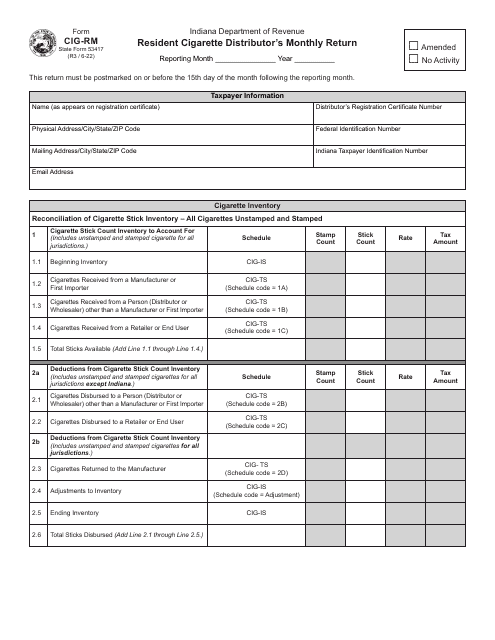

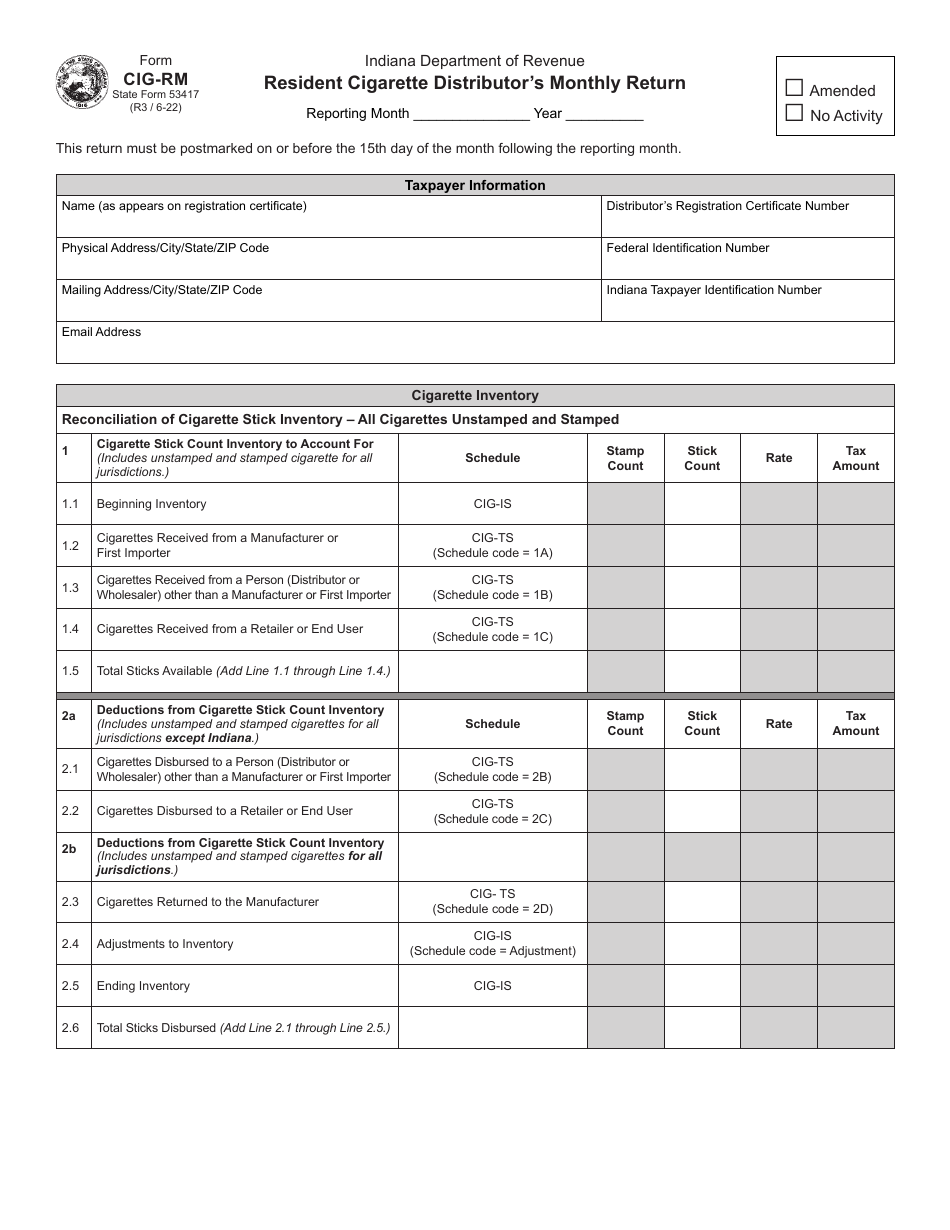

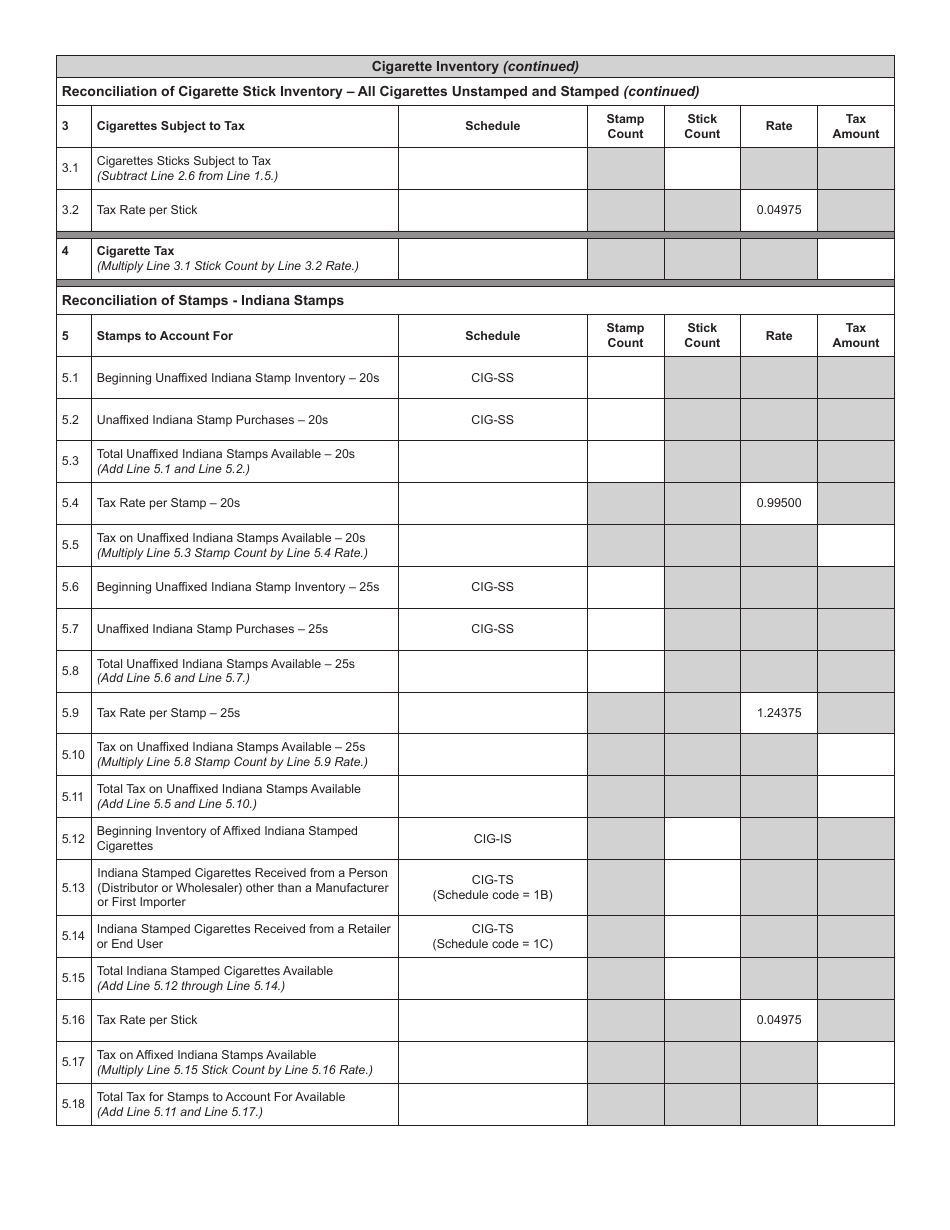

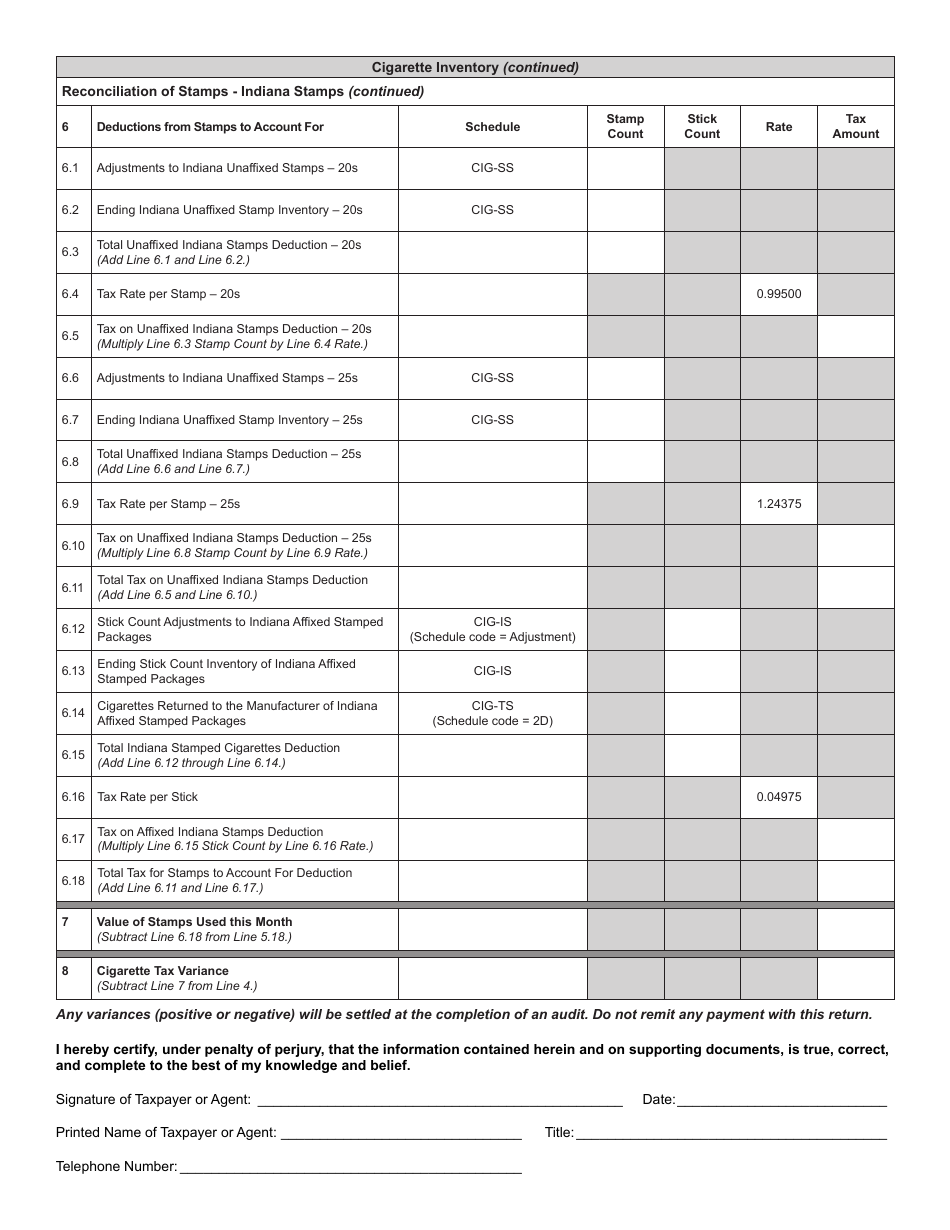

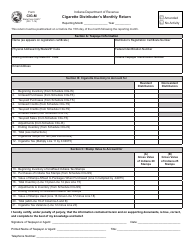

Form CIG-RM (State Form 53417) Resident Cigarette Distributor's Monthly Return - Indiana

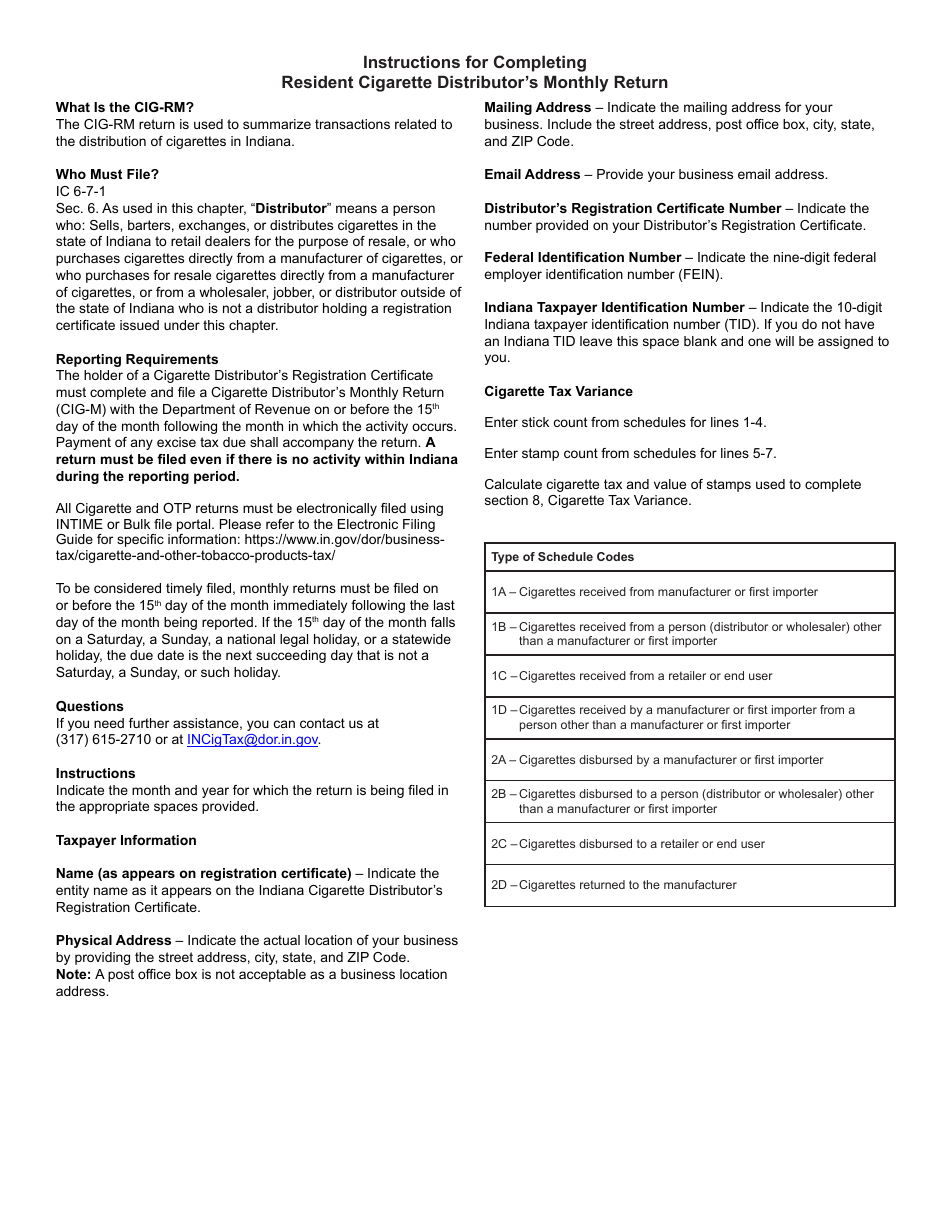

What Is Form CIG-RM (State Form 53417)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIG-RM?

A: Form CIG-RM is the Resident Cigarette Distributor's Monthly Return for the state of Indiana.

Q: Who needs to file Form CIG-RM?

A: Resident cigarette distributors in Indiana need to file Form CIG-RM.

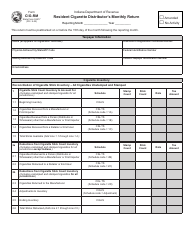

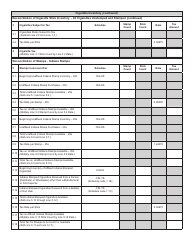

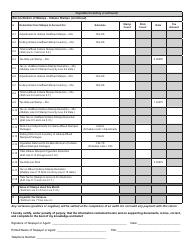

Q: What is the purpose of Form CIG-RM?

A: The purpose of Form CIG-RM is to report the monthly cigarette distributions and related taxes.

Q: How often do I need to file Form CIG-RM?

A: Form CIG-RM must be filed monthly by resident cigarette distributors in Indiana.

Q: Are there any penalties for not filing Form CIG-RM?

A: Yes, there may be penalties for not filing or late filing of Form CIG-RM. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG-RM (State Form 53417) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.