This version of the form is not currently in use and is provided for reference only. Download this version of

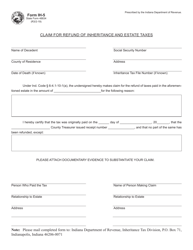

Form REF-1000 (State Form 50854)

for the current year.

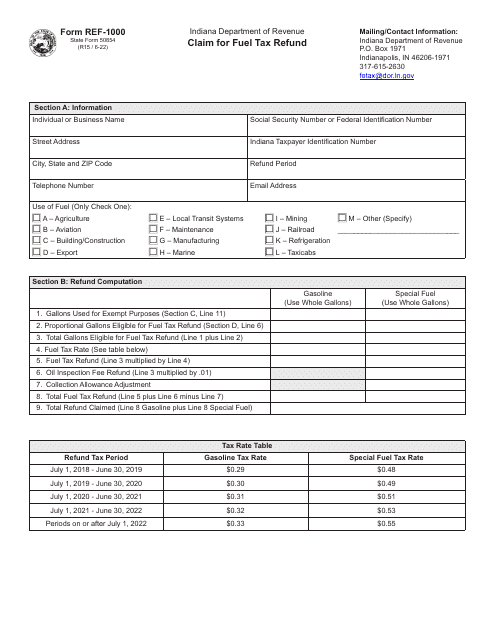

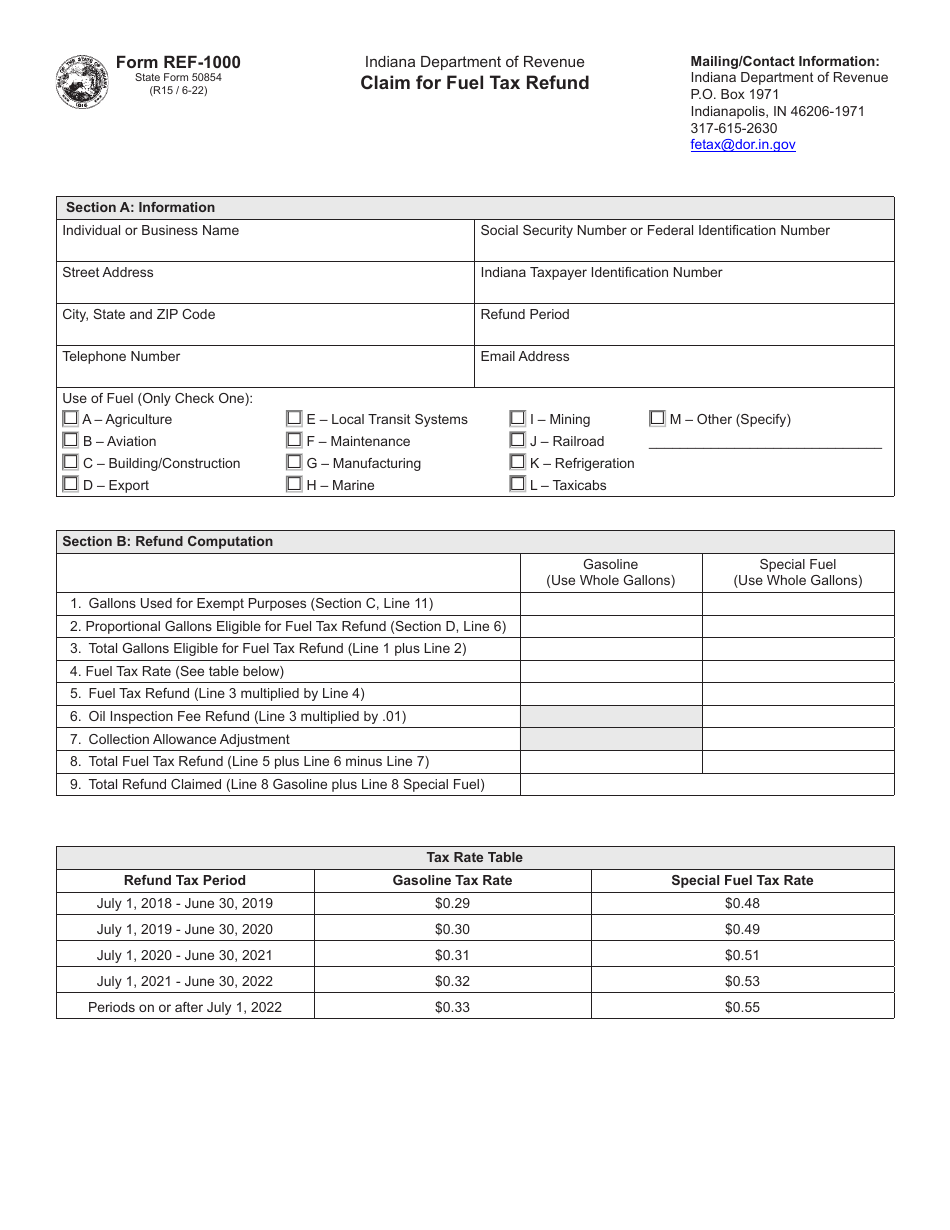

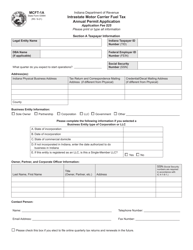

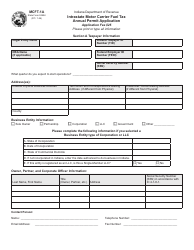

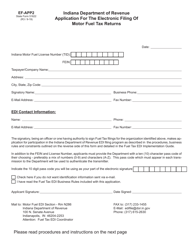

Form REF-1000 (State Form 50854) Claim for Fuel Tax Refund - Indiana

What Is Form REF-1000 (State Form 50854)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

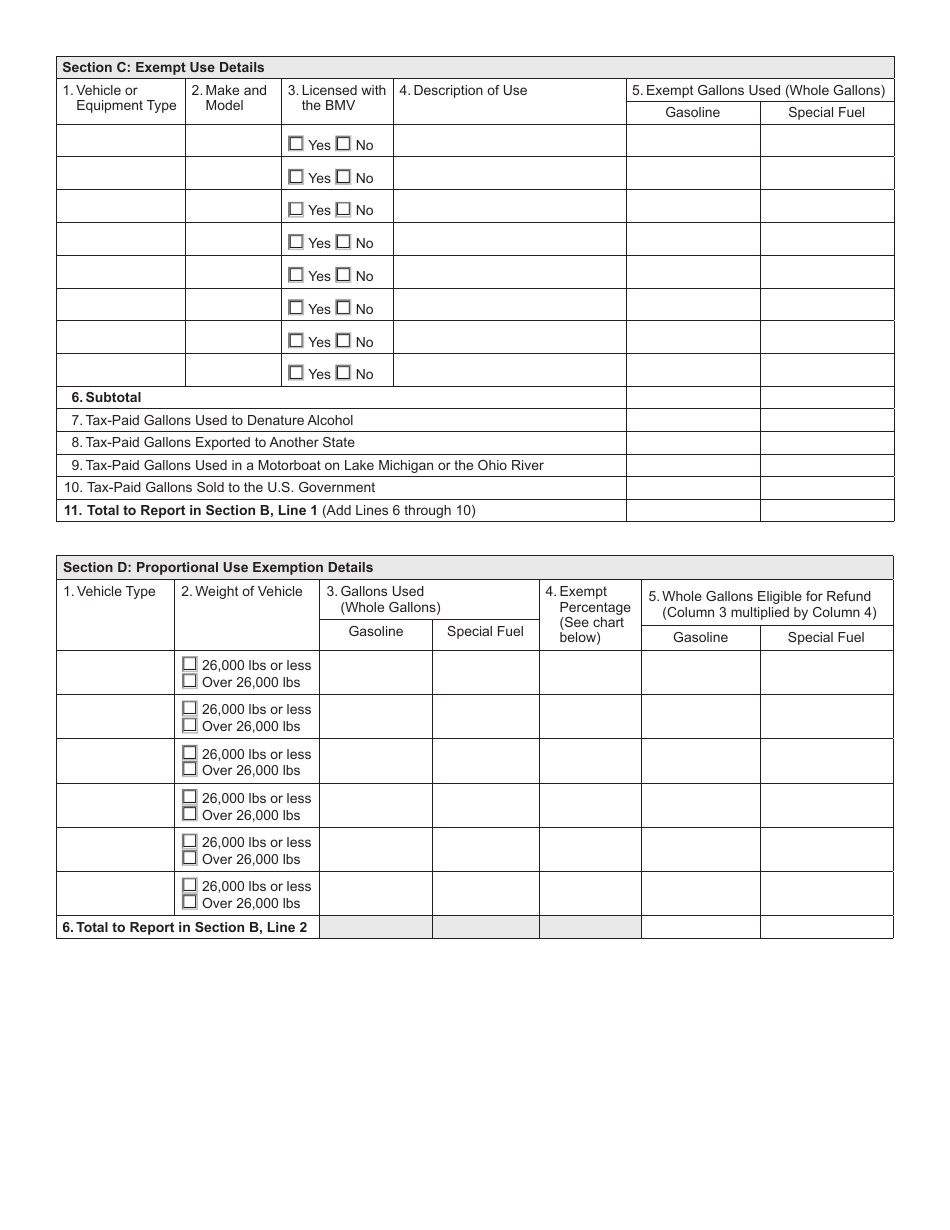

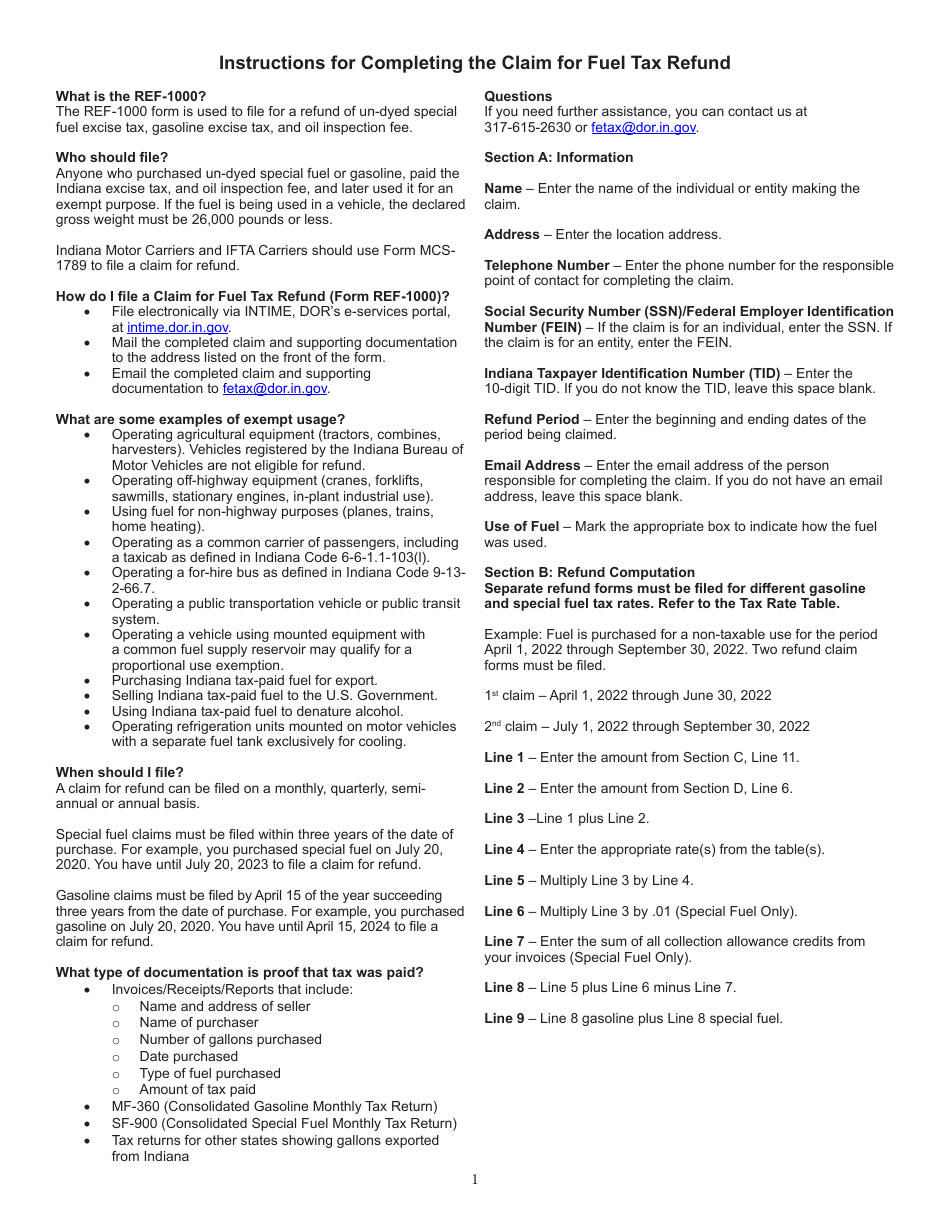

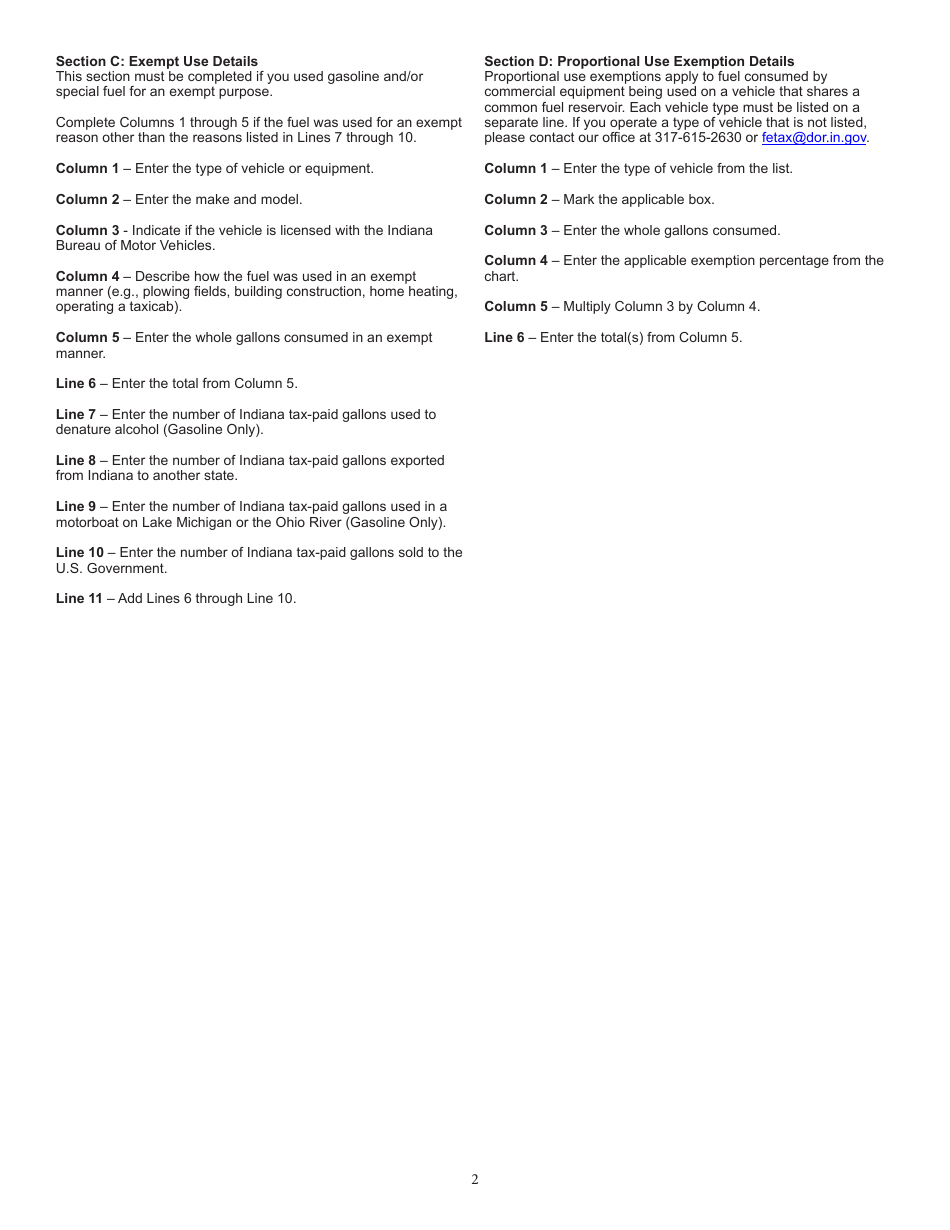

Q: What is Form REF-1000?

A: Form REF-1000 is a claim form for fuel tax refund in Indiana.

Q: What is the purpose of Form REF-1000?

A: The purpose of Form REF-1000 is to request a refund on fuel tax paid in Indiana.

Q: How do I obtain Form REF-1000?

A: You can obtain Form REF-1000, also known as State Form 50854, from the Indiana Department of Revenue.

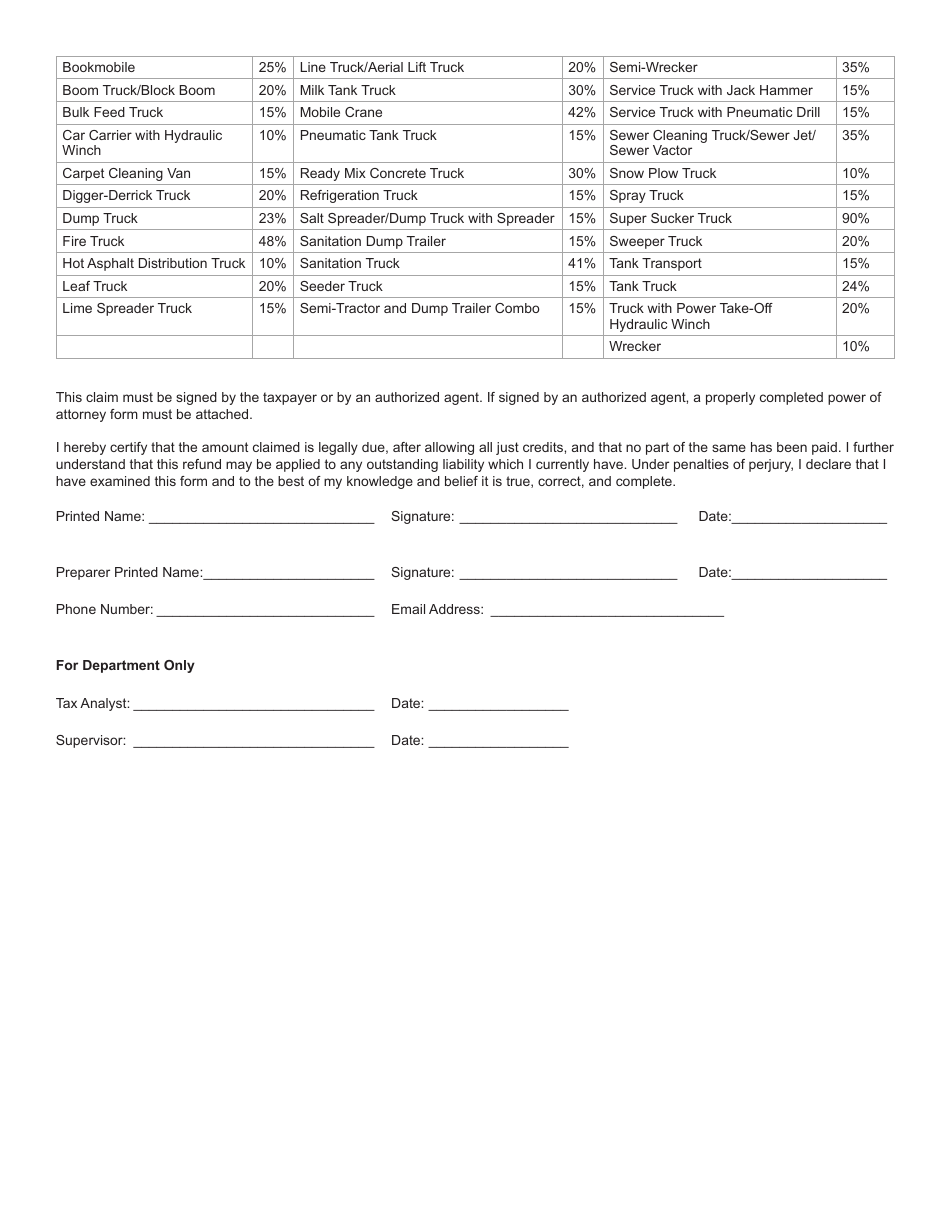

Q: Who is eligible to use Form REF-1000?

A: Any individual or business that has paid fuel tax in Indiana may be eligible to use Form REF-1000.

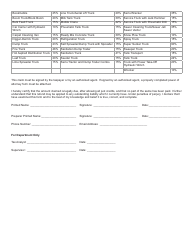

Q: What information is needed to complete Form REF-1000?

A: To complete Form REF-1000, you will need to provide information such as fuel purchase details, mileage records, and proof of tax payment.

Q: Are there any filing deadlines for Form REF-1000?

A: Yes, Form REF-1000 must be filed within one year from the date the fuel tax was paid.

Q: Is there a fee to file Form REF-1000?

A: No, there is no fee to file Form REF-1000.

Q: Can I e-file Form REF-1000?

A: No, Form REF-1000 can only be filed by mail.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REF-1000 (State Form 50854) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.