This version of the form is not currently in use and is provided for reference only. Download this version of

Form UCT-101-E

for the current year.

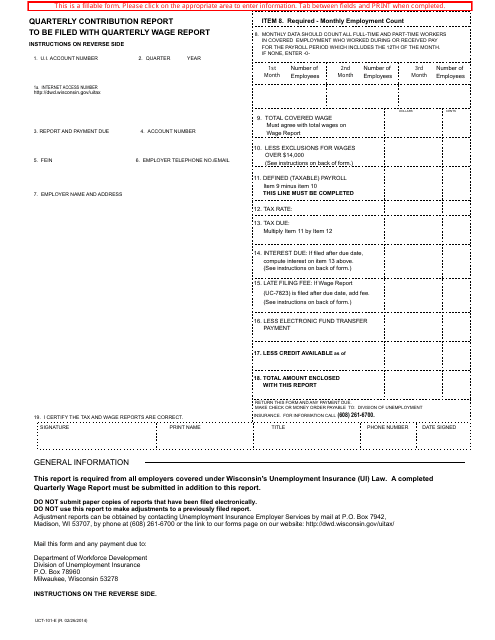

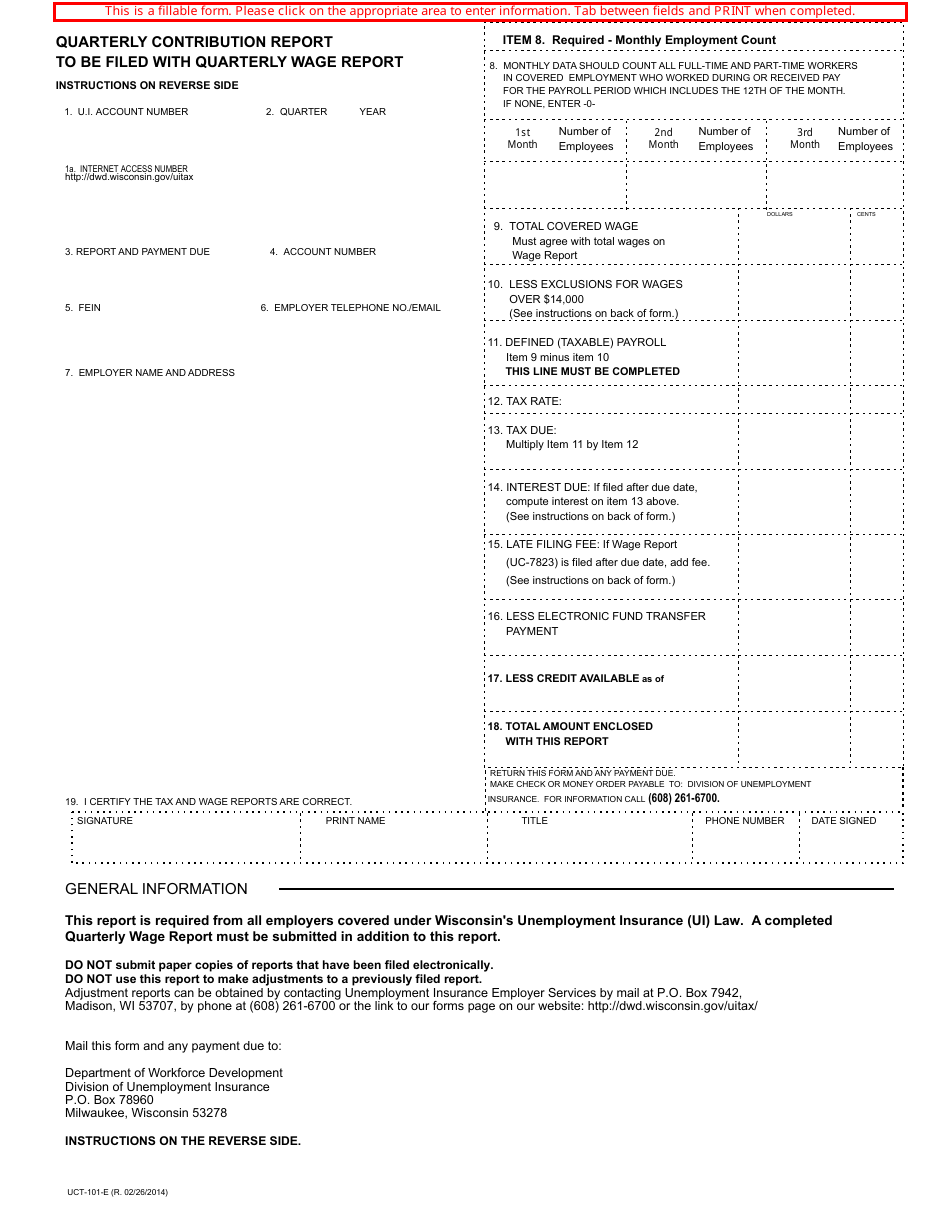

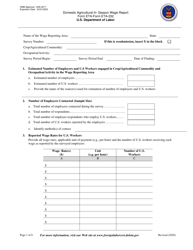

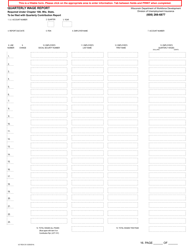

Form UCT-101-E Quarterly Contribution Report to Be Filed With Quarterly Wage Report - Wisconsin

What Is Form UCT-101-E?

This is a legal form that was released by the Wisconsin Department of Workforce Development - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UCT-101-E?

A: Form UCT-101-E is the Quarterly Contribution Report that needs to be filed with the Quarterly Wage Report in the state of Wisconsin.

Q: What is the purpose of Form UCT-101-E?

A: The purpose of Form UCT-101-E is to report the quarterly contributions made by employers in Wisconsin.

Q: Who needs to file Form UCT-101-E?

A: Employers in Wisconsin who have employees and are required to contribute to the Unemployment Compensation Fund need to file Form UCT-101-E.

Q: When should Form UCT-101-E be filed?

A: Form UCT-101-E should be filed quarterly, along with the Quarterly Wage Report, by the last day of the month following the end of the quarter.

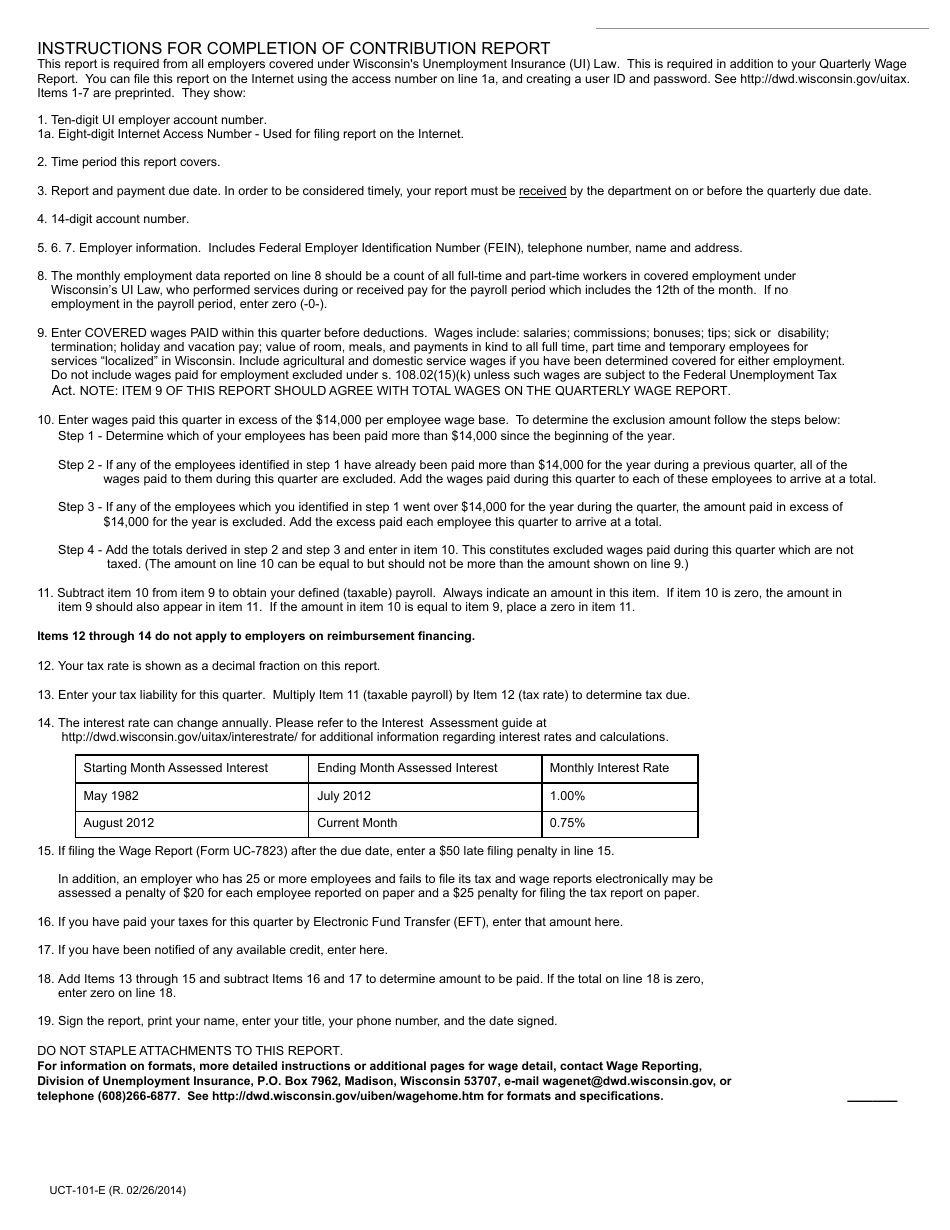

Q: What information is required to complete Form UCT-101-E?

A: To complete Form UCT-101-E, you will need to provide details of the contributions made during the quarter, including the taxable wages subject to contribution and the amount of contributions made.

Q: Are there any penalties for not filing Form UCT-101-E?

A: Yes, there are penalties for not filing Form UCT-101-E or for filing it late. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on February 26, 2014;

- The latest edition provided by the Wisconsin Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCT-101-E by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Workforce Development.