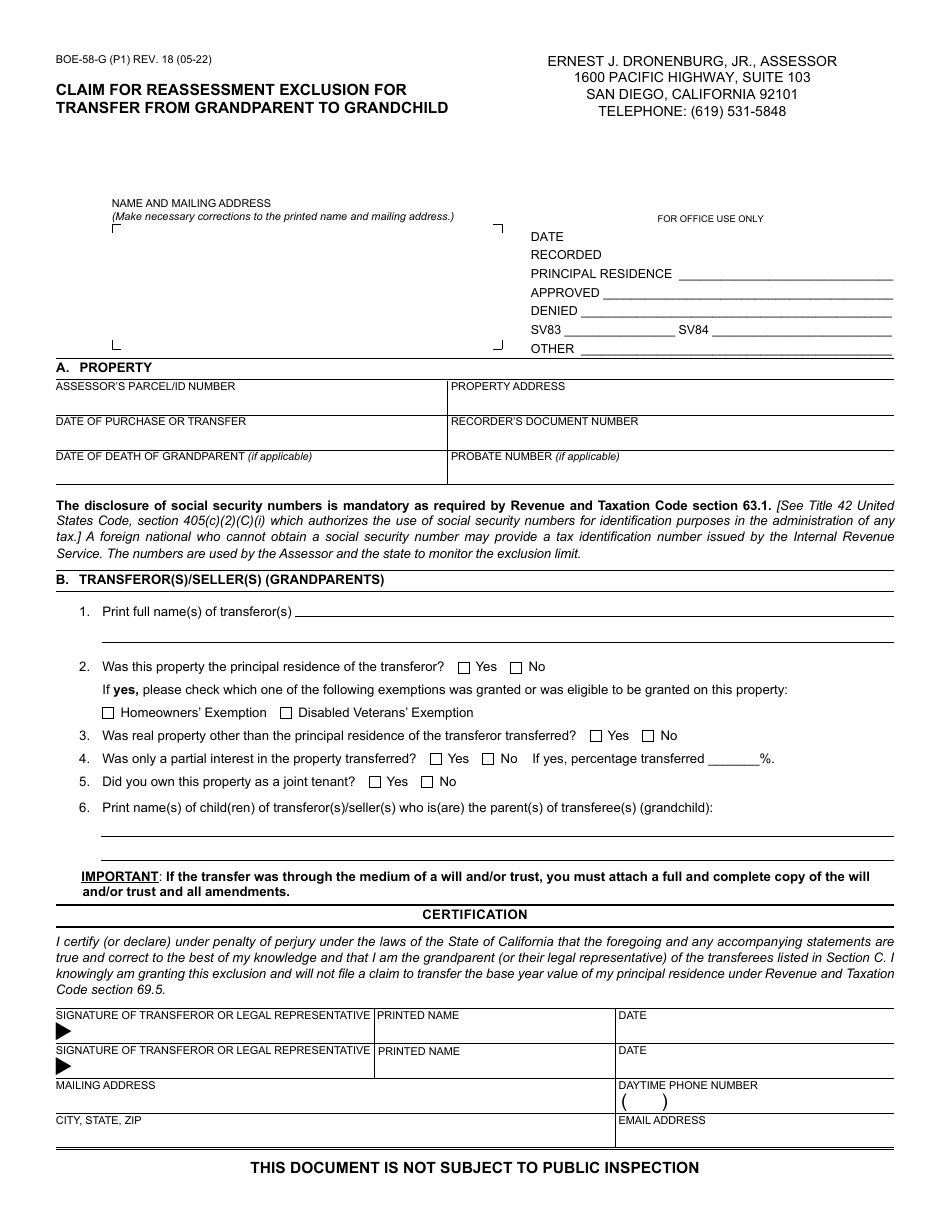

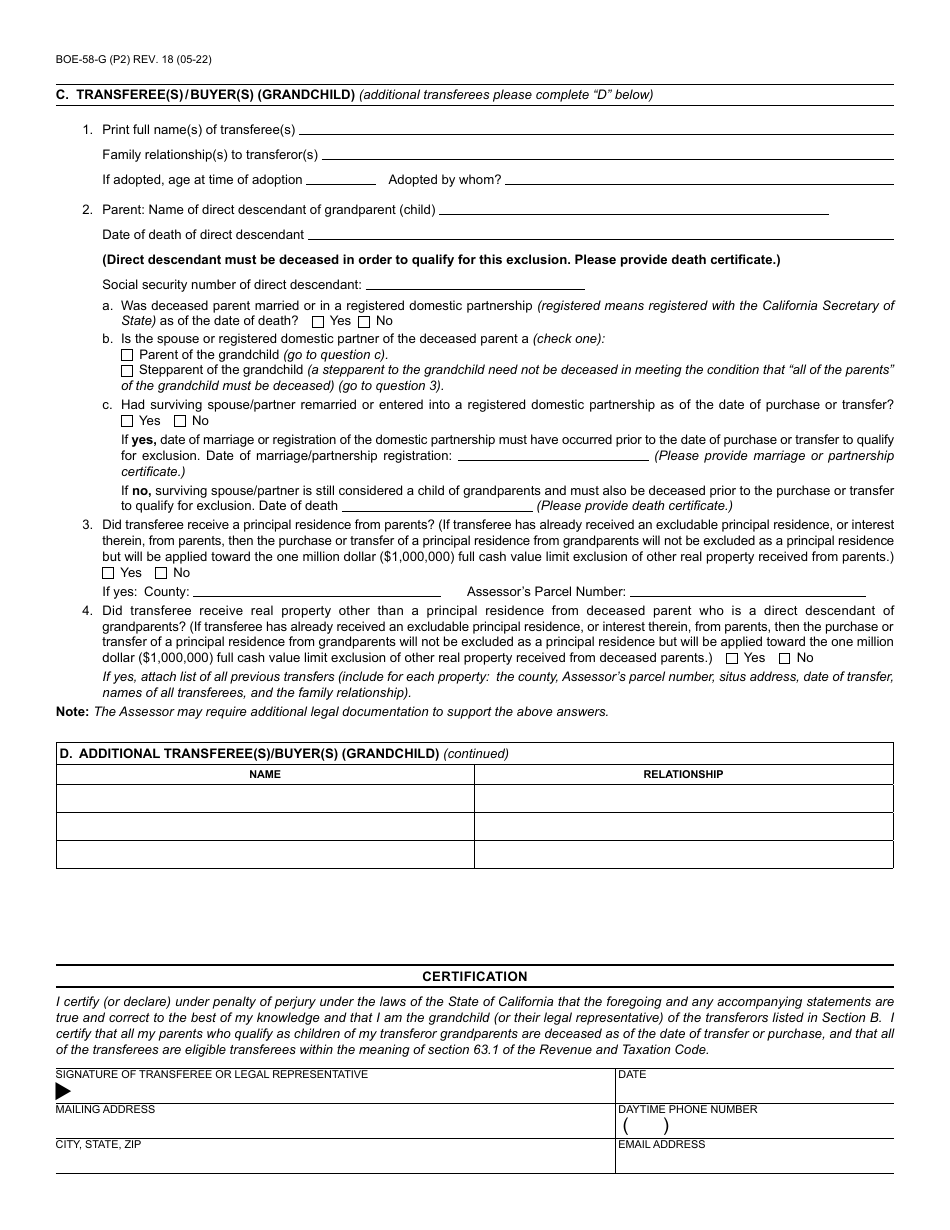

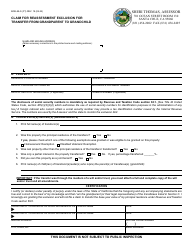

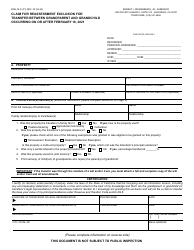

Form BOE-58-G Claim for Reassessment Exclusion for Transfer From Grandparent to Grandchild - County of San Diego, California

What Is Form BOE-58-G?

This is a legal form that was released by the Assessor, Recorder, County Clerk's Office - County of San Diego, California - a government authority operating within California. The form may be used strictly within County of San Diego. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

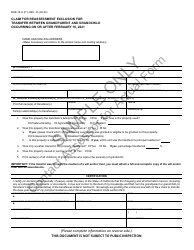

Q: What is form BOE-58-G?

A: Form BOE-58-G is the form used to claim reassessment exclusion for transfer from a grandparent to a grandchild in San Diego, California.

Q: Why would someone use form BOE-58-G?

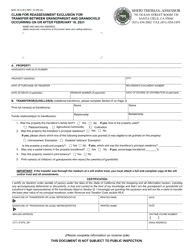

A: Someone would use form BOE-58-G to exclude the reassessment of property taxes when transferring real property from a grandparent to a grandchild.

Q: What is the reassessment exclusion?

A: The reassessment exclusion is a provision that allows the transfer of real property from a grandparent to a grandchild without triggering a reassessment of property taxes.

Q: How does the reassessment exclusion work?

A: The reassessment exclusion allows the grandchild to inherit the property at the assessed value for property tax purposes, rather than its current market value.

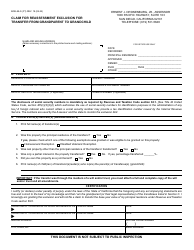

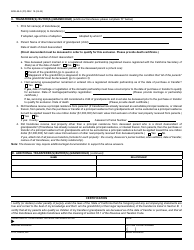

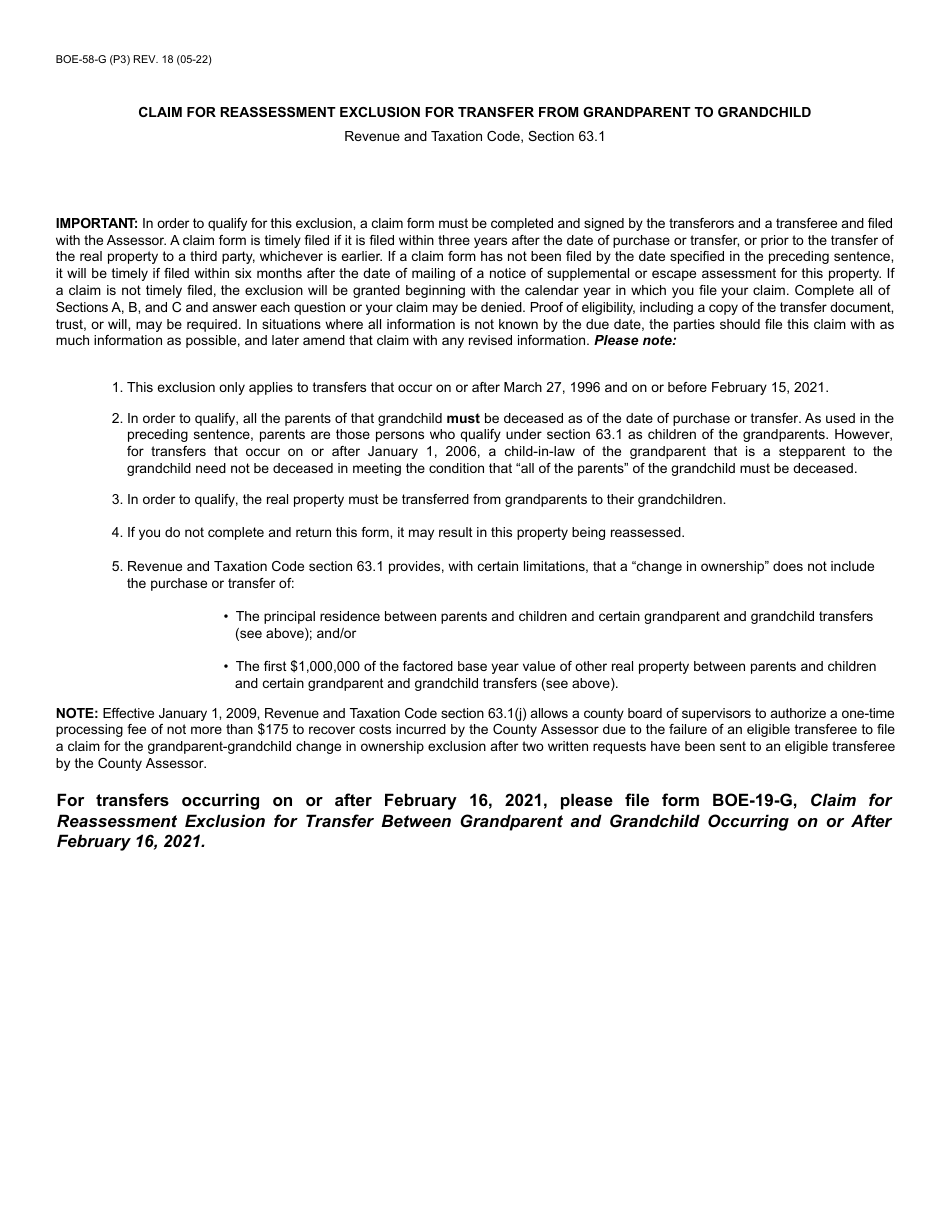

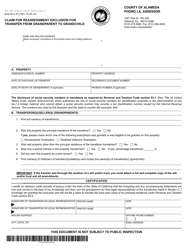

Q: Are there any eligibility requirements for using form BOE-58-G?

A: Yes, there are eligibility requirements that must be met, including the relationship between the grandparent and grandchild, and certain conditions related to the property.

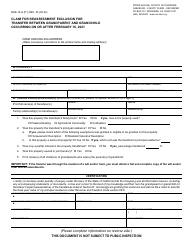

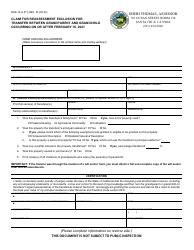

Q: What should I do after completing form BOE-58-G?

A: After completing the form, you should submit it to the Assessor's Office in the County of San Diego, California for processing.

Q: Is there a deadline for submitting form BOE-58-G?

A: Yes, there is a deadline for submitting form BOE-58-G. It must be filed within three years of the date of the transfer of the real property.

Q: Are there any fees associated with filing form BOE-58-G?

A: There may be fees associated with filing form BOE-58-G, such as recording fees or documentary transfer tax, depending on the specifics of the transfer.

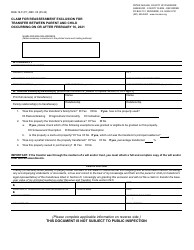

Q: Can I get help or additional information about form BOE-58-G?

A: Yes, you can contact the Assessor's Office in the County of San Diego, California for assistance or more information about form BOE-58-G.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Assessor, Recorder, County Clerk's Office - County of San Diego, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-58-G by clicking the link below or browse more documents and templates provided by the Assessor, Recorder, County Clerk's Office - County of San Diego, California.