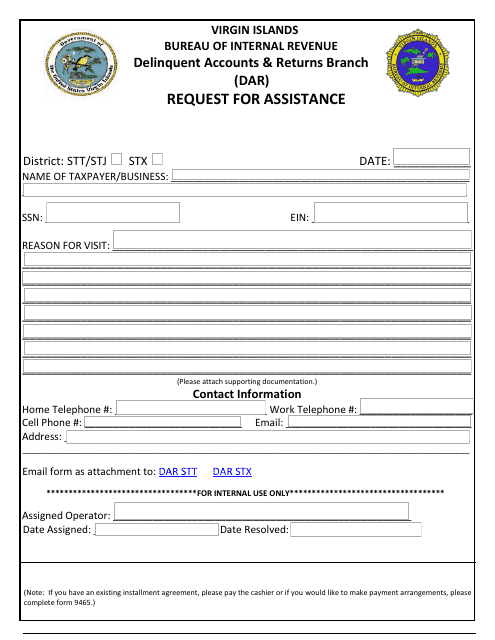

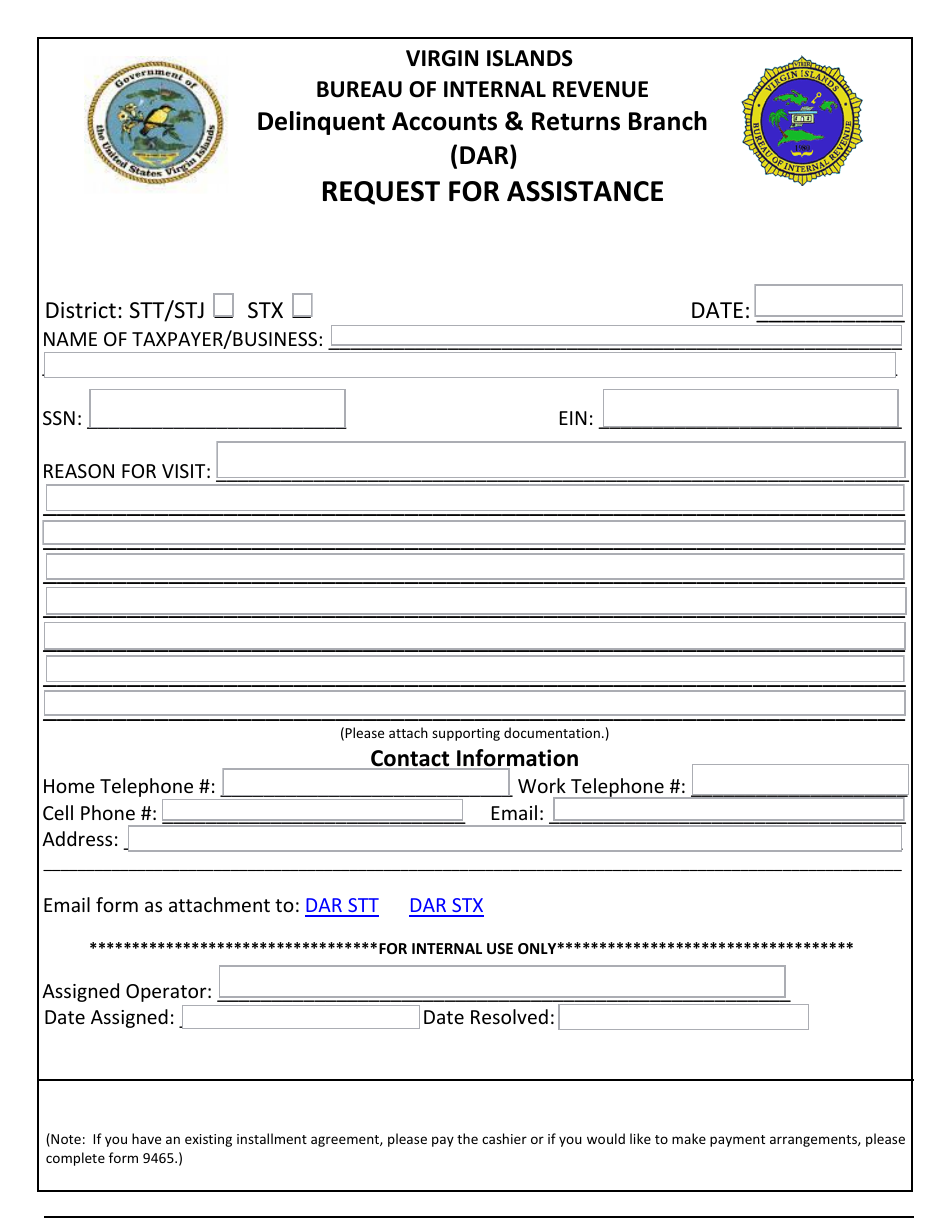

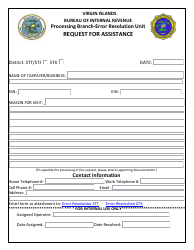

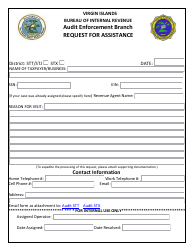

Delinquent Accounts & Returns Branch (Dar) Request for Assistance - Virgin Islands

Delinquent Accounts & Returns Branch (Dar) Request for Assistance is a legal document that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands.

FAQ

Q: What is the Delinquent Accounts & Returns Branch (DAR)?

A: The Delinquent Accounts & Returns Branch (DAR) is a branch of the IRS that deals with accounts that are delinquent or with customers who have filed returns with errors or omissions.

Q: What is the purpose of the DAR?

A: The purpose of the DAR is to help customers with delinquent accounts or returns in the Virgin Islands.

Q: Who can request assistance from the DAR?

A: Customers in the Virgin Islands who have delinquent accounts or returns can request assistance from the DAR.

Q: What types of assistance does the DAR provide?

A: The DAR provides assistance in resolving delinquent accounts, correcting errors or omissions on filed returns, and answering customer inquiries.

Q: How can I request assistance from the DAR?

A: You can request assistance from the DAR by contacting their office in the Virgin Islands or calling their toll-free number.

Q: What should I do if I have a delinquent account or return?

A: If you have a delinquent account or return, you should contact the DAR for assistance in resolving the issue.

Q: Can the DAR help with other tax-related issues?

A: The DAR primarily focuses on delinquent accounts and returns, but they may be able to provide general assistance or refer you to the appropriate department for other tax-related issues.

Q: Is there a deadline for requesting assistance from the DAR?

A: There is no specific deadline for requesting assistance from the DAR, but it is recommended to seek assistance as soon as possible to avoid further penalties or complications.

Q: Is there a fee for the DAR's assistance?

A: There is no fee for the DAR's assistance. It is a free service provided by the IRS.

Q: What information should I have when contacting the DAR?

A: When contacting the DAR, it is helpful to have relevant account or return information, such as your Social Security number, tax year, and any notices or correspondence received from the IRS.

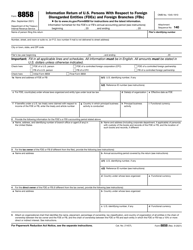

Form Details:

- The latest edition currently provided by the Virgin Islands Bureau of Internal Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.