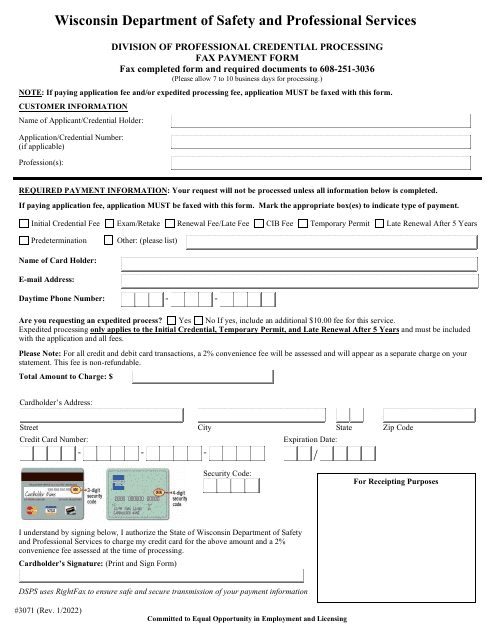

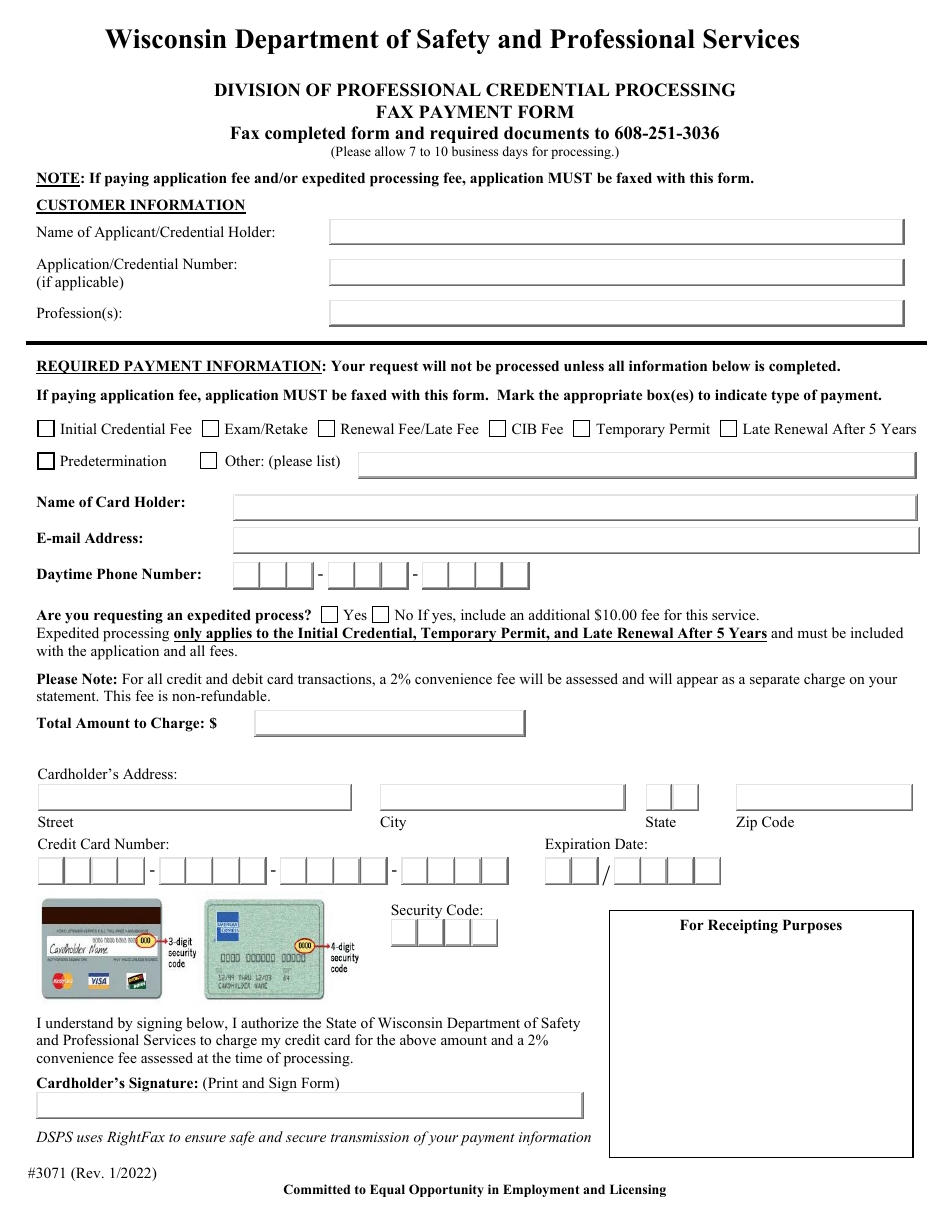

This version of the form is not currently in use and is provided for reference only. Download this version of

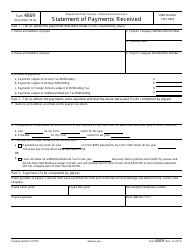

Form 3071

for the current year.

Form 3071 Fax Payment Form - Wisconsin

What Is Form 3071?

This is a legal form that was released by the Wisconsin Department of Safety and Professional Services - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3071?

A: Form 3071 is a Fax Payment Form used in Wisconsin.

Q: What is the purpose of Form 3071?

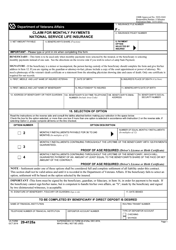

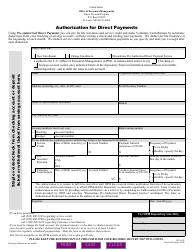

A: The purpose of Form 3071 is to provide a convenient method for making payments via fax in Wisconsin.

Q: Can I use Form 3071 to make payments for any type of taxes in Wisconsin?

A: Yes, Form 3071 can be used to make payments for various types of taxes in Wisconsin.

Q: Is there a deadline for submitting Form 3071?

A: Yes, you must submit Form 3071 by the deadline specified by the Wisconsin Department of Revenue.

Q: Are there any fees associated with using Form 3071?

A: No, there are no fees associated with using Form 3071.

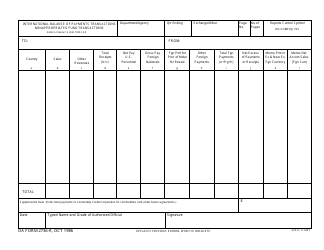

Q: What information do I need to provide on Form 3071?

A: You will need to provide your payment information, tax account number, and other relevant details as requested on the form.

Q: Can I use Form 3071 if I am not a resident of Wisconsin?

A: No, Form 3071 is specifically for making payments in Wisconsin, so it can only be used by residents of the state.

Q: Can I submit Form 3071 by mail?

A: No, Form 3071 can only be submitted via fax.

Q: What should I do if I have questions or need assistance with Form 3071?

A: If you have any questions or need assistance with Form 3071, you can contact the Wisconsin Department of Revenue for help.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Wisconsin Department of Safety and Professional Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3071 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Safety and Professional Services.