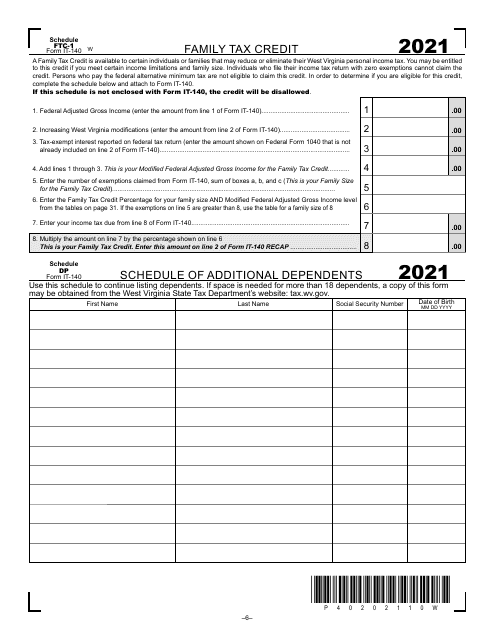

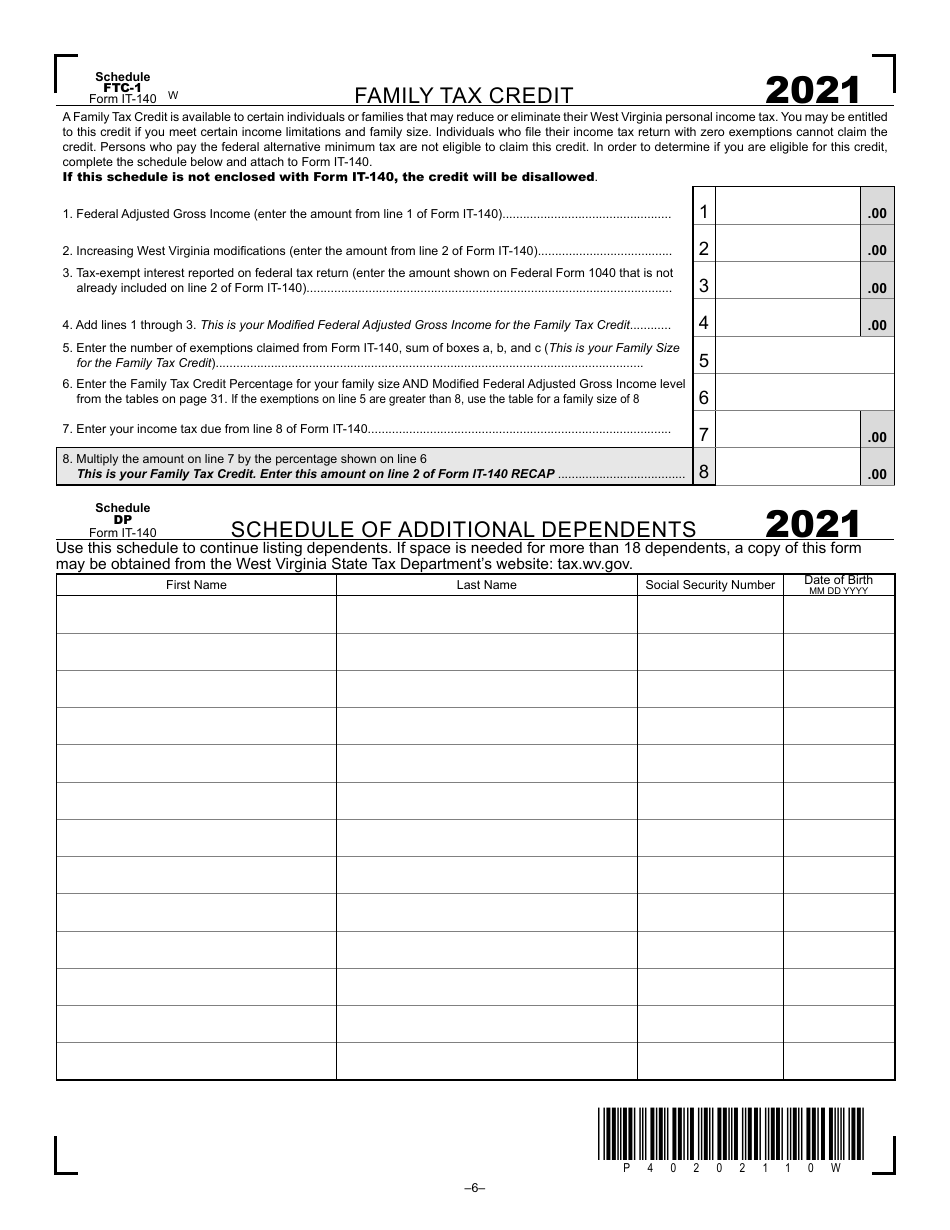

Form IT-140 Schedule DP, FTC-1 - West Virginia

What Is Form IT-140 Schedule DP, FTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140 Schedule DP?

A: Form IT-140 Schedule DP is a schedule for reporting the Domestic Production Activities Deduction (DPAD) for tax-year 2019 in West Virginia.

Q: What is the Domestic Production Activities Deduction (DPAD)?

A: The Domestic Production Activities Deduction (DPAD) is a deduction that allows eligible businesses to reduce their taxable income based on income generated from qualified domestic production activities.

Q: What is FTC-1?

A: FTC-1 is a form used to report foreign tax credits on your West Virginia state tax return.

Q: What are foreign tax credits?

A: Foreign tax credits are credits that can be claimed by taxpayers who have paid or accrued foreign taxes to a foreign country or U.S. possession.

Q: What is the purpose of Form IT-140 Schedule DP and FTC-1?

A: The purpose of Form IT-140 Schedule DP and FTC-1 is to report the Domestic Production Activities Deduction (DPAD) and foreign tax credits on your West Virginia state tax return.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-140 Schedule DP, FTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.