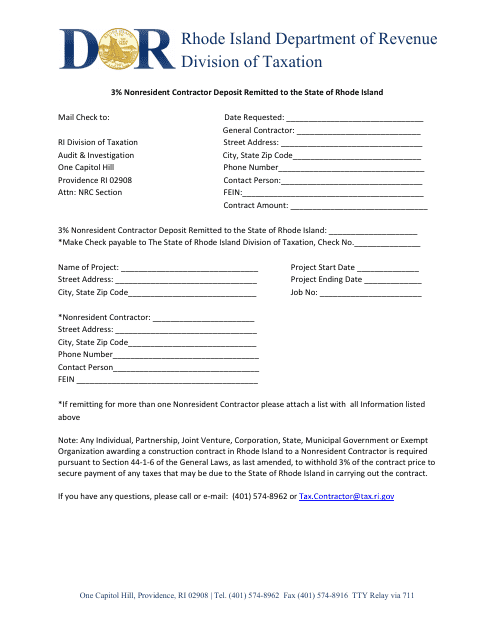

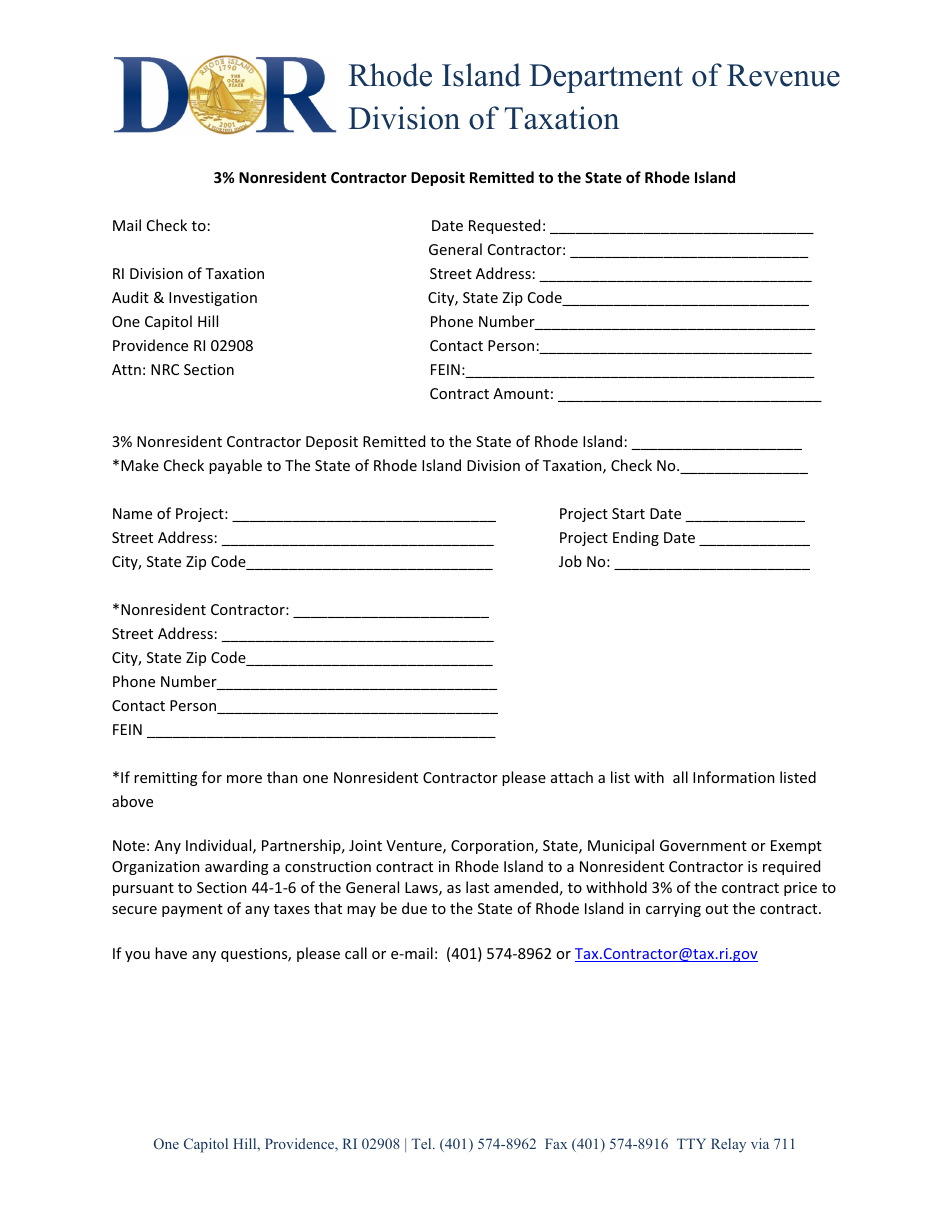

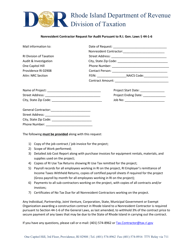

3% Nonresident Contractor Deposit Remitted to the State of Rhode Island - Rhode Island

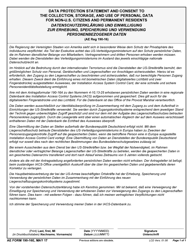

3% Nonresident Contractor Deposit Remitted to the State of Rhode Island is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the 3% Nonresident Contractor Deposit?

A: The 3% Nonresident Contractor Deposit is a deposit required to be remitted by nonresident contractors who perform work in Rhode Island.

Q: Who is responsible for remitting the 3% Nonresident Contractor Deposit?

A: Nonresident contractors are responsible for remitting the 3% Nonresident Contractor Deposit.

Q: What is the purpose of the 3% Nonresident Contractor Deposit?

A: The purpose of the 3% Nonresident Contractor Deposit is to ensure that nonresident contractors comply with their obligations under the Rhode Island tax laws.

Q: How much is the 3% Nonresident Contractor Deposit?

A: The 3% Nonresident Contractor Deposit is equal to 3% of the gross contract price.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.