This version of the form is not currently in use and is provided for reference only. Download this version of

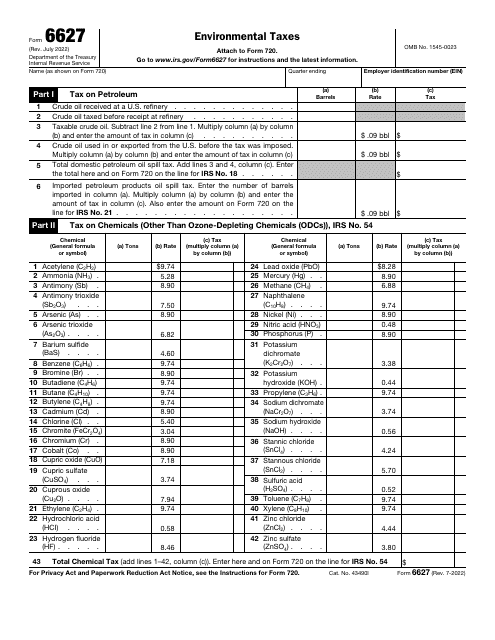

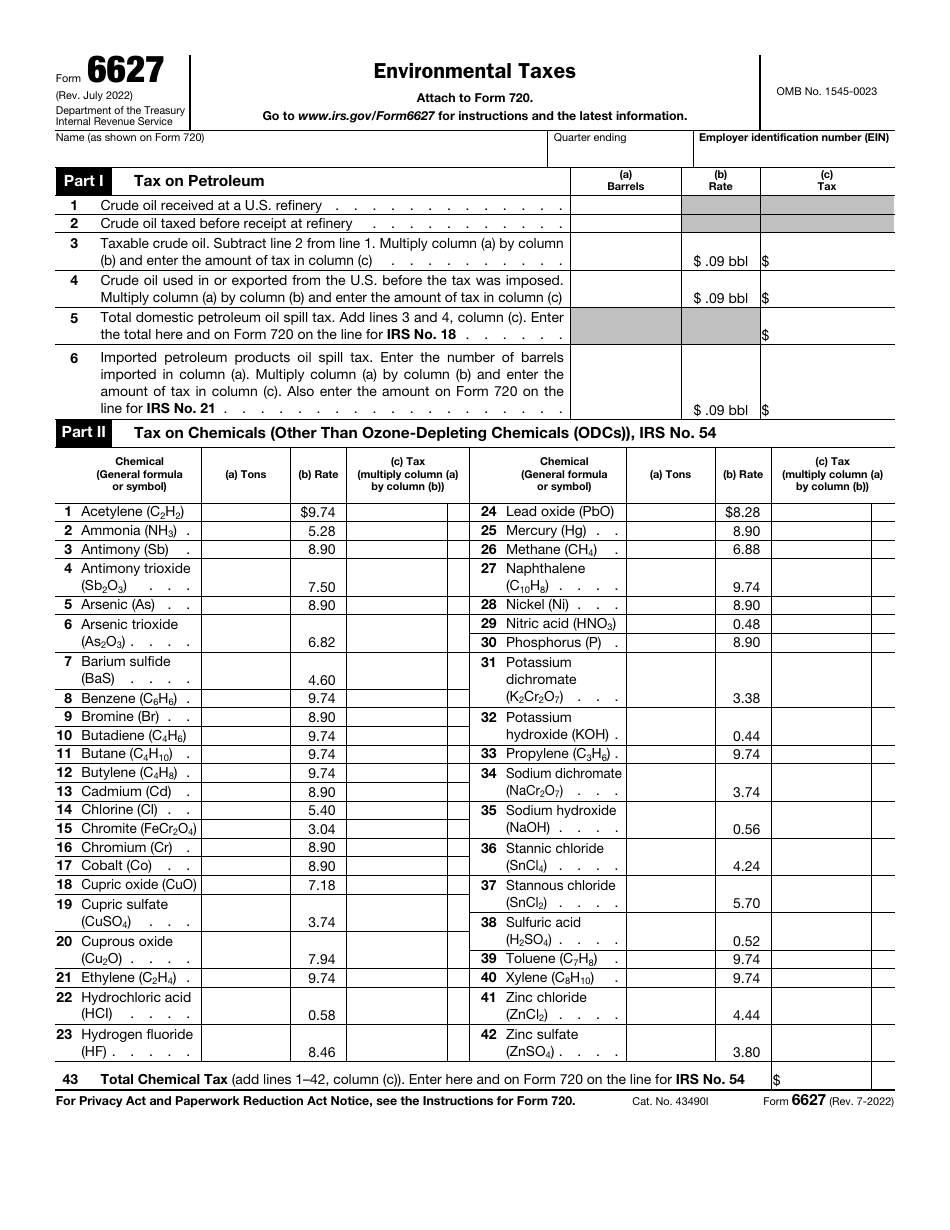

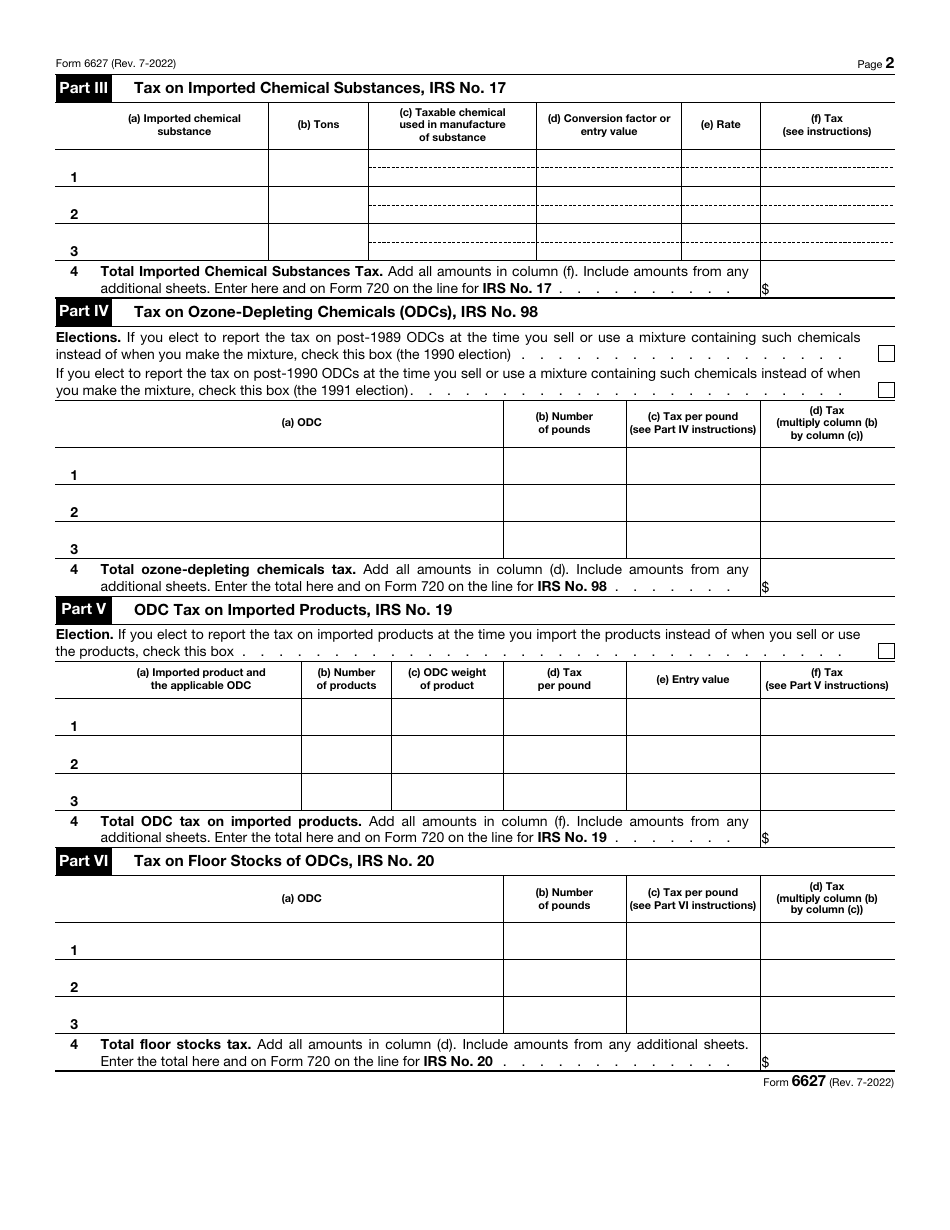

IRS Form 6627

for the current year.

IRS Form 6627 Environmental Taxes

What Is IRS Form 6627?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 6627?

A: IRS Form 6627 is used to report and pay environmental taxes.

Q: What are environmental taxes?

A: Environmental taxes are taxes imposed on activities that have a negative impact on the environment, such as the production or use of certain fuels or chemicals.

Q: Who is required to file IRS Form 6627?

A: Businesses and individuals who are liable for environmental taxes are required to file IRS Form 6627.

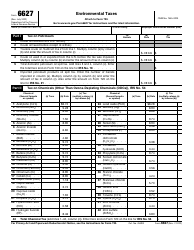

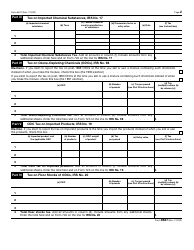

Q: What types of environmental taxes are reported on IRS Form 6627?

A: IRS Form 6627 is used to report taxes such as the fuel taxes on gasoline, diesel fuel, and aviation fuel, as well as the tax on ozone-depleting chemicals.

Q: When is IRS Form 6627 due?

A: IRS Form 6627 is generally due by the last day of the first calendar quarter following the calendar quarter in which the environmental tax liability is incurred.

Q: Are there any penalties for not filing IRS Form 6627?

A: Yes, there are penalties for not filing IRS Form 6627, including a potential failure to file penalty and interest on any unpaid taxes.

Q: Can I file IRS Form 6627 electronically?

A: Yes, you can file IRS Form 6627 electronically using the IRS e-file system.

Q: What should I do if I made an error on IRS Form 6627?

A: If you made an error on IRS Form 6627, you should correct it as soon as possible by filing an amended Form 6627.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6627 through the link below or browse more documents in our library of IRS Forms.