This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

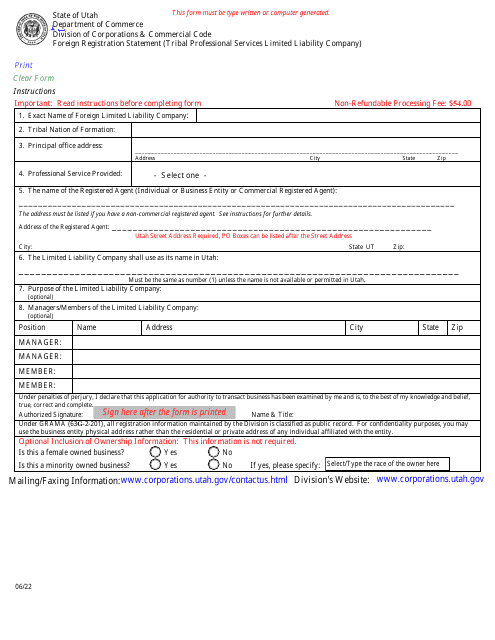

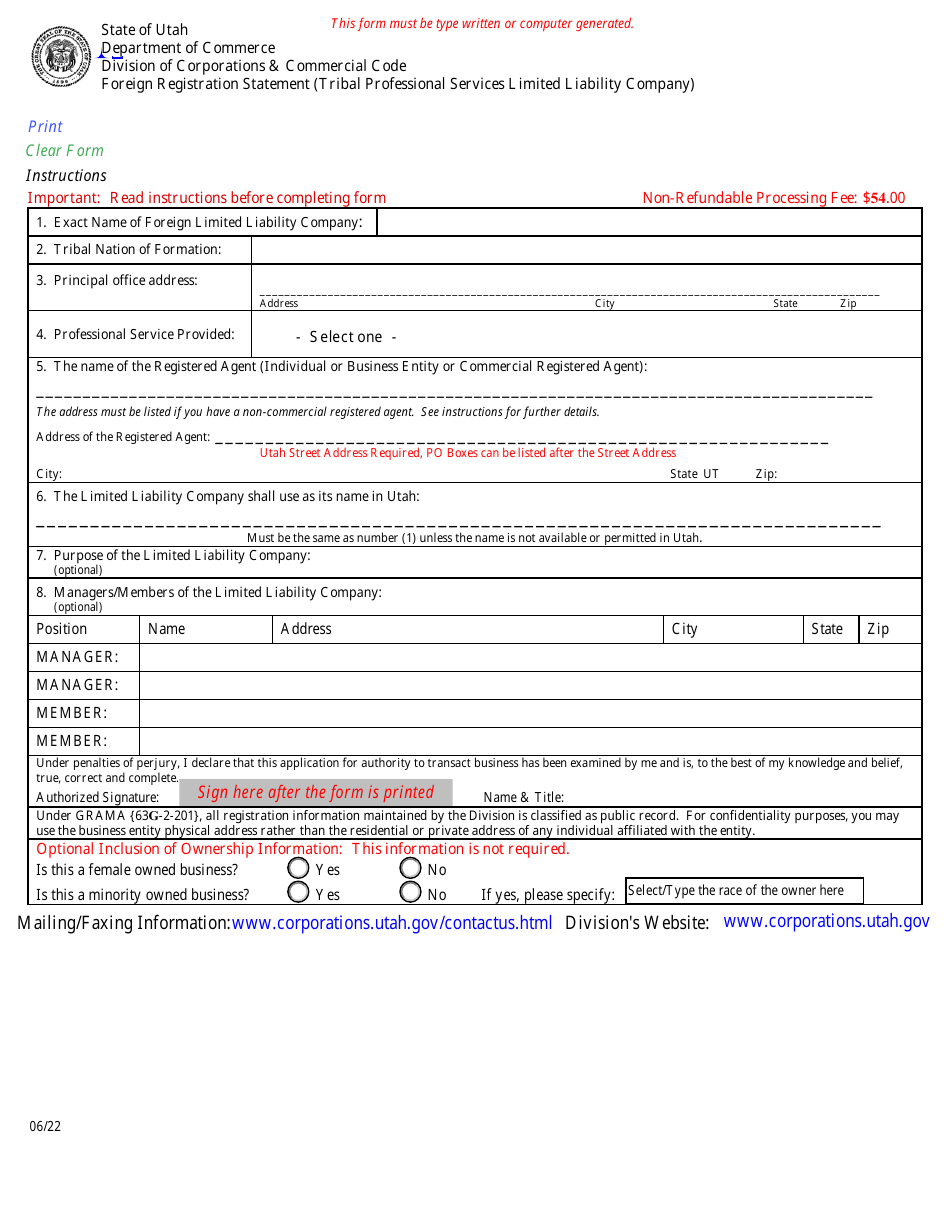

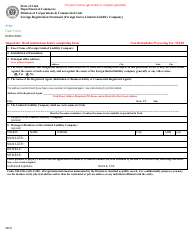

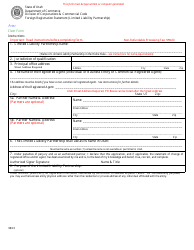

Foreign Registration Statement (Tribal Professional Services Limited Liability Company) - Utah

Foreign Registration Statement (Tribal Professional Services Limited Liability Company) is a legal document that was released by the Utah Department of Commerce - a government authority operating within Utah.

FAQ

Q: What is a foreign registration statement?

A: A foreign registration statement is a document that a company files to register or qualify as a foreign business entity in a state other than its home state.

Q: What is a Tribal Professional Services Limited Liability Company?

A: A Tribal Professional Services Limited Liability Company is a specific type of company that provides professional services and is formed under the laws of a Native American tribe.

Q: Why would a company file a foreign registration statement?

A: A company would file a foreign registration statement if it wants to do business in a state other than its home state.

Q: What is the purpose of filing a foreign registration statement?

A: The purpose of filing a foreign registration statement is to comply with the laws of the state and obtain the necessary authority to do business in that state.

Q: Is a foreign registration statement required in Utah for a Tribal Professional Services Limited Liability Company?

A: Yes, a Tribal Professional Services Limited Liability Company is required to file a foreign registration statement in the state of Utah if it wants to do business there.

Q: How can a company file a foreign registration statement?

A: A company can file a foreign registration statement by submitting the required form and fee to the appropriate state agency, typically the Secretary of State's office.

Q: What information is typically required to be included in a foreign registration statement?

A: The information required in a foreign registration statement typically includes the company's name, address, registered agent, organizational structure, and a certificate of good standing from its home state.

Q: What are the consequences of not filing a foreign registration statement?

A: The consequences of not filing a foreign registration statement can include fines, penalties, and being unable to legally do business in the state where registration is required.

Form Details:

- Released on June 1, 2022;

- The latest edition currently provided by the Utah Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Commerce.