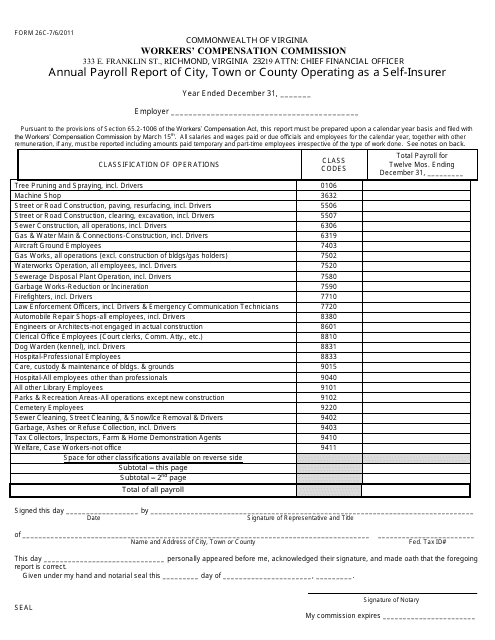

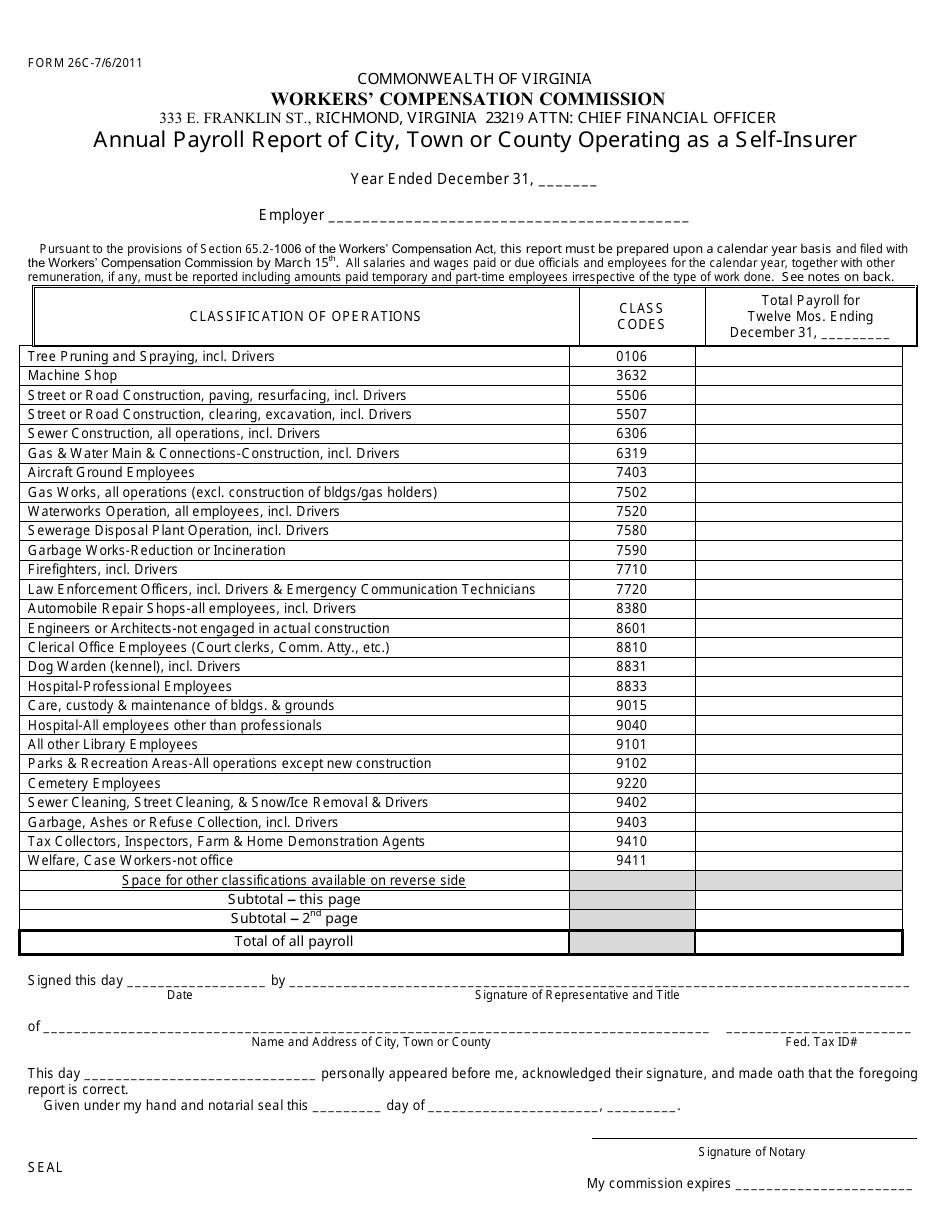

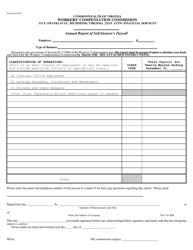

Form 26C Annual Payroll Report of City, Town or County Operating as a Self-insurer - Virginia

What Is Form 26C?

This is a legal form that was released by the Virginia Workers' Compensation Commission - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 26C?

A: Form 26C is the Annual Payroll Report of City, Town, or County Operating as a Self-insurer in Virginia.

Q: Who needs to file Form 26C?

A: Cities, towns, or counties that operate as self-insurers in Virginia need to file Form 26C.

Q: What is the purpose of Form 26C?

A: Form 26C is used to report the annual payroll of city, town, or county self-insurers in Virginia.

Q: When is Form 26C due?

A: Form 26C is due on or before March 1st of each year.

Q: Is there a fee for filing Form 26C?

A: No, there is no fee for filing Form 26C.

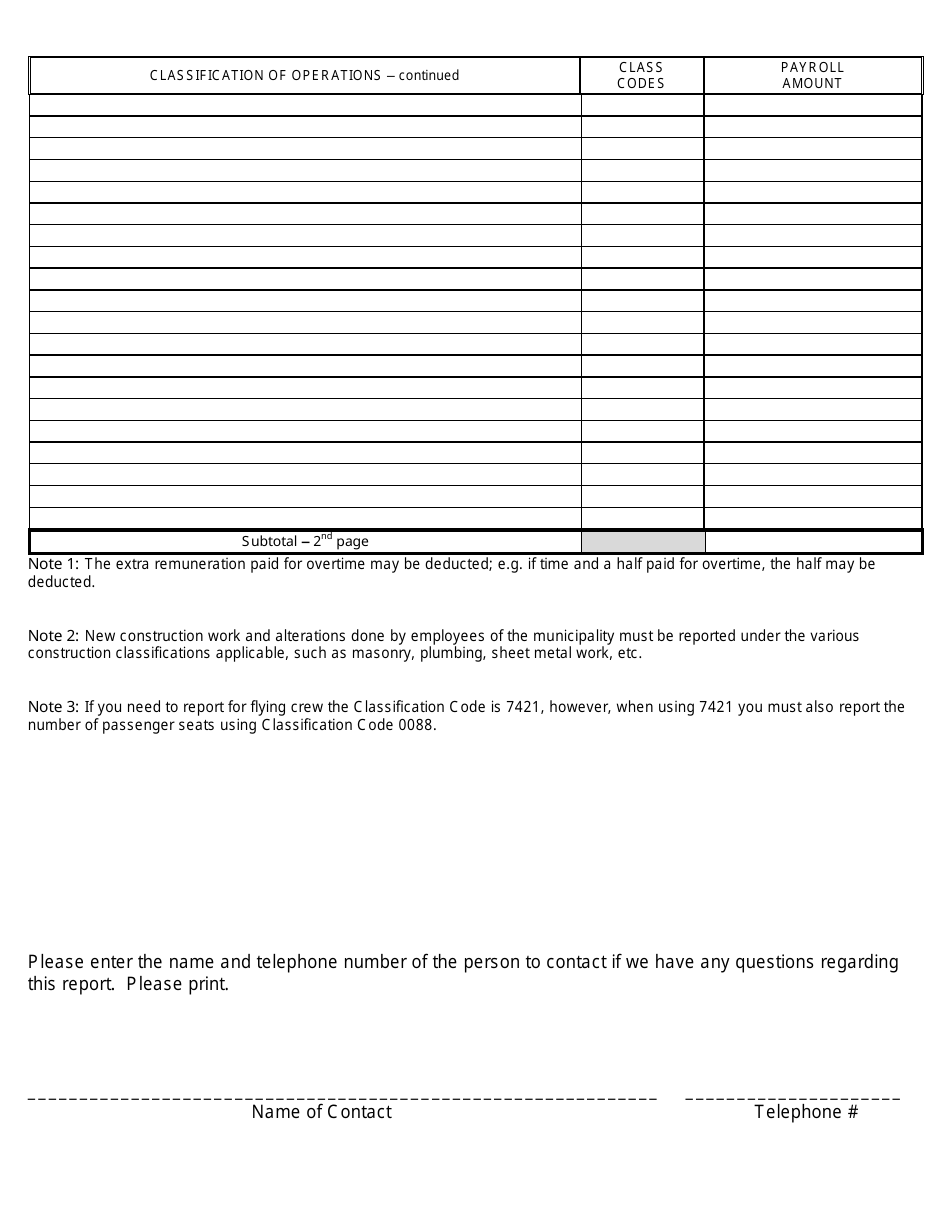

Q: What information do I need to complete Form 26C?

A: You will need information about your payroll, number of employees, and any changes in ownership or coverage during the reporting period.

Q: What happens if I don't file Form 26C?

A: Failure to file Form 26C may result in penalties or other enforcement actions by the Virginia Workers' Compensation Commission.

Q: Who can I contact for assistance with Form 26C?

A: You can contact the Virginia Workers' Compensation Commission for assistance with Form 26C.

Form Details:

- Released on July 6, 2011;

- The latest edition provided by the Virginia Workers' Compensation Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 26C by clicking the link below or browse more documents and templates provided by the Virginia Workers' Compensation Commission.