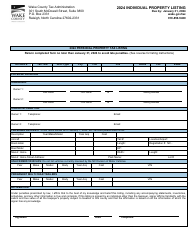

This version of the form is not currently in use and is provided for reference only. Download this version of

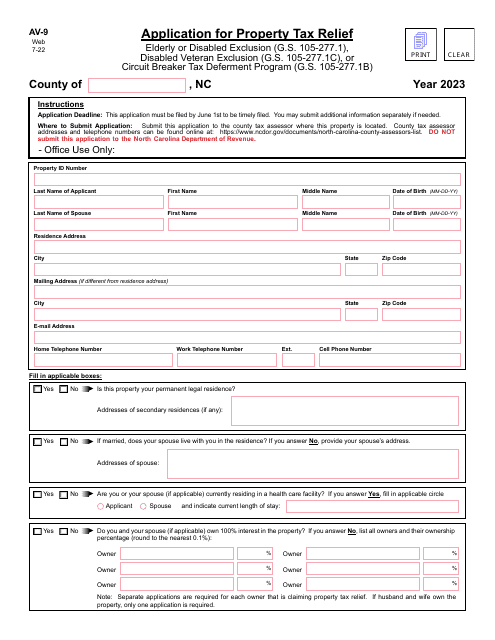

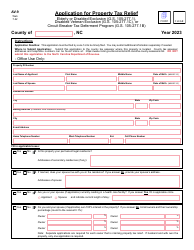

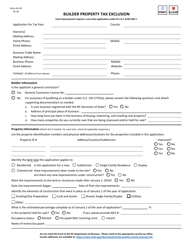

Form AV-9

for the current year.

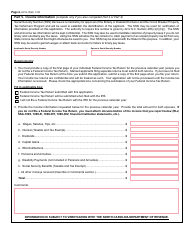

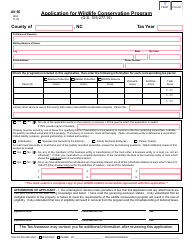

Form AV-9 Application for Property Tax Relief - North Carolina

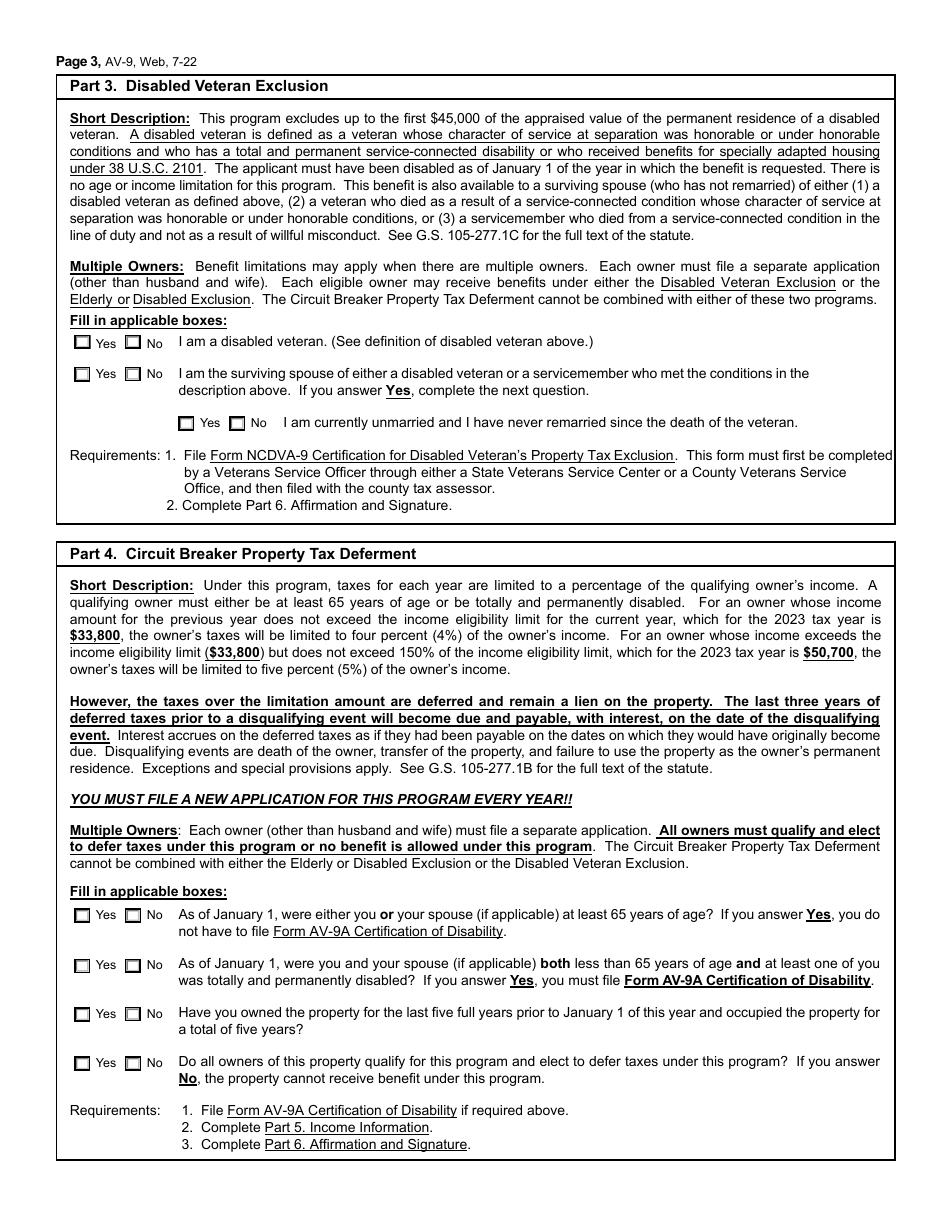

What Is Form AV-9?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

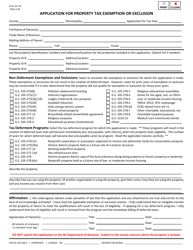

Q: What is Form AV-9?

A: Form AV-9 is an application for property tax relief in North Carolina.

Q: Who can use Form AV-9?

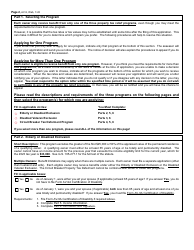

A: Homeowners in North Carolina who meet certain criteria may use Form AV-9 to apply for property tax relief.

Q: What is the purpose of Form AV-9?

A: The purpose of Form AV-9 is to request a reduction in property taxes based on eligibility criteria.

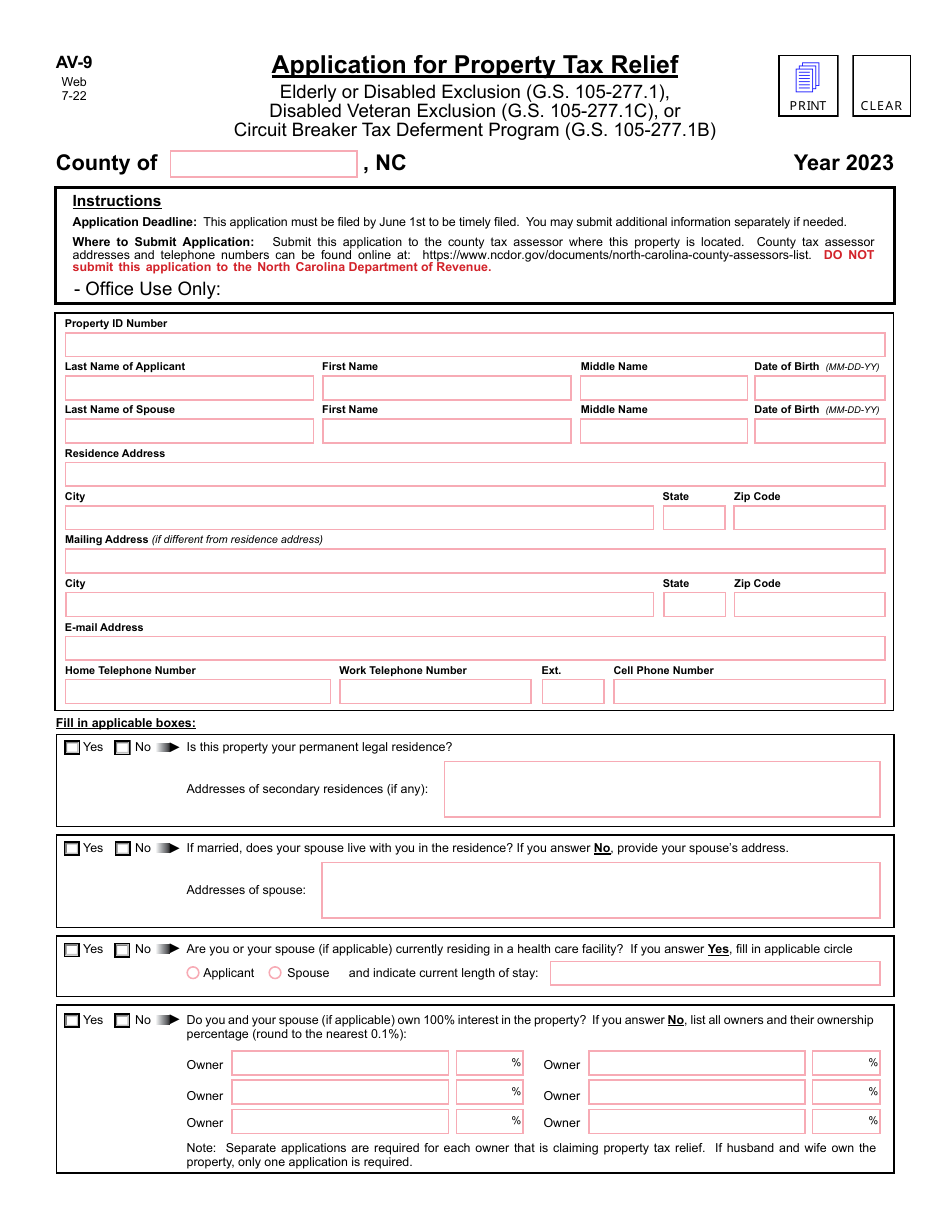

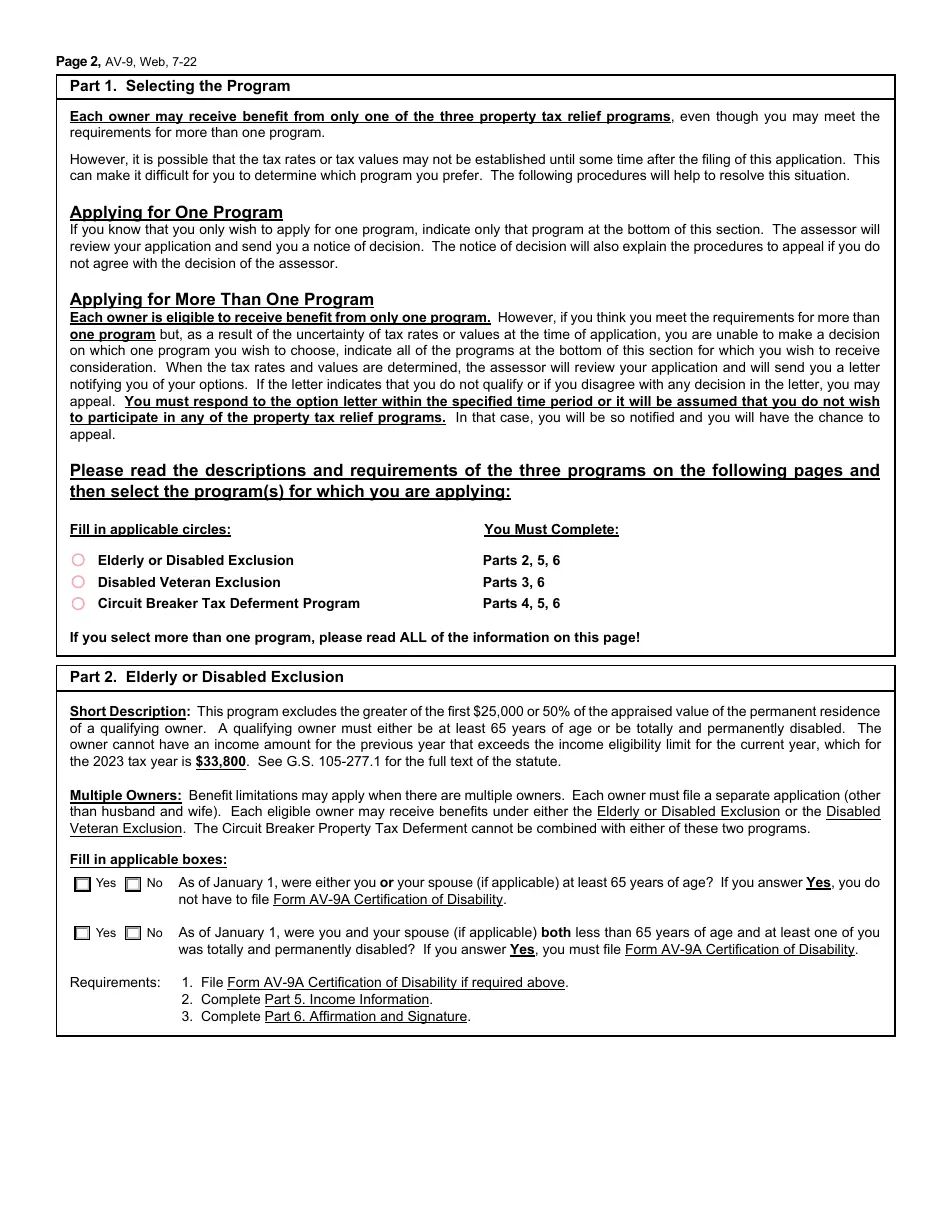

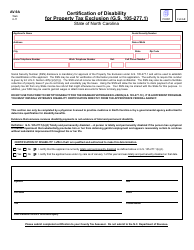

Q: What criteria must be met to use Form AV-9?

A: To use Form AV-9, homeowners must meet certain criteria such as being 65 or older, having a disability, or being the surviving spouse of a disabled veteran.

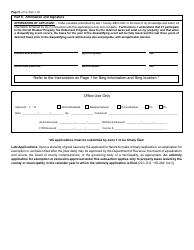

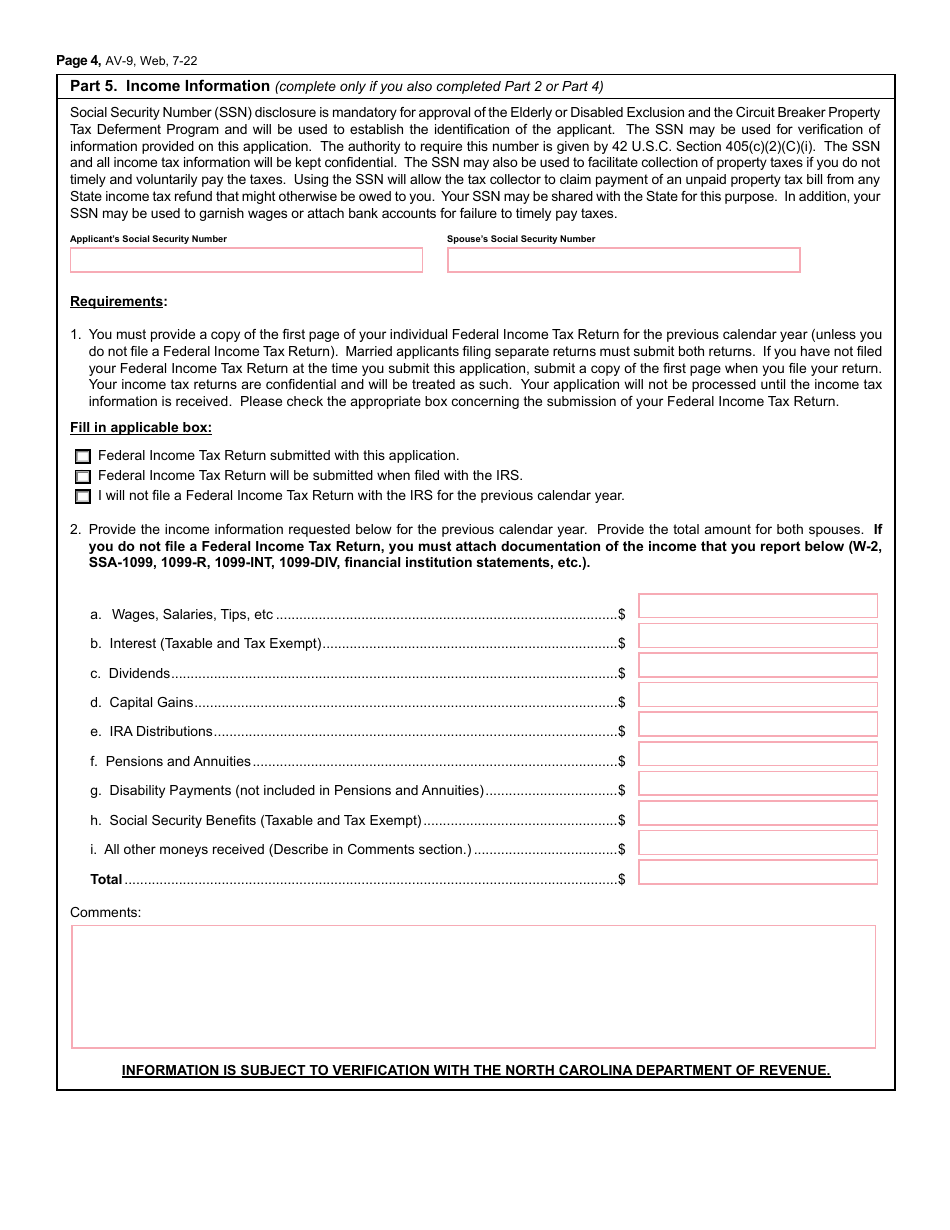

Q: What information is required on Form AV-9?

A: Form AV-9 requires information such as property details, income, and other relevant documentation to determine eligibility for property tax relief.

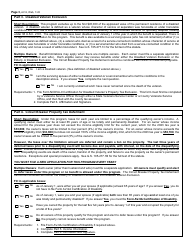

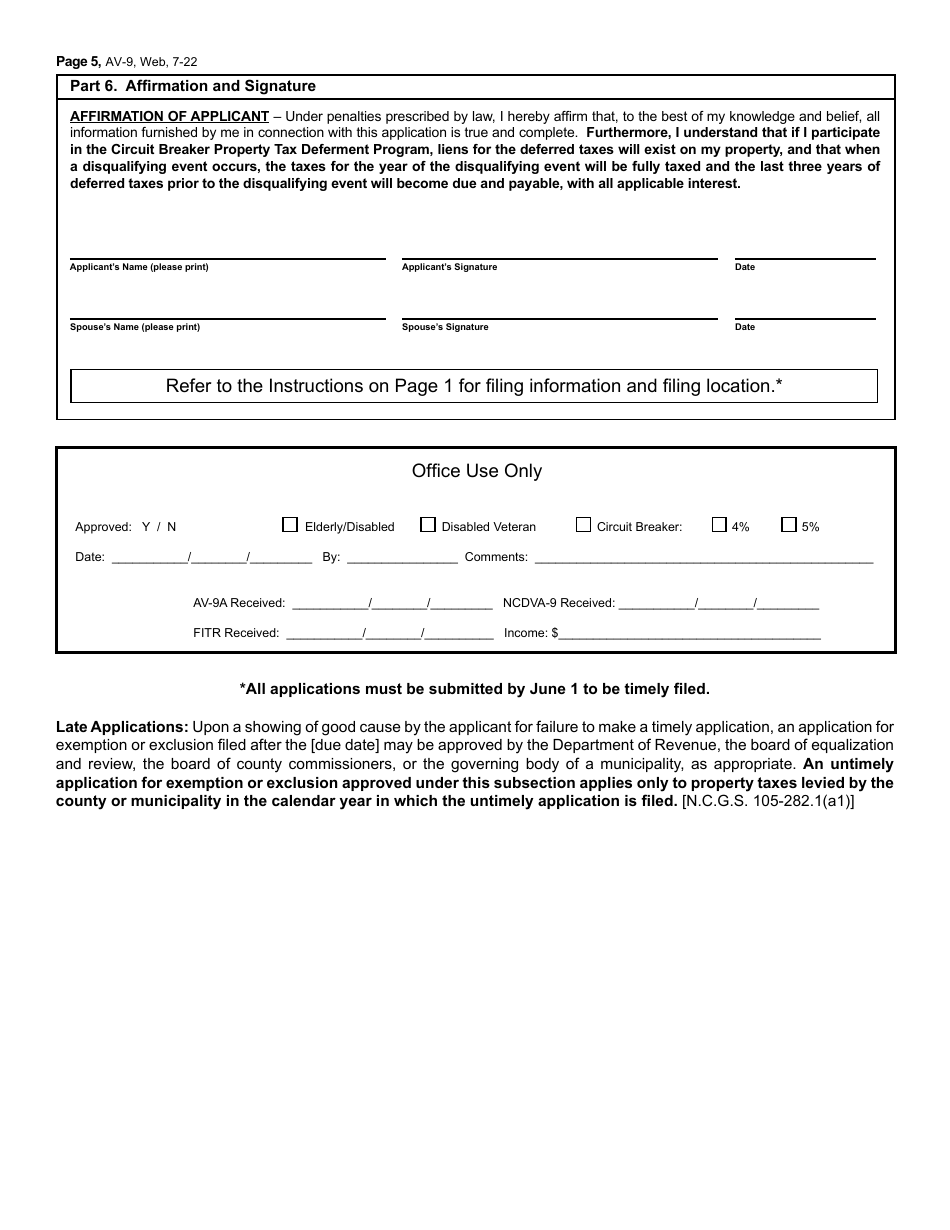

Q: Are there any deadlines for submitting Form AV-9?

A: The deadline for submitting Form AV-9 varies by county, so it is important to check with your local tax office for specific deadlines.

Q: How long does it take to process Form AV-9?

A: The processing time for Form AV-9 can vary, but it generally takes a few months for the application to be reviewed and a decision to be made.

Q: What happens after submitting Form AV-9?

A: After submitting Form AV-9, the local tax office will review the application, verify the information provided, and determine if the homeowner is eligible for property tax relief.

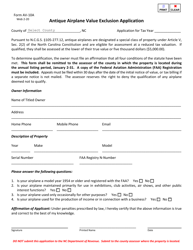

Q: What types of property tax relief are available through Form AV-9?

A: Form AV-9 provides options for different types of property tax relief, such as the Homestead Exclusion or Circuit Breaker.

Q: Can I appeal if my application for property tax relief is denied?

A: Yes, if your application for property tax relief is denied, you have the right to appeal the decision and provide additional information or documentation to support your eligibility.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-9 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.