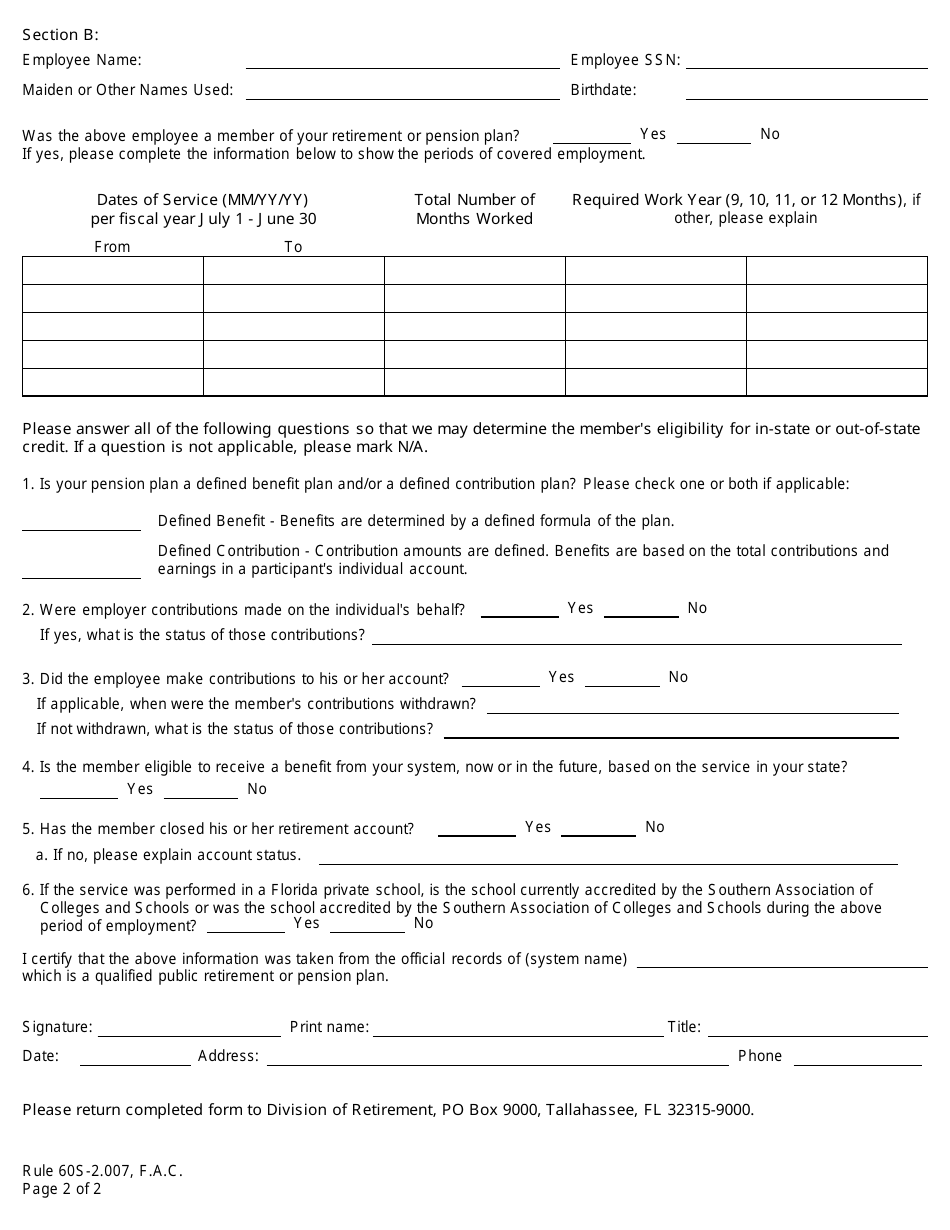

Form FR-30 Verification for in-State or Out-of-State Service Credit - Florida

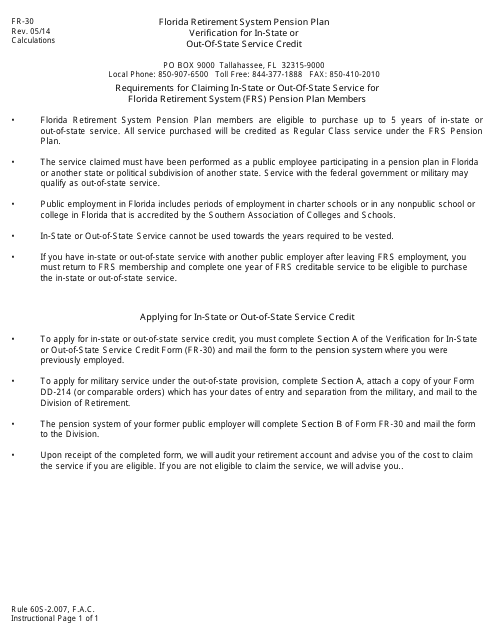

What Is Form FR-30?

This is a legal form that was released by the Florida Department of Management Services - Florida Retirement System - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FR-30?

A: Form FR-30 is a form used for the verification of in-state or out-of-state service credit in Florida.

Q: Who needs to complete Form FR-30?

A: Employees who want to claim or verify their service credit in Florida need to complete Form FR-30.

Q: What is the purpose of Form FR-30?

A: The purpose of Form FR-30 is to establish and verify an employee's service credit in Florida with an in-state or out-of-state employer.

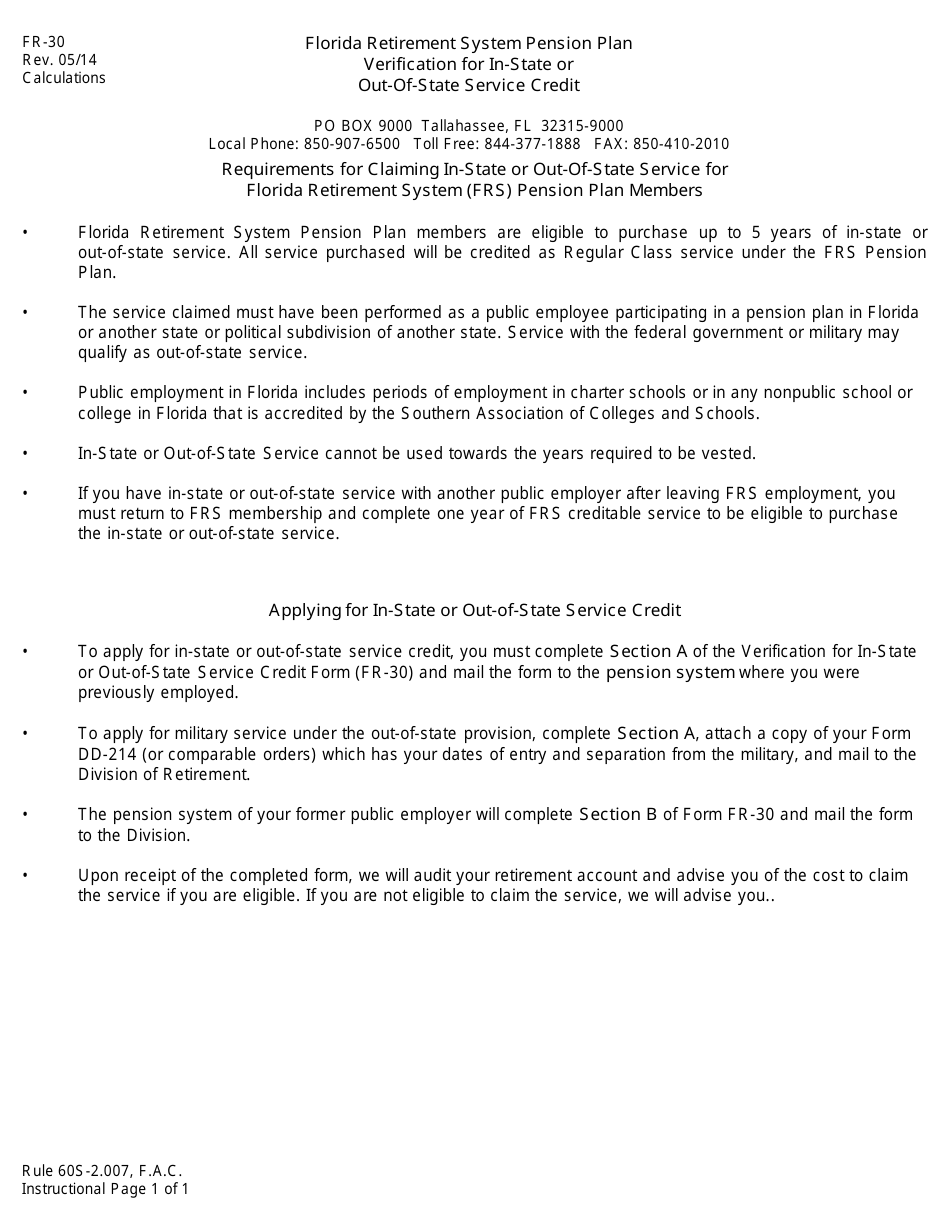

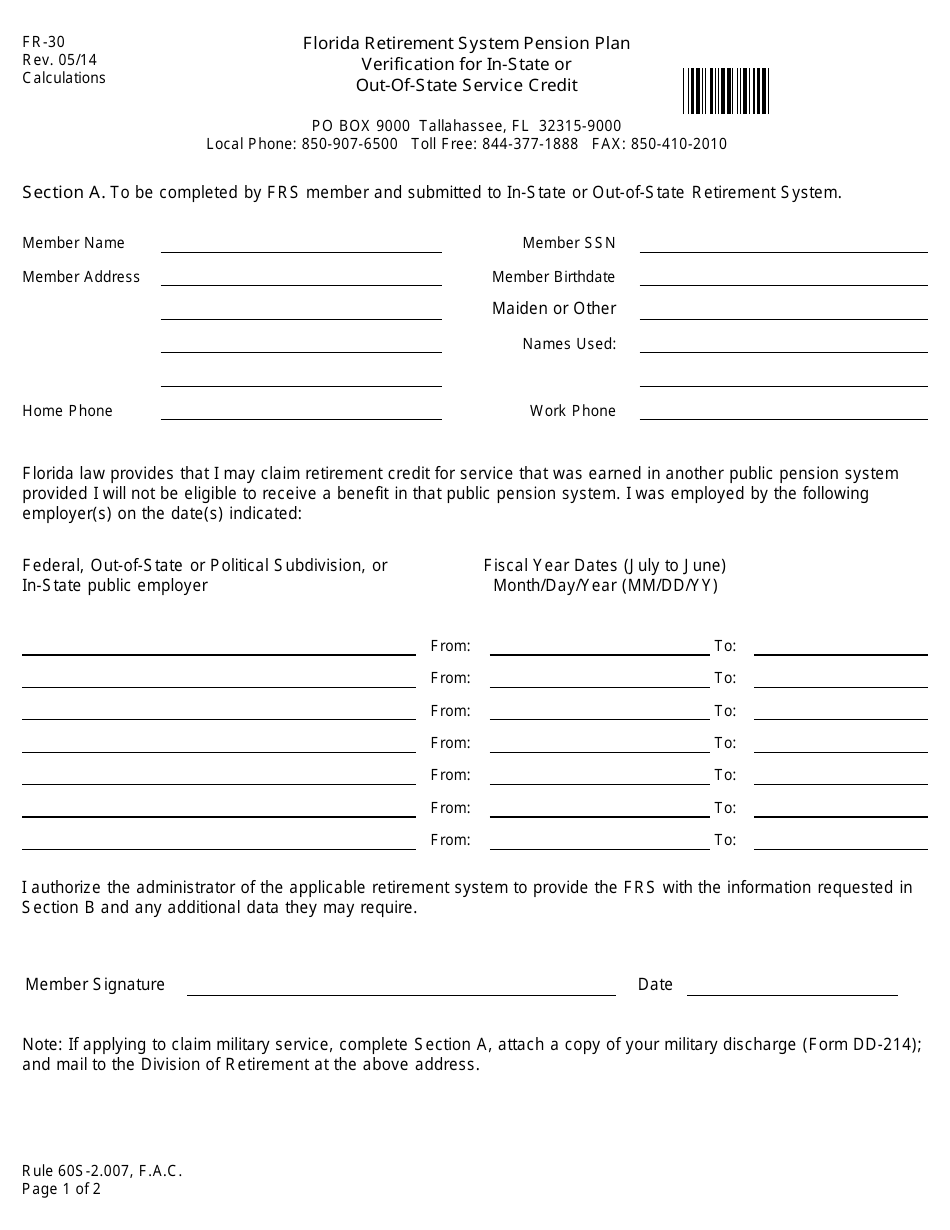

Q: How do I complete Form FR-30?

A: You need to provide your personal information, employer information, and details of your service credit on Form FR-30. Make sure to sign and date the form.

Q: Can I claim both in-state and out-of-state service credit on one Form FR-30?

A: Yes, you can claim both in-state and out-of-state service credit on one Form FR-30. Provide the necessary information for each employer separately.

Q: What supporting documents do I need to submit with Form FR-30?

A: You may need to submit supporting documentation such as employment contracts, pay stubs, or W-2 forms to verify your service credit. Check the instructions on the form for specific requirements.

Q: How long does it take to process Form FR-30?

A: The processing time for Form FR-30 varies. Contact the Florida Retirement System (FRS) for more information on the expected processing time.

Q: What should I do if there is an error on my Form FR-30?

A: If there is an error on your Form FR-30, contact the Florida Retirement System (FRS) to rectify the issue and provide the corrected information.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Florida Department of Management Services - Florida Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FR-30 by clicking the link below or browse more documents and templates provided by the Florida Department of Management Services - Florida Retirement System.