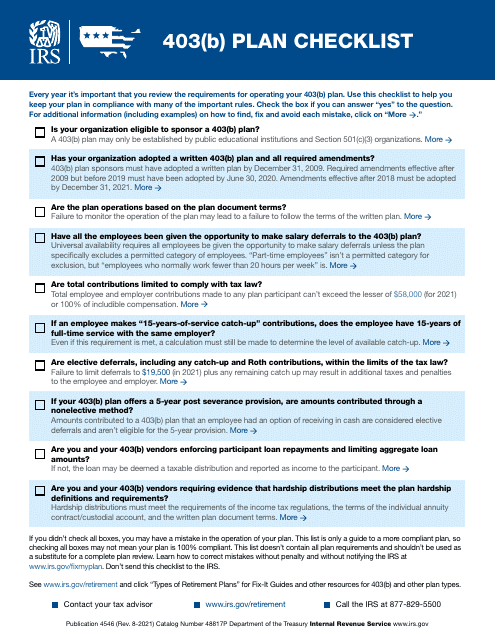

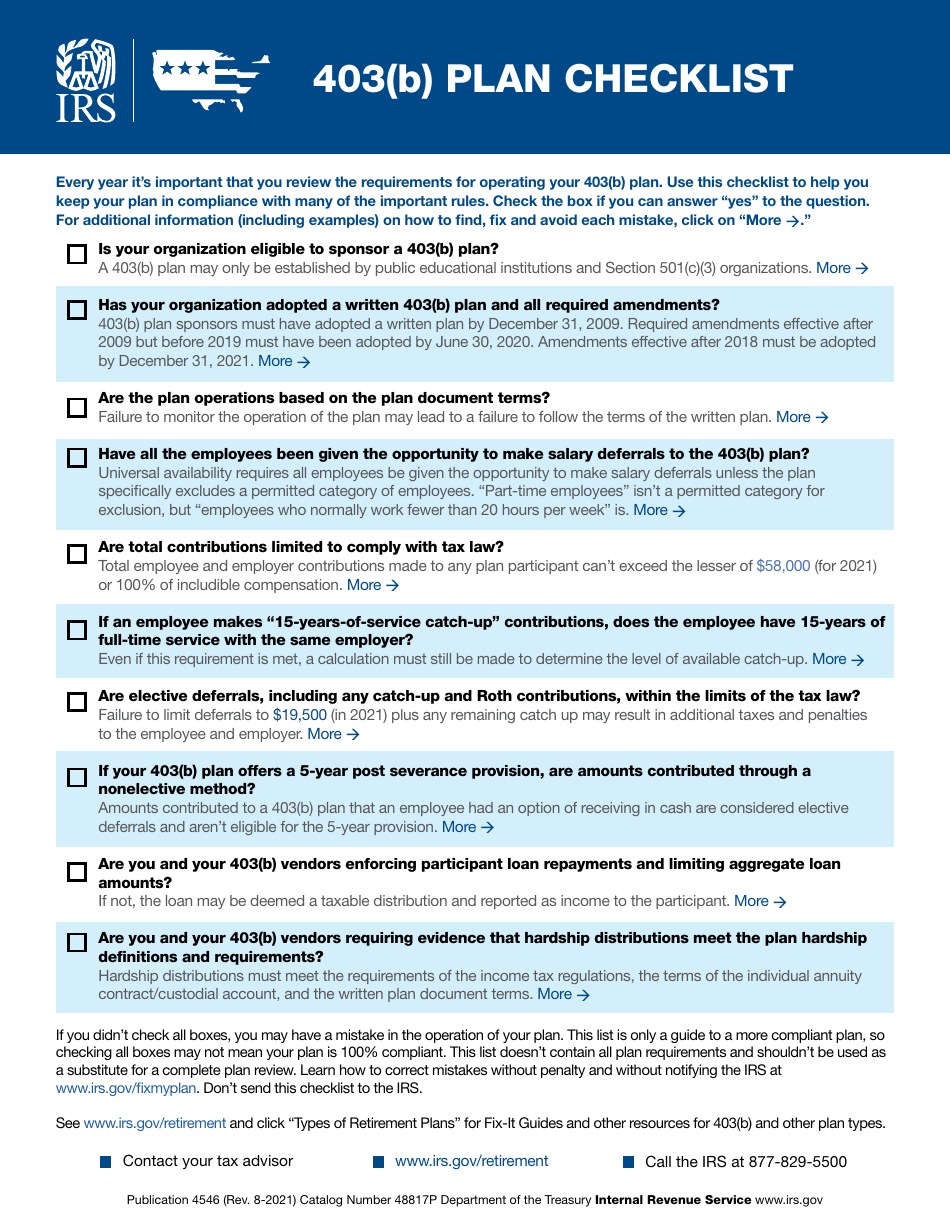

403(B) Plan Checklist

403(B) Plan Checklist is a 1-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2021.

FAQ

Q: What is a 403(b) plan?

A: A 403(b) plan is a retirement savings plan for certain employees of public schools, tax-exempt organizations, and certain ministers.

Q: Who is eligible for a 403(b) plan?

A: Employees of public schools, tax-exempt organizations, and certain ministers are eligible for a 403(b) plan.

Q: What are the benefits of a 403(b) plan?

A: Some benefits of a 403(b) plan include tax advantages, employer matching contributions, and the ability to save for retirement.

Q: What is the contribution limit for a 403(b) plan?

A: The contribution limit for a 403(b) plan is $19,500 for 2021.

Q: Can I contribute more than the annual limit to a 403(b) plan?

A: If you are age 50 or older, you may be eligible to make catch-up contributions of up to $6,500 in addition to the annual limit.

Q: How are 403(b) plans different from 401(k) plans?

A: The main difference between 403(b) plans and 401(k) plans is that 403(b) plans are available to employees of public schools and tax-exempt organizations, while 401(k) plans are primarily for private sector employees.

Q: Can I take a loan from my 403(b) plan?

A: Some 403(b) plans may allow for loans, but it is important to check with your plan provider to see if loans are available and what the requirements are.

Q: Can I withdraw money from my 403(b) plan before retirement?

A: In general, you can only withdraw money from your 403(b) plan before retirement if you meet certain qualifying events, such as reaching age 59½, becoming disabled, or experiencing financial hardship.

Q: Are there any penalties for early withdrawal from a 403(b) plan?

A: Yes, if you withdraw money from your 403(b) plan before age 59½, you may be subject to a 10% early withdrawal penalty in addition to ordinary income taxes.

Q: Can I roll over my 403(b) plan into another retirement account?

A: Yes, you can roll over your 403(b) plan into another eligible retirement account, such as an Individual Retirement Account (IRA) or another employer's retirement plan, if allowed by the receiving plan.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of the form through the link below or browse more documents in our library of IRS Forms.