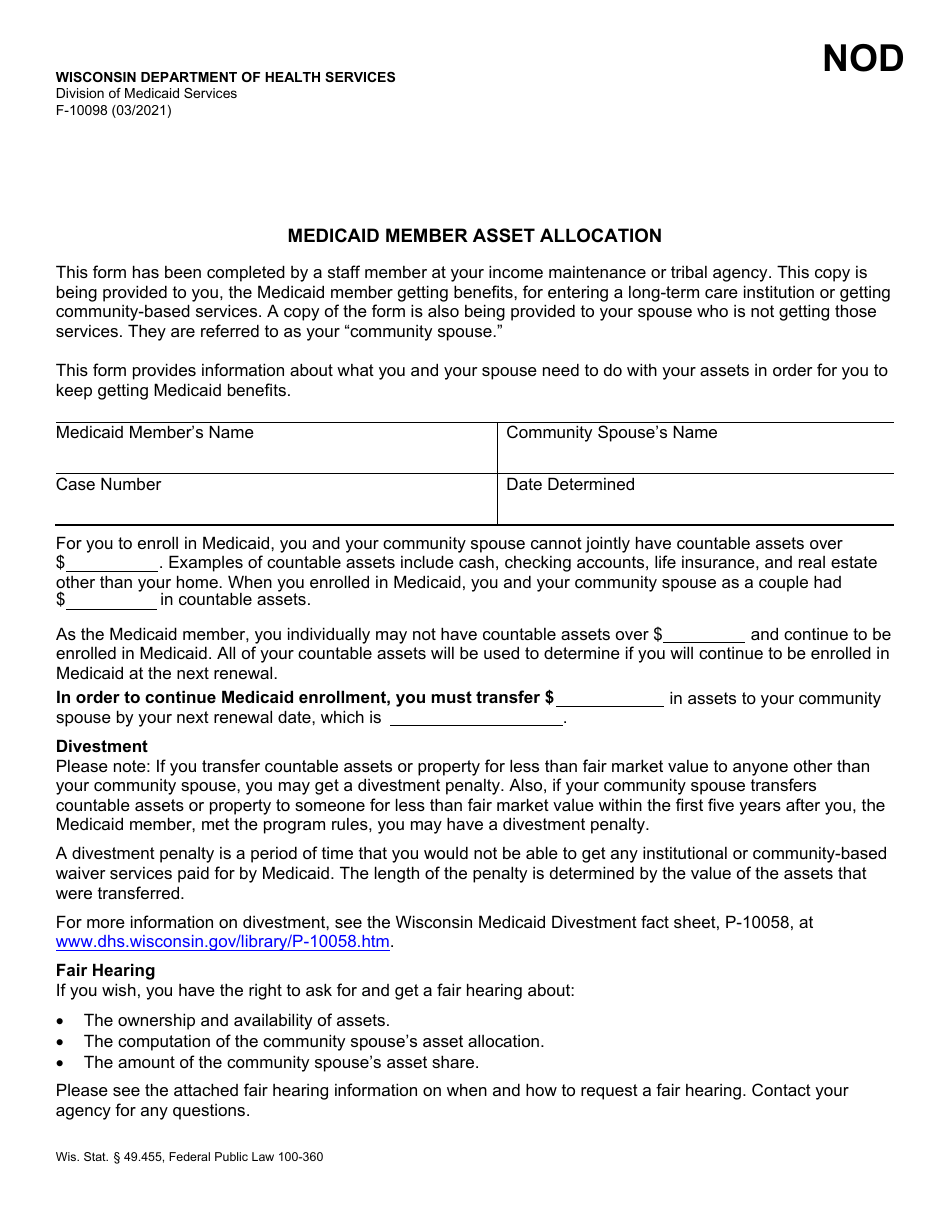

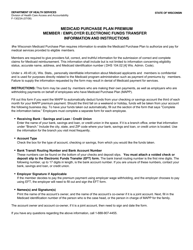

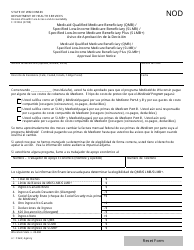

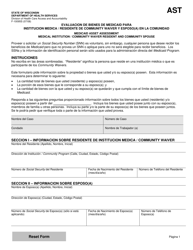

Form F-10098 Medicaid Member Asset Allocation - Wisconsin

What Is Form F-10098?

This is a legal form that was released by the Wisconsin Department of Health Services - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-10098?

A: Form F-10098 is a Medicaid member asset allocation form in Wisconsin.

Q: What is Medicaid?

A: Medicaid is a healthcare program that provides assistance to low-income individuals and families.

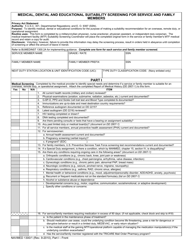

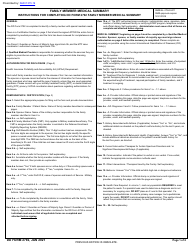

Q: Who is required to fill out Form F-10098?

A: Medicaid members in Wisconsin who have assets are required to fill out Form F-10098.

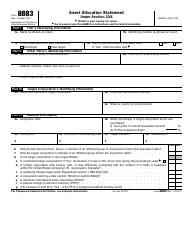

Q: What is asset allocation?

A: Asset allocation is the process of dividing and distributing assets among various investment options.

Q: Why is asset allocation important for Medicaid members?

A: Asset allocation is important for Medicaid members because it determines their eligibility for benefits.

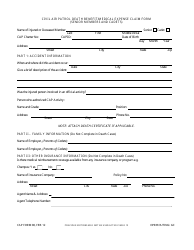

Q: What information is needed to fill out Form F-10098?

A: Form F-10098 requires information about the Medicaid member's assets, such as bank accounts, real estate, and investments.

Q: Is there a deadline for submitting Form F-10098?

A: Yes, there is a deadline for submitting Form F-10098. The specific deadline will be specified by the Wisconsin Department of Health Services.

Q: What happens if I don't fill out Form F-10098?

A: Failure to fill out Form F-10098 may result in ineligibility for Medicaid benefits.

Q: Can I get help with filling out Form F-10098?

A: Yes, you can seek assistance from the Wisconsin Department of Health Services or other Medicaid enrollment counselors to help you fill out Form F-10098.

Q: Are there any exemptions for filling out Form F-10098?

A: There may be exemptions available for certain Medicaid members. You should consult with the Wisconsin Department of Health Services for more information.

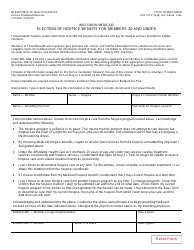

Q: Can I make changes to my asset allocation after submitting Form F-10098?

A: Yes, you can make changes to your asset allocation after submitting Form F-10098. However, you should inform the Wisconsin Department of Health Services about any changes.

Q: What if I have additional questions about Form F-10098?

A: If you have additional questions about Form F-10098, you should contact the Wisconsin Department of Health Services for clarification.

Q: Is Form F-10098 specific to Wisconsin?

A: Yes, Form F-10098 is specific to Wisconsin and its Medicaid program. Other states may have different forms and requirements.

Q: Can someone else fill out Form F-10098 on behalf of the Medicaid member?

A: Yes, someone else, such as a guardian or power of attorney, can fill out Form F-10098 on behalf of the Medicaid member.

Q: Is there a fee for submitting Form F-10098?

A: There is no fee for submitting Form F-10098.

Q: What happens after submitting Form F-10098?

A: After submitting Form F-10098, the Wisconsin Department of Health Services will review the information provided and determine the Medicaid member's eligibility for benefits.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Wisconsin Department of Health Services;

- Easy to use and ready to print;

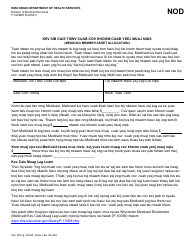

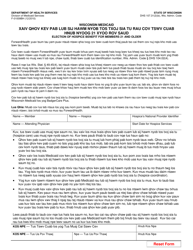

- Available in Hmong;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-10098 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Health Services.