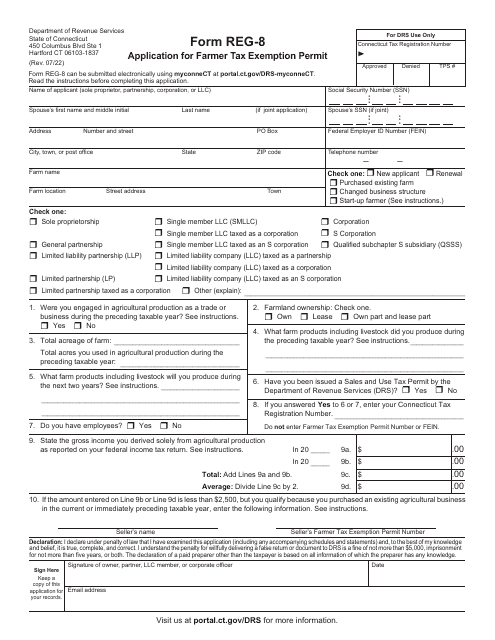

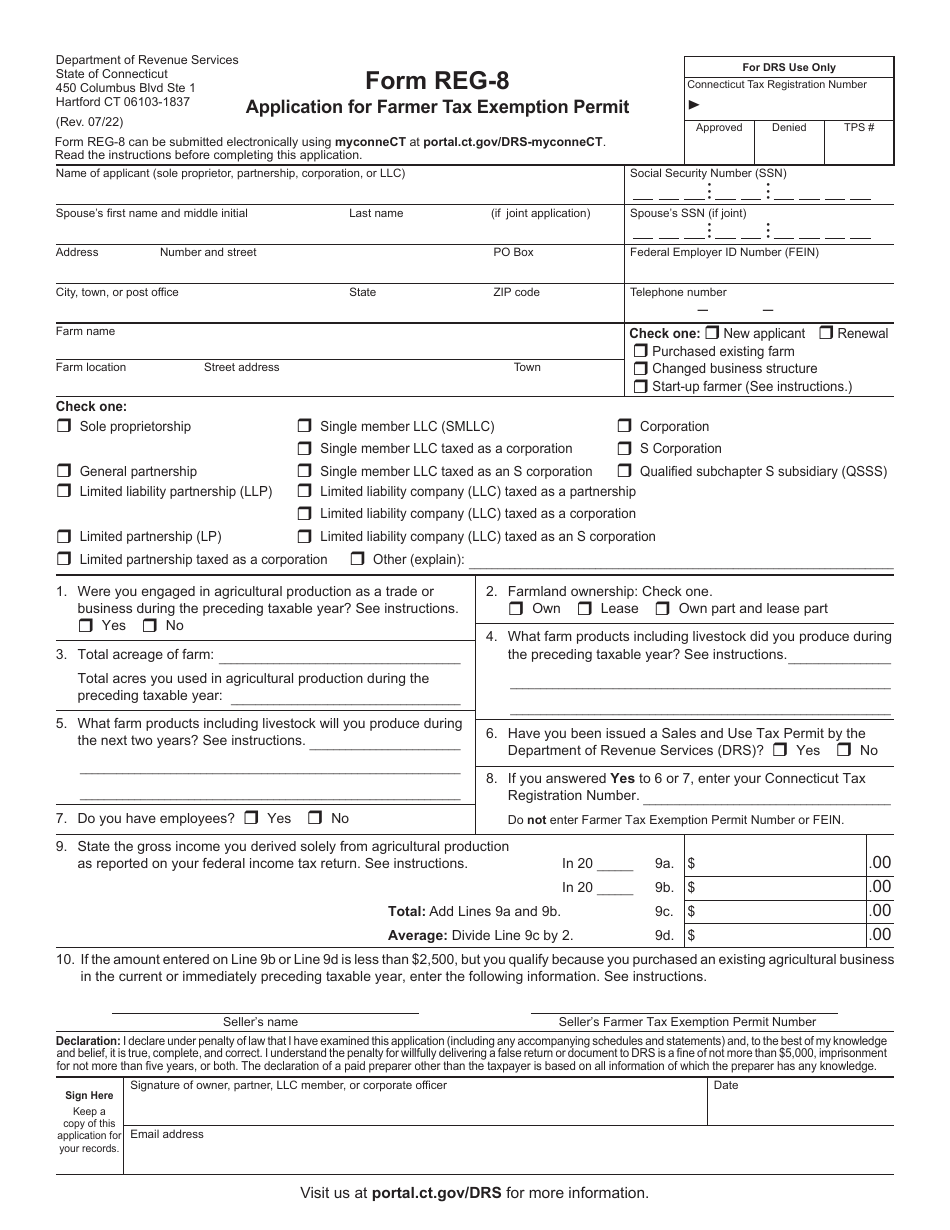

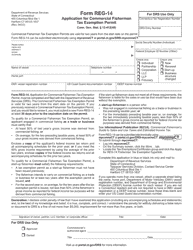

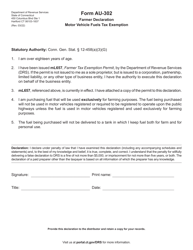

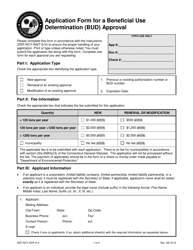

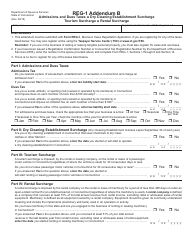

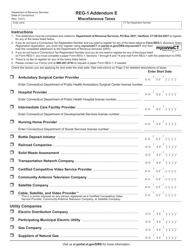

Form REG-8 Application for Farmer Tax Exemption Permit - Connecticut

What Is Form REG-8?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-8?

A: Form REG-8 is the application for a Farmer Tax Exemption Permit in Connecticut.

Q: Who needs to fill out Form REG-8?

A: Farmers in Connecticut who want to apply for a tax exemption permit need to fill out Form REG-8.

Q: What is the purpose of a Farmer Tax Exemption Permit?

A: A Farmer Tax Exemption Permit allows eligible farmers to purchase certain items without paying sales tax.

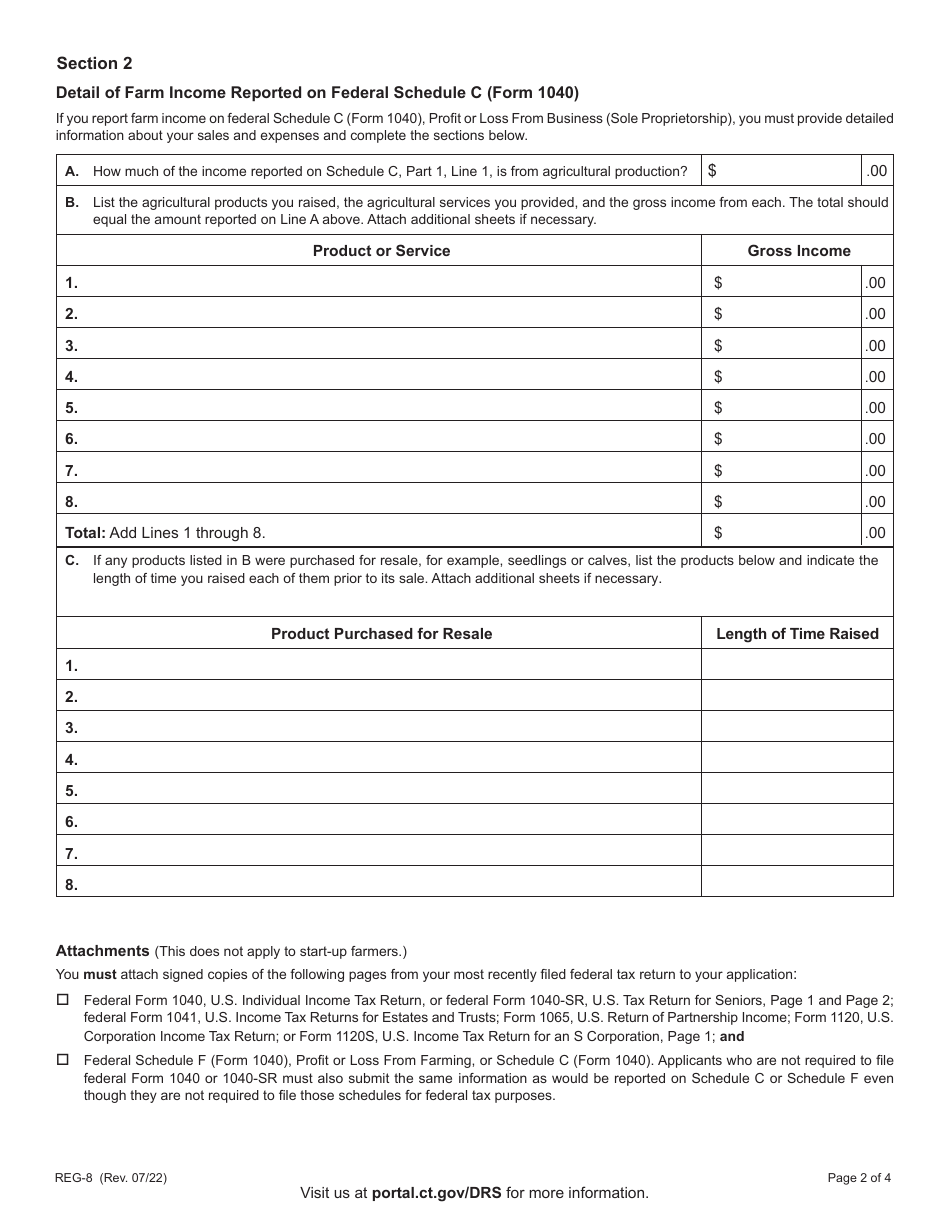

Q: What information is required on Form REG-8?

A: Form REG-8 requires information about the farmer, the farm operation, and the types of items to be purchased.

Q: Are there any fees for the Farmer Tax Exemption Permit?

A: No, there are no fees to apply for a Farmer Tax Exemption Permit.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-8 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.