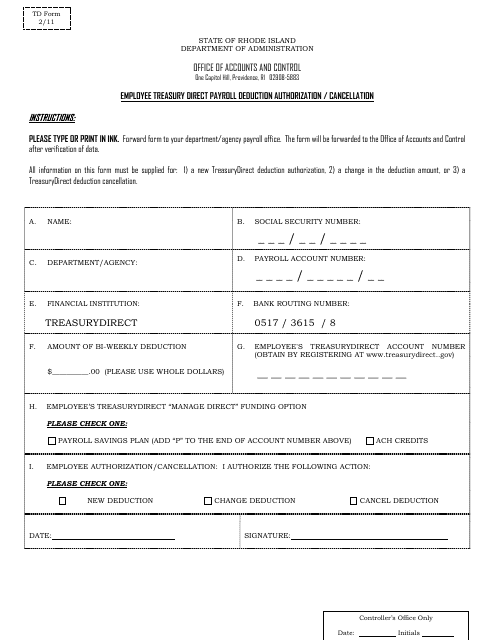

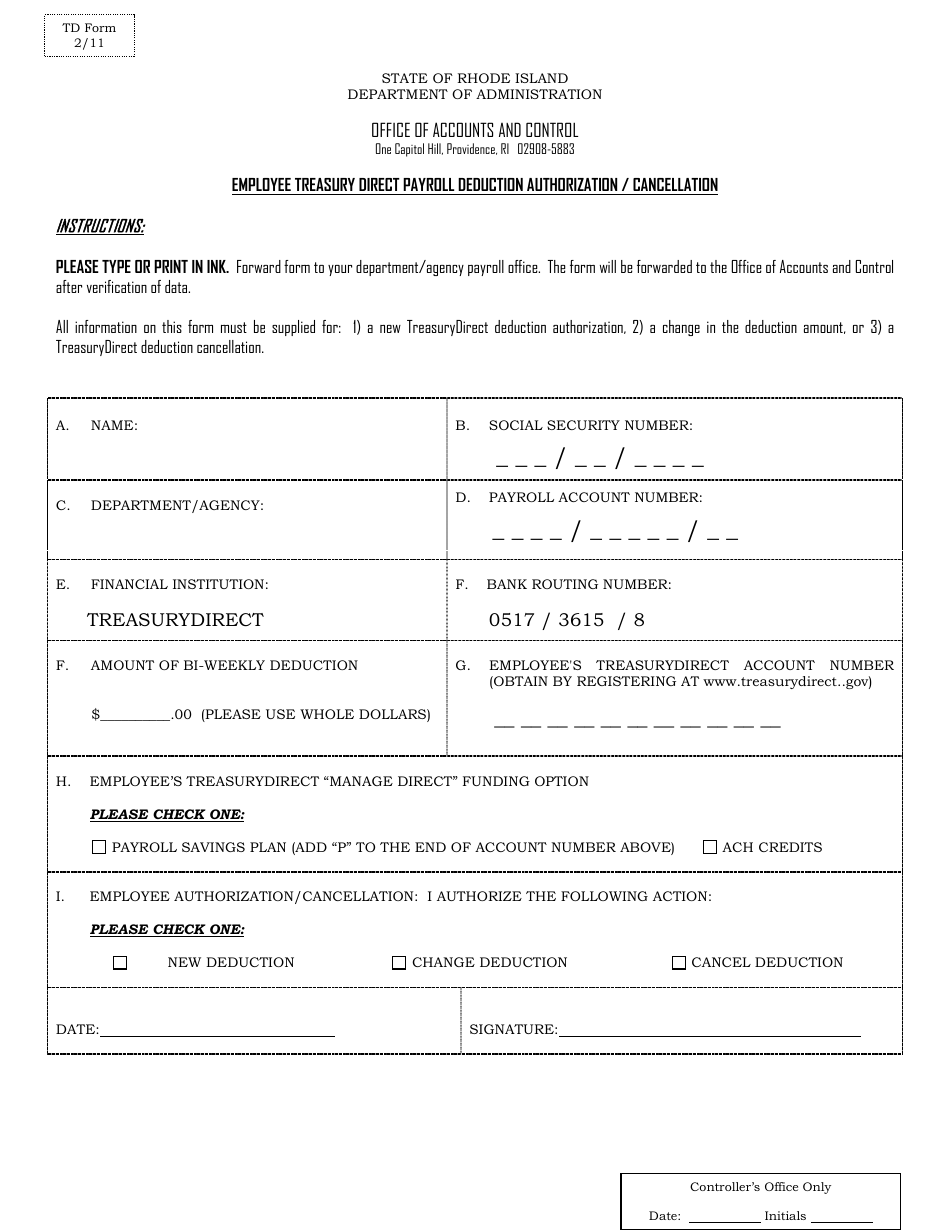

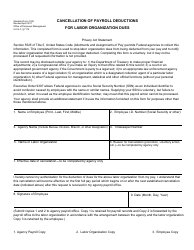

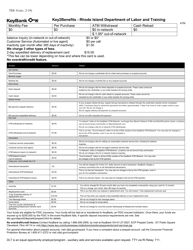

Employee Treasury Direct Payroll Deduction Authorization / Cancellation - Rhode Island

Employee Treasury Direct Payroll Deduction Authorization/Cancellation is a legal document that was released by the Rhode Island Department of Administration - Office of Accounts and Control - a government authority operating within Rhode Island.

FAQ

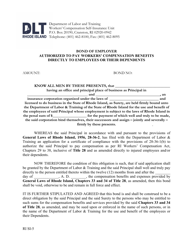

Q: What is the Employee Treasury Direct Payroll Deduction?

A: The Employee Treasury Direct Payroll Deduction is a program that allows Rhode Island employees to authorize or cancel deductions from their paychecks for specific purposes.

Q: What can be deducted through the Employee Treasury Direct Payroll Deduction?

A: Various deductions can be made through the Employee Treasury Direct Payroll Deduction, including contributions to retirement plans, health insurance premiums, and charitable donations.

Q: How can I authorize or cancel deductions through the Employee Treasury Direct Payroll Deduction?

A: To authorize or cancel deductions, you need to submit the Employee Treasury Direct Payroll Deduction Authorization/Cancellation form to your employer.

Q: What information do I need to provide on the form?

A: You will need to provide your personal information, such as your name, employee ID, and the specific deductions you wish to authorize or cancel.

Q: Is participation in the Employee Treasury Direct Payroll Deduction voluntary?

A: Yes, participation in the Employee Treasury Direct Payroll Deduction is voluntary. You can choose whether or not to authorize deductions from your paycheck.

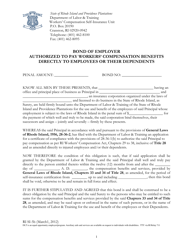

Q: Can I make changes to my authorized deductions at any time?

A: Yes, you can make changes to your authorized deductions at any time by submitting a new Employee Treasury Direct Payroll Deduction Authorization/Cancellation form to your employer.

Form Details:

- Released on February 1, 2011;

- The latest edition currently provided by the Rhode Island Department of Administration - Office of Accounts and Control;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Administration - Office of Accounts and Control.