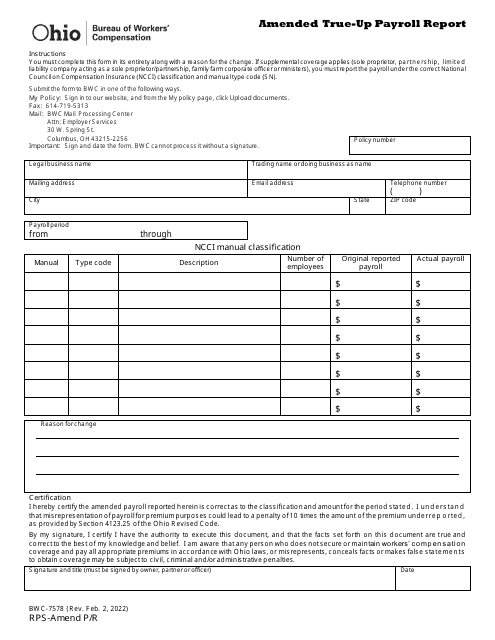

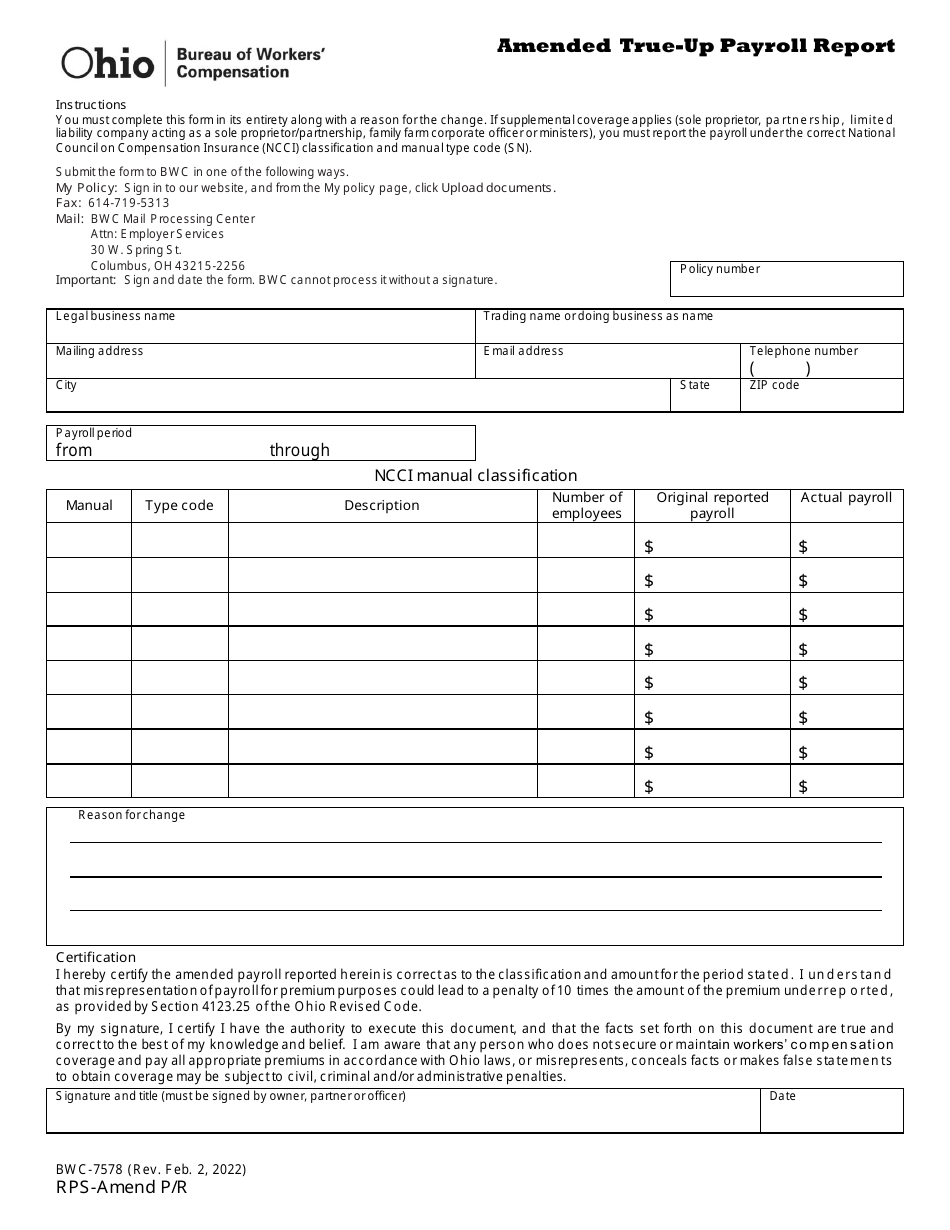

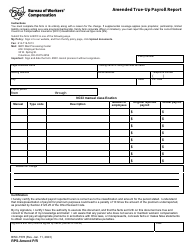

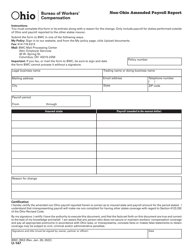

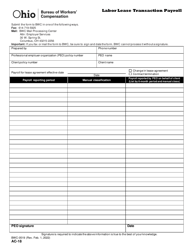

Form BWC-7578 Amended True-Up Payroll Report - Ohio

What Is Form BWC-7578?

This is a legal form that was released by the Ohio Bureau of Workers' Compensation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BWC-7578?

A: Form BWC-7578 is the Amended True-Up Payroll Report.

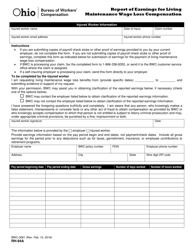

Q: What is the purpose of Form BWC-7578?

A: The purpose of Form BWC-7578 is to report amended payroll information.

Q: Who needs to file Form BWC-7578?

A: Employers in Ohio need to file Form BWC-7578 if they need to amend their previously reported payroll.

Q: When should Form BWC-7578 be filed?

A: Form BWC-7578 should be filed when there are changes or corrections to the previously reported payroll.

Q: Are there any penalties for not filing Form BWC-7578?

A: Yes, there may be penalties for not filing or filing late.

Q: Is Form BWC-7578 specific to Ohio?

A: Yes, Form BWC-7578 is specific to employers in Ohio.

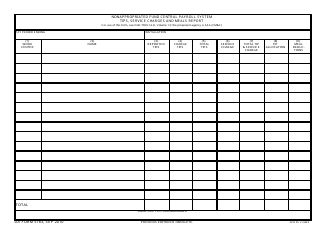

Q: What information is required on Form BWC-7578?

A: Form BWC-7578 requires information such as the employer's name, federal employer identification number, and amended payroll details.

Q: Can I make changes to Form BWC-7578 after submitting it?

A: Yes, you can make changes to Form BWC-7578 after submitting it by filing an amended report.

Q: Is there a deadline for filing Form BWC-7578?

A: Yes, the deadline for filing Form BWC-7578 is typically within 45 days from the end of the policy period.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Ohio Bureau of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BWC-7578 by clicking the link below or browse more documents and templates provided by the Ohio Bureau of Workers' Compensation.