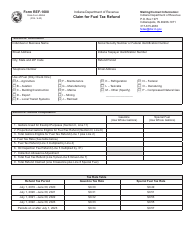

This version of the form is not currently in use and is provided for reference only. Download this version of

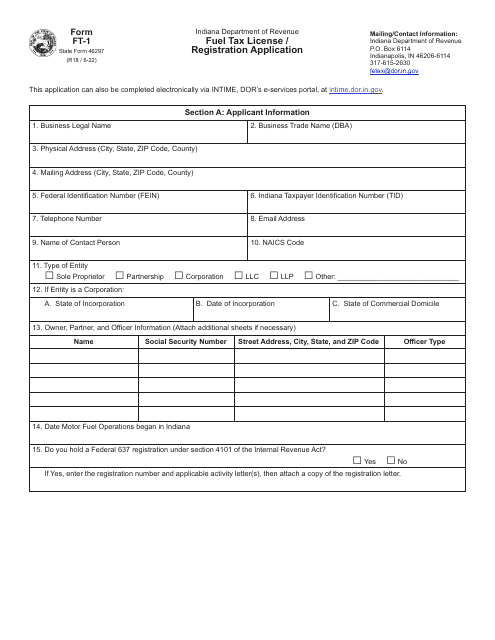

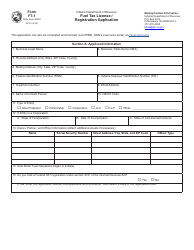

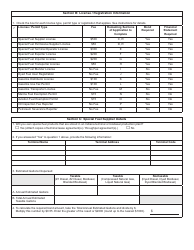

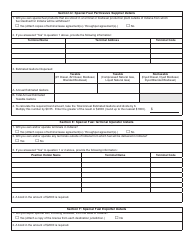

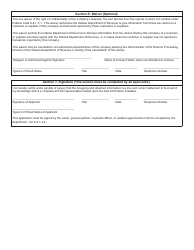

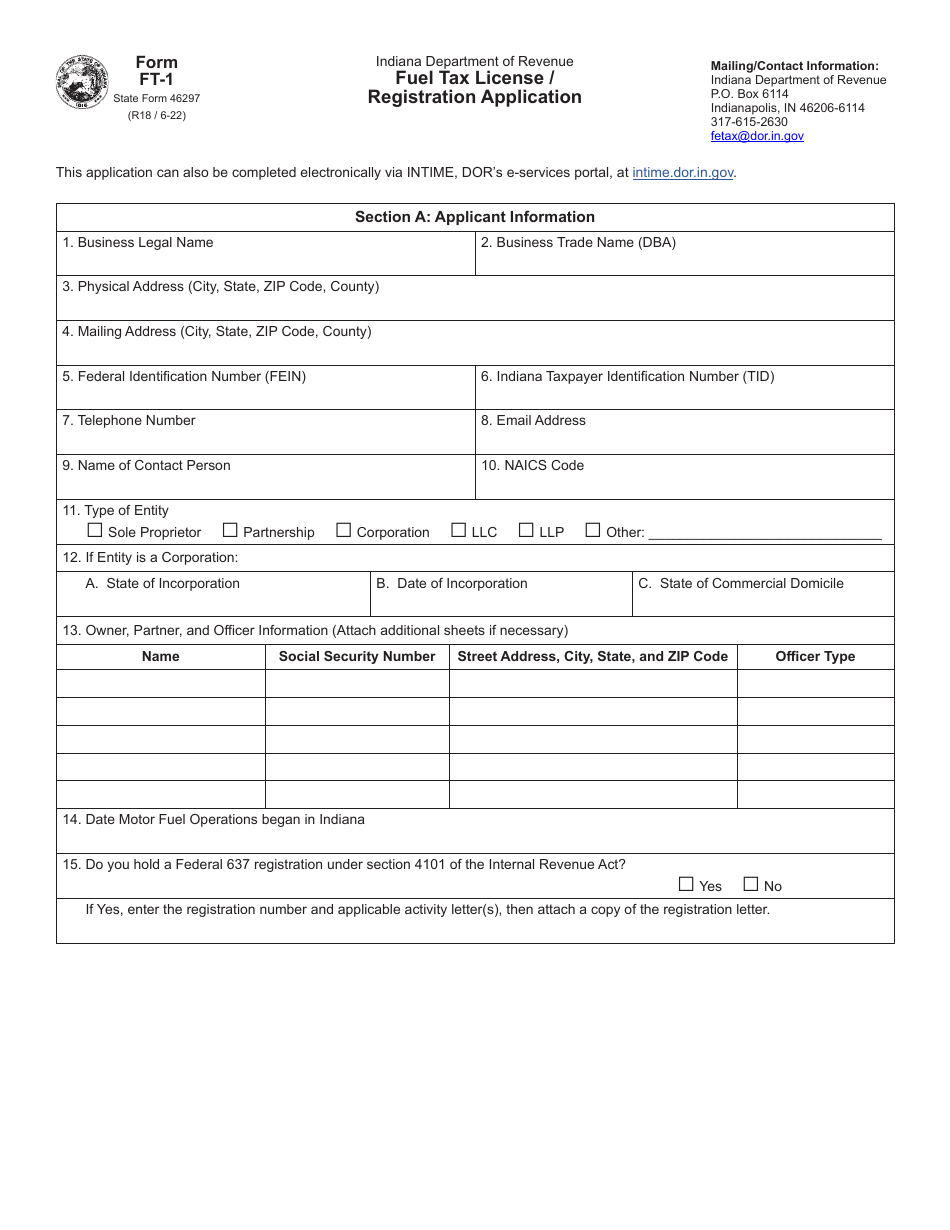

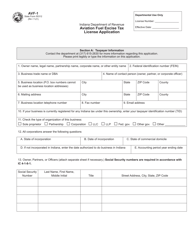

Form FT-1 (State Form 46297)

for the current year.

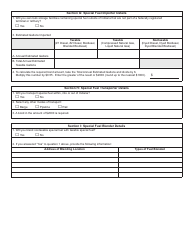

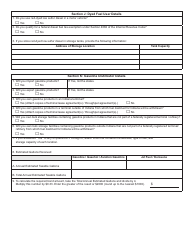

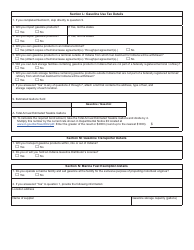

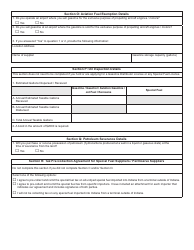

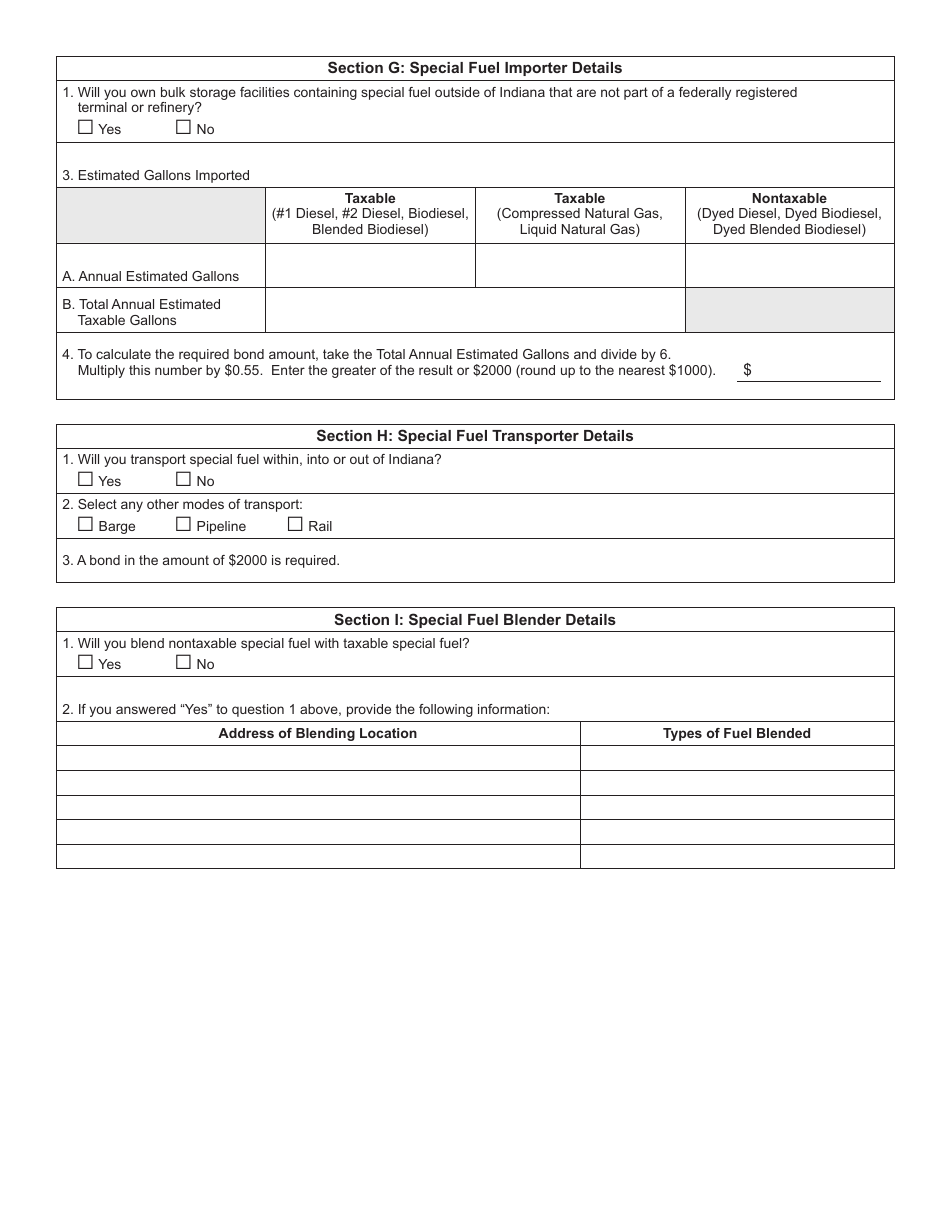

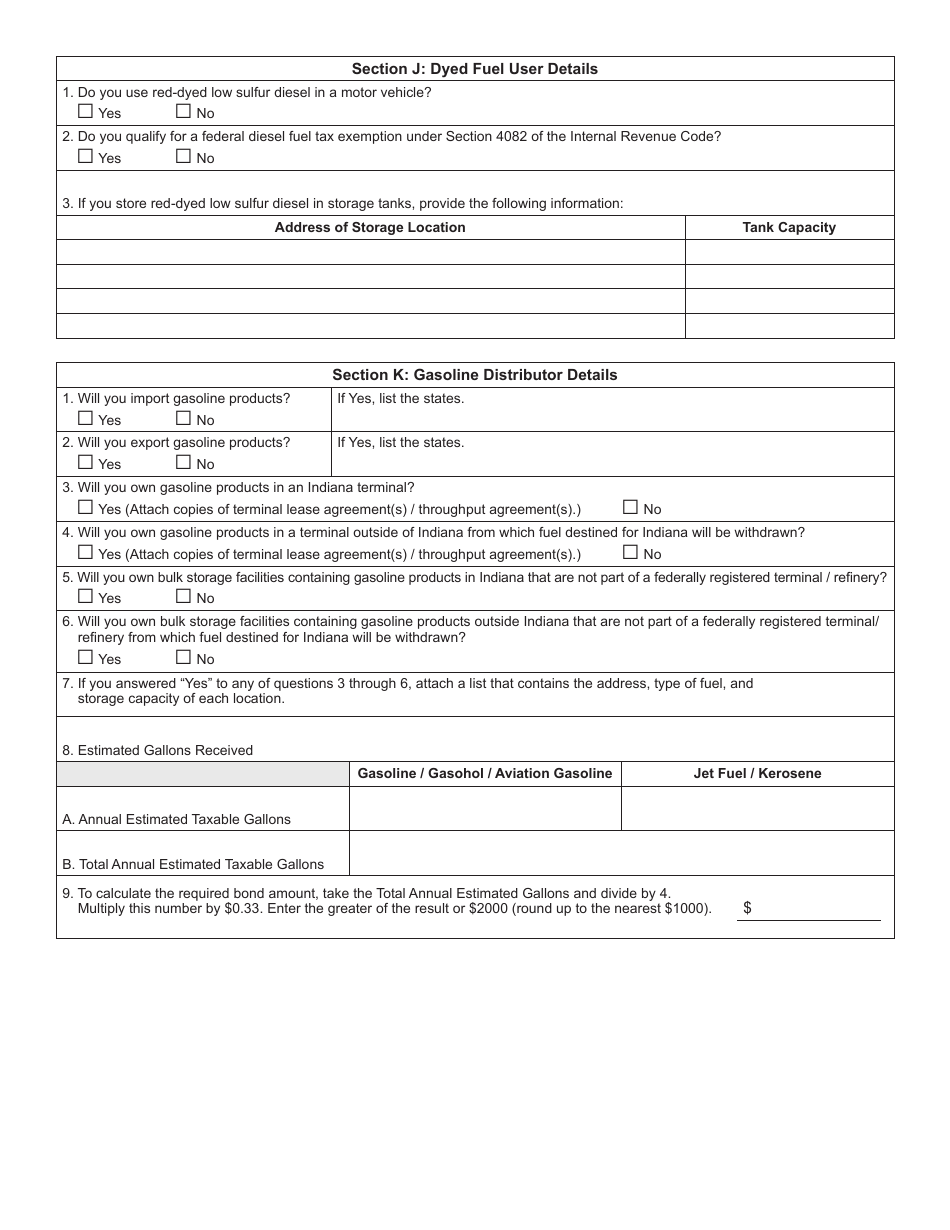

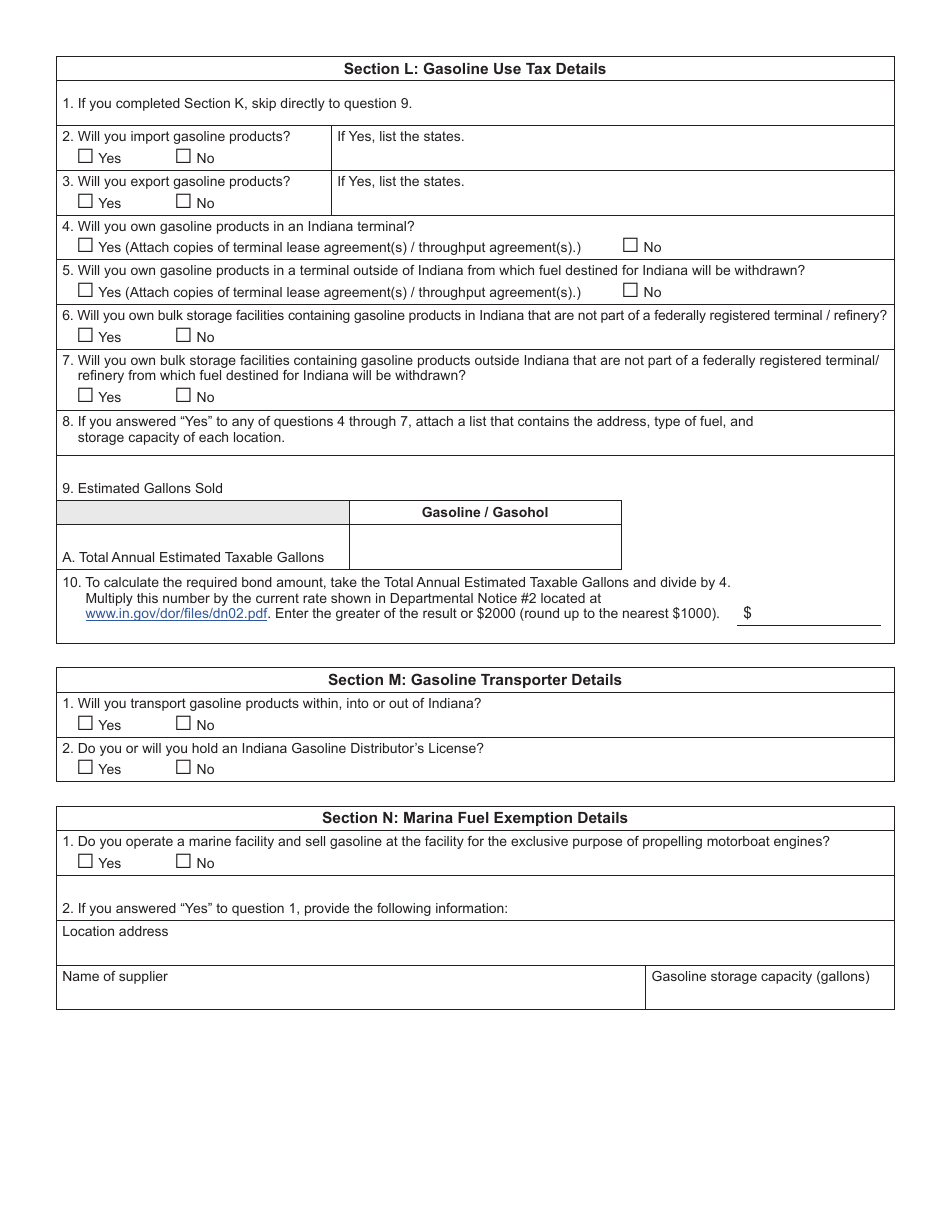

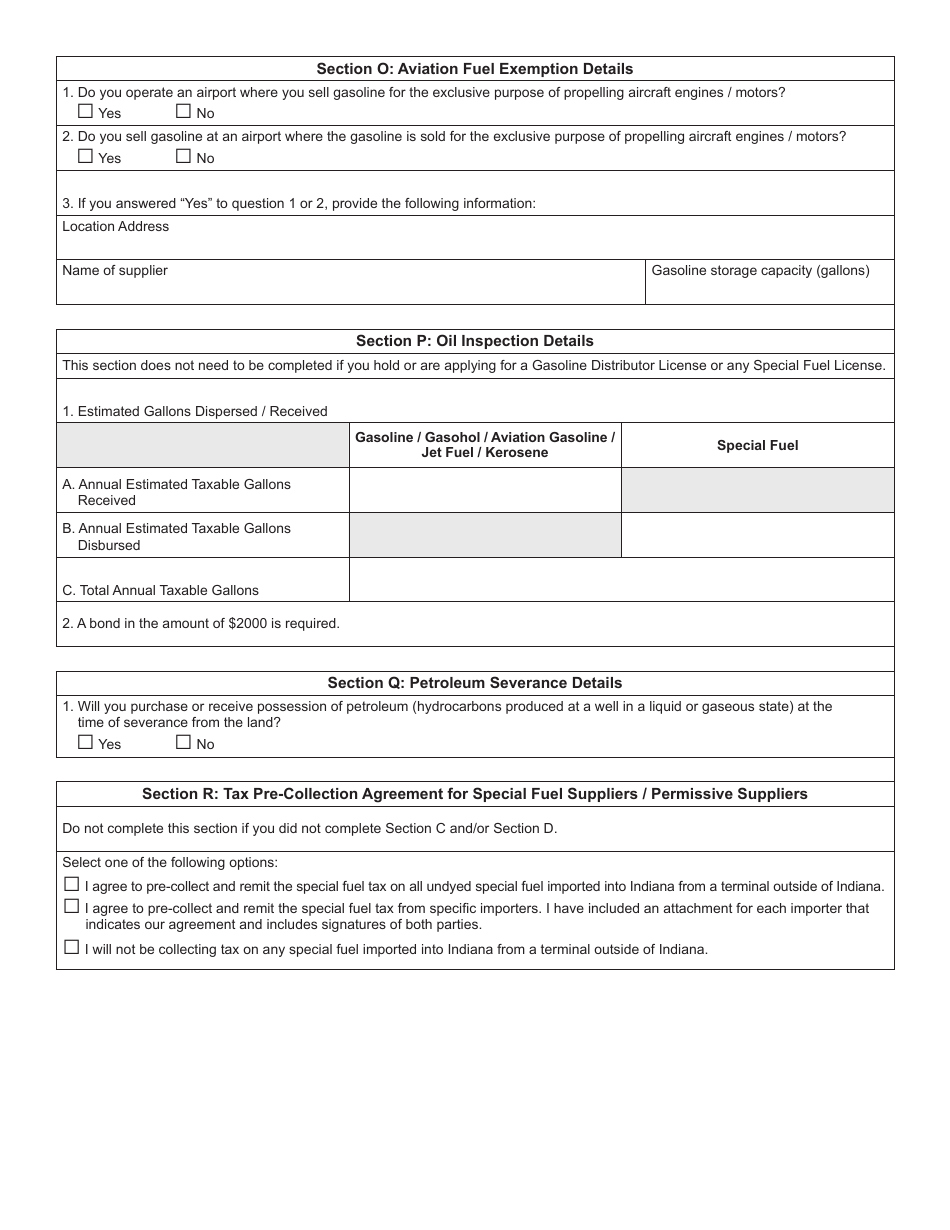

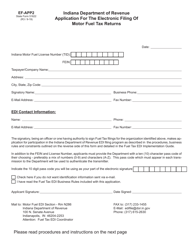

Form FT-1 (State Form 46297) Fuel Tax License Registration Application - Indiana

What Is Form FT-1 (State Form 46297)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

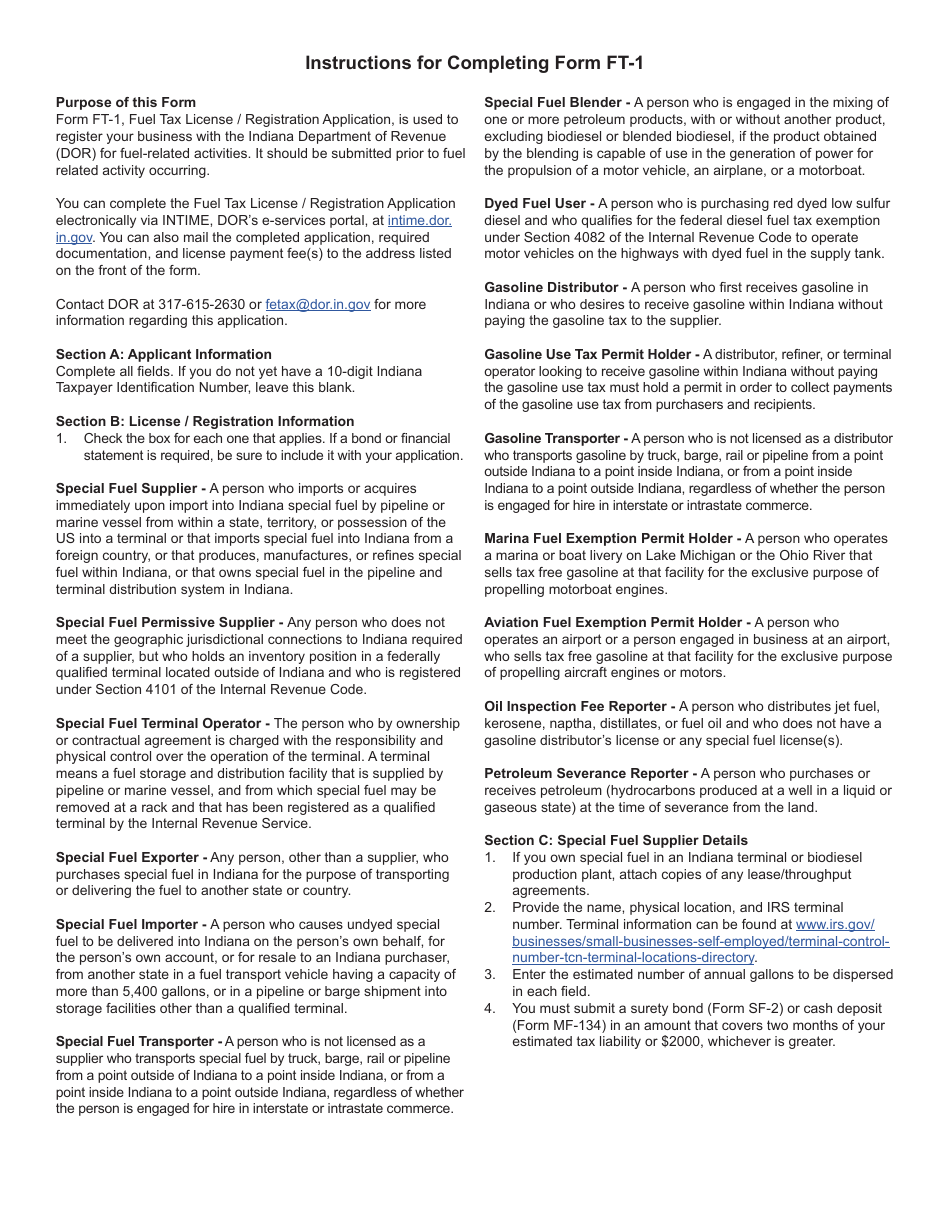

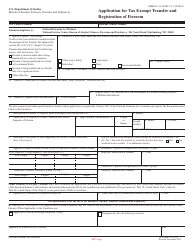

Q: What is Form FT-1?

A: Form FT-1 is the Fuel Tax License Registration Application.

Q: What is the purpose of Form FT-1?

A: The purpose of Form FT-1 is to register for a fuel tax license in Indiana.

Q: Do I need to submit Form FT-1?

A: Yes, if you plan to engage in activities subject to Indiana fuel tax, you need to submit Form FT-1.

Q: What information is required on Form FT-1?

A: Form FT-1 requires information such as your business details, fuel types, registration period, and contact information.

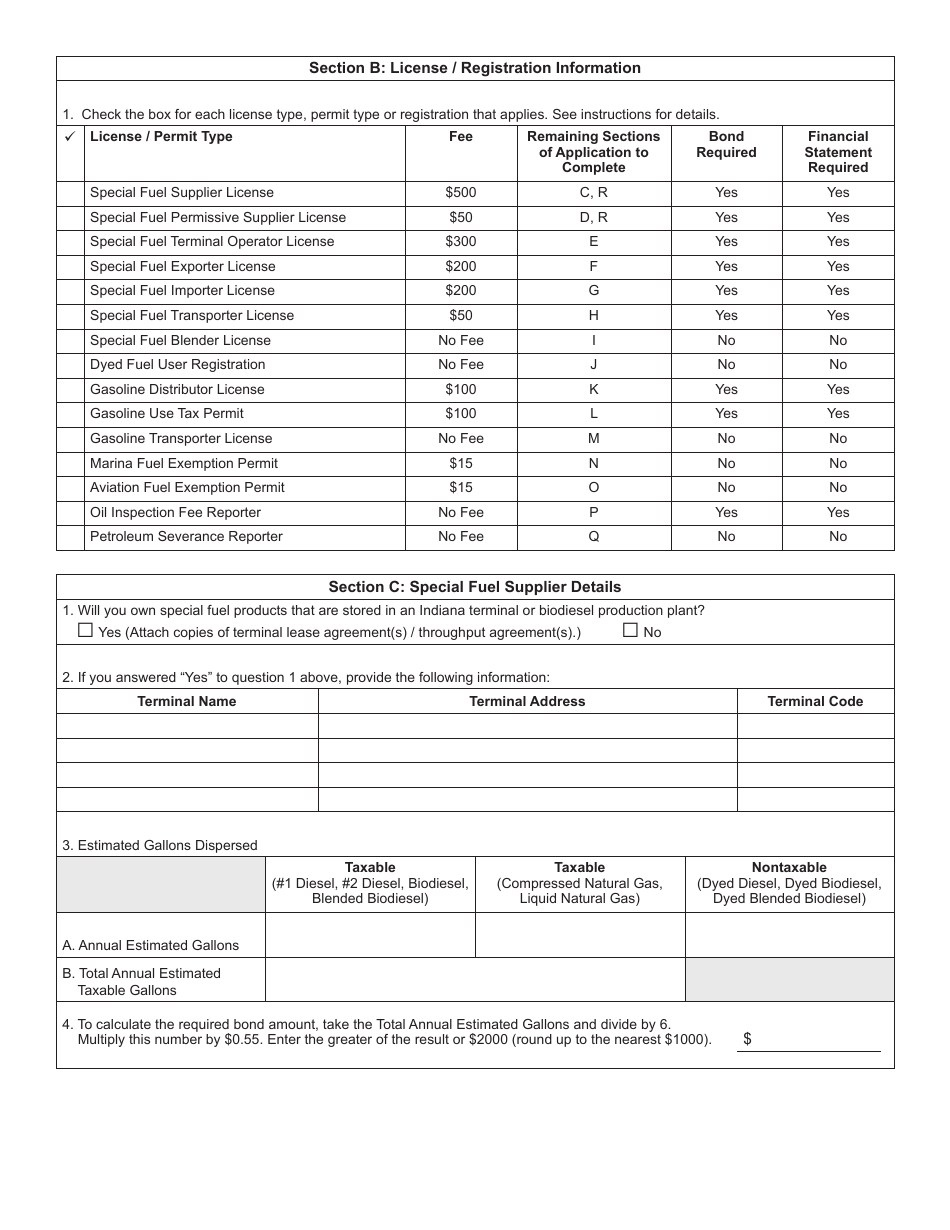

Q: Are there any fees associated with Form FT-1?

A: Yes, there is a $25 non-refundable fee for processing the application.

Q: Can I make changes to my Form FT-1 after submission?

A: Yes, you can make changes to your Form FT-1 by filing an amended form.

Q: Do I need to renew my fuel tax license?

A: Yes, your fuel tax license needs to be renewed annually by submitting a new Form FT-1.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-1 (State Form 46297) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.