This version of the form is not currently in use and is provided for reference only. Download this version of

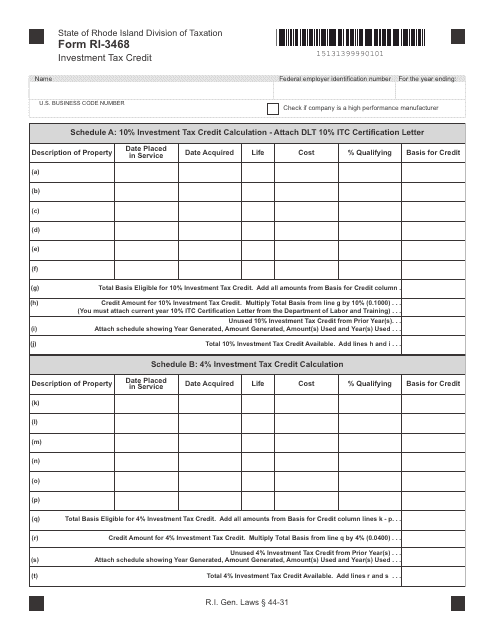

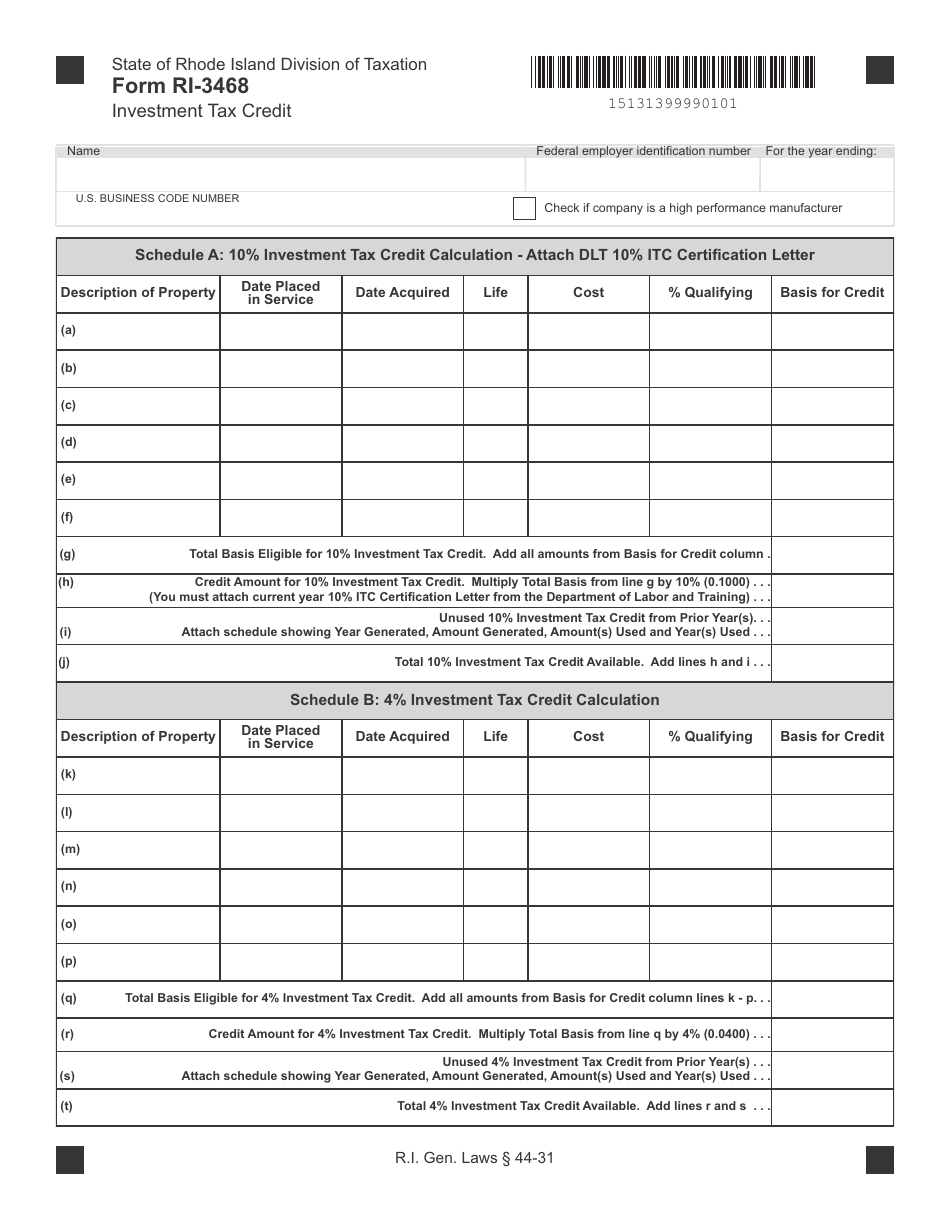

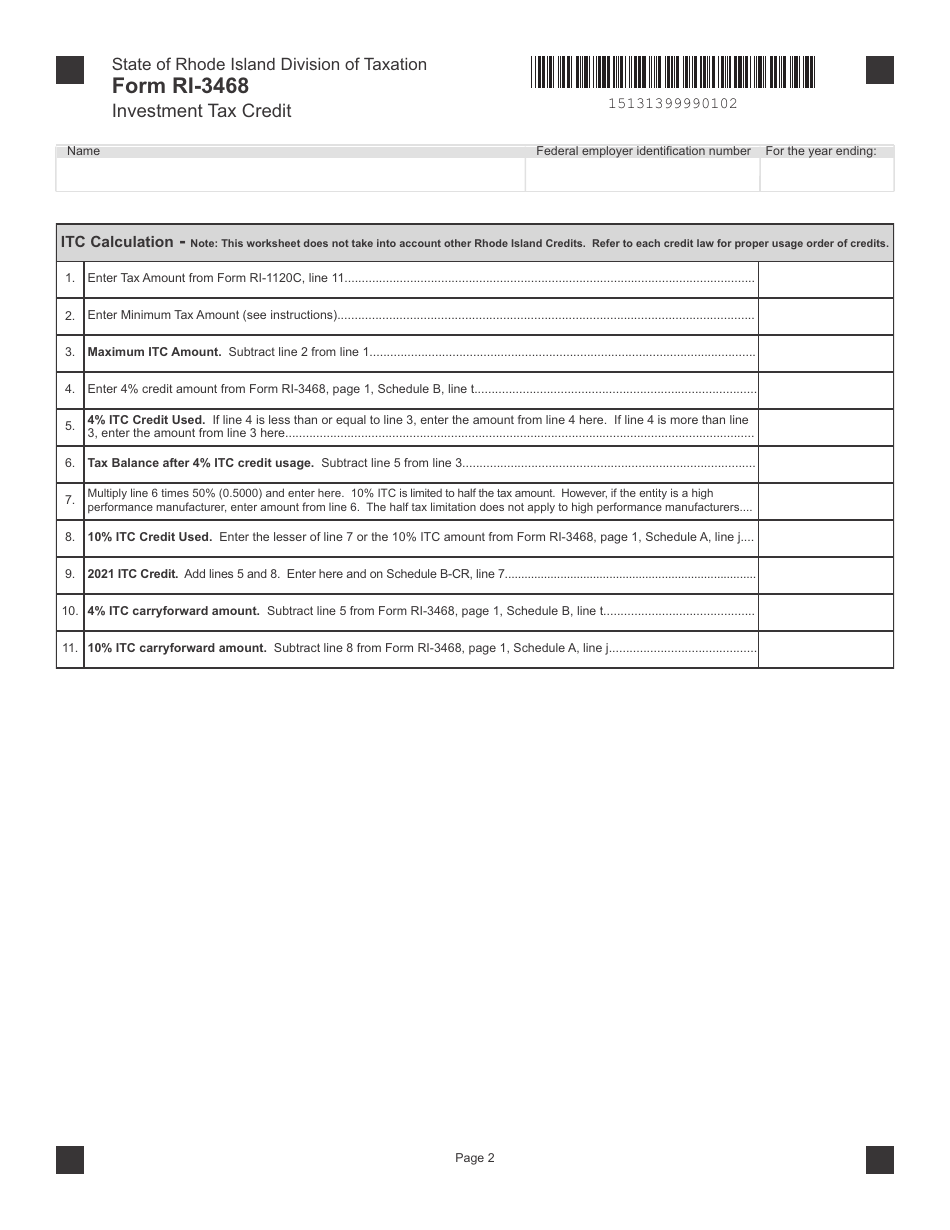

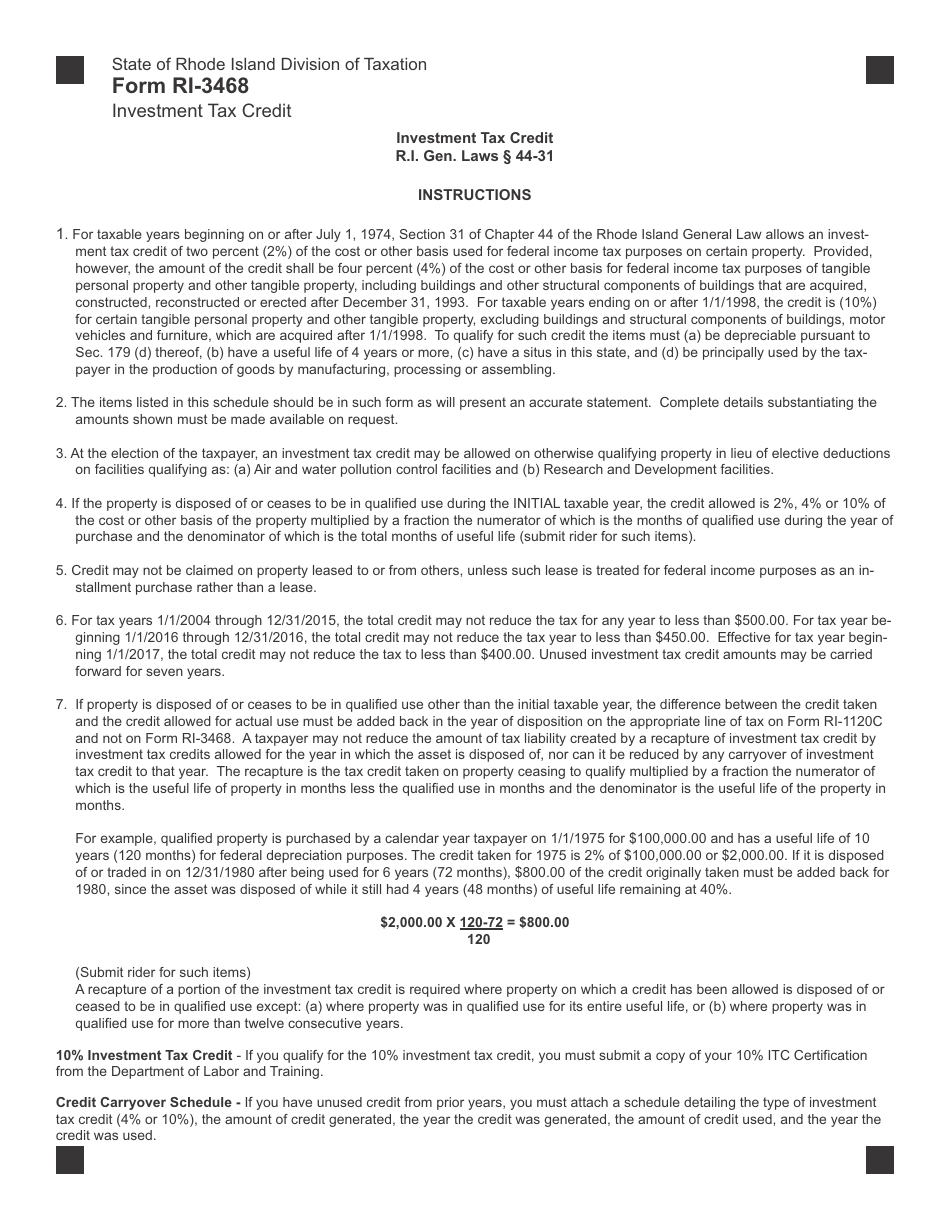

Form RI-3468

for the current year.

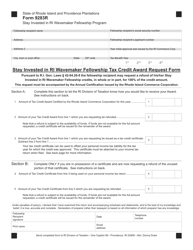

Form RI-3468 Investment Tax Credit - Rhode Island

What Is Form RI-3468?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-3468?

A: Form RI-3468 is the Investment Tax Credit form for Rhode Island.

Q: What is the purpose of Form RI-3468?

A: The purpose of Form RI-3468 is to claim the Investment Tax Credit in Rhode Island.

Q: What is the Investment Tax Credit?

A: The Investment Tax Credit is a tax incentive provided by Rhode Island for eligible businesses.

Q: Who is eligible to claim the Investment Tax Credit?

A: Eligible businesses in Rhode Island can claim the Investment Tax Credit.

Q: Are there any specific requirements or limitations for claiming the Investment Tax Credit?

A: Yes, there are specific requirements and limitations for claiming the Investment Tax Credit. It is advised to review the instructions and consult with a tax professional for accurate guidance.

Q: When is Form RI-3468 due?

A: Form RI-3468 is typically due on the same date as your Rhode Island tax return, which is usually April 15th for calendar year filers.

Q: Is the Investment Tax Credit refundable?

A: No, the Investment Tax Credit is non-refundable in Rhode Island.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-3468 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.