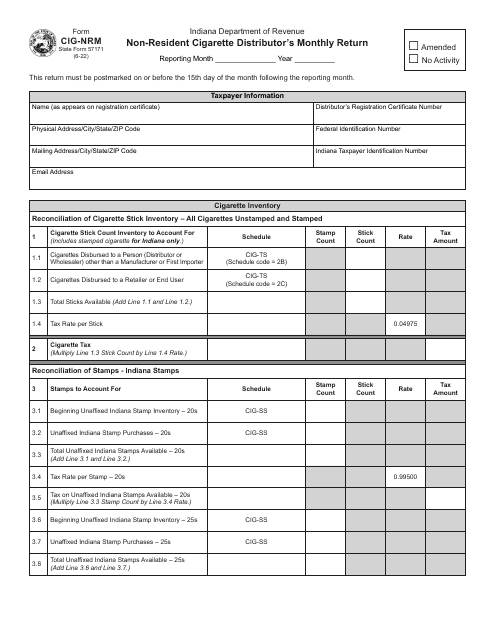

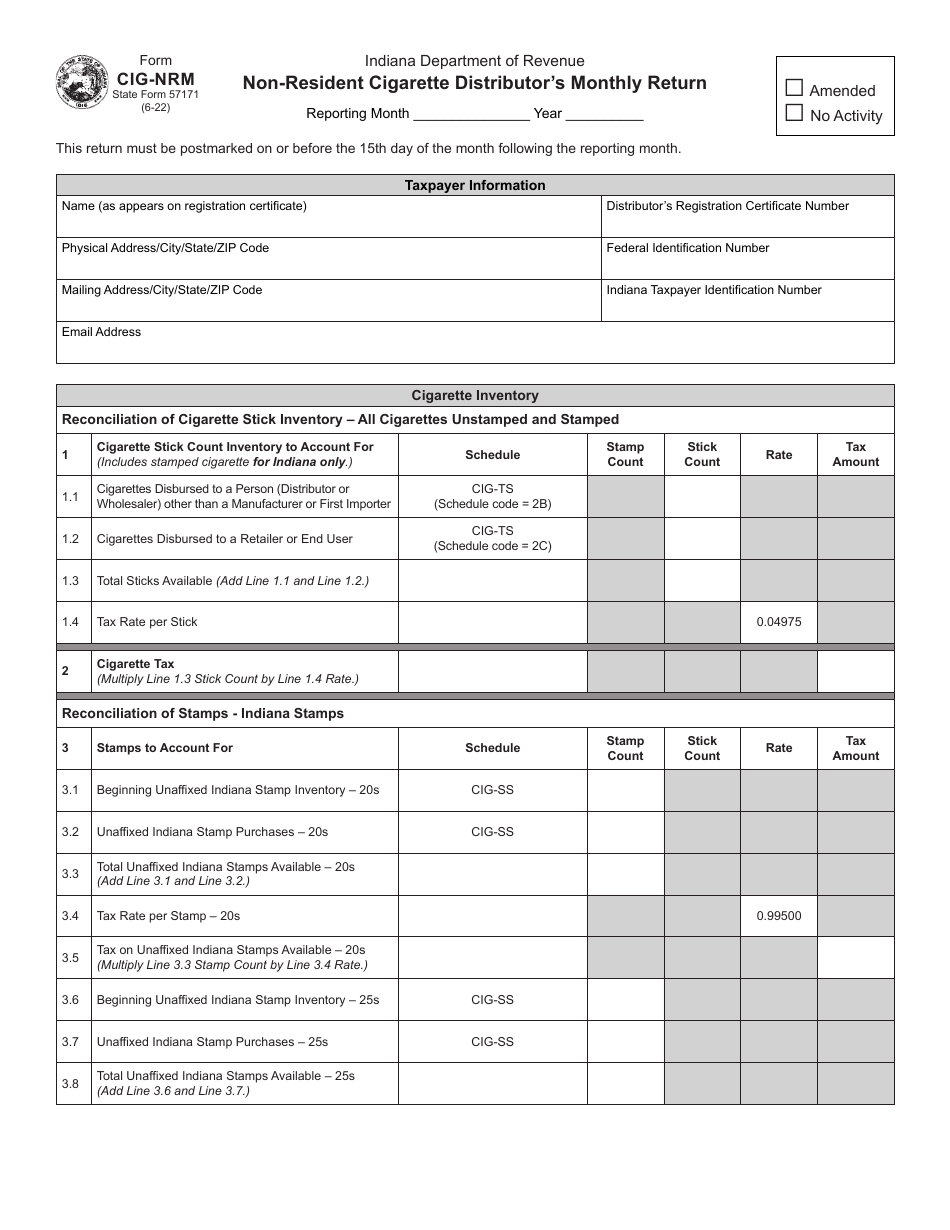

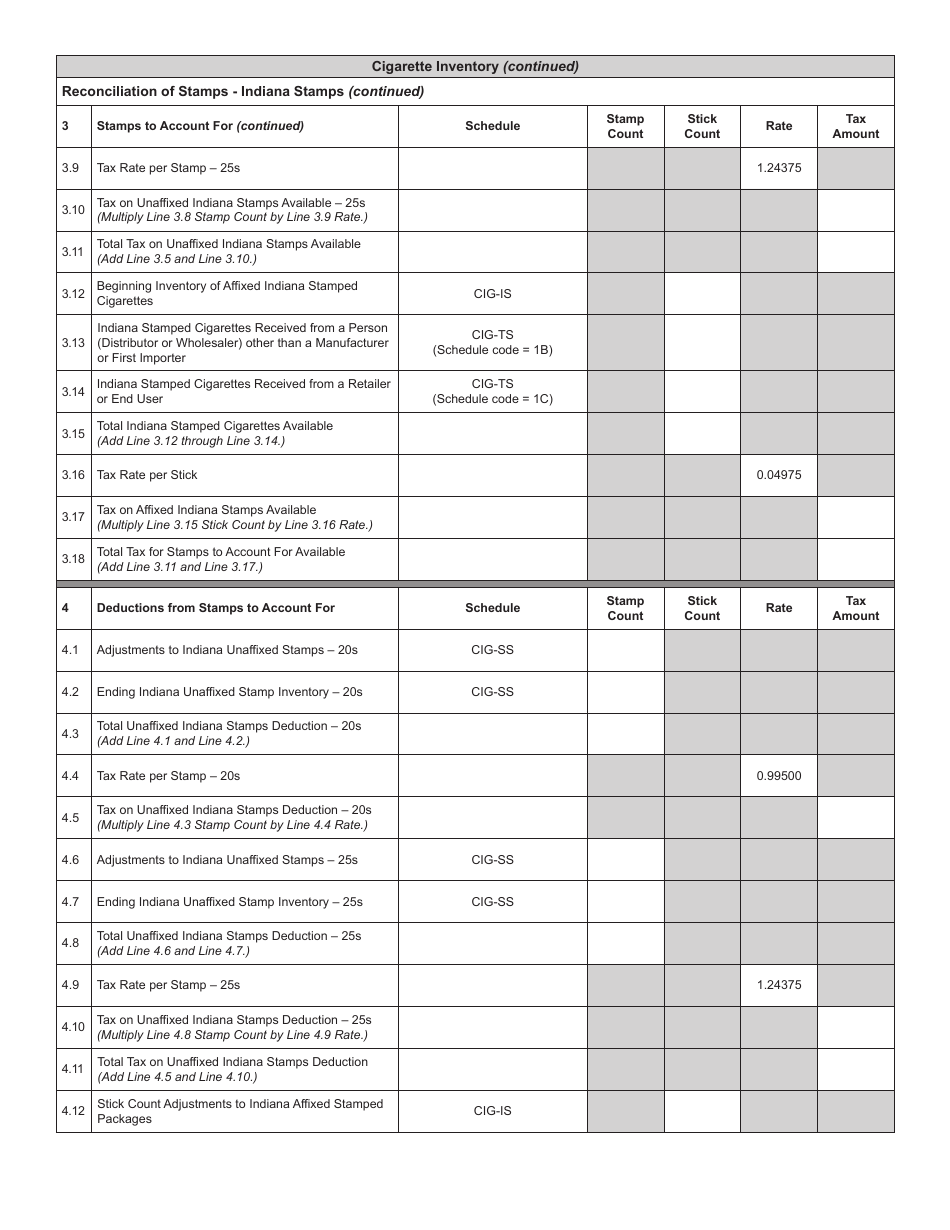

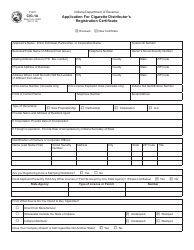

State Form 57171 Schedule CIG-NRM Non-resident Cigarette Distributor's Monthly Return - Indiana

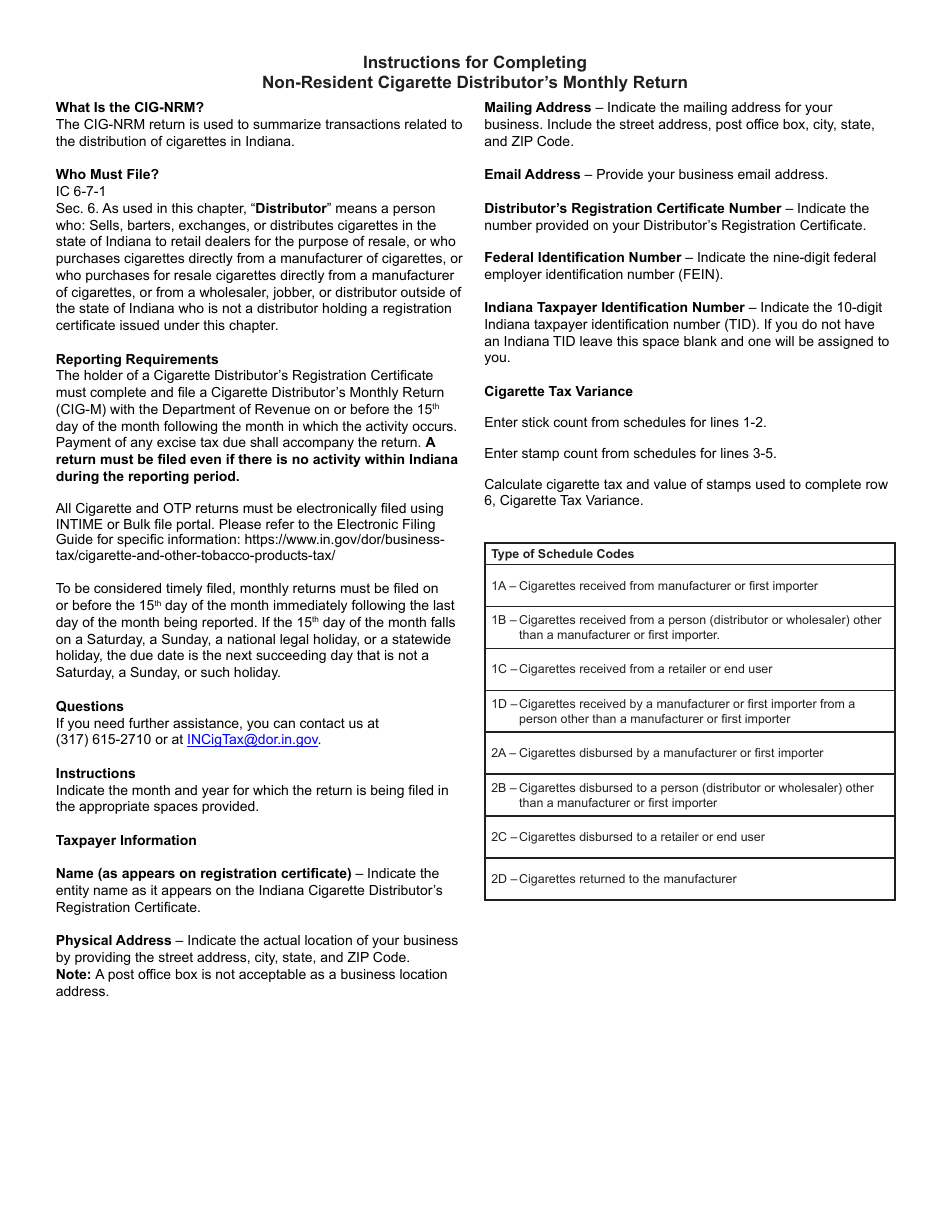

What Is State Form 57171 Schedule CIG-NRM?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 57171?

A: Form 57171 is the Non-resident Cigarette Distributor's Monthly Return for the state of Indiana.

Q: Who needs to file Form 57171?

A: Non-resident cigarette distributors who distribute cigarettes in Indiana need to file Form 57171.

Q: What is the purpose of Form 57171?

A: Form 57171 is used to report and remit the cigarette tax liability for non-resident cigarette distributors in Indiana.

Q: How often should Form 57171 be filed?

A: Form 57171 should be filed on a monthly basis.

Q: Is Form 57171 only for non-residents?

A: Yes, Form 57171 is specifically for non-resident cigarette distributors in Indiana.

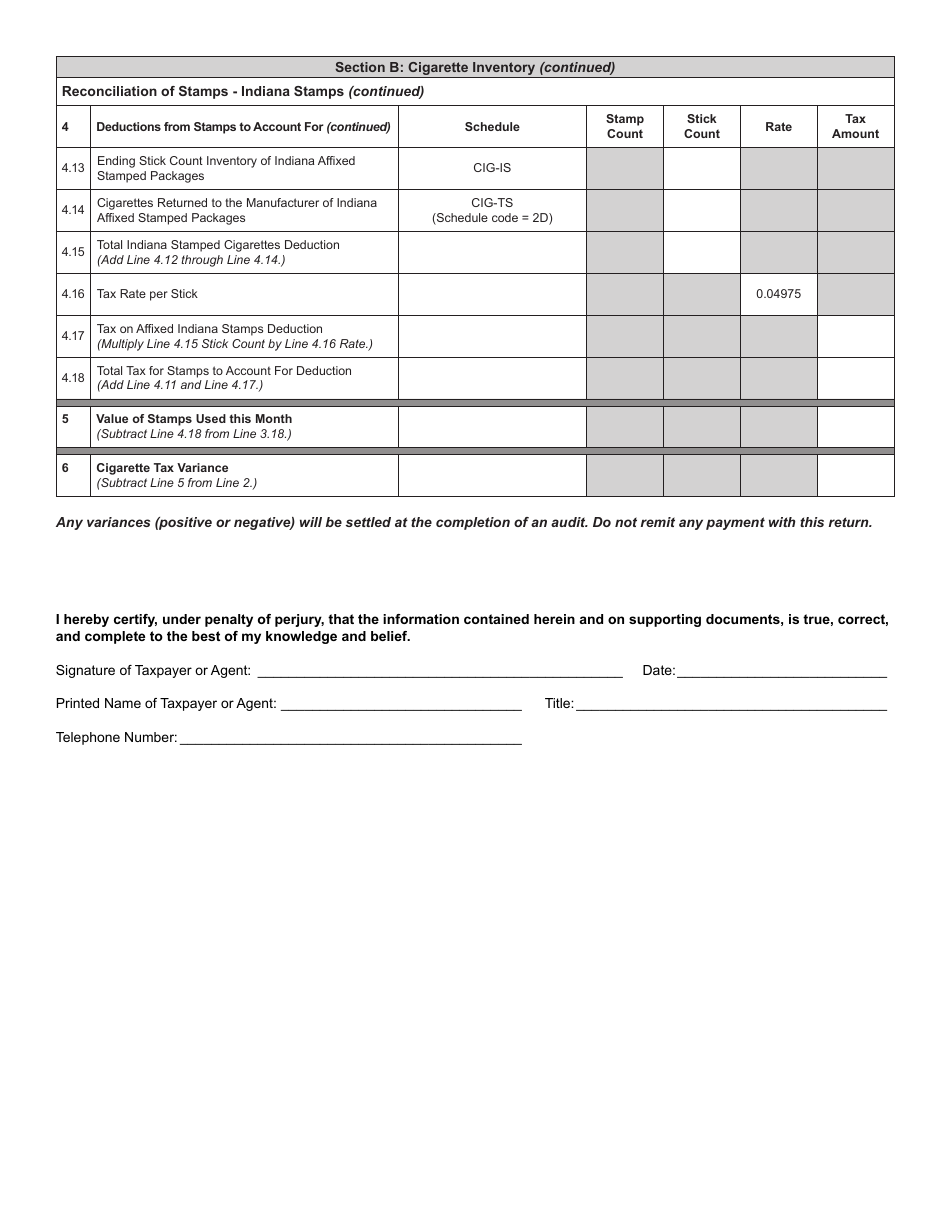

Q: What information is required on Form 57171?

A: Form 57171 requires information such as the number of cigarettes distributed, the total tax due, and the distributor's contact information.

Q: Are there any penalties for not filing Form 57171?

A: Yes, there may be penalties for not filing Form 57171 or for filing it late.

Q: Can I request an extension to file Form 57171?

A: Yes, you can request an extension to file Form 57171, but it must be done before the original due date.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 57171 Schedule CIG-NRM by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.