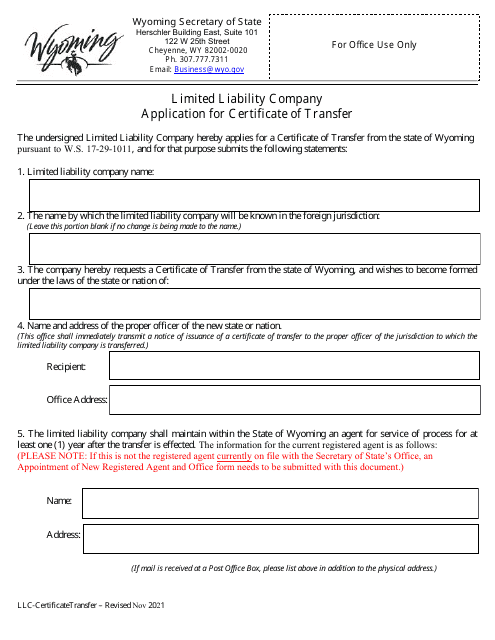

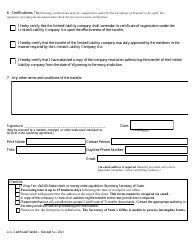

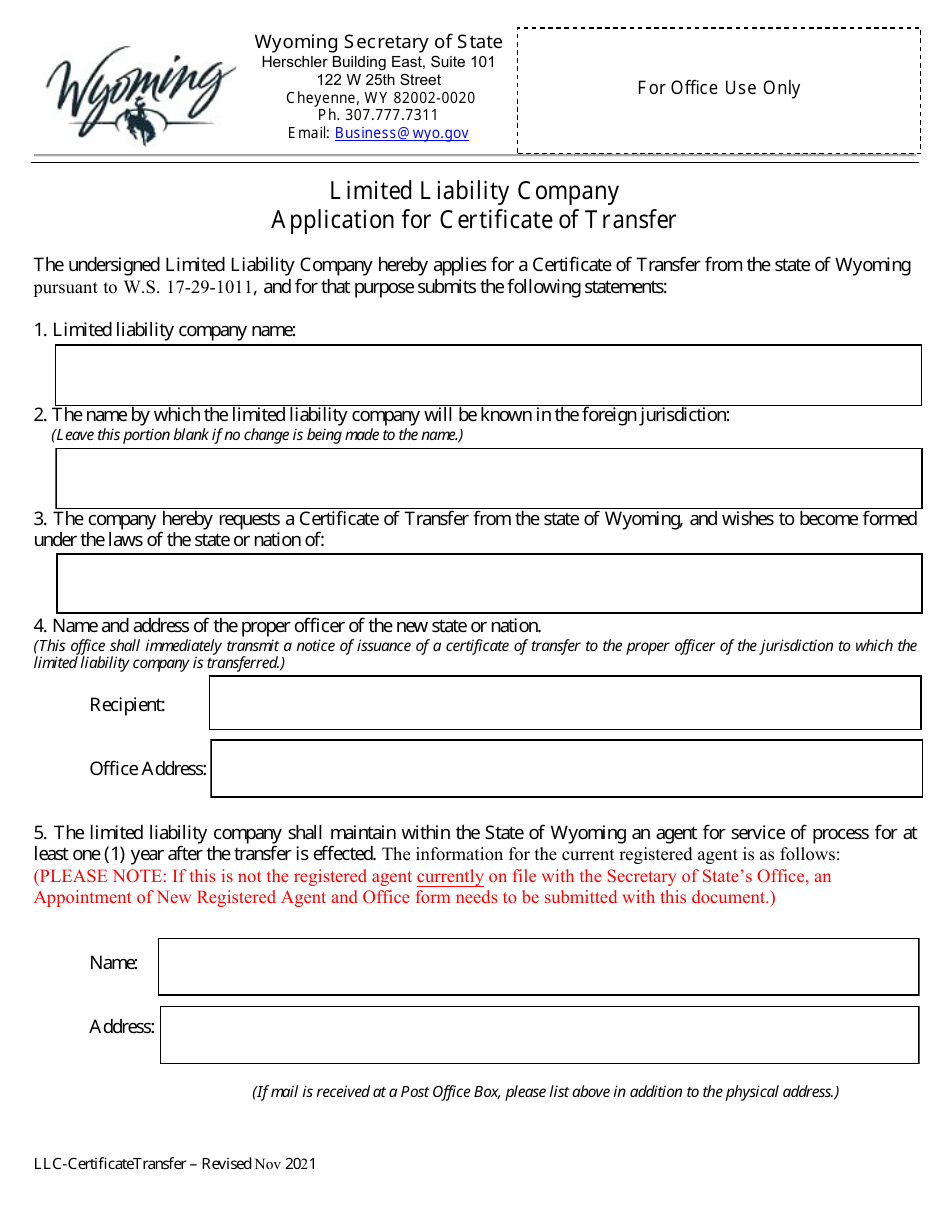

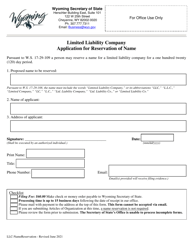

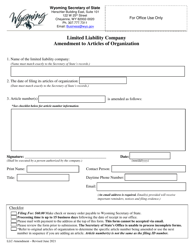

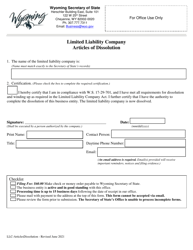

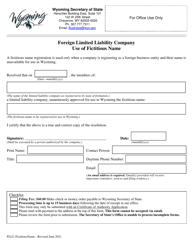

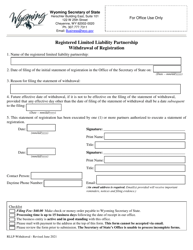

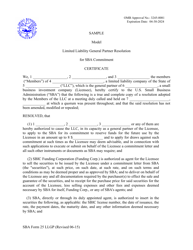

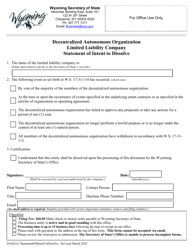

Limited Liability Company Application for Certificate of Transfer - Wyoming

Limited Liability Company Application for Certificate of Transfer is a legal document that was released by the Wyoming Secretary of State - a government authority operating within Wyoming.

FAQ

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company (LLC) is a legal entity that offers limited liability protection to its owners while providing flexibility in management and taxation.

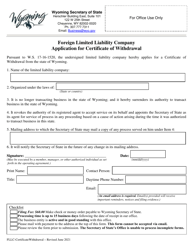

Q: What is a Certificate of Transfer?

A: A Certificate of Transfer is a document that allows a Limited Liability Company (LLC) to transfer its business operations to a different state.

Q: Why would an LLC transfer its business operations to a different state?

A: LLCs may transfer their business operations to a different state for various reasons, such as expanding into new markets or taking advantage of more favorable tax or regulatory environments.

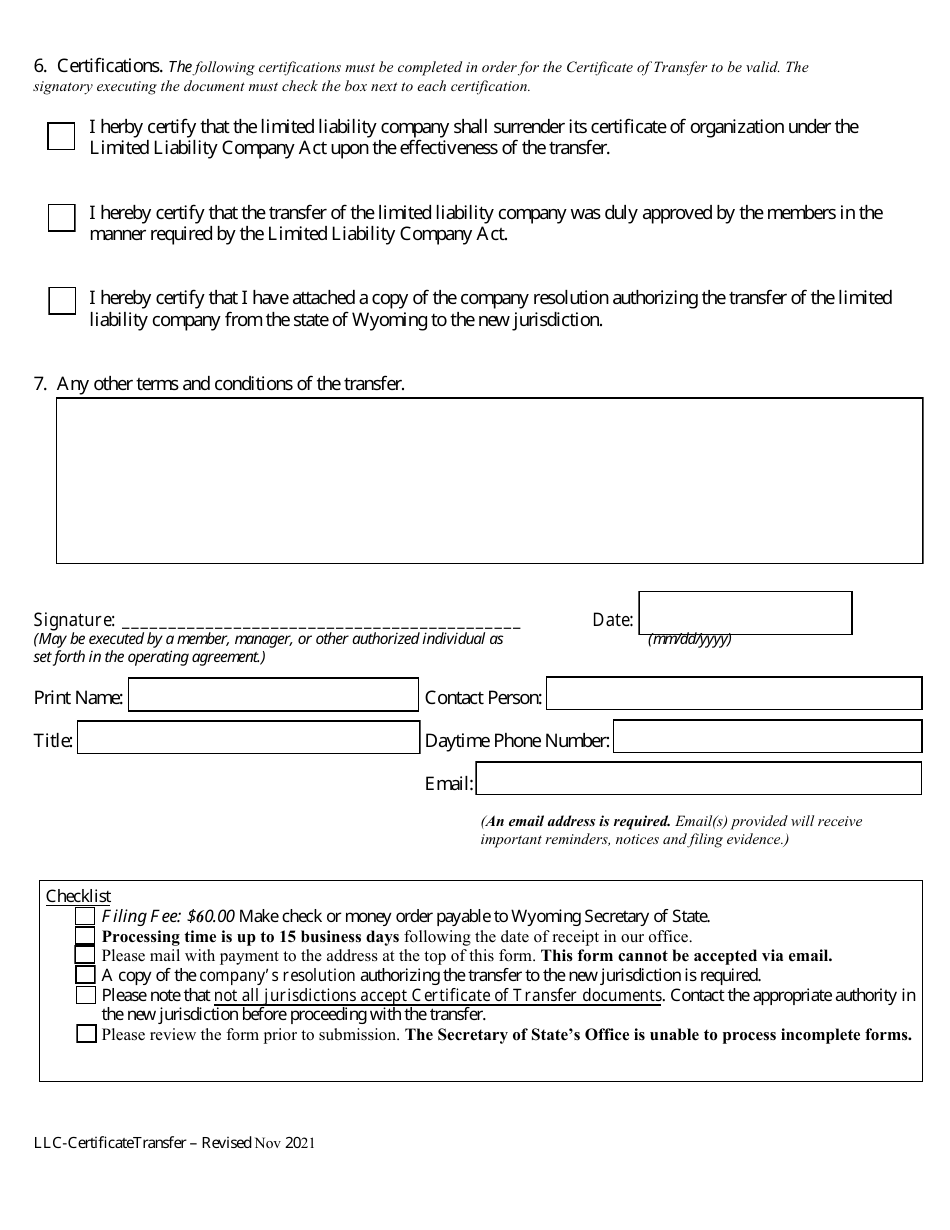

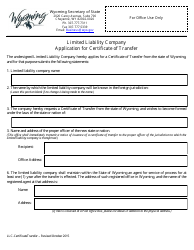

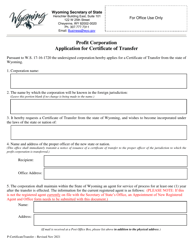

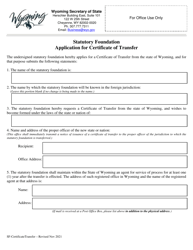

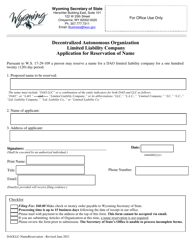

Q: What is the process for applying for a Certificate of Transfer in Wyoming?

A: The process for applying for a Certificate of Transfer in Wyoming involves completing and filing the necessary forms with the Wyoming Secretary of State, along with the required filing fee.

Q: What information is required in the LLC Application for Certificate of Transfer?

A: The LLC Application for Certificate of Transfer typically requires information about the current LLC, the new state of transfer, and the authorized representatives of the LLC.

Q: Is there a filing fee for the LLC Application for Certificate of Transfer in Wyoming?

A: Yes, there is a filing fee for the LLC Application for Certificate of Transfer in Wyoming. The fee amount can vary, so it is recommended to check the current fee schedule with the Wyoming Secretary of State.

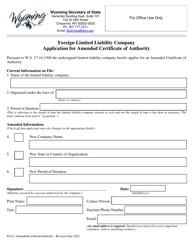

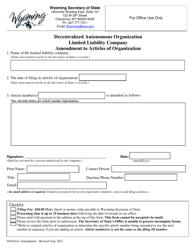

Q: Are there any additional requirements or documents needed for the transfer of an LLC to Wyoming?

A: It is possible that there may be additional requirements or documents needed for the transfer of an LLC to Wyoming. It is advisable to consult with an attorney or professional familiar with Wyoming's laws and regulations for accurate guidance.

Q: Can an LLC continue operating in its original state after filing for a Certificate of Transfer?

A: Yes, an LLC can continue operating in its original state after filing for a Certificate of Transfer. The LLC will be recognized as a foreign entity in its original state while being treated as a domestic entity in the state of transfer.

Q: How long does it take to process a Certificate of Transfer in Wyoming?

A: The processing time for a Certificate of Transfer in Wyoming can vary. It is best to check with the Wyoming Secretary of State for current processing times.

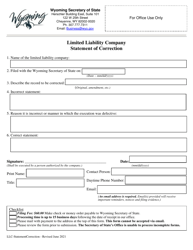

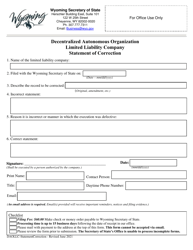

Q: What if there is a mistake or omission in the LLC Application for Certificate of Transfer?

A: If there is a mistake or omission in the LLC Application for Certificate of Transfer, it may result in a delay or rejection of the application. It is crucial to carefully review the application and seek professional advice if needed.

Form Details:

- Released on November 1, 2021;

- The latest edition currently provided by the Wyoming Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Wyoming Secretary of State.