This version of the form is not currently in use and is provided for reference only. Download this version of

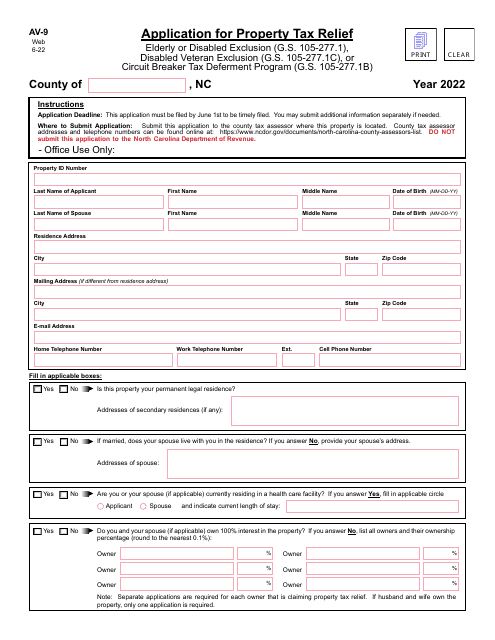

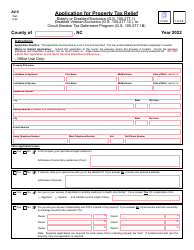

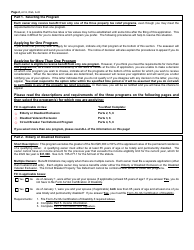

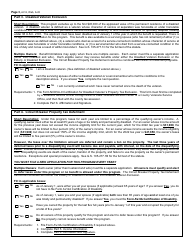

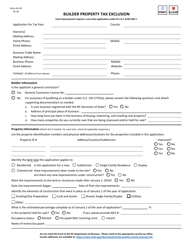

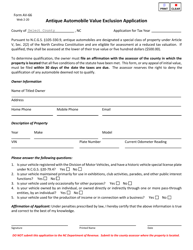

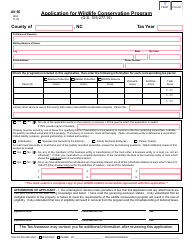

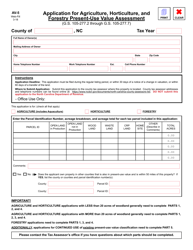

Form AV-9

for the current year.

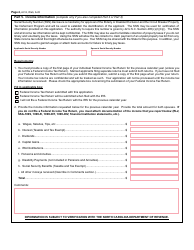

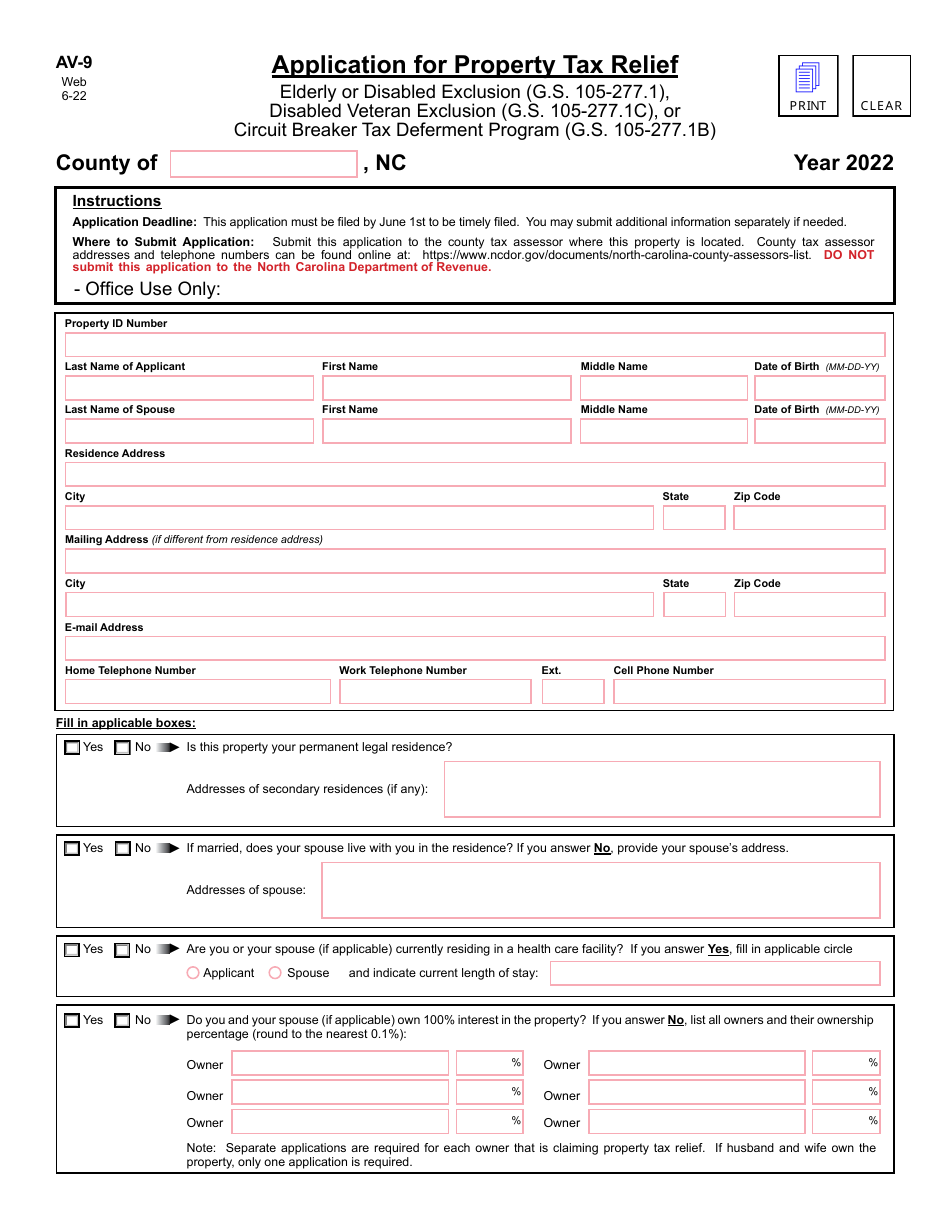

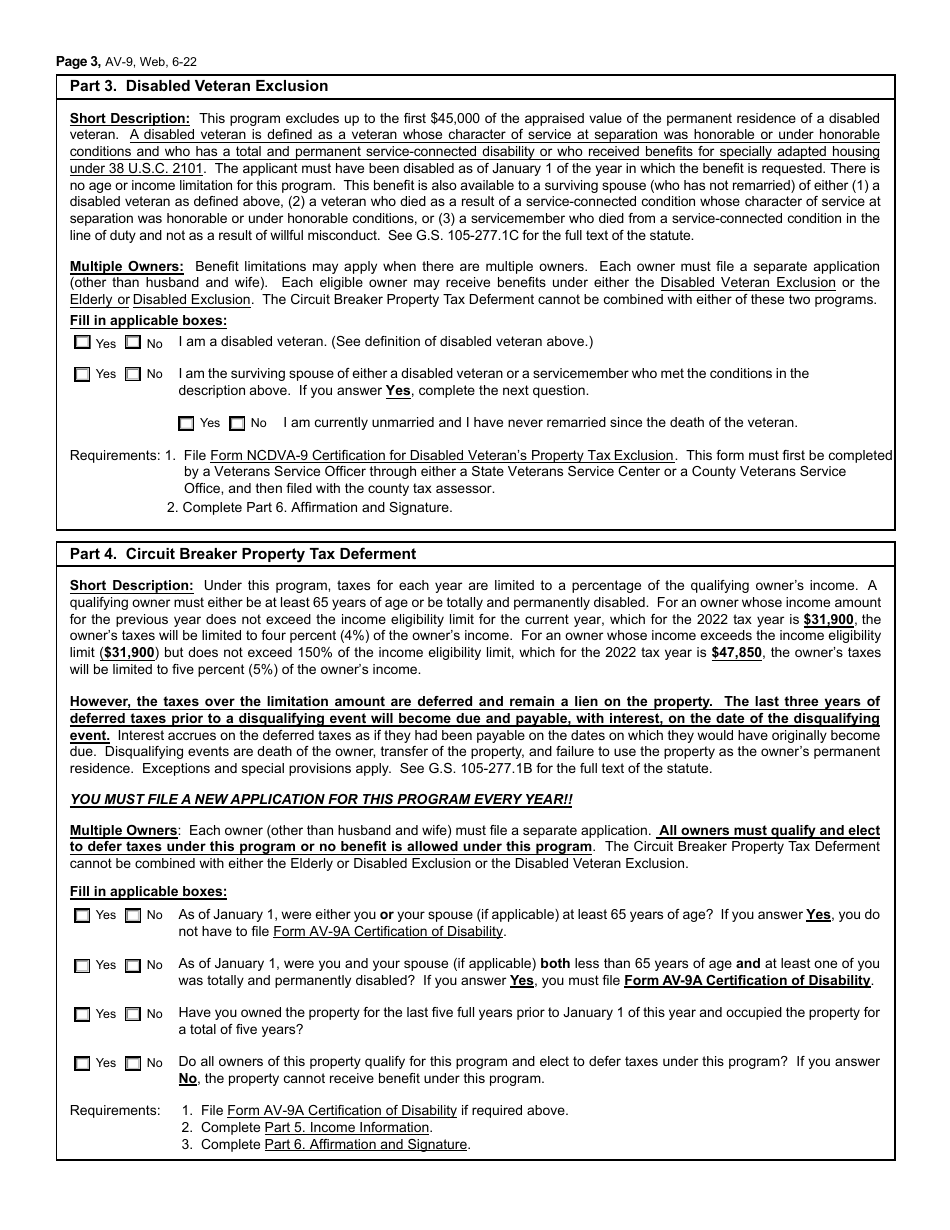

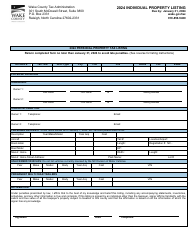

Form AV-9 Application for Property Tax Relief - North Carolina

What Is Form AV-9?

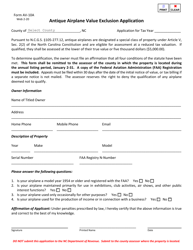

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

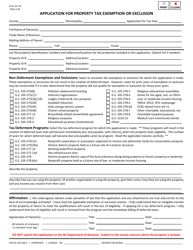

Q: What is Form AV-9?

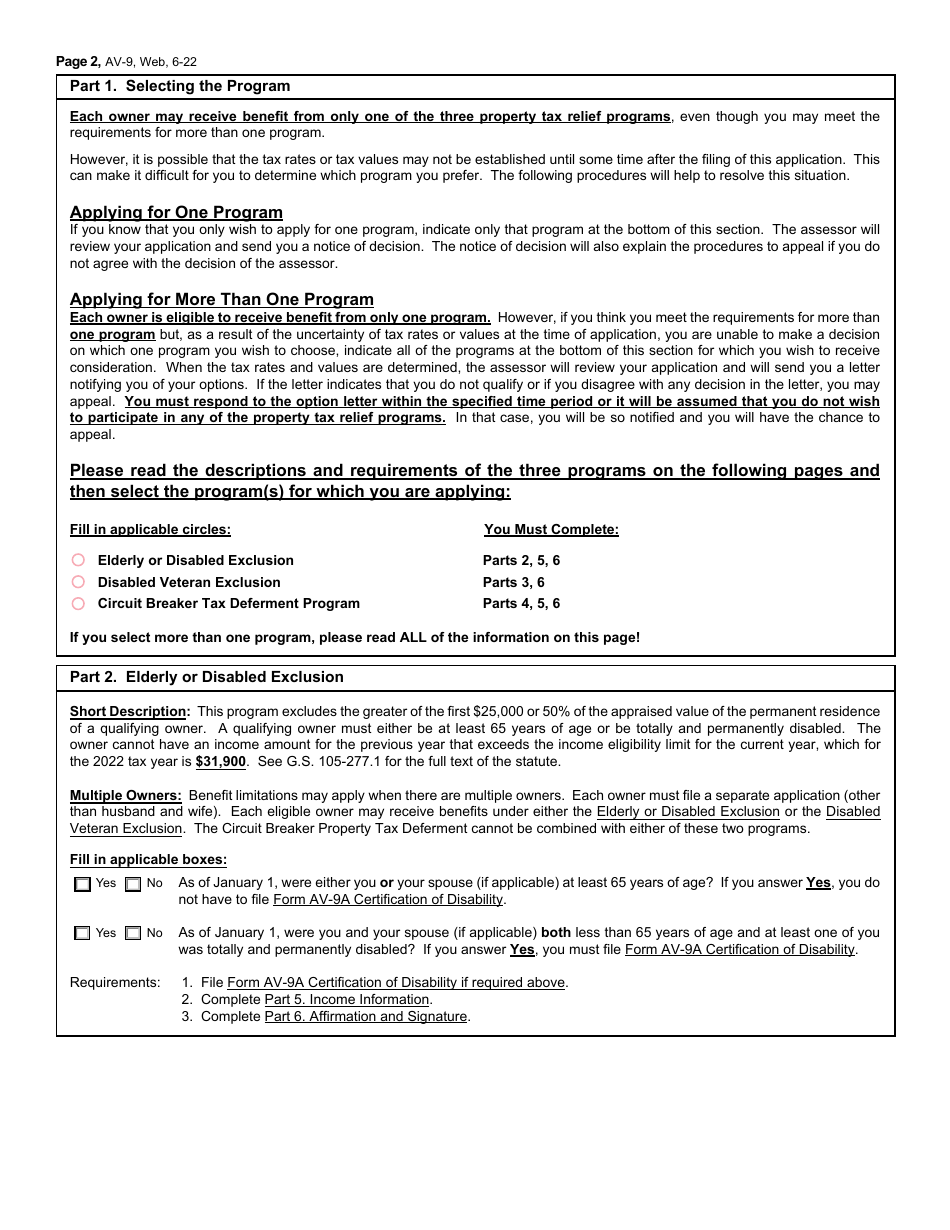

A: Form AV-9 is the application for property tax relief in North Carolina.

Q: Who can use Form AV-9?

A: Form AV-9 can be used by homeowners who meet certain eligibility criteria for property tax relief.

Q: What is property tax relief?

A: Property tax relief is a program that provides financial assistance to homeowners by reducing the amount of property taxes they have to pay.

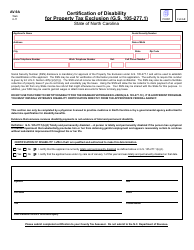

Q: What are the eligibility criteria for property tax relief?

A: The eligibility criteria for property tax relief in North Carolina include being a homeowner, having a certain income level, and being either 65 years or older, or being totally and permanently disabled.

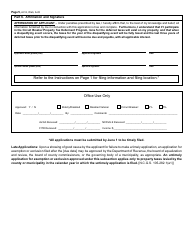

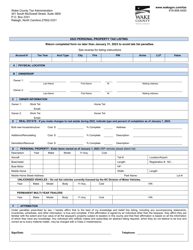

Q: What documents do I need to submit with Form AV-9?

A: Along with the completed Form AV-9, you will need to submit supporting documents such as proof of income, proof of age or disability, and property tax bills.

Q: When is the deadline to submit Form AV-9?

A: The deadline to submit Form AV-9 for property tax relief in North Carolina is January 31st of each year.

Q: How long does it take to process the application?

A: The processing time for Form AV-9 may vary, but it typically takes a few weeks to months.

Q: Can I appeal the decision if my application is denied?

A: Yes, if your application for property tax relief is denied, you have the right to appeal the decision.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-9 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.