This version of the form is not currently in use and is provided for reference only. Download this version of

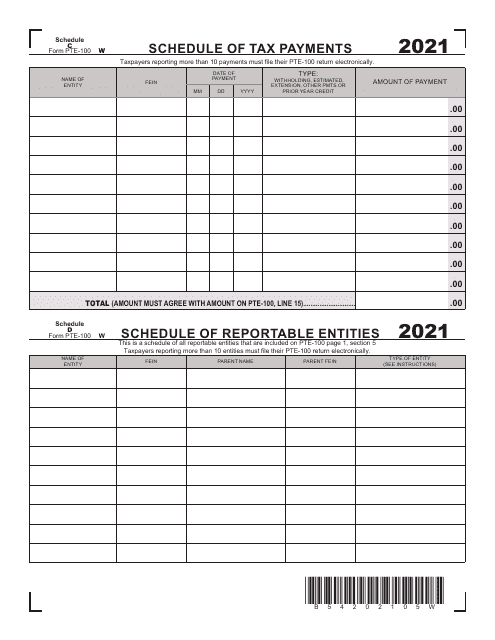

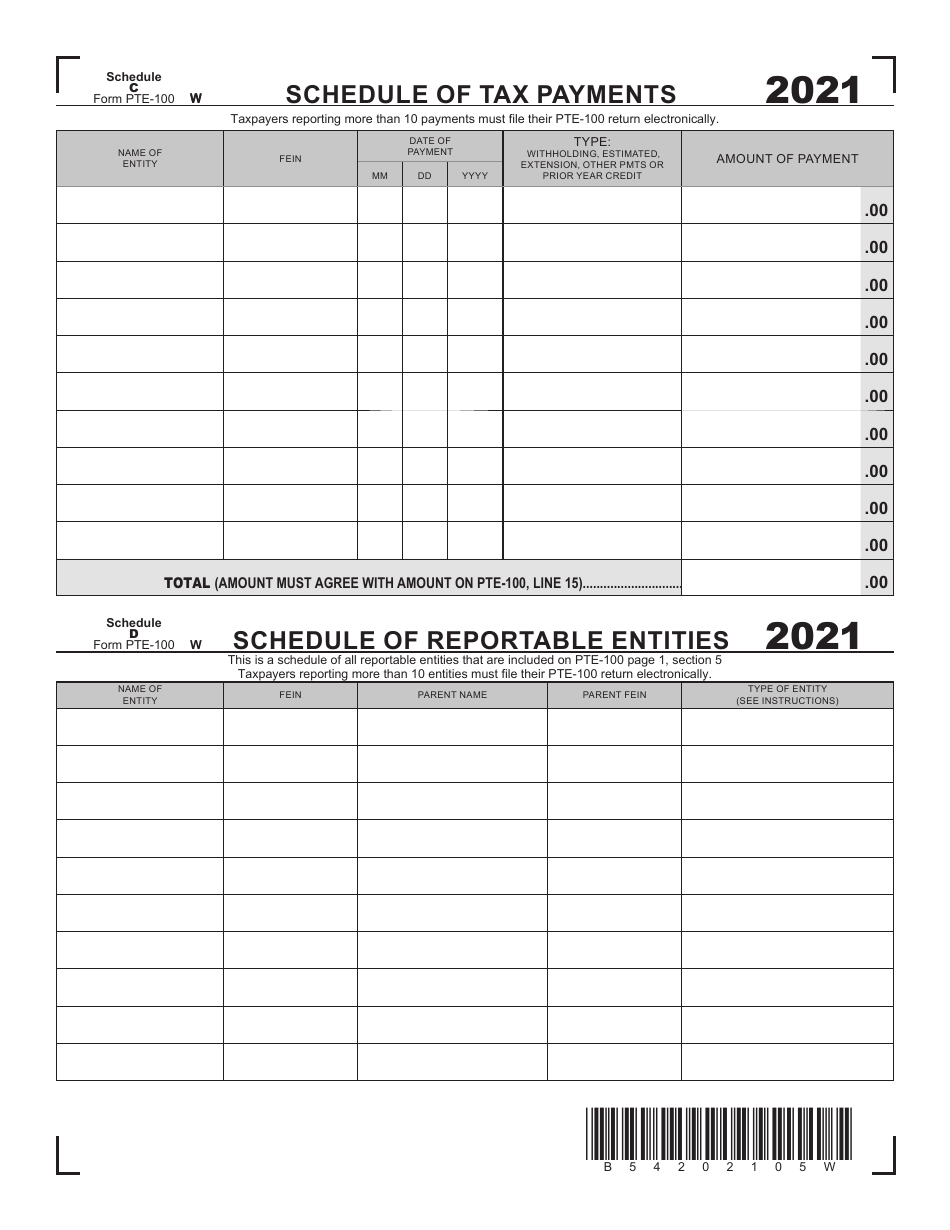

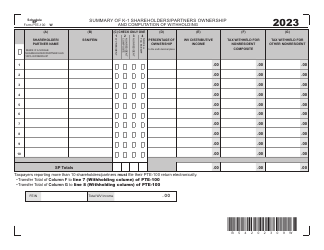

Form PTE-100 Schedule C, D

for the current year.

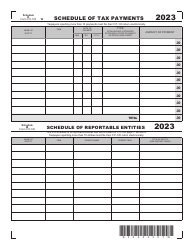

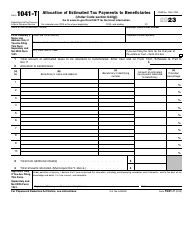

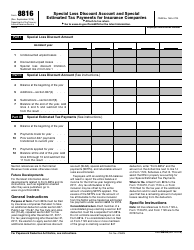

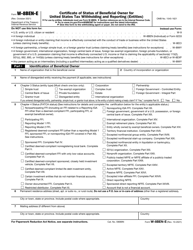

Form PTE-100 Schedule C, D Schedule of Tax Payments and Schedule of Reportable Entities - West Virginia

What Is Form PTE-100 Schedule C, D?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100?

A: Form PTE-100 is a tax form used in West Virginia for filing the annual composite tax return for pass-through entities.

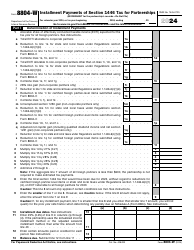

Q: What is Schedule C?

A: Schedule C is a part of Form PTE-100 that is used to report the tax payments made by the pass-through entity.

Q: What is Schedule D?

A: Schedule D is a part of Form PTE-100 that is used to report the details of reportable entities associated with the pass-through entity.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income tax at the entity level, but instead passes the income and tax obligations to the owners or partners.

Q: Who needs to file Form PTE-100?

A: Pass-through entities doing business in West Virginia that have nonresident members or partners need to file Form PTE-100.

Q: Are there any penalties for not filing Form PTE-100?

A: Yes, failure to file Form PTE-100 or filing it late may result in penalties and interest charges.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 Schedule C, D by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.