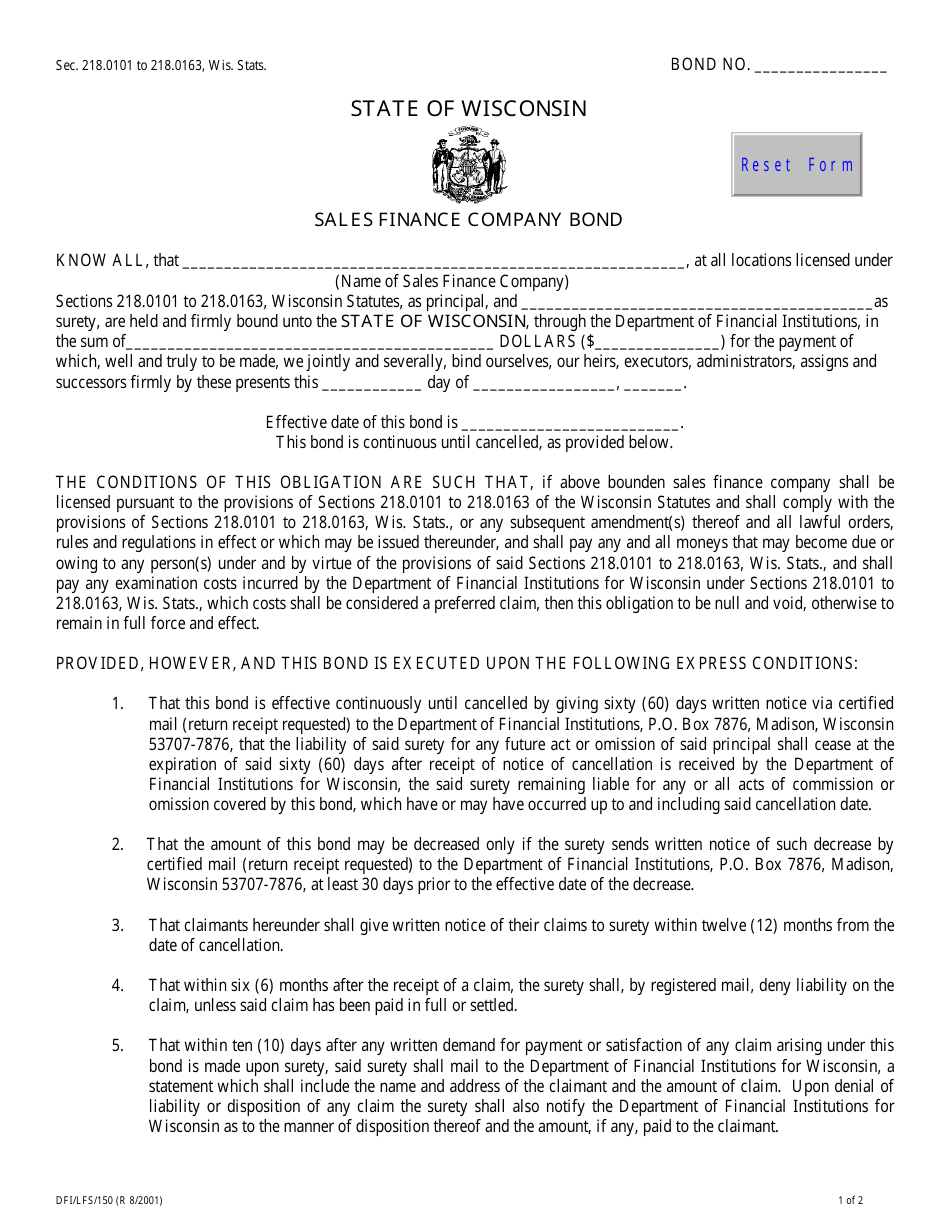

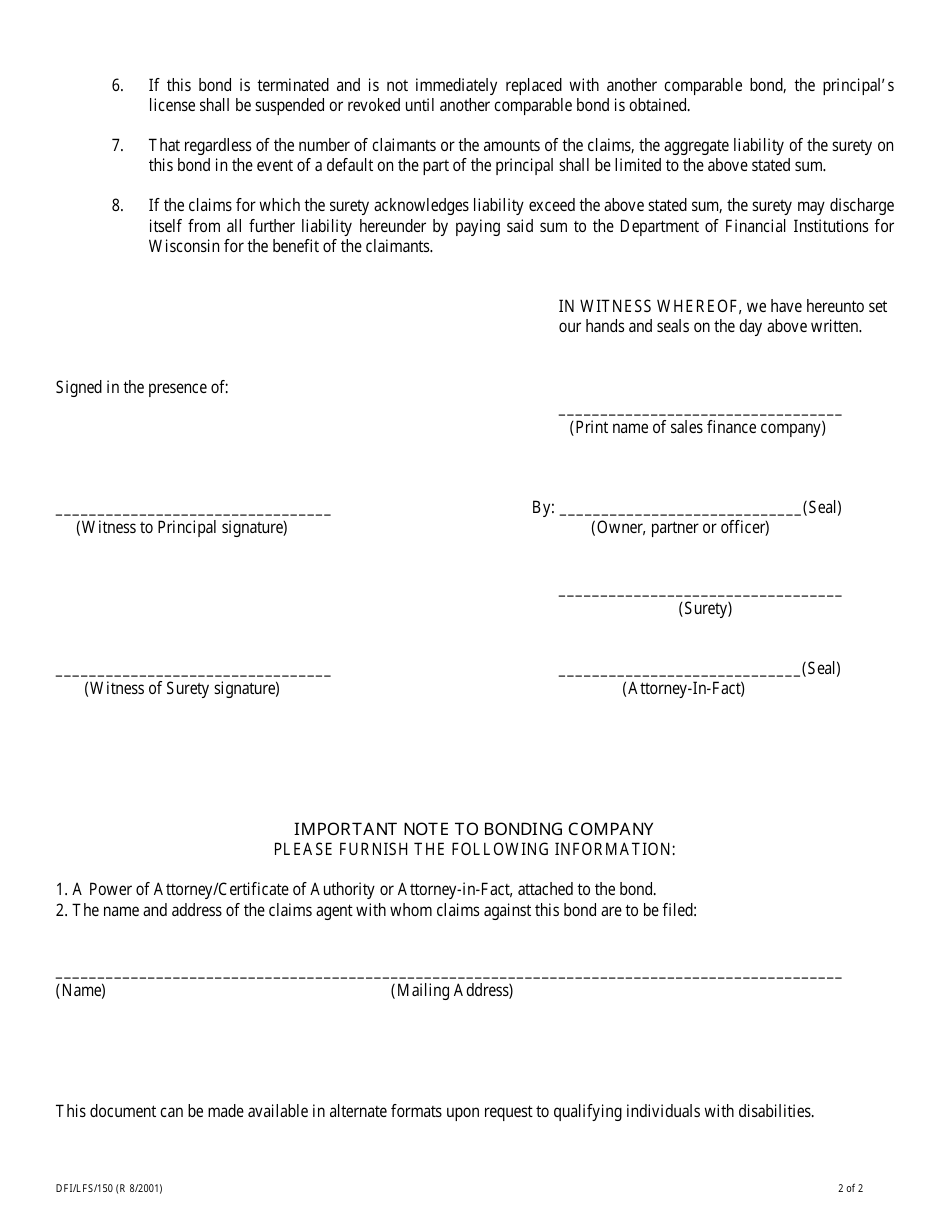

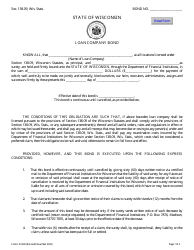

Form DFI / LFS / 150 Sales Finance Company Bond - Wisconsin

What Is Form DFI/LFS/150?

This is a legal form that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

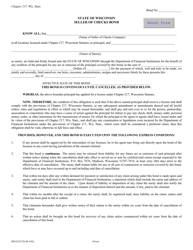

Q: What is the Form DFI/LFS/150 Sales Finance Company Bond?

A: The Form DFI/LFS/150 Sales Finance Company Bond is a type of surety bond required for sales finance companies in Wisconsin.

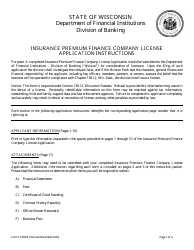

Q: Who needs to obtain the Form DFI/LFS/150 Sales Finance Company Bond?

A: Sales finance companies operating in Wisconsin are required to obtain this bond as part of their licensing requirements.

Q: What is the purpose of the Form DFI/LFS/150 Sales Finance Company Bond?

A: The bond provides financial protection to consumers by ensuring that sales finance companies comply with state regulations and fulfill their obligations.

Q: How much does the Form DFI/LFS/150 Sales Finance Company Bond cost?

A: The cost of the bond varies based on factors such as the company's financial stability and credit history. Typically, it is a percentage of the bond amount required by the state.

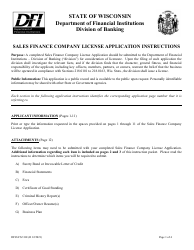

Q: How do I obtain the Form DFI/LFS/150 Sales Finance Company Bond?

A: To obtain the bond, you need to contact a licensed surety bond provider who can guide you through the application process and issue the bond.

Q: What happens if a sales finance company fails to have the Form DFI/LFS/150 Sales Finance Company Bond?

A: Failure to have the required bond can result in penalties, fines, or the suspension of the company's license to operate in Wisconsin.

Form Details:

- Released on August 1, 2001;

- The latest edition provided by the Wisconsin Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFI/LFS/150 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.