This version of the form is not currently in use and is provided for reference only. Download this version of

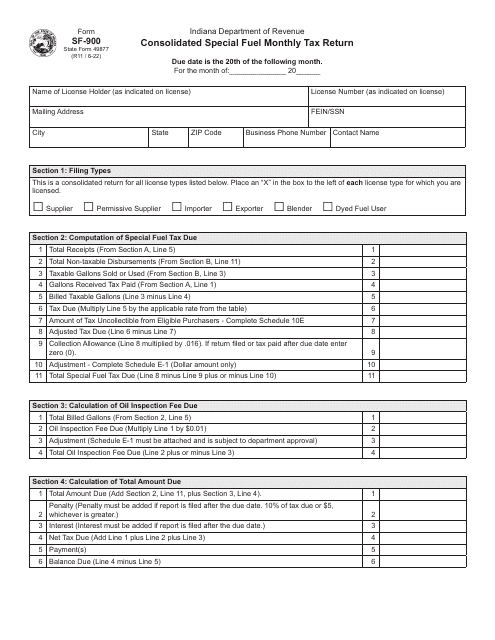

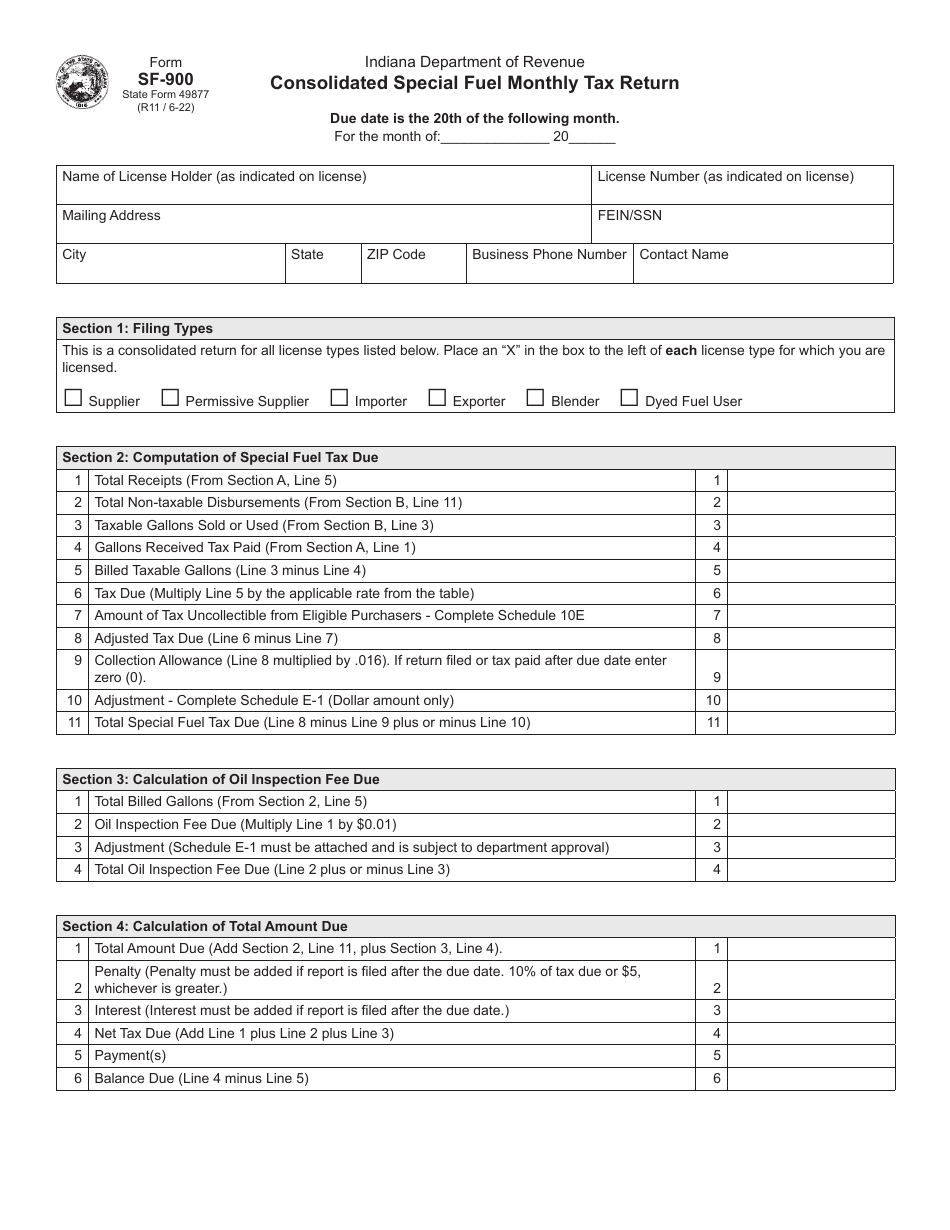

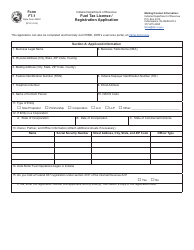

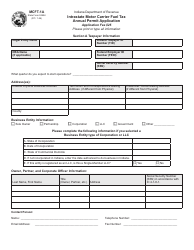

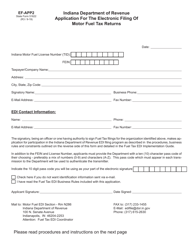

Form SF-900 (State Form 49877)

for the current year.

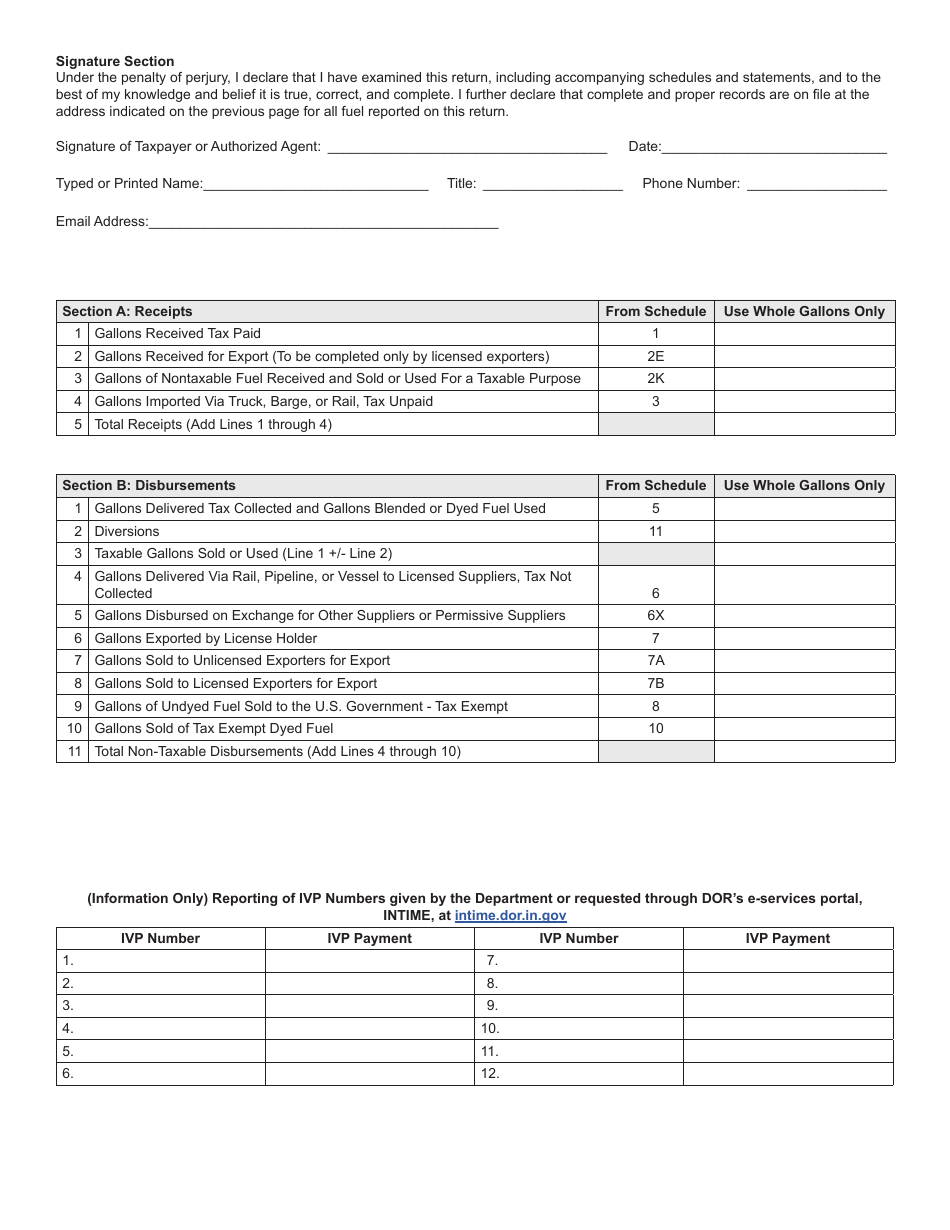

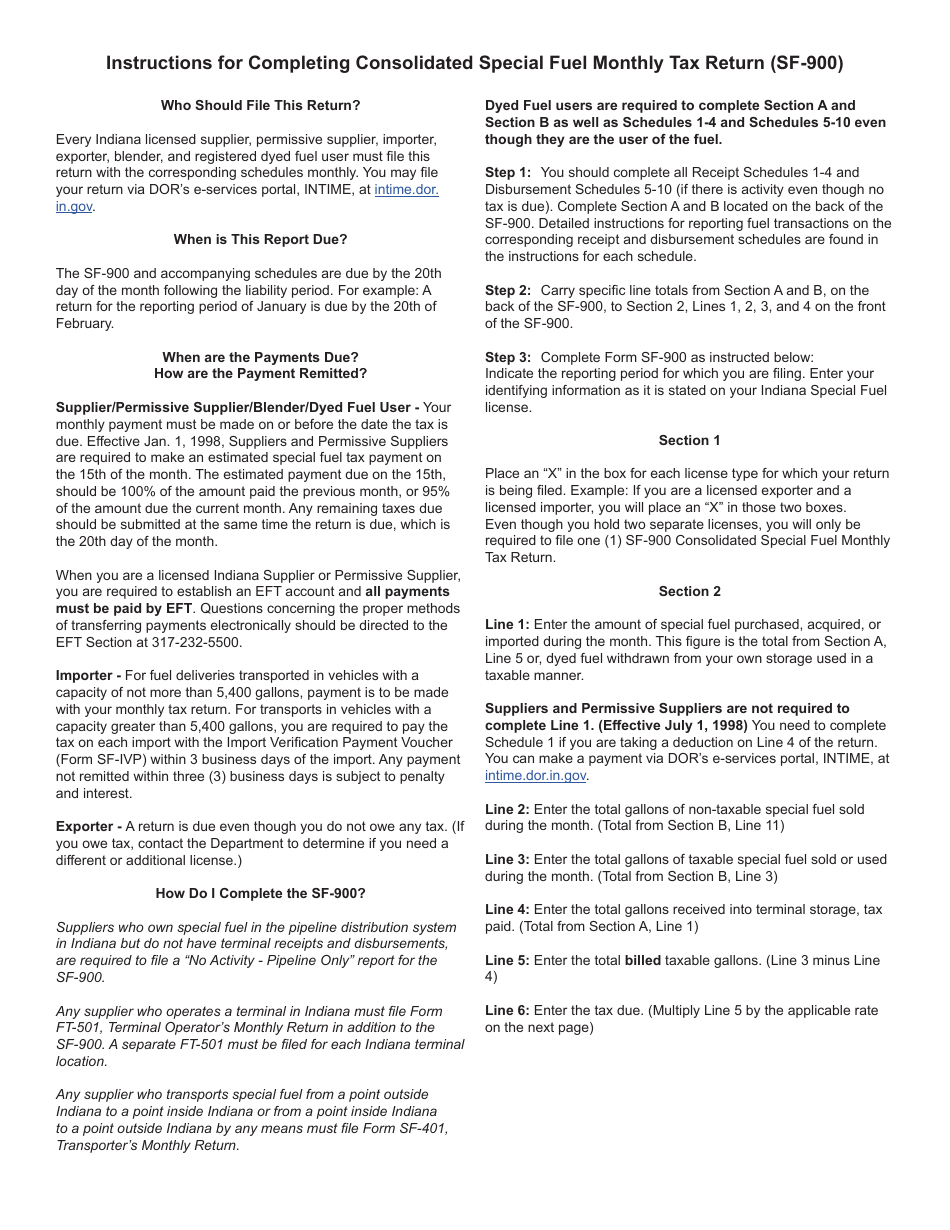

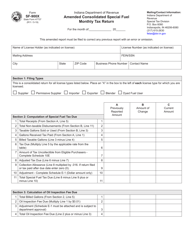

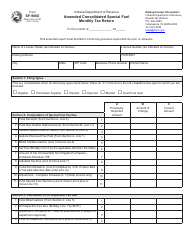

Form SF-900 (State Form 49877) Consolidated Special Fuel Monthly Tax Return - Indiana

What Is Form SF-900 (State Form 49877)?

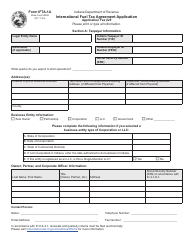

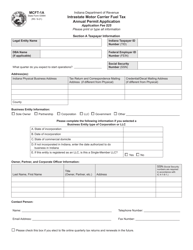

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-900?

A: Form SF-900 is the Consolidated Special Fuel Monthly Tax Return for the state of Indiana.

Q: What is the purpose of Form SF-900?

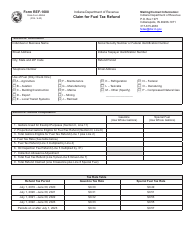

A: The purpose of Form SF-900 is to report and pay special fuel taxes on a monthly basis in Indiana.

Q: Who needs to file Form SF-900?

A: Any person or business engaged in the sale, importation, or use of special fuel in Indiana needs to file Form SF-900.

Q: How often do I need to file Form SF-900?

A: Form SF-900 should be filed on a monthly basis, with payments due by the 20th day of the following month.

Q: What information do I need to provide on Form SF-900?

A: On Form SF-900, you will need to provide information such as gallons of special fuel sold or used, tax rates, and total tax due.

Q: Are there any penalties for late or incorrect filing of Form SF-900?

A: Yes, there are penalties for late or incorrect filing of Form SF-900, including interest charges and possible enforcement actions by the Indiana Department of Revenue.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-900 (State Form 49877) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.