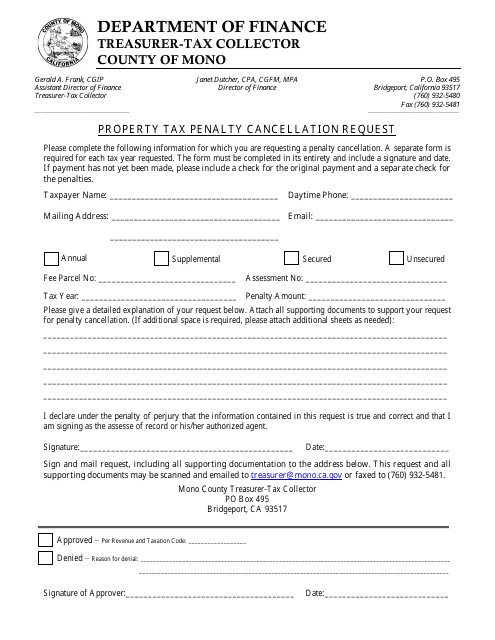

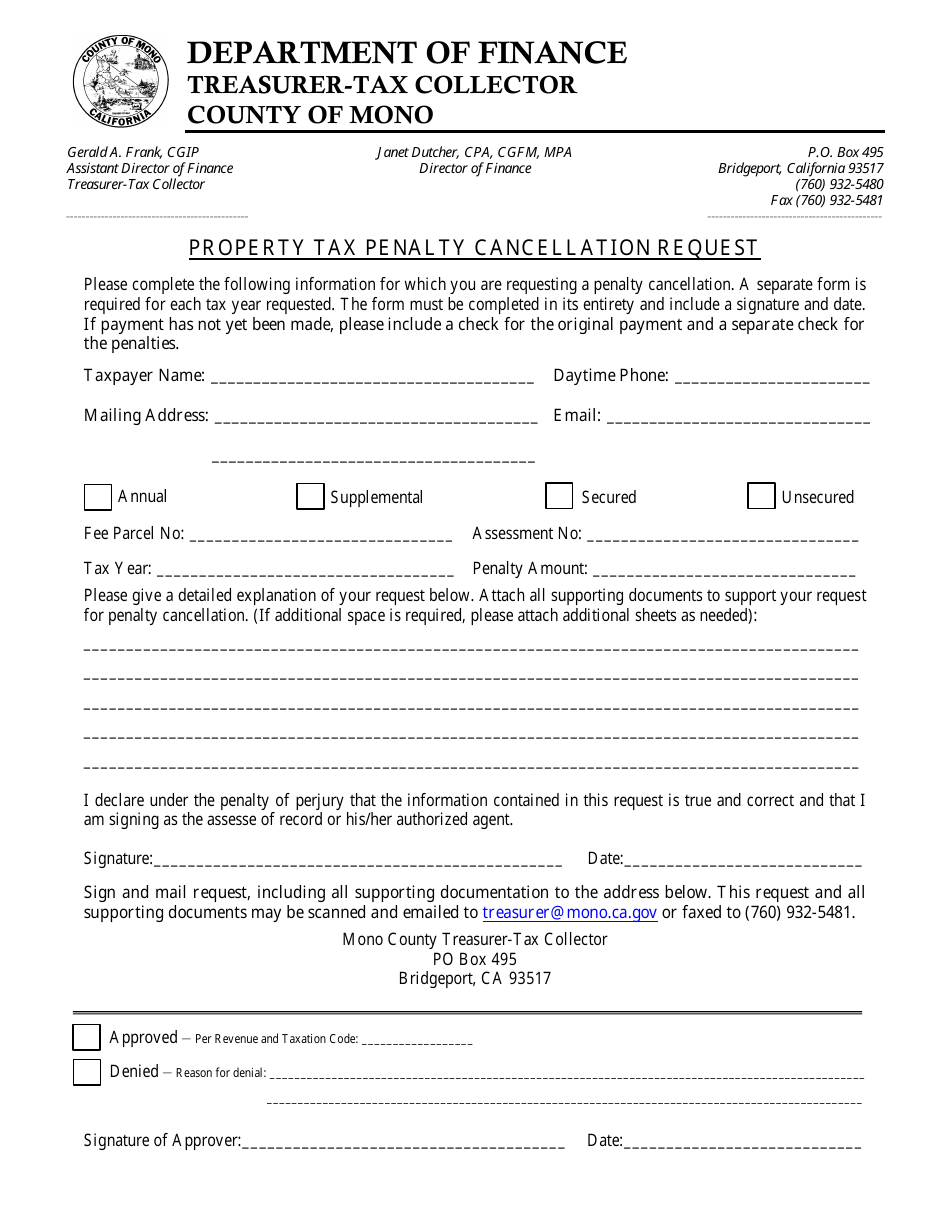

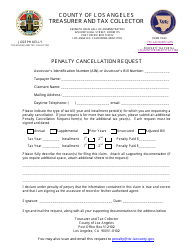

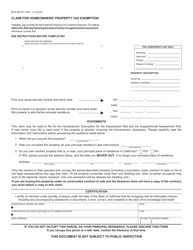

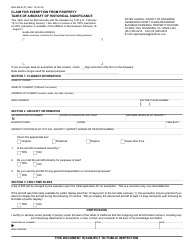

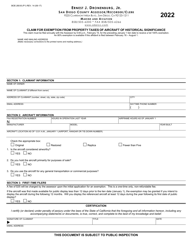

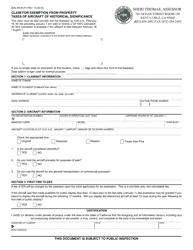

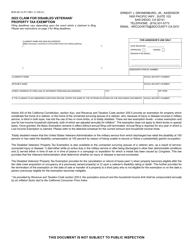

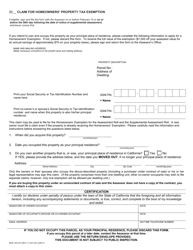

Property Tax Penalty Cancellation Request - Mono County, California

Property Tax Penalty Cancellation Request is a legal document that was released by the Treasurer-Tax Collector's Office - Mono County, California - a government authority operating within California. The form may be used strictly within Mono County.

FAQ

Q: What is a Property Tax Penalty Cancellation Request?

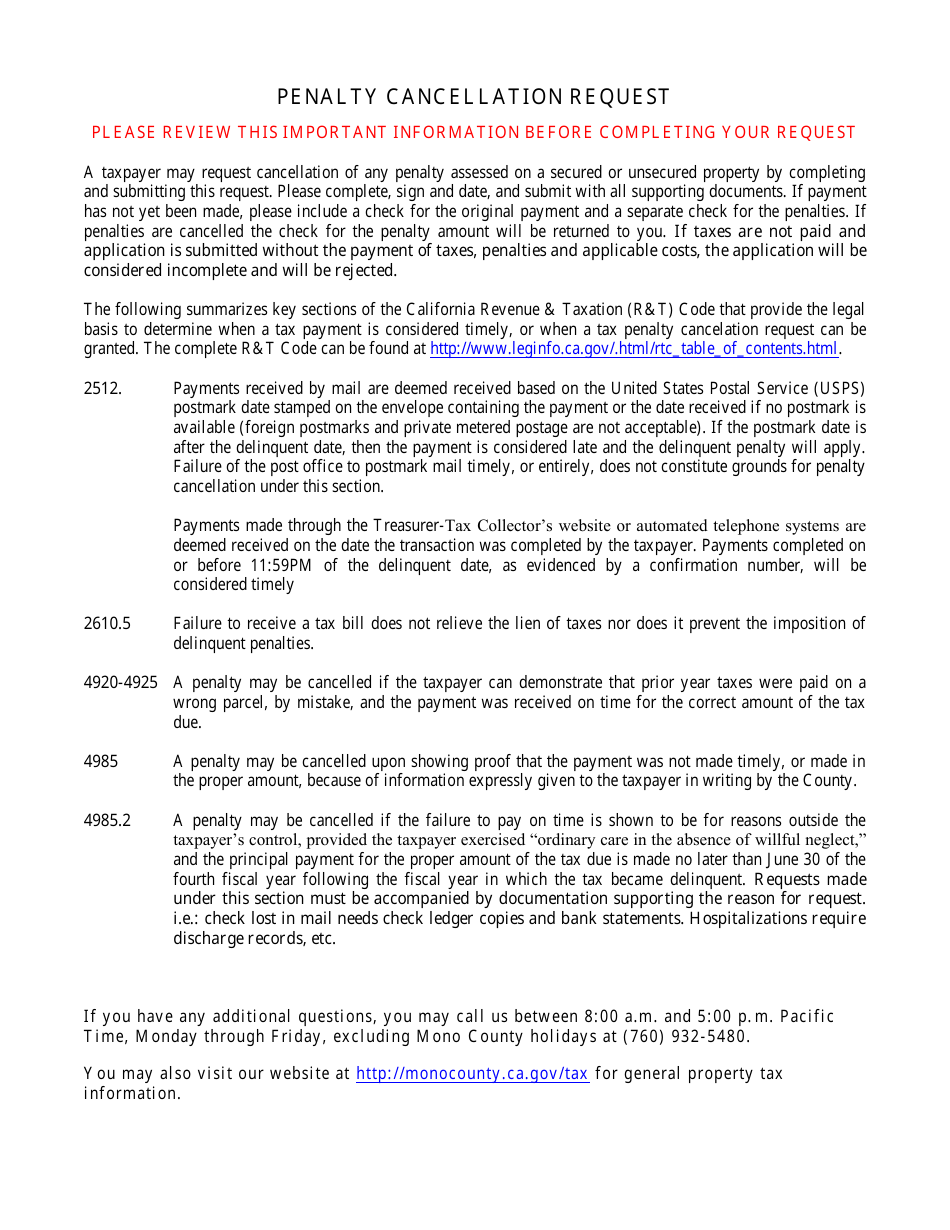

A: A Property Tax Penalty Cancellation Request is a form that allows property owners to request the cancellation of penalties assessed on their property tax bill.

Q: Why would someone request a property tax penalty cancellation?

A: Someone might request a property tax penalty cancellation if they have a valid reason for not paying their property taxes on time, such as financial hardship or an error by the tax collector.

Q: How can I request a property tax penalty cancellation in Mono County, California?

A: To request a property tax penalty cancellation in Mono County, California, you can fill out the Property Tax Penalty Cancellation Request form and submit it to the Mono County Assessor's Office.

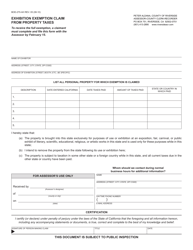

Q: What should I include in my property tax penalty cancellation request?

A: In your property tax penalty cancellation request, you should include your contact information, property details, the reason for your request, and any supporting documentation.

Q: Is there a deadline to submit a property tax penalty cancellation request?

A: Yes, there is usually a deadline to submit a property tax penalty cancellation request. It is important to check with the Mono County Assessor's Office for the specific deadline.

Q: Will my property tax penalty be automatically cancelled if I submit a request?

A: No, the cancellation of your property tax penalty is not guaranteed. The Mono County Assessor's Office will review your request and make a determination based on the information provided.

Q: What happens if my property tax penalty cancellation request is approved?

A: If your property tax penalty cancellation request is approved, the penalties assessed on your property tax bill will be cancelled, and you will only be responsible for paying the original tax amount.

Q: What happens if my property tax penalty cancellation request is denied?

A: If your property tax penalty cancellation request is denied, you will be required to pay the penalties assessed on your property tax bill in addition to the original tax amount.

Q: Can I appeal the decision if my property tax penalty cancellation request is denied?

A: Yes, if your property tax penalty cancellation request is denied, you have the right to appeal the decision. Contact the Mono County Assessor's Office for more information on the appeals process.

Q: Are there any fees associated with submitting a property tax penalty cancellation request?

A: There may be fees associated with submitting a property tax penalty cancellation request. It is recommended to check with the Mono County Assessor's Office for the current fee schedule.

Form Details:

- The latest edition currently provided by the Treasurer-Tax Collector's Office - Mono County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Treasurer-Tax Collector's Office - Mono County, California.