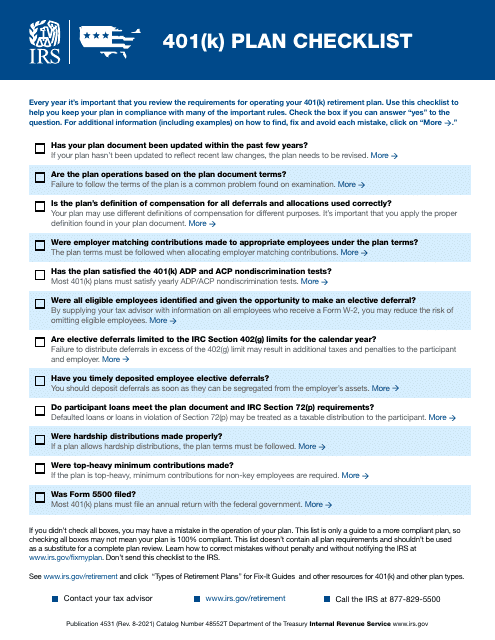

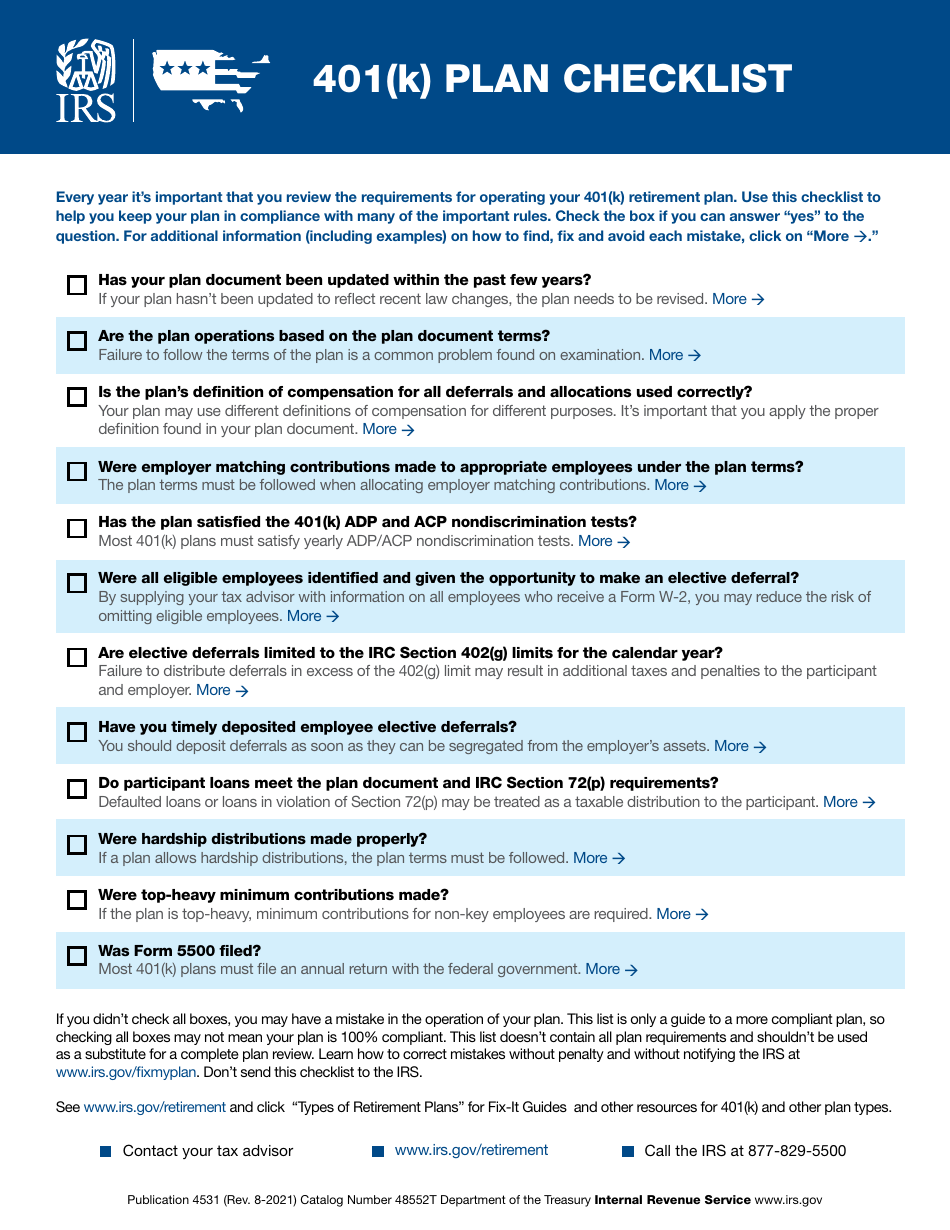

401(K) Plan Checklist

401(K) Plan Checklist is a 1-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2021.

FAQ

Q: What is a 401(k) plan?

A: A 401(k) plan is a retirement savings plan offered by employers.

Q: How does a 401(k) plan work?

A: Employees contribute a portion of their salary to the plan, and the funds are invested for potential growth.

Q: What are the benefits of participating in a 401(k) plan?

A: Some benefits include tax advantages, employer matching contributions, and the ability to save for retirement.

Q: How much can I contribute to a 401(k) plan?

A: The annual contribution limit for 2021 is $19,500, or $26,000 for individuals age 50 or older.

Q: Can I withdraw money from a 401(k) plan before retirement?

A: Generally, you cannot withdraw money from a 401(k) plan penalty-free before the age of 59½, unless certain exceptions apply.

Q: What happens to my 401(k) if I change jobs?

A: You have several options, such as rolling over your 401(k) into an individual retirement account (IRA) or transferring it to your new employer's plan.

Q: Is a 401(k) plan the only way to save for retirement?

A: No, there are other retirement savings options like individual retirement accounts (IRAs), pensions, and Social Security.

Q: Should I contribute to a 401(k) plan if my employer doesn't offer a matching contribution?

A: Even without an employer match, contributing to a 401(k) can still offer tax advantages and help you save for retirement.

Q: What should I consider when choosing investment options within my 401(k) plan?

A: Factors to consider include your risk tolerance, time horizon, and investment objectives.

Q: Are there any penalties for early withdrawal from a 401(k) plan?

A: Yes, if you withdraw from your 401(k) plan before the age of 59½, you may have to pay income taxes and a 10% early withdrawal penalty.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of the form through the link below or browse more documents in our library of IRS Forms.